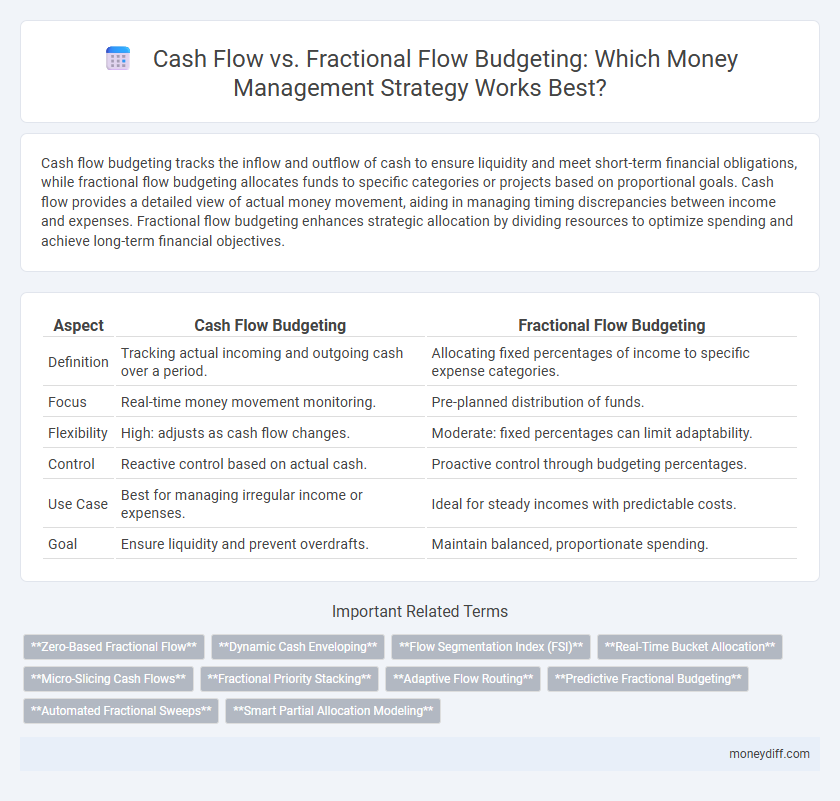

Cash flow budgeting tracks the inflow and outflow of cash to ensure liquidity and meet short-term financial obligations, while fractional flow budgeting allocates funds to specific categories or projects based on proportional goals. Cash flow provides a detailed view of actual money movement, aiding in managing timing discrepancies between income and expenses. Fractional flow budgeting enhances strategic allocation by dividing resources to optimize spending and achieve long-term financial objectives.

Table of Comparison

| Aspect | Cash Flow Budgeting | Fractional Flow Budgeting |

|---|---|---|

| Definition | Tracking actual incoming and outgoing cash over a period. | Allocating fixed percentages of income to specific expense categories. |

| Focus | Real-time money movement monitoring. | Pre-planned distribution of funds. |

| Flexibility | High: adjusts as cash flow changes. | Moderate: fixed percentages can limit adaptability. |

| Control | Reactive control based on actual cash. | Proactive control through budgeting percentages. |

| Use Case | Best for managing irregular income or expenses. | Ideal for steady incomes with predictable costs. |

| Goal | Ensure liquidity and prevent overdrafts. | Maintain balanced, proportionate spending. |

Introduction to Cash Flow and Fractional Flow Budgeting

Cash flow represents the total amount of money moving in and out of a business or personal finances over a specific period, providing critical insights into liquidity and financial health. Fractional flow budgeting divides income into predefined percentages allocated to various expenses, savings, and investments, enabling structured and strategic money management. Understanding the dynamics of cash flow alongside fractional flow budgeting empowers individuals and organizations to optimize resource allocation and maintain financial stability.

Core Principles of Cash Flow Management

Cash flow management centers on tracking and optimizing the timing and amounts of cash inflows and outflows to ensure liquidity and operational stability. Fractional flow budgeting divides income into fixed portions allocated to specific spending categories, promoting disciplined financial planning and preventing overspending. Core principles emphasize monitoring actual cash movement, forecasting future cash positions, maintaining liquidity reserves, and adjusting expenditures based on cash availability to avoid deficits.

Understanding Fractional Flow Budgeting

Fractional flow budgeting divides cash inflows into predetermined percentages allocated to specific expense categories, improving financial control and prioritization. This method contrasts traditional cash flow management that tracks total income and expenses without fixed allocation ratios. Understanding fractional flow budgeting helps optimize money management by ensuring disciplined spending and savings aligned with financial goals.

Key Differences Between Cash Flow and Fractional Flow Budgeting

Cash flow budgeting focuses on tracking the actual inflows and outflows of cash during a specific period to ensure liquidity and meet short-term financial obligations. Fractional flow budgeting allocates a fixed percentage of income or revenue to various expense categories, promoting proportional spending and long-term financial planning. Key differences include cash flow's emphasis on real-time cash management versus fractional flow's strategy of predetermined allocation based on income fractions.

Advantages of Cash Flow Approach

Cash flow budgeting offers real-time tracking of income and expenses, enabling precise management of available funds and preventing overspending. This approach enhances liquidity monitoring, ensuring businesses maintain sufficient cash to meet immediate obligations and avoid short-term financial strain. Compared to fractional flow budgeting, cash flow budgeting provides a clearer, more accurate financial picture that supports better decision-making and operational stability.

Benefits of Fractional Flow Budgeting

Fractional flow budgeting enhances money management by allocating fixed percentages of income toward specific expenses, savings, and investments, ensuring disciplined financial control. This method promotes consistent cash flow monitoring, preventing overspending and improving long-term financial stability. By creating predictable financial allocations, fractional flow budgeting simplifies decision-making and increases the efficiency of cash flow management.

Common Challenges in Implementing Each Method

Cash flow budgeting often faces challenges such as unpredictability in income timing and difficulty in accurately forecasting expenses, leading to potential liquidity shortages. Fractional flow budgeting encounters obstacles including the complexity of allocating fixed percentage amounts to diverse categories, which can result in overspending or underspending if financial priorities shift. Both methods require consistent monitoring and adjustments to maintain financial balance and avoid cash deficits.

Selecting the Right Budgeting Strategy for Your Needs

Choosing between cash flow and fractional flow budgeting depends on your financial goals and transaction patterns. Cash flow budgeting tracks actual inflows and outflows to maintain liquidity and avoid overspending, ideal for managing daily expenses and irregular income. Fractional flow budgeting allocates specific portions of income to predefined categories, promoting disciplined saving and spending habits suitable for long-term financial planning.

Practical Tips for Optimizing Personal Cash Flow

Effective personal cash flow management requires understanding the difference between cash flow and fractional flow budgeting, where cash flow tracks actual income and expenses while fractional flow budgeting allocates specific percentages to spending categories. Prioritize creating a realistic budget that designates fixed percentages for essentials, savings, and discretionary spending to maintain financial balance. Regularly review and adjust allocations based on actual cash flow patterns to optimize liquidity and prevent overspending.

How to Transition from Cash Flow to Fractional Flow Budgeting

Transitioning from cash flow to fractional flow budgeting requires analyzing historical cash inflows and outflows to determine consistent spending percentages across categories. Establish a baseline by categorizing expenses into fixed, variable, and discretionary, then allocate fractional budgets that flex in proportion to income variations. Regularly monitor and adjust allocations based on real-time income changes to maintain financial stability while optimizing spending efficiency.

Related Important Terms

Zero-Based Fractional Flow

Zero-Based Fractional Flow budgeting allocates funds based on current income without carrying over previous balances, ensuring precise cash flow management by aligning expenditures strictly with available resources. This method enhances financial discipline by promoting real-time allocation and preventing overspending commonly seen in traditional cash flow approaches.

Dynamic Cash Enveloping

Dynamic Cash Enveloping enhances cash flow management by allocating funds into variable, real-time budget categories, unlike static Fractional Flow Budgeting which divides income based on fixed percentages. This method improves liquidity control and spending flexibility, enabling more accurate tracking and adjustments to cash inflows and outflows.

Flow Segmentation Index (FSI)

Flow Segmentation Index (FSI) measures the effectiveness of cash flow segmentation in fractional flow budgeting, enabling more precise allocation of funds to optimize liquidity. By analyzing FSI, businesses can identify bottlenecks in cash inflows and outflows, improving financial forecasting and enhancing money management strategies.

Real-Time Bucket Allocation

Real-time bucket allocation in cash flow management enables instantaneous distribution of funds into predefined budget categories, ensuring optimal liquidity and minimizing overspending risks. Fractional flow budgeting allocates partial funds across multiple categories simultaneously but often lacks the responsiveness and precision of real-time adjustments critical for dynamic cash flow optimization.

Micro-Slicing Cash Flows

Micro-slicing cash flows in fractional flow budgeting enables precise allocation of funds to specific time intervals or projects, improving liquidity management and optimizing working capital. This granular approach contrasts with traditional cash flow methods by enhancing cash visibility and facilitating targeted financial decision-making for better money management.

Fractional Priority Stacking

Fractional Priority Stacking in cash flow versus fractional flow budgeting strategically allocates funds based on a prioritized fraction of income streams, enhancing financial control and ensuring critical expenses are covered first. This approach optimizes money management by systematically reducing cash flow volatility and improving the predictability of budget adherence.

Adaptive Flow Routing

Adaptive Flow Routing in cash flow management dynamically allocates funds based on real-time income and expenses, offering greater flexibility than traditional fractional flow budgeting, which rigidly divides money into fixed categories. This approach enhances liquidity optimization by continuously adjusting cash allocations to prioritize immediate financial needs and investment opportunities.

Predictive Fractional Budgeting

Predictive Fractional Budgeting enhances cash flow management by allocating future income proportions to specific expenses based on predictive analytics, improving accuracy over traditional cash flow tracking. This approach enables more precise forecasting and optimized financial planning by tailoring budgets to fluctuating income patterns and anticipated expenditures.

Automated Fractional Sweeps

Automated fractional sweeps optimize cash flow management by systematically transferring surplus funds from multiple accounts into a primary account, ensuring liquidity while maximizing interest earnings. This method surpasses traditional cash flow budgeting by providing dynamic, real-time allocation of funds based on preset fractional thresholds, enhancing financial flexibility and control.

Smart Partial Allocation Modeling

Smart Partial Allocation Modeling in cash flow management optimizes liquidity by dynamically distributing funds based on real-time priorities and projected expenses, unlike fractional flow budgeting which allocates fixed percentages. This approach enhances financial agility, minimizing idle cash and improving investment opportunities while maintaining essential operational funding.

Cash flow vs Fractional flow budgeting for money management. Infographic

moneydiff.com

moneydiff.com