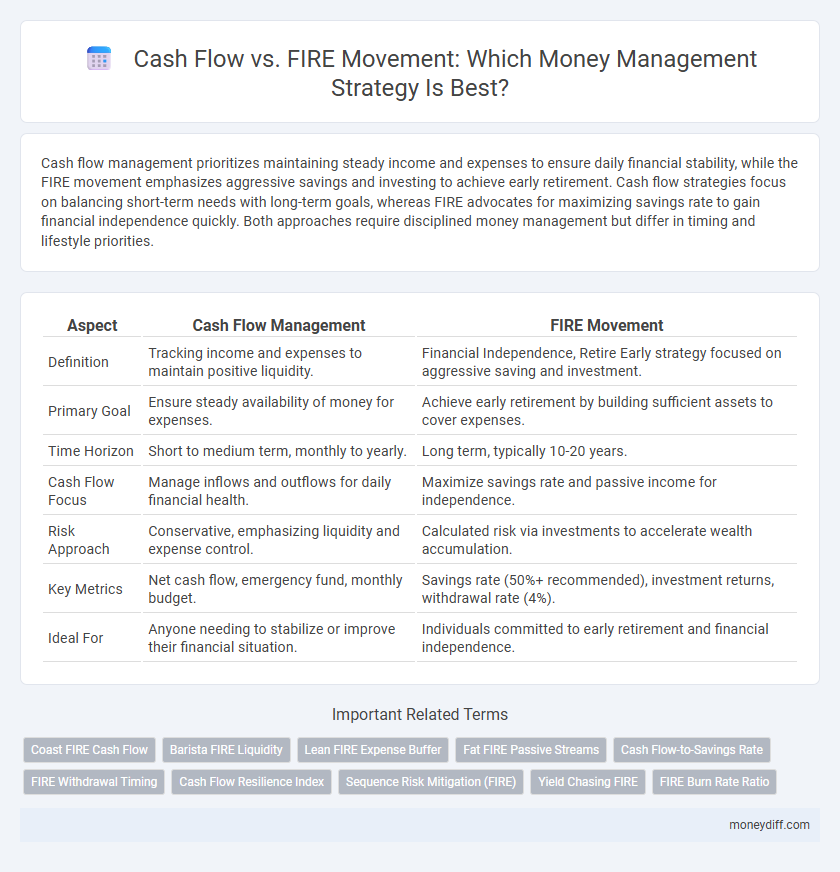

Cash flow management prioritizes maintaining steady income and expenses to ensure daily financial stability, while the FIRE movement emphasizes aggressive savings and investing to achieve early retirement. Cash flow strategies focus on balancing short-term needs with long-term goals, whereas FIRE advocates for maximizing savings rate to gain financial independence quickly. Both approaches require disciplined money management but differ in timing and lifestyle priorities.

Table of Comparison

| Aspect | Cash Flow Management | FIRE Movement |

|---|---|---|

| Definition | Tracking income and expenses to maintain positive liquidity. | Financial Independence, Retire Early strategy focused on aggressive saving and investment. |

| Primary Goal | Ensure steady availability of money for expenses. | Achieve early retirement by building sufficient assets to cover expenses. |

| Time Horizon | Short to medium term, monthly to yearly. | Long term, typically 10-20 years. |

| Cash Flow Focus | Manage inflows and outflows for daily financial health. | Maximize savings rate and passive income for independence. |

| Risk Approach | Conservative, emphasizing liquidity and expense control. | Calculated risk via investments to accelerate wealth accumulation. |

| Key Metrics | Net cash flow, emergency fund, monthly budget. | Savings rate (50%+ recommended), investment returns, withdrawal rate (4%). |

| Ideal For | Anyone needing to stabilize or improve their financial situation. | Individuals committed to early retirement and financial independence. |

Understanding Cash Flow in Personal Finances

Understanding cash flow in personal finances is crucial for effective money management, as it tracks the inflow and outflow of funds to ensure expenses do not exceed income. The FIRE (Financial Independence, Retire Early) movement emphasizes maximizing positive cash flow by increasing savings and reducing discretionary spending to build wealth rapidly. Maintaining a detailed cash flow statement helps individuals align their financial habits with FIRE principles, promoting long-term financial stability and early retirement goals.

What Is the FIRE Movement?

The FIRE (Financial Independence, Retire Early) movement emphasizes aggressive saving and investing to achieve financial independence and retire sooner than traditional retirement age. Cash flow management plays a critical role within the FIRE strategy by ensuring consistent income exceeds expenses, allowing surplus funds to be reinvested for accelerated wealth growth. Effective cash flow tracking supports the disciplined budgeting and expense control necessary to meet the stringent savings rates typical of the FIRE movement.

Key Differences: Cash Flow vs. FIRE Strategies

Cash flow management prioritizes maintaining a positive inflow-outflow balance for daily financial stability, emphasizing liquidity and ongoing income streams. The FIRE (Financial Independence, Retire Early) movement focuses on aggressive saving and investing to achieve financial freedom and early retirement, often requiring significant lifestyle adjustments. Key differences include cash flow's short-term emphasis on budgeting and expense control versus FIRE's long-term goal of asset accumulation and reduced dependence on earned income.

Building Passive Income Streams for Cash Flow

Building passive income streams is essential for enhancing cash flow and achieving financial independence within the FIRE movement, which emphasizes early retirement through disciplined saving and investing. Strategic investments in rental properties, dividend stocks, and automated online businesses create consistent cash flow that supports living expenses without depleting principal assets. Sustainable cash flow generation provides financial security and flexibility, reducing reliance on active income sources while accelerating the path to financial independence.

The Role of Aggressive Saving in FIRE

Aggressive saving is a cornerstone of the FIRE (Financial Independence, Retire Early) movement, emphasizing maximizing cash flow by significantly reducing expenses and increasing income streams. This approach prioritizes accumulating substantial savings rapidly to achieve financial independence well before traditional retirement age. Maintaining a strong positive cash flow through disciplined budgeting and high savings rates accelerates wealth growth, enabling early exit from the workforce.

Cash Flow Management for Long-Term Wealth

Effective cash flow management prioritizes consistent income streams and controlled expenses to build sustainable wealth over time, contrasting with the FIRE movement's emphasis on aggressive early retirement savings. Maintaining positive cash flow enables reinvestment opportunities, financial flexibility, and resilience against market volatility, which supports long-term wealth accumulation. Robust cash flow strategies integrate budgeting, debt management, and diversified income to ensure ongoing liquidity and asset growth.

FIRE Movement: Early Retirement Planning

The FIRE movement emphasizes aggressive saving and investing to achieve financial independence and retire early, prioritizing consistently positive cash flow from multiple income streams. Effective cash flow management enables FIRE adherents to maximize savings rates, reduce expenses, and build a sustainable investment portfolio that generates passive income. By focusing on optimizing cash inflows and controlling outflows, individuals accelerate their path to early retirement with long-term financial security.

Balancing Cash Flow and FIRE Goals

Balancing cash flow with FIRE (Financial Independence, Retire Early) goals requires precise budgeting to ensure consistent income exceeds expenses while maximizing savings rate. Effective money management entails tracking monthly cash inflows and outflows to maintain liquidity without compromising investment contributions toward early retirement funds. Prioritizing emergency funds and debt reduction enhances financial stability, supporting sustainable progress within the FIRE movement.

Risks and Challenges: Cash Flow vs. FIRE

Cash flow management emphasizes maintaining steady liquidity to cover expenses, reducing risk of insolvency during economic downturns or unexpected financial emergencies. The FIRE (Financial Independence, Retire Early) movement involves aggressive saving and investing, which can pose risks such as market volatility, premature depletion of retirement funds, and lifestyle inflation if not carefully planned. Balancing cash flow stability with FIRE goals requires strategic budgeting, risk tolerance assessment, and contingency planning to mitigate financial challenges over the long term.

Which Approach Suits Your Financial Journey?

Cash flow management emphasizes steady income and controlled expenses to maintain liquidity and financial stability, ideal for those prioritizing flexibility and day-to-day financial security. The FIRE (Financial Independence, Retire Early) movement focuses on aggressive saving and investing to achieve early retirement, suited for individuals aiming for long-term wealth accumulation and financial freedom. Choosing between cash flow management and the FIRE approach depends on your financial goals, risk tolerance, and preferred timeline for independence.

Related Important Terms

Coast FIRE Cash Flow

Coast FIRE prioritizes building enough investments early so future financial independence can be achieved with minimal ongoing contributions, allowing individuals to focus on maintaining positive cash flow for present expenses. Effective cash flow management in Coast FIRE ensures that current spending aligns with sustainable income streams, reducing the need for aggressive savings while still progressing towards long-term financial freedom.

Barista FIRE Liquidity

Barista FIRE emphasizes maintaining steady cash flow through part-time work while pursuing financial independence, balancing liquidity with investment growth. This approach ensures sufficient cash reserves to cover expenses without fully relying on portfolio withdrawals, optimizing money management and financial flexibility.

Lean FIRE Expense Buffer

Maintaining a Lean FIRE expense buffer ensures sufficient liquidity to cover essential costs without excessive cash hoarding, optimizing cash flow management during the Financial Independence, Retire Early (FIRE) journey. This targeted buffer reduces reliance on fragile investment withdrawals, providing a stable cash flow cushion that balances frugality with financial security.

Fat FIRE Passive Streams

Fat FIRE emphasizes building substantial passive income streams through diversified investments such as real estate, dividend stocks, and online businesses to maintain a high standard of living without active employment. Effective cash flow management within Fat FIRE strategies ensures consistent liquidity and financial stability, enabling early retirement with elevated spending capacity.

Cash Flow-to-Savings Rate

Cash flow-to-savings rate is a crucial metric distinguishing effective money management in the Cash Flow approach versus the FIRE movement, emphasizing consistent income surplus over aggressive savings targets. While FIRE prioritizes maximizing savings rate to achieve early retirement, Cash Flow focuses on maintaining positive cash flow for sustainable financial flexibility and liquidity.

FIRE Withdrawal Timing

FIRE withdrawal timing critically impacts cash flow sustainability, as early or aggressive withdrawals may deplete reserves before passive income streams stabilize. Optimizing withdrawal strategies ensures steady cash flow aligns with financial independence milestones to maintain long-term fiscal health.

Cash Flow Resilience Index

The Cash Flow Resilience Index measures an individual's ability to maintain positive cash flow during financial stress, offering a practical metric for money management compared to the FIRE movement's emphasis on early financial independence. Prioritizing a high Cash Flow Resilience Index enhances financial stability by ensuring consistent liquidity and adaptive income streams despite market fluctuations.

Sequence Risk Mitigation (FIRE)

Sequence risk mitigation in the FIRE movement emphasizes maintaining positive cash flow to protect investment portfolios during market downturns, ensuring sustainable withdrawals over time. By prioritizing cash flow stability, individuals reduce the risk of depleting assets early, which aligns with the principles of long-term financial independence and early retirement.

Yield Chasing FIRE

Yield Chasing FIRE prioritizes maximizing investment returns through aggressive yield-seeking strategies, often at the expense of stable cash flow generation critical for sustainable money management. While traditional cash flow methods emphasize consistent income streams from dividends or rentals, Yield Chasing FIRE focuses on rapid portfolio growth to achieve financial independence faster, increasing exposure to market volatility and cash flow irregularities.

FIRE Burn Rate Ratio

The FIRE Burn Rate Ratio measures the rate at which a retiree depletes their investment portfolio, highlighting the importance of sustainable cash flow management to maintain financial independence. Monitoring this ratio allows individuals in the FIRE movement to balance their spending against passive income, ensuring long-term stability without exhausting resources prematurely.

Cash flow vs FIRE movement for money management. Infographic

moneydiff.com

moneydiff.com