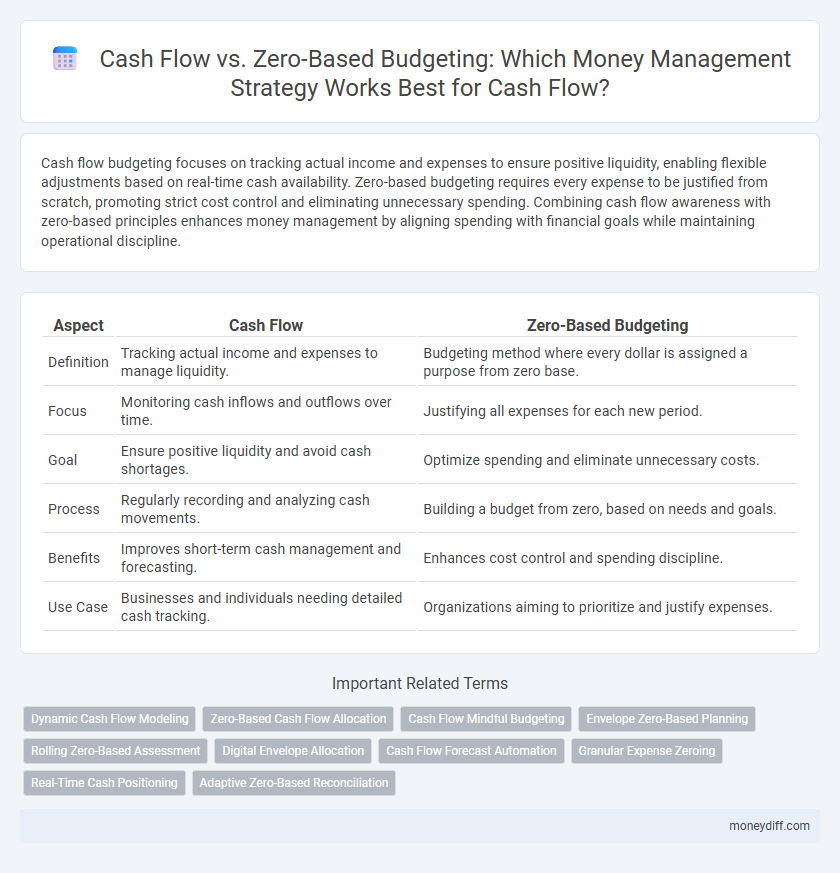

Cash flow budgeting focuses on tracking actual income and expenses to ensure positive liquidity, enabling flexible adjustments based on real-time cash availability. Zero-based budgeting requires every expense to be justified from scratch, promoting strict cost control and eliminating unnecessary spending. Combining cash flow awareness with zero-based principles enhances money management by aligning spending with financial goals while maintaining operational discipline.

Table of Comparison

| Aspect | Cash Flow | Zero-Based Budgeting |

|---|---|---|

| Definition | Tracking actual income and expenses to manage liquidity. | Budgeting method where every dollar is assigned a purpose from zero base. |

| Focus | Monitoring cash inflows and outflows over time. | Justifying all expenses for each new period. |

| Goal | Ensure positive liquidity and avoid cash shortages. | Optimize spending and eliminate unnecessary costs. |

| Process | Regularly recording and analyzing cash movements. | Building a budget from zero, based on needs and goals. |

| Benefits | Improves short-term cash management and forecasting. | Enhances cost control and spending discipline. |

| Use Case | Businesses and individuals needing detailed cash tracking. | Organizations aiming to prioritize and justify expenses. |

Understanding Cash Flow in Money Management

Understanding cash flow is essential for effective money management, as it tracks the actual inflows and outflows of cash within a business or personal budget. Unlike zero-based budgeting, which allocates every dollar of income to specific expenses or savings, cash flow analysis emphasizes the timing and availability of money to cover obligations. Monitoring cash flow ensures liquidity, prevents overdrafts, and supports informed financial decisions.

What Is Zero-Based Budgeting?

Zero-based budgeting is a financial planning method where every dollar of income is assigned a specific purpose, ensuring no funds are left unallocated. Unlike traditional cash flow management that tracks income and expenses over time, zero-based budgeting requires justifying all expenses from scratch for each new period. This approach promotes disciplined money management by aligning spending directly with financial goals and priorities.

Key Differences: Cash Flow vs Zero-Based Budgeting

Cash flow management tracks actual inflows and outflows to ensure liquidity and operational stability, whereas zero-based budgeting requires allocating every dollar of income to specific expenses, leaving no surplus unassigned. Cash flow emphasizes timing and availability of cash, while zero-based budgeting focuses on justifying and planning every expense from scratch each period. The primary difference lies in cash flow's dynamic tracking approach versus zero-based budgeting's detailed, upfront allocation process for financial discipline.

Pros and Cons of Cash Flow Management

Cash flow management offers real-time tracking of income and expenses, providing a clear snapshot of liquidity and enabling quick adjustments to spending habits. However, its reliance on past and current cash movements may overlook long-term financial goals and hidden costs, potentially leading to short-term decision-making. Compared to zero-based budgeting, cash flow management requires less rigid structure but may lack the discipline needed to allocate funds effectively toward specific objectives.

Advantages and Disadvantages of Zero-Based Budgeting

Zero-based budgeting enhances cash flow management by requiring every expense to be justified from scratch, promoting efficient allocation and reducing unnecessary spending, which leads to improved financial control. However, this method demands significant time and effort for detailed expense review, potentially slowing decision-making and increasing administrative overhead. While zero-based budgeting fosters accountability and prevents budget complacency, its complexity may challenge organizations with limited resources or fluctuating cash flows.

How to Track Your Cash Flow Effectively

To track your cash flow effectively, start by categorizing all income and expenses with detailed records in a digital spreadsheet or specialized budgeting app, enabling real-time updates and accurate analysis. Implementing zero-based budgeting requires assigning every dollar a purpose before the month begins, ensuring all cash inflows are accounted for and allocated to specific spending or saving goals. Regularly reviewing cash flow statements and comparing actual spending against the zero-based budget highlights variances and helps maintain financial discipline.

Step-by-Step Guide to Zero-Based Budgeting

Zero-based budgeting requires allocating every dollar of income to specific expenses, savings, or debt repayment, ensuring no unassigned funds remain. Begin by listing all sources of cash flow, then assign spending categories starting from zero, justifying each expense rather than relying on previous budgets. This method enhances financial control, improves cash flow visibility, and prevents unnecessary spending by aligning every dollar with a defined purpose.

Which Method Suits Different Financial Goals?

Cash flow management prioritizes tracking income and expenses to maintain liquidity, making it ideal for short-term financial goals such as debt repayment or emergency fund building. Zero-based budgeting requires allocating every dollar to specific expenses, aligning well with detailed financial planning and long-term goals like saving for retirement or large purchases. Choosing the right method depends on whether focus lies on immediate cash availability or precise control over every dollar for strategic financial objectives.

Common Mistakes in Cash Flow and Zero-Based Budgeting

Common mistakes in cash flow management include underestimating variable expenses and failing to track real-time inflows and outflows, leading to inaccurate financial forecasting. In zero-based budgeting, errors often arise from neglecting to justify every expense from scratch each period, resulting in overlooked necessary costs or unnecessary spending. Both approaches require meticulous data analysis and regular review to avoid cash shortages and ensure effective money management.

Choosing the Best Money Management Strategy for You

Evaluating cash flow management alongside zero-based budgeting reveals distinct advantages in controlling finances; cash flow focuses on tracking income and expenses over time, while zero-based budgeting allocates every dollar to a specific purpose, ensuring no money is left unassigned. Selecting the best money management strategy depends on individual financial goals, spending habits, and the need for flexibility versus precision in budgeting. For those seeking strict expense control and accountability, zero-based budgeting offers granular oversight, whereas cash flow management suits individuals prioritizing liquidity and ongoing financial monitoring.

Related Important Terms

Dynamic Cash Flow Modeling

Dynamic cash flow modeling enhances traditional cash flow analysis by integrating real-time data and predictive algorithms to forecast liquidity more accurately, unlike zero-based budgeting which allocates resources based on justifications from a zero baseline each period. This advanced approach allows businesses to adapt quickly to financial fluctuations and optimize money management strategies with precise cash inflow and outflow projections.

Zero-Based Cash Flow Allocation

Zero-based cash flow allocation prioritizes assigning every dollar of income to specific expenses or savings categories, ensuring no funds remain idle and enhancing financial discipline. This method contrasts with traditional cash flow budgeting by requiring detailed justification for each allocation, promoting more precise control over financial resources.

Cash Flow Mindful Budgeting

Cash flow mindful budgeting emphasizes tracking actual income and expenses in real-time to maintain liquidity and ensure financial stability, unlike zero-based budgeting which allocates every dollar to specific categories regardless of cash availability. This approach enhances cash flow visibility, enabling proactive adjustments that prevent overspending and optimize fund allocation based on current monetary inflows and outflows.

Envelope Zero-Based Planning

Envelope Zero-Based Planning allocates every dollar of income to specific spending categories, ensuring no funds remain unassigned and promoting precise cash flow management. This approach contrasts with traditional cash flow methods by emphasizing proactive budget control and eliminating unnecessary expenditures through detailed, zero-based allocation.

Rolling Zero-Based Assessment

Rolling Zero-Based Assessment integrates continuous evaluation with zero-based budgeting principles, ensuring every expense is justified from a baseline of zero while adapting to real-time cash flow variations. This approach enhances financial control by aligning resource allocation directly with current cash inflows and outflows, optimizing liquidity management.

Digital Envelope Allocation

Digital envelope allocation enhances cash flow management by categorizing funds into specific virtual envelopes aligned with zero-based budgeting principles, ensuring every dollar is purposefully assigned to expenses, savings, or investments. This integration promotes precise tracking of income and expenditures, reduces overspending, and optimizes financial discipline by matching actual cash inflows with planned outflows.

Cash Flow Forecast Automation

Cash flow forecast automation enhances money management by providing real-time visibility into future cash inflows and outflows, enabling more accurate financial planning compared to zero-based budgeting's baseline expense justification. Automating cash flow forecasts reduces manual errors and saves time, allowing businesses to dynamically adjust strategies and improve liquidity management.

Granular Expense Zeroing

Granular expense zeroing in zero-based budgeting requires every dollar of cash flow to be justified and allocated from a zero base, ensuring precise money management that eliminates unnecessary spending. This method contrasts with traditional cash flow forecasting by providing detailed control over each expense category, enhancing financial discipline and optimizing resource allocation.

Real-Time Cash Positioning

Real-time cash positioning enhances cash flow management by providing instantaneous visibility into available funds, enabling precise allocation aligned with zero-based budgeting principles that require justifying every expense from scratch. Integrating real-time data optimizes liquidity monitoring and ensures budget adherence, improving financial control and decision-making accuracy.

Adaptive Zero-Based Reconciliation

Adaptive Zero-Based Reconciliation enhances cash flow management by aligning every dollar of income with specific expenses, improving precision over traditional zero-based budgeting methods. This approach dynamically adjusts allocations based on real-time cash inflows and outflows, ensuring optimized liquidity and financial stability.

Cash flow vs Zero-based budgeting for money management. Infographic

moneydiff.com

moneydiff.com