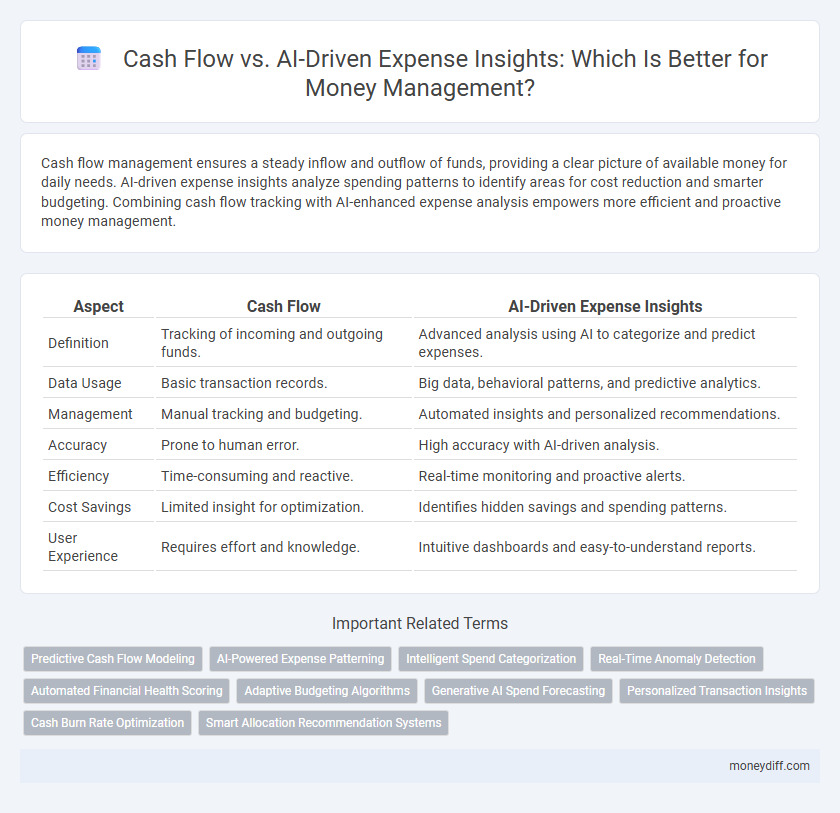

Cash flow management ensures a steady inflow and outflow of funds, providing a clear picture of available money for daily needs. AI-driven expense insights analyze spending patterns to identify areas for cost reduction and smarter budgeting. Combining cash flow tracking with AI-enhanced expense analysis empowers more efficient and proactive money management.

Table of Comparison

| Aspect | Cash Flow | AI-Driven Expense Insights |

|---|---|---|

| Definition | Tracking of incoming and outgoing funds. | Advanced analysis using AI to categorize and predict expenses. |

| Data Usage | Basic transaction records. | Big data, behavioral patterns, and predictive analytics. |

| Management | Manual tracking and budgeting. | Automated insights and personalized recommendations. |

| Accuracy | Prone to human error. | High accuracy with AI-driven analysis. |

| Efficiency | Time-consuming and reactive. | Real-time monitoring and proactive alerts. |

| Cost Savings | Limited insight for optimization. | Identifies hidden savings and spending patterns. |

| User Experience | Requires effort and knowledge. | Intuitive dashboards and easy-to-understand reports. |

Understanding Cash Flow: The Foundation of Money Management

Understanding cash flow is essential for effective money management as it provides a clear picture of income versus expenses over time. AI-driven expense insights enhance this understanding by analyzing spending patterns to identify inefficiencies and optimize budgets. Integrating cash flow analysis with AI technologies enables more accurate forecasting and informed financial decisions.

The Rise of AI-Driven Expense Insights

AI-driven expense insights revolutionize cash flow management by providing real-time, data-driven analysis of spending patterns and cash inflows. Machine learning algorithms categorize expenses, predict future cash flow trends, and identify cost-saving opportunities with greater accuracy than traditional methods. These advanced technologies enable businesses and individuals to optimize budgeting, reduce financial risks, and enhance overall money management efficiency.

Traditional Cash Flow Analysis: Strengths and Limitations

Traditional cash flow analysis provides a clear overview of income and expenditures, aiding in effective budgeting and financial planning by tracking historical data. However, it often lacks real-time insights and predictive capabilities, limiting proactive decision-making in dynamic financial environments. AI-driven expense insights enhance cash flow management by offering automated categorization, trend analysis, and forecasting to optimize money management strategies.

How AI Transforms Expense Tracking and Categorization

AI-driven expense insights revolutionize cash flow management by automating expense tracking and categorization with high accuracy. Machine learning algorithms analyze transaction data in real-time, identifying spending patterns and anomalies that manual processes often miss. This automation enhances budgeting precision and provides actionable insights, enabling more strategic money management.

Comparing Manual Cash Flow vs AI-Powered Insights

Manual cash flow management requires tracking income and expenses through spreadsheets or bank statements, often leading to delayed or inaccurate financial visibility. AI-powered expense insights use machine learning algorithms to analyze spending patterns in real time, providing personalized budgeting recommendations and forecasting future cash flow needs. This automation enhances accuracy, saves time, and enables proactive decision-making for effective money management.

Real-Time Decision Making: AI vs. Conventional Methods

AI-driven expense insights enable real-time cash flow analysis by processing large datasets instantly, uncovering spending patterns and predicting upcoming financial needs with high accuracy. Conventional methods rely on manual data entry and periodic reviews, causing delays that hinder timely decision-making and increase the risk of overdrafts or missed opportunities. Leveraging AI enhances proactive money management through automated alerts and dynamic budgeting, optimizing financial health more effectively than traditional approaches.

Forecasting and Budgeting: Human Estimation vs AI Accuracy

Cash flow forecasting traditionally relies on human estimation, which can be prone to bias and inaccuracies due to fluctuating income and expenses. AI-driven expense insights enhance money management by analyzing vast datasets in real-time, offering precise budget predictions and identifying spending patterns. This technological accuracy enables more reliable financial planning, reducing risks associated with unforeseen cash shortfalls.

Personalized Money Management with AI Analysis

AI-driven expense insights enhance cash flow management by providing personalized analysis of spending patterns and financial behavior. This technology identifies opportunities for optimizing expenses and forecasting cash flow needs, enabling more precise budgeting. Personalized money management through AI leads to improved financial decision-making and better allocation of resources.

Challenges and Risks of AI in Cash Flow Management

AI-driven expense insights enhance cash flow management by automating data analysis and identifying spending patterns, but challenges include data privacy concerns, algorithmic biases, and inaccurate forecasting due to reliance on historical data. Risks also involve potential security breaches exposing sensitive financial information and over-dependence on AI systems reducing human oversight. Ensuring robust cybersecurity measures and continuous manual review are essential to mitigate these risks in AI-powered cash flow solutions.

Choosing the Right Approach: Blending Cash Flow Basics and AI

Cash flow management remains a cornerstone of financial stability, providing clear visibility into income and expenses over time. Integrating AI-driven expense insights enhances this foundation by identifying spending patterns and optimizing budget allocations with predictive analytics. Combining traditional cash flow tracking with AI technology offers a balanced approach for more accurate and proactive money management.

Related Important Terms

Predictive Cash Flow Modeling

Predictive cash flow modeling leverages AI-driven expense insights to forecast future financial positions with greater accuracy, enabling businesses to optimize liquidity and avoid cash shortages. By analyzing historical spending patterns and external factors, AI algorithms deliver real-time projections that enhance strategic money management and improve decision-making efficiency.

AI-Powered Expense Patterning

AI-powered expense patterning enhances cash flow management by analyzing transaction data to identify recurring spending trends and predict future expenses with high accuracy. This technology enables real-time adjustments to budgets, optimizing liquidity and preventing overspending through proactive financial insights.

Intelligent Spend Categorization

Cash flow management improves significantly through AI-driven expense insights, utilizing intelligent spend categorization to automatically classify transactions into precise categories such as utilities, subscriptions, and groceries. This technology enhances budgeting accuracy and visibility, enabling proactive control over money management by identifying spending patterns and optimizing cash allocation.

Real-Time Anomaly Detection

Real-time anomaly detection in AI-driven expense insights enhances cash flow management by instantly identifying irregular spending patterns, enabling proactive financial decisions. This technology leverages machine learning algorithms to monitor transactions continuously, reducing the risk of cash shortages and optimizing liquidity.

Automated Financial Health Scoring

Automated financial health scoring leverages AI-driven expense insights to provide real-time cash flow analysis, enabling precise tracking of income and expenditures. This integration enhances money management by identifying spending patterns and predicting future cash flow challenges, ensuring optimal financial decisions.

Adaptive Budgeting Algorithms

Adaptive budgeting algorithms enhance cash flow management by dynamically analyzing spending patterns and adjusting expense forecasts in real time, increasing accuracy in financial planning. Integrating AI-driven expense insights empowers businesses to optimize cash inflows and outflows, reducing liquidity risks while maximizing operational efficiency.

Generative AI Spend Forecasting

Generative AI spend forecasting enhances cash flow management by analyzing historical expense patterns and predicting future outflows with high accuracy. Integrating these AI-driven expense insights enables businesses to optimize liquidity, reduce unexpected cash shortfalls, and improve strategic financial planning.

Personalized Transaction Insights

Personalized transaction insights leverage AI-driven expense analysis to enhance cash flow management by categorizing spending patterns and predicting future expenses with precision. This advanced technology enables users to optimize budgeting, identify saving opportunities, and maintain healthier financial stability through tailored recommendations.

Cash Burn Rate Optimization

Cash flow management hinges on accurately tracking and controlling cash burn rate to sustain business operations and enhance liquidity. AI-driven expense insights optimize cash burn by identifying inefficiencies and forecasting expenditure trends, enabling precise budget adjustments and strategic financial planning.

Smart Allocation Recommendation Systems

Smart Allocation Recommendation Systems leverage AI-driven expense insights to analyze cash flow patterns, enabling precise budgeting and optimized fund distribution across financial categories. These systems enhance money management by predicting future expenses and recommending strategic reallocations that improve liquidity and prevent overspending.

Cash flow vs AI-driven expense insights for money management. Infographic

moneydiff.com

moneydiff.com