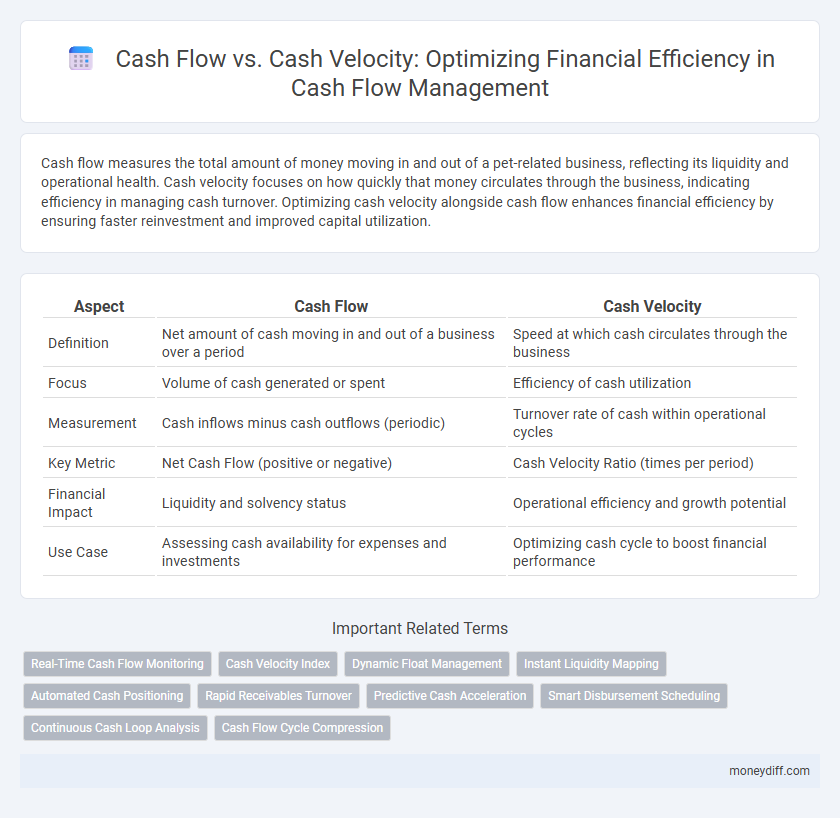

Cash flow measures the total amount of money moving in and out of a pet-related business, reflecting its liquidity and operational health. Cash velocity focuses on how quickly that money circulates through the business, indicating efficiency in managing cash turnover. Optimizing cash velocity alongside cash flow enhances financial efficiency by ensuring faster reinvestment and improved capital utilization.

Table of Comparison

| Aspect | Cash Flow | Cash Velocity |

|---|---|---|

| Definition | Net amount of cash moving in and out of a business over a period | Speed at which cash circulates through the business |

| Focus | Volume of cash generated or spent | Efficiency of cash utilization |

| Measurement | Cash inflows minus cash outflows (periodic) | Turnover rate of cash within operational cycles |

| Key Metric | Net Cash Flow (positive or negative) | Cash Velocity Ratio (times per period) |

| Financial Impact | Liquidity and solvency status | Operational efficiency and growth potential |

| Use Case | Assessing cash availability for expenses and investments | Optimizing cash cycle to boost financial performance |

Understanding Cash Flow: The Basics

Cash flow measures the net amount of cash moving in and out of a business over a specific period, reflecting liquidity and operational health. Cash velocity, or cash conversion velocity, quantifies how quickly cash cycles through business activities, indicating efficiency in asset utilization and receivables management. Understanding the balance between cash flow and cash velocity helps optimize financial efficiency by ensuring sufficient liquidity while accelerating cash turnover.

Defining Cash Velocity in Financial Management

Cash velocity measures the speed at which cash moves through a business, reflecting how quickly receivables convert to cash and cash disburses for obligations. Unlike cash flow, which tracks net cash inflows and outflows over a period, cash velocity emphasizes the turnover rate of cash assets, critical for liquidity management. High cash velocity indicates efficient capital utilization, enabling better financial agility and operational sustainability.

Key Differences: Cash Flow vs. Cash Velocity

Cash flow measures the total amount of cash moving in and out of a business over a specific period, reflecting liquidity and operational health. Cash velocity quantifies the speed at which cash circulates through the company, indicating how efficiently assets convert to revenue. Understanding these key differences helps optimize financial efficiency by balancing cash availability with rapid turnover to support growth and stability.

Why Cash Velocity Matters for Business Efficiency

Cash velocity measures how quickly cash circulates within a business, directly impacting operational agility and the ability to seize growth opportunities. Higher cash velocity reduces the need for external financing by accelerating receivables conversion and optimizing payables management, enhancing overall financial efficiency. Monitoring cash velocity alongside cash flow provides a clearer picture of liquidity dynamics and helps identify areas for process improvements to maximize cash utilization.

Measuring Cash Flow and Cash Velocity Accurately

Measuring cash flow accurately involves tracking net inflows and outflows over a specific period, which reveals the liquidity available for operational needs and investments. Cash velocity, defined as the rate at which cash circulates through the business cycle, provides deeper insight into financial efficiency by indicating how quickly cash converts into revenue and returns. Employing precise metrics like operating cash flow ratio alongside cash turnover rate enables businesses to optimize capital utilization and improve overall financial health.

Impact of Cash Flow on Financial Health

Cash flow directly influences a company's financial health by determining its ability to meet obligations, invest in growth, and maintain liquidity. High cash velocity enhances financial efficiency by accelerating the conversion of cash inflows into operational activities, reducing working capital needs. Optimizing both cash flow and cash velocity supports sustainable business operations and strengthens overall financial stability.

Strategies to Improve Cash Velocity

Enhancing cash velocity involves accelerating the rate at which cash circulates through business operations, optimizing accounts receivable by shortening invoice payment cycles, and streamlining inventory turnover to reduce holding costs. Implementing dynamic discounting for early payments and leveraging digital payment solutions can significantly improve cash inflows. Efficient cash management strategies such as just-in-time purchasing and rigorous expense controls contribute to faster cash movement and improved financial efficiency.

Balancing Cash Flow and Cash Velocity for Optimal Results

Balancing cash flow and cash velocity is critical for financial efficiency, as cash flow measures the net amount of cash moving in and out of a business, while cash velocity tracks how quickly cash circulates through operations. Optimizing both ensures sufficient liquidity to meet obligations and accelerates cash turnover, enhancing working capital management. Companies that effectively manage this balance improve profitability, reduce financing costs, and sustain long-term operational stability.

Common Pitfalls in Managing Cash Flow and Cash Velocity

Mismanaging cash flow and cash velocity often leads to liquidity crises and missed growth opportunities. Common pitfalls include overestimating receivables turnover, underestimating payment cycles, and neglecting real-time cash flow tracking, which hinders accurate forecasting. Improving accuracy in cash inflows and outflows data, along with optimizing cash cycle timing, enhances financial efficiency and business resilience.

Future Trends: Enhancing Financial Efficiency with Cash Flow and Velocity

Future trends in financial efficiency emphasize optimizing both cash flow and cash velocity to maximize operational liquidity. Advanced analytics and AI-driven forecasting enable businesses to predict cash inflows and outflows more accurately, accelerating cash velocity while maintaining stable cash flow. Integrating real-time monitoring systems enhances decision-making speed, reducing working capital requirements and boosting overall financial agility.

Related Important Terms

Real-Time Cash Flow Monitoring

Real-time cash flow monitoring enhances financial efficiency by providing instant visibility into cash velocity, enabling businesses to quickly identify liquidity bottlenecks and optimize operational cash conversion cycles. This dynamic approach ensures that cash inflows and outflows are managed proactively, improving working capital management and supporting timely investment decisions.

Cash Velocity Index

Cash Velocity Index measures the speed at which cash circulates within a business, providing a dynamic assessment of liquidity beyond traditional cash flow metrics. Higher cash velocity indicates more efficient utilization of available cash, accelerating operational cycles and improving overall financial performance.

Dynamic Float Management

Dynamic Float Management accelerates cash velocity by optimizing the timing of cash inflows and outflows, enhancing liquidity without increasing cash balances. This method improves financial efficiency by reducing the cash conversion cycle and maximizing the effective use of available funds.

Instant Liquidity Mapping

Cash flow measures the total amount of money moving in and out of a business over a period, while cash velocity quantifies how quickly cash circulates through operations, directly impacting financial efficiency. Instant Liquidity Mapping enables real-time tracking of cash velocity, optimizing working capital management and enhancing liquidity positions for swift decision-making.

Automated Cash Positioning

Automated Cash Positioning enhances financial efficiency by optimizing cash flow management and increasing cash velocity through real-time allocation and movement of funds across accounts. This automation reduces idle cash, improves liquidity utilization, and accelerates payment cycles, enabling businesses to maximize working capital and minimize financing costs.

Rapid Receivables Turnover

Rapid receivables turnover accelerates cash flow by quickly converting sales into liquid assets, enhancing financial efficiency and reducing the cash conversion cycle. Optimizing cash velocity through prompt collection cycles minimizes working capital needs, enabling businesses to reinvest and maintain liquidity.

Predictive Cash Acceleration

Predictive Cash Acceleration enhances financial efficiency by forecasting cash flow timing and optimizing cash velocity, enabling businesses to accelerate receivables and improve liquidity management. This approach uses advanced analytics to reduce cash conversion cycles, ultimately maximizing working capital utilization.

Smart Disbursement Scheduling

Cash velocity measures how quickly cash cycles through business operations, while cash flow tracks the net amount of cash moving in and out over time; optimizing smart disbursement scheduling aligns outflows with cash velocity to maximize financial efficiency. Implementing predictive algorithms for disbursement timing reduces idle cash and enhances liquidity management, driving improved operational performance and cost savings.

Continuous Cash Loop Analysis

Continuous Cash Loop Analysis enhances financial efficiency by comparing cash flow metrics with cash velocity, emphasizing the speed and volume at which cash circulates within a business. Tracking cash velocity alongside cash flow enables companies to identify bottlenecks, optimize liquidity management, and accelerate revenue recycling for improved operational performance.

Cash Flow Cycle Compression

Cash flow cycle compression enhances financial efficiency by reducing the time between cash outflows and inflows, accelerating cash velocity within a business. Optimizing inventory turnover, receivables collection, and payables management directly shortens the cash flow cycle, improving liquidity and operational responsiveness.

Cash flow vs Cash velocity for financial efficiency. Infographic

moneydiff.com

moneydiff.com