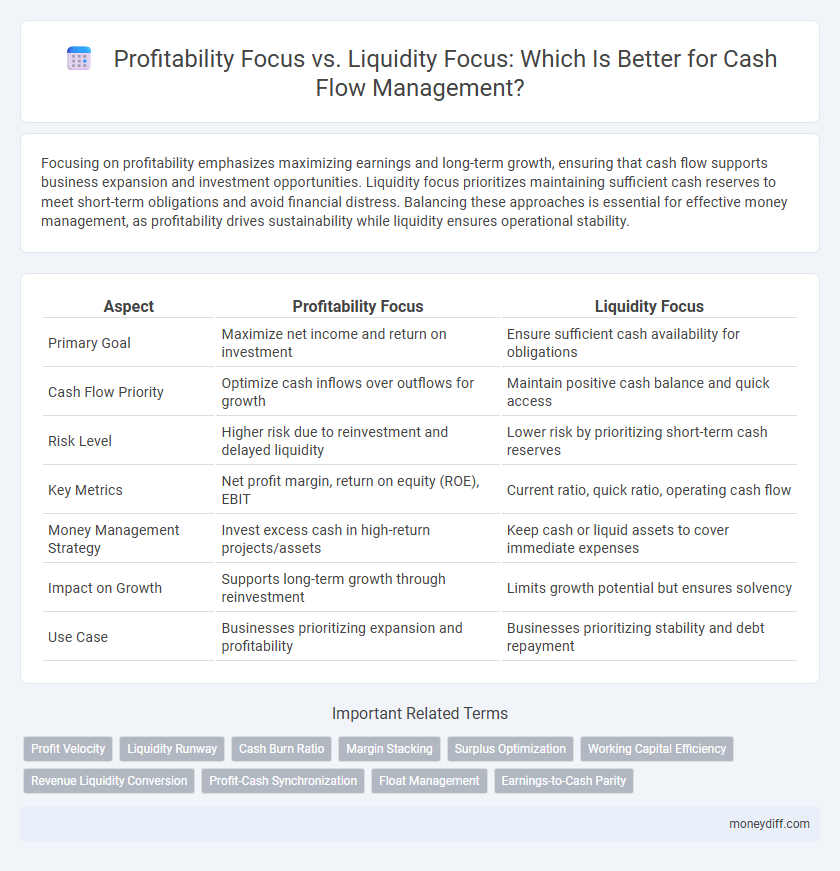

Focusing on profitability emphasizes maximizing earnings and long-term growth, ensuring that cash flow supports business expansion and investment opportunities. Liquidity focus prioritizes maintaining sufficient cash reserves to meet short-term obligations and avoid financial distress. Balancing these approaches is essential for effective money management, as profitability drives sustainability while liquidity ensures operational stability.

Table of Comparison

| Aspect | Profitability Focus | Liquidity Focus |

|---|---|---|

| Primary Goal | Maximize net income and return on investment | Ensure sufficient cash availability for obligations |

| Cash Flow Priority | Optimize cash inflows over outflows for growth | Maintain positive cash balance and quick access |

| Risk Level | Higher risk due to reinvestment and delayed liquidity | Lower risk by prioritizing short-term cash reserves |

| Key Metrics | Net profit margin, return on equity (ROE), EBIT | Current ratio, quick ratio, operating cash flow |

| Money Management Strategy | Invest excess cash in high-return projects/assets | Keep cash or liquid assets to cover immediate expenses |

| Impact on Growth | Supports long-term growth through reinvestment | Limits growth potential but ensures solvency |

| Use Case | Businesses prioritizing expansion and profitability | Businesses prioritizing stability and debt repayment |

Introduction: Understanding Profitability vs Liquidity in Cash Flow Management

Profitability focuses on generating higher revenue and return on investments, ensuring long-term business growth and value creation. Liquidity emphasizes maintaining sufficient cash or liquid assets to meet immediate financial obligations and operational expenses. Effective cash flow management balances profitability and liquidity to sustain business stability and optimal financial performance.

Defining Profitability Focus in Money Management

Profitability focus in money management emphasizes generating higher returns by investing resources in opportunities that maximize net income and overall value creation. This approach prioritizes long-term growth and strategic allocation of funds to projects with high profit margins rather than immediate cash availability. It contrasts with liquidity focus, which centers on maintaining sufficient cash flow to meet short-term obligations and operational expenses.

What It Means to Prioritize Liquidity

Prioritizing liquidity in money management means maintaining sufficient cash or cash-equivalents to meet short-term obligations and avoid financial distress. This approach emphasizes readily accessible funds over higher but less liquid profits, ensuring operational stability and flexibility during cash flow fluctuations. Businesses that focus on liquidity can quickly respond to unexpected expenses, whereas prioritizing profitability may risk cash shortages despite overall gains.

Key Differences: Profitability Focus vs Liquidity Focus

Profitability focus prioritizes maximizing net income and long-term growth, emphasizing efficient asset utilization and revenue generation. Liquidity focus centers on maintaining sufficient cash and quick assets to meet short-term obligations and avoid insolvency risks. Key differences include profitability's emphasis on earnings optimization, while liquidity prioritizes cash availability and financial stability.

Benefits of Maintaining a Profitability-Centric Approach

Maintaining a profitability-centric approach in cash flow management ensures sustained business growth by prioritizing revenue generation and cost control, leading to higher net income and stronger financial health. This focus enables better strategic investment decisions and attracts investors seeking long-term value rather than short-term liquidity. Emphasizing profitability helps businesses build reserves that improve liquidity over time, providing a balanced foundation for operational stability and expansion.

Advantages of Liquidity Prioritization in Cash Flow

Liquidity prioritization in cash flow management ensures that businesses maintain sufficient cash reserves to meet short-term obligations, reducing the risk of insolvency and enabling operational stability. Adequate liquidity enhances flexibility, allowing companies to quickly respond to unexpected expenses or seize timely investment opportunities. Prioritizing liquidity supports continuous supplier and employee payments, fostering trust and sustaining business relationships critical for long-term success.

Risks of Over-Focusing on Profitability

Over-focusing on profitability in cash flow management can lead to liquidity shortages, increasing the risk of cash crunches that hinder daily operations. Companies may delay payments or forego essential expenses, which compromises supplier relationships and operational stability. Maintaining a balance between profitability and liquidity safeguards against financial distress and ensures sustainable business growth.

Pitfalls of Excessive Liquidity Focus

Excessive liquidity focus in cash flow management can lead to underutilized assets and missed investment opportunities that enhance profitability. Holding too much cash reduces returns on equity and may cause a company to lag behind competitors prioritizing growth and efficiency. Balancing liquidity with profitability ensures sufficient cash for obligations while maximizing asset utilization and long-term value creation.

Balancing Profitability and Liquidity: Best Practices

Balancing profitability and liquidity requires businesses to strategically manage cash flow by maintaining sufficient liquid assets to meet short-term obligations while maximizing returns on available capital. Implementing cash flow forecasting and monitoring key performance indicators such as current ratio and operating cash flow margin can optimize financial stability and growth potential. Effective money management integrates timely receivables collection with controlled payables disbursement to sustain both operational efficiency and profitability.

Strategic Decision-Making: Choosing the Right Focus for Your Business

Profitability focus emphasizes maximizing net income to drive long-term growth, while liquidity focus prioritizes maintaining sufficient cash flow for operational stability. Strategic decision-making requires balancing these perspectives to ensure sustainable business performance without risking insolvency. Businesses must evaluate cash flow patterns, working capital needs, and market conditions to select the optimal focus aligned with their financial goals.

Related Important Terms

Profit Velocity

Profitability focus emphasizes maximizing returns on investments, driving growth through efficient asset utilization, whereas liquidity focus prioritizes maintaining sufficient cash flow to meet short-term obligations and operational stability. Profit velocity, measuring the speed at which profits are generated and converted into cash, serves as a critical indicator of effective money management by balancing profitability and liquidity.

Liquidity Runway

Liquidity runway measures the length of time a company can sustain operations using its available cash reserves without additional income, serving as a critical indicator to maintain solvency. Prioritizing liquidity focus over profitability ensures sufficient cash flow to cover immediate expenses, mitigating risks of insolvency despite potential short-term profit sacrifices.

Cash Burn Ratio

Cash Burn Ratio measures the rate at which a company uses its cash reserves to cover operating expenses, highlighting liquidity management's critical role in sustaining business operations during periods of low profitability. Prioritizing liquidity focus over profitability focus ensures sufficient cash flow to meet short-term obligations, preventing insolvency despite negative earnings or slower revenue growth.

Margin Stacking

Profitability focus emphasizes maximizing margin stacking by increasing revenue streams and optimizing cost structures to enhance overall profit margins. Liquidity focus prioritizes maintaining sufficient cash flow to meet short-term obligations, ensuring financial stability without compromising operational efficiency.

Surplus Optimization

Prioritizing profitability focuses on maximizing surplus through effective revenue generation and cost control, ensuring long-term value creation and financial growth. Emphasizing liquidity centers on maintaining sufficient cash flow to meet immediate obligations, optimizing surplus by balancing quick asset conversion and operational efficiency.

Working Capital Efficiency

Prioritizing profitability focus drives long-term value by maximizing net income and return on investment, whereas liquidity focus ensures sufficient cash flow to meet short-term obligations and avoid financial distress. Efficient management of working capital--optimizing accounts receivable, inventory, and accounts payable--strikes a balance between profitability and liquidity, enhancing overall cash flow stability and operational effectiveness.

Revenue Liquidity Conversion

Effective money management balances profitability focus, which emphasizes maximizing revenue and net income, with liquidity focus, ensuring sufficient cash flow to meet short-term obligations. Prioritizing revenue liquidity conversion enhances operational efficiency by accelerating cash inflows from sales, strengthening the company's ability to fund expenses without compromising profitability.

Profit-Cash Synchronization

Profitability focus prioritizes maximizing net income by aligning revenue generation with cost control, while liquidity focus emphasizes maintaining sufficient cash reserves to meet short-term obligations. Effective profit-cash synchronization ensures that earnings translate into actual cash inflows, optimizing operational stability and financial flexibility.

Float Management

Profitability focus in cash flow management prioritizes maximizing earnings through strategic investment and efficient cost control, whereas liquidity focus emphasizes maintaining sufficient cash reserves to meet short-term obligations and avoid solvency risks. Effective float management optimizes the timing disparity between cash inflows and outflows, enhancing liquidity without sacrificing profitability by accelerating receivables and delaying payables within operational constraints.

Earnings-to-Cash Parity

Profitability focus emphasizes maximizing earnings, often leading to higher reported profits but potentially lower cash availability, whereas liquidity focus prioritizes maintaining sufficient cash flow to meet immediate obligations. Achieving earnings-to-cash parity ensures that reported profits align closely with actual cash generated, optimizing both profitability and liquidity management for sustainable financial health.

Profitability focus vs liquidity focus for money management. Infographic

moneydiff.com

moneydiff.com