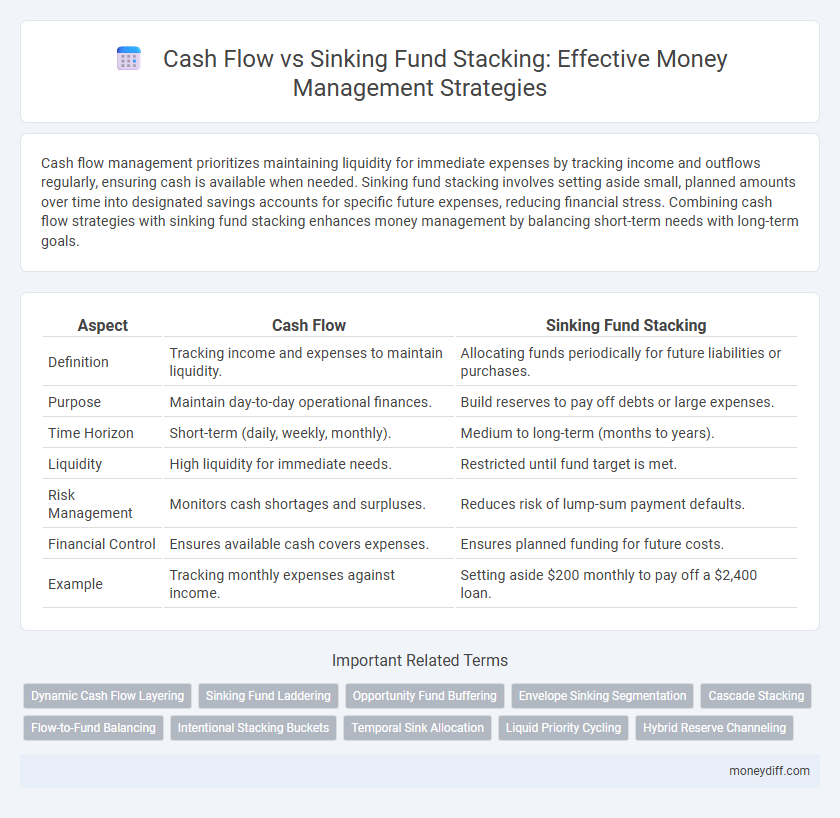

Cash flow management prioritizes maintaining liquidity for immediate expenses by tracking income and outflows regularly, ensuring cash is available when needed. Sinking fund stacking involves setting aside small, planned amounts over time into designated savings accounts for specific future expenses, reducing financial stress. Combining cash flow strategies with sinking fund stacking enhances money management by balancing short-term needs with long-term goals.

Table of Comparison

| Aspect | Cash Flow | Sinking Fund Stacking |

|---|---|---|

| Definition | Tracking income and expenses to maintain liquidity. | Allocating funds periodically for future liabilities or purchases. |

| Purpose | Maintain day-to-day operational finances. | Build reserves to pay off debts or large expenses. |

| Time Horizon | Short-term (daily, weekly, monthly). | Medium to long-term (months to years). |

| Liquidity | High liquidity for immediate needs. | Restricted until fund target is met. |

| Risk Management | Monitors cash shortages and surpluses. | Reduces risk of lump-sum payment defaults. |

| Financial Control | Ensures available cash covers expenses. | Ensures planned funding for future costs. |

| Example | Tracking monthly expenses against income. | Setting aside $200 monthly to pay off a $2,400 loan. |

Introduction to Cash Flow and Sinking Fund Stacking

Cash flow represents the movement of money in and out of an account, reflecting the net amount of cash generated or spent over a specific period. Sinking fund stacking is a strategic approach to money management that involves allocating cash flow into multiple designated funds for future expenses, ensuring financial goals are met without disrupting daily operations. Understanding how to balance positive cash flow with sinking fund allocations enhances liquidity management and long-term financial stability.

Defining Cash Flow in Personal Finance

Cash flow in personal finance refers to the total amount of money being transferred into and out of an individual's accounts, reflecting their income and expenses over a specific period. Accurate cash flow management ensures timely bill payments, savings accumulation, and prevents overdrafts by monitoring actual liquidity. Unlike sinking funds, which allocate money for future expenses, cash flow analysis provides the real-time financial flexibility needed for daily money management and emergency readiness.

Understanding the Sinking Fund Stacking Method

The Sinking Fund Stacking method involves allocating discrete amounts of money into separate, goal-specific funds to manage future expenses efficiently, enhancing cash flow predictability. Unlike traditional cash flow management that pools funds, this method prioritizes targeted saving, reducing the risk of overspending and improving financial discipline. Utilizing sinking funds promotes better budgeting for liabilities like debt repayments, asset replacement, or planned large purchases, stabilizing overall cash flow dynamics.

Key Differences: Cash Flow vs Sinking Fund Stacking

Cash flow management involves tracking the inflow and outflow of cash to ensure liquidity and operational stability, while sinking fund stacking focuses on systematically setting aside specific amounts for future liabilities or large expenses. Cash flow prioritizes real-time financial health and covers daily operational needs, whereas sinking funds emphasize disciplined savings targeted at predetermined goals, reducing the risk of debt accumulation. Effective money management integrates both strategies to balance immediate cash availability with long-term financial planning.

Pros and Cons of Managing Money with Cash Flow

Managing money through cash flow offers immediate liquidity and flexibility, allowing for dynamic allocation of funds toward operational expenses and unexpected costs. However, relying solely on cash flow can lead to volatility and insufficient reserves during low-revenue periods, increasing the risk of cash shortages. In contrast, sinking fund stacking provides disciplined savings for future liabilities but may reduce short-term spending agility.

Advantages and Disadvantages of Sinking Fund Stacking

Sinking fund stacking allows for targeted savings by allocating specific amounts toward future expenses, reducing the need for large lump-sum payments and improving budget predictability. However, it may limit cash flow flexibility as funds are tied up in designated accounts, potentially reducing liquidity for unexpected expenses. While it enforces disciplined saving habits, the downside includes the risk of inefficient fund use if priorities shift or expenses change suddenly.

When to Choose Cash Flow Management

Cash flow management is essential when prioritizing liquidity to cover immediate expenses and operational costs without depleting reserves. It is ideal for businesses or individuals facing variable income streams or unexpected expenses that require flexible access to funds. Choosing cash flow management ensures financial stability and smooth day-to-day operations before allocating money into sinking funds for future obligations.

When Sinking Fund Stacking Makes Sense

Sinking fund stacking makes sense when managing multiple, planned expenses that require disciplined saving over time, ensuring each financial goal is funded without disrupting cash flow. This method allows for precise allocation of funds toward specific future liabilities, reducing the risk of underfunding or debt accumulation. It optimizes cash flow management by creating separate reserves for predictable costs, improving financial stability and budgeting accuracy.

Combining Cash Flow and Sinking Fund Stacking Strategies

Combining cash flow management with sinking fund stacking optimizes liquidity by ensuring regular income covers immediate expenses while allocating specific amounts into targeted savings for future liabilities. This dual approach enhances financial stability, reduces reliance on credit, and enables systematic preparation for large, anticipated costs such as insurance premiums or annual subscriptions. Effective integration of these methods improves cash flow forecasting accuracy and promotes disciplined money management aligned with short- and long-term financial goals.

Optimizing Your Money Management for Future Goals

Optimizing your money management for future goals involves balancing cash flow and sinking fund stacking to ensure liquidity while systematically saving for planned expenses. Maintaining positive cash flow allows for daily operational needs, whereas sinking funds allocate specific amounts regularly toward future liabilities, reducing financial stress. Integrating both strategies enhances financial stability and prepares you effectively for upcoming financial commitments.

Related Important Terms

Dynamic Cash Flow Layering

Dynamic cash flow layering optimizes liquidity by strategically allocating funds between immediate cash flow needs and sinking fund reserves, enhancing financial flexibility and risk management. This approach prioritizes real-time adjustment of cash inflows and outflows to maintain operational stability while systematically building reserves for future liabilities.

Sinking Fund Laddering

Sinking fund laddering enhances cash flow management by allocating funds into staggered, time-bound reserves dedicated to specific future expenses, reducing the risk of liquidity shortages. This strategic approach contrasts with traditional cash flow methods by promoting disciplined savings through scheduled contributions, optimizing financial stability and expense forecasting.

Opportunity Fund Buffering

Cash flow management ensures liquidity for immediate expenses, while sinking fund stacking allocates money over time for planned large expenditures, optimizing financial stability. Opportunity fund buffering amplifies this strategy by preserving cash reserves to seize unexpected investment opportunities without disrupting ongoing cash flow or sinking fund goals.

Envelope Sinking Segmentation

Envelope sinking segmentation enhances cash flow management by categorizing funds into designated allocations for future expenses, ensuring disciplined savings without disrupting daily liquidity. This method contrasts traditional sinking fund stacking by providing clearer visualization of budgeted cash reserves, optimizing financial planning and reducing risk of overspending.

Cascade Stacking

Cascade stacking optimizes cash flow by prioritizing sinking fund allocations in a sequential manner, ensuring each financial goal is fully funded before moving to the next. This method minimizes idle cash while maintaining disciplined savings, improving overall money management and financial stability.

Flow-to-Fund Balancing

Effective money management requires balancing cash flow with sinking fund contributions to maintain liquidity while preparing for future expenses. Prioritizing flow-to-fund balancing ensures steady operational cash availability alongside strategic accumulation in sinking funds, optimizing financial stability and goal achievement.

Intentional Stacking Buckets

Intentional stacking buckets prioritize allocating cash flow into distinct funds for targeted goals, enhancing financial discipline compared to traditional sinking fund stacking. This method improves money management by clearly segmenting resources based on priority and timing, ensuring optimized fund availability for both immediate and future expenses.

Temporal Sink Allocation

Temporal Sink Allocation in cash flow management prioritizes directing excess cash into sinking funds at specific intervals to ensure future liabilities are covered without disrupting operational liquidity. This method optimizes financial stability by systematically matching cash outflows with predetermined obligations, reducing the risk of cash shortages during critical payment periods.

Liquid Priority Cycling

Liquid Priority Cycling enhances cash flow management by strategically allocating funds between immediate liquidity and sinking fund contributions, ensuring operational expenses are covered while systematically building reserves for future liabilities. This approach optimizes financial flexibility, reduces borrowing needs, and balances short-term cash availability with long-term financial goals.

Hybrid Reserve Channeling

Hybrid Reserve Channeling integrates cash flow analysis with sinking fund stacking to optimize liquidity and long-term financial stability by systematically allocating surplus cash toward targeted reserves. This approach enhances money management by balancing immediate operational needs with planned future expenditures, reducing financial risk and improving capital allocation efficiency.

Cash flow vs Sinking fund stacking for money management. Infographic

moneydiff.com

moneydiff.com