Traditional budgeting often relies on historical spending patterns, which can lead to inefficiencies and overspending. Zero-based cash flow management requires every expense to be justified from scratch, promoting more precise control and alignment with actual financial goals. This approach enhances cash flow visibility and ensures resources are allocated based on current priorities rather than past habits.

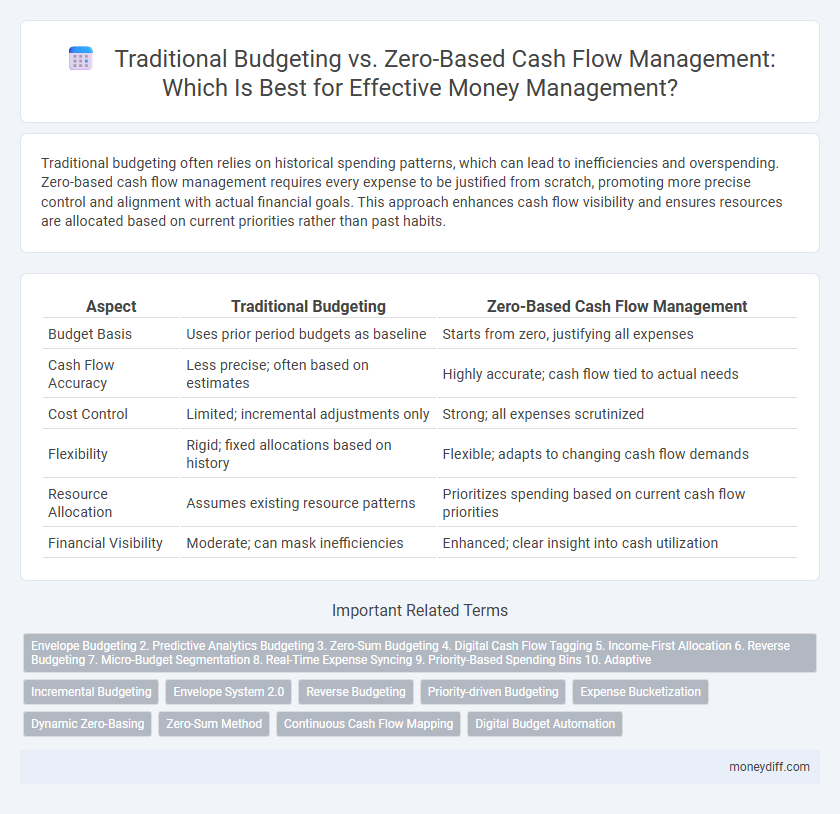

Table of Comparison

| Aspect | Traditional Budgeting | Zero-Based Cash Flow Management |

|---|---|---|

| Budget Basis | Uses prior period budgets as baseline | Starts from zero, justifying all expenses |

| Cash Flow Accuracy | Less precise; often based on estimates | Highly accurate; cash flow tied to actual needs |

| Cost Control | Limited; incremental adjustments only | Strong; all expenses scrutinized |

| Flexibility | Rigid; fixed allocations based on history | Flexible; adapts to changing cash flow demands |

| Resource Allocation | Assumes existing resource patterns | Prioritizes spending based on current cash flow priorities |

| Financial Visibility | Moderate; can mask inefficiencies | Enhanced; clear insight into cash utilization |

Introduction to Cash Flow Management Approaches

Traditional budgeting allocates cash flow based on historical expenses and fixed categories, often leading to inefficient money management by overlooking changing financial priorities. Zero-based cash flow management requires justifying every expense from scratch each period, ensuring funds are directed toward essential activities and improving overall financial control. This approach enhances resource allocation accuracy, reduces waste, and enables dynamic adjustment to cash inflows and outflows for optimal money management.

Understanding Traditional Budgeting Methods

Traditional budgeting methods rely on historical financial data to forecast future cash flows, often leading to incremental adjustments rather than fundamental reevaluation of expenditures. This approach typically emphasizes fixed budget allocations and periodic variance analysis, which may overlook inefficiencies and hinder adaptive cash flow management. By focusing on past consumption patterns, traditional budgeting can limit proactive decision-making and responsiveness to changing financial conditions.

What is Zero-Based Cash Flow Management?

Zero-Based Cash Flow Management allocates every dollar of income to specific expenses, savings, or debt repayment, ensuring no cash is left unassigned. Unlike traditional budgeting, which often bases spending on previous periods, zero-based budgeting starts from a "zero base," requiring justification for all expenses each cycle. This method promotes precise control over money management, reduces waste, and aligns spending with current financial priorities.

Key Differences Between Traditional and Zero-Based Budgeting

Traditional budgeting allocates funds based on historical expenses, often leading to incremental adjustments, whereas zero-based budgeting requires justification for every expense from a zero base each period. Traditional methods may overlook inefficiencies due to reliance on past data, while zero-based approaches optimize cash flow by prioritizing current needs and eliminating non-essential costs. Key differences include the level of detailed expense scrutiny, flexibility in fund allocation, and the impact on cash flow precision and control.

Advantages of Traditional Budgeting for Money Management

Traditional budgeting provides a clear framework by allocating fixed amounts to specific expense categories, ensuring predictable cash flow management and simplifying financial planning processes. It fosters disciplined spending habits with historical data guiding future financial decisions, promoting consistency and control over monetary resources. This method allows organizations to track variance easily between projected and actual expenditures, enhancing overall budget adherence and accountability.

Benefits of Zero-Based Cash Flow Management

Zero-based cash flow management enhances financial discipline by requiring every expense to be justified, leading to more precise allocation of funds and elimination of unnecessary costs. This method improves cash visibility and control, allowing businesses to adapt quickly to cash flow fluctuations without relying on historical budget assumptions. Organizations benefit from increased operational efficiency and better alignment of spending with current financial goals.

Common Challenges with Each Cash Flow Approach

Traditional budgeting often struggles with inflexibility and reliance on historical data, leading to inaccurate cash flow forecasts and missed opportunities for cost reduction. Zero-based cash flow management demands intensive time and resource investment to justify every expense, creating complexity and potential resistance from departments. Both approaches face challenges in balancing accuracy with efficiency, impacting overall financial agility and decision-making.

Which Method Suits Your Financial Goals?

Traditional budgeting allocates funds based on historical spending patterns, suitable for stable income and predictable expenses, while zero-based cash flow management requires justifying every expense from scratch, ideal for fluctuating incomes and tight financial control. Assessing your financial goals, zero-based budgeting supports aggressive saving and debt reduction by promoting mindfulness in spending. Choosing between these methods depends on whether your priority is simplicity and consistency or customized, goal-driven cash flow optimization.

Transitioning from Traditional to Zero-Based Cash Flow Management

Transitioning from traditional budgeting to zero-based cash flow management enhances financial precision by requiring every expense to be justified from zero each period, eliminating assumptions based on past budgets. This method improves cash flow visibility and control, allowing for more strategic allocation of resources aligned with current organizational priorities. Businesses adopting zero-based cash flow management experience increased efficiency and reduced waste, driving better financial discipline and adaptability.

Final Thoughts: Choosing the Right Money Management Strategy

Traditional budgeting relies on historical data to allocate funds, often leading to rigid financial plans that may not reflect current priorities. Zero-based cash flow management requires justifying every expense from scratch, promoting more efficient resource allocation and adaptability to changing financial conditions. Selecting the right money management strategy depends on your organization's need for flexibility, accuracy, and control over cash flow processes.

Related Important Terms

Envelope Budgeting 2. Predictive Analytics Budgeting 3. Zero-Sum Budgeting 4. Digital Cash Flow Tagging 5. Income-First Allocation 6. Reverse Budgeting 7. Micro-Budget Segmentation 8. Real-Time Expense Syncing 9. Priority-Based Spending Bins 10. Adaptive

Envelope Budgeting allocates fixed amounts to spending categories, enhancing control over expenses, while Predictive Analytics Budgeting uses historical data to forecast cash flow and adjust budgets dynamically. Zero-Sum Budgeting ensures every dollar is assigned a purpose, Digital Cash Flow Tagging categorizes transactions in real-time for precise tracking, and Income-First Allocation prioritizes saving and investing before expenses; Reverse Budgeting starts from financial goals to allocate spending, Micro-Budget Segmentation breaks down budgets into smaller units for detailed oversight, Real-Time Expense Syncing updates financial data instantly, Priority-Based Spending Bins focus funds on high-impact needs, and Adaptive budgeting allows continuous adjustments based on changing cash flow conditions.

Incremental Budgeting

Incremental budgeting, a traditional budgeting method, allocates funds based on previous periods with incremental adjustments, often leading to inefficiency and resource misallocation. Zero-based cash flow management demands justification for every expense, optimizing cash utilization by aligning outflows directly with current business priorities and operational needs.

Envelope System 2.0

Traditional budgeting allocates funds based on historical spending patterns, often leading to inflexibility, whereas zero-based cash flow management requires justifying every expense from scratch to optimize resource allocation. The Envelope System 2.0 enhances zero-based methods by digitally categorizing income into predetermined spending envelopes, promoting disciplined, transparent cash flow control and reducing financial waste.

Reverse Budgeting

Reverse budgeting reallocates cash flow by prioritizing savings and essential expenses before discretionary spending, contrasting with traditional budgeting's fixed allocation method. Zero-based cash flow management complements this approach by requiring every dollar to be assigned a specific purpose, enhancing financial control and reducing waste.

Priority-driven Budgeting

Priority-driven budgeting in zero-based cash flow management allocates funds based on current business needs and strategic goals, unlike traditional budgeting which relies on historical expenditure patterns. This method enhances financial efficiency by ensuring every dollar is purposefully assigned, improving cash flow visibility and control.

Expense Bucketization

Traditional budgeting groups expenses into fixed categories based on historical spending, often leading to inefficient allocation and overlooked cash flow fluctuations. Zero-based cash flow management requires each expense bucket to be justified from scratch every period, promoting precise allocation and improved control over variable cash inflows and outflows.

Dynamic Zero-Basing

Dynamic Zero-Basing revolutionizes cash flow management by continuously evaluating and justifying every expense from zero, unlike traditional budgeting which relies on incremental adjustments to past budgets. This approach enhances financial agility, optimizes resource allocation, and provides real-time visibility into cash flow performance, driving more efficient money management.

Zero-Sum Method

Zero-based cash flow management applies the Zero-Sum Method by assigning every dollar a specific purpose, ensuring income minus expenses equals zero, which enhances precise money allocation and reduces waste. Unlike traditional budgeting that relies on historical spending patterns, zero-based cash flow demands justification for all expenses, promoting disciplined financial control and maximizing savings potential.

Continuous Cash Flow Mapping

Traditional budgeting relies on static annual projections that often overlook dynamic cash flow variations, while zero-based cash flow management employs continuous cash flow mapping to align every expense with real-time financial inflows and outflows. This continuous monitoring enables precise money management by identifying cash surpluses and deficits promptly, optimizing liquidity, and enhancing financial agility.

Digital Budget Automation

Digital Budget Automation enhances zero-based cash flow management by enabling precise allocation of every dollar based on current financial needs rather than historical spending, improving cash flow accuracy and operational efficiency. Traditional budgeting often relies on incremental adjustments, while digital tools automate real-time cash flow tracking and forecasting, reducing errors and optimizing liquidity management for businesses.

Traditional budgeting vs zero-based cash flow management for money management. Infographic

moneydiff.com

moneydiff.com