Cash flow from traditional assets involves direct payments received over time, while tokenized cash flow leverages blockchain technology to automate and fractionalize these payments through smart contracts. Tokenized cash flow enables enhanced liquidity and transparency by representing ownership stakes as digital tokens that can be securely traded on decentralized platforms. This innovation transforms asset management by providing real-time access to earnings and reducing reliance on intermediaries in cash flow distribution.

Table of Comparison

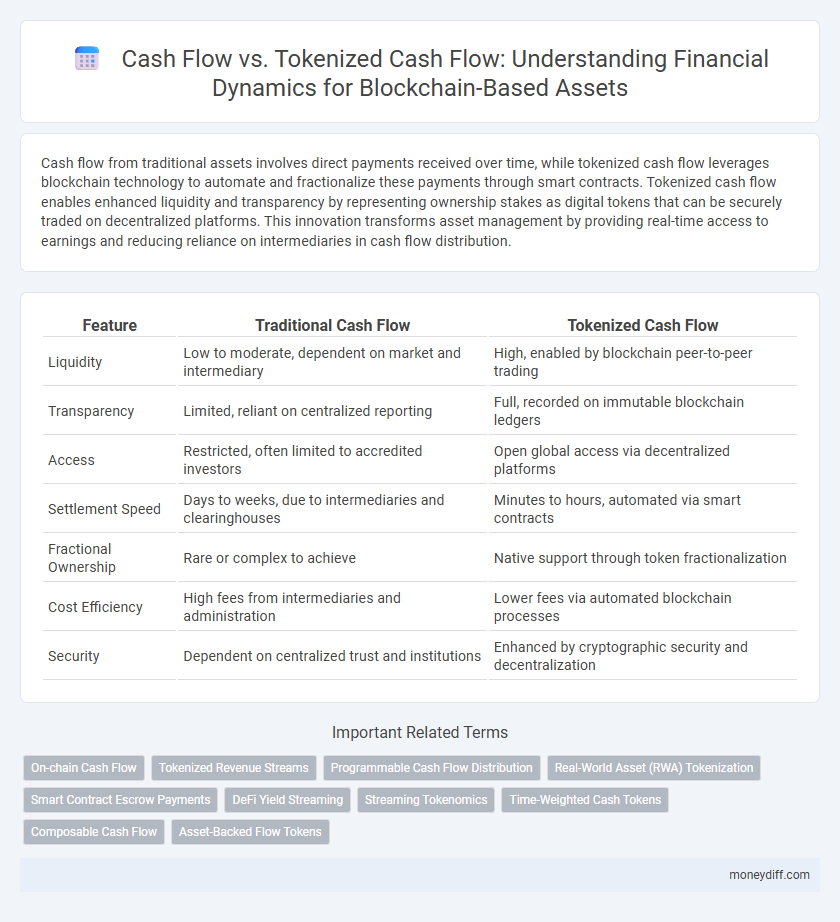

| Feature | Traditional Cash Flow | Tokenized Cash Flow |

|---|---|---|

| Liquidity | Low to moderate, dependent on market and intermediary | High, enabled by blockchain peer-to-peer trading |

| Transparency | Limited, reliant on centralized reporting | Full, recorded on immutable blockchain ledgers |

| Access | Restricted, often limited to accredited investors | Open global access via decentralized platforms |

| Settlement Speed | Days to weeks, due to intermediaries and clearinghouses | Minutes to hours, automated via smart contracts |

| Fractional Ownership | Rare or complex to achieve | Native support through token fractionalization |

| Cost Efficiency | High fees from intermediaries and administration | Lower fees via automated blockchain processes |

| Security | Dependent on centralized trust and institutions | Enhanced by cryptographic security and decentralization |

Introduction to Cash Flow in Asset Management

Cash flow in asset management represents the net amount of cash generated or consumed by an asset over a specific period, serving as a critical indicator of its financial health and profitability. Tokenized cash flow leverages blockchain technology to digitize and fractionalize these cash flows, enabling transparent, real-time distribution and simplified transferability of income streams for blockchain-based assets. This innovation enhances liquidity and accessibility, allowing investors to participate in asset cash flows through tradable digital tokens while maintaining accurate and immutable records on the blockchain.

Understanding Tokenized Cash Flow

Tokenized cash flow transforms traditional cash flow streams into digital tokens on a blockchain, enabling fractional ownership and increased liquidity for asset holders. Unlike conventional cash flow, tokenized cash flow allows real-time tracking, automated distributions through smart contracts, and enhanced transparency. This innovation reduces intermediaries, lowers transaction costs, and broadens investor access to previously illiquid markets.

Key Differences Between Traditional and Tokenized Cash Flow

Traditional cash flow relies on centralized financial institutions to track and distribute payments, often resulting in slower transaction speeds and limited transparency. Tokenized cash flow leverages blockchain technology to enable real-time, automated, and transparent distribution of asset-generated income through smart contracts. This innovation enhances liquidity, reduces intermediaries, and provides fractional ownership opportunities, distinguishing tokenized cash flows from conventional financial systems.

Advantages of Tokenized Cash Flow for Blockchain Assets

Tokenized cash flow for blockchain-based assets offers enhanced liquidity by enabling fractional ownership and seamless secondary market trading. Automated smart contracts ensure transparent, real-time distribution of returns, reducing administrative costs and mitigating counterparty risks. This innovation improves accessibility to diverse investors and fosters global capital inflows through efficient digital asset management.

Real-Time Tracking and Transparency

Tokenized cash flow on blockchain-based assets enables real-time tracking by recording every transaction on an immutable ledger, ensuring transparent and immediate visibility into cash movements. Traditional cash flow systems often rely on periodic updates and manual reconciliation, which can delay access to accurate financial data. Blockchain technology facilitates enhanced transparency and accountability by providing stakeholders with direct, continuous access to transaction histories and cash flow performance.

Automation and Smart Contracts in Tokenized Cash Flow

Tokenized cash flow leverages blockchain technology to automate revenue distribution through smart contracts, ensuring real-time, transparent transactions without intermediaries. Unlike traditional cash flow management, this automation reduces errors and accelerates payment cycles by executing predefined terms instantly. The integration of smart contracts in tokenized cash flow enhances security and accuracy, providing immutable records and facilitating seamless asset management on decentralized platforms.

Risks and Challenges in Tokenizing Cash Flow

Tokenizing cash flow for blockchain-based assets introduces risks such as smart contract vulnerabilities, regulatory uncertainties, and market liquidity issues. The reliance on decentralized platforms increases exposure to cyberattacks and technological failures, potentially disrupting expected income streams. Additionally, valuation difficulties and the lack of standardized frameworks complicate risk assessment and investor protection in tokenized cash flow models.

Regulatory Considerations for Blockchain-Based Cash Flow

Regulatory considerations for blockchain-based cash flow involve strict compliance with securities laws, anti-money laundering (AML) regulations, and know-your-customer (KYC) requirements to ensure transparency and investor protection. Tokenized cash flow assets are subject to evolving frameworks from authorities like the SEC and FINRA, which scrutinize the classification of tokens as securities or commodities. Ensuring smart contracts and token issuance adhere to jurisdiction-specific guidelines is critical to mitigate legal risks and maintain operational legitimacy in tokenized cash flow transactions.

Case Studies: Tokenized Cash Flow in Practice

Case studies of tokenized cash flow in blockchain-based assets demonstrate enhanced liquidity and fractional ownership, reducing entry barriers for investors. Real estate projects using tokenized cash flows have enabled instant revenue distribution and real-time tracking of income streams through smart contracts. These implementations highlight increased transparency, automated compliance, and efficient management compared to traditional cash flow systems.

Future Outlook: Evolving Cash Flow Management with Blockchain

Tokenized cash flow leverages blockchain technology to enhance transparency, security, and liquidity for asset-based revenues, fundamentally transforming traditional cash flow management. The future outlook indicates increased adoption of blockchain-driven platforms that allow fractional ownership and real-time distribution of cash flows, optimizing investor access and operational efficiency. Integration of smart contracts automates cash flow processes, reducing intermediaries and enabling more precise, programmable financial flows.

Related Important Terms

On-chain Cash Flow

On-chain cash flow leverages blockchain technology to provide transparent, real-time tracking of tokenized cash flow from digital assets, ensuring immutable records and automated distribution via smart contracts. This method enhances liquidity, reduces intermediaries, and facilitates fractional ownership, contrasting with traditional cash flow that relies on centralized systems and delayed settlements.

Tokenized Revenue Streams

Tokenized cash flow transforms traditional cash flow by enabling fractional ownership and real-time revenue distribution through blockchain-based smart contracts, enhancing transparency and liquidity. Tokenized revenue streams allow investors to directly access and trade diversified income sources, optimizing asset management and unlocking new funding opportunities in digital finance ecosystems.

Programmable Cash Flow Distribution

Programmable cash flow distribution enables automated, transparent, and real-time allocation of revenue streams in blockchain-based assets, enhancing efficiency compared to traditional cash flow methods. Tokenized cash flow leverages smart contracts to enforce precise distribution rules, reducing human error and enabling fractional ownership with instantaneous settlements.

Real-World Asset (RWA) Tokenization

Tokenized cash flow for blockchain-based Real-World Assets (RWAs) offers enhanced liquidity and transparency compared to traditional cash flow models by enabling fractional ownership and real-time tracking on decentralized ledgers. This innovation streamlines asset management, reduces intermediaries, and provides investors with programmable, secure, and automated distributions of income derived from physical assets.

Smart Contract Escrow Payments

Smart Contract Escrow Payments in tokenized cash flow systems enhance transparency and security by automating transaction releases based on predefined conditions encoded on the blockchain, reducing counterparty risk and ensuring timely payments. This contrasts with traditional cash flow processes, which rely on intermediaries and manual reconciliation, often leading to delays and increased operational costs.

DeFi Yield Streaming

Tokenized cash flow for blockchain-based assets enables real-time, transparent distribution of DeFi yield streaming, enhancing liquidity and fractional ownership compared to traditional cash flow models. This innovation leverages smart contracts to automate payments, reduce intermediaries, and provide immutable audit trails, optimizing asset monetization within decentralized finance ecosystems.

Streaming Tokenomics

Streaming Tokenomics enables continuous, real-time cash flow distribution for blockchain-based assets, enhancing liquidity and transparency compared to traditional periodic cash flow models. Tokenized cash flow leverages smart contracts to automate payments and fractional ownership, optimizing efficiency and investor accessibility within decentralized finance ecosystems.

Time-Weighted Cash Tokens

Time-Weighted Cash Tokens optimize cash flow management for blockchain-based assets by allowing investors to receive payouts proportional to the duration of their holdings, enhancing liquidity and transparency compared to traditional cash flow models. This approach enables precise allocation of revenue streams, aligning tokenized asset performance with real-time cash flow generation and investor engagement.

Composable Cash Flow

Composable cash flow enables the dynamic aggregation and redistribution of tokenized cash flow streams from blockchain-based assets, enhancing transparency and liquidity. Unlike traditional cash flow, tokenized composable streams allow real-time tracking, fractional ownership, and programmable revenue distribution through smart contracts on decentralized platforms.

Asset-Backed Flow Tokens

Asset-backed flow tokens enhance traditional cash flow by enabling fractional ownership and real-time liquidity of blockchain-based assets while ensuring transparent, immutable record-keeping via smart contracts. This tokenization facilitates seamless distribution of revenue streams, reducing intermediaries and operational costs compared to conventional cash flow mechanisms.

Cash flow vs Tokenized cash flow for blockchain-based assets. Infographic

moneydiff.com

moneydiff.com