Invoicing provides a clear, structured approach to requesting payment, ensuring predictable cash flow and accurate financial records for businesses managing expenses related to pets. Dynamic discounting offers flexibility by enabling companies to pay early in exchange for discounts, improving cash flow efficiency and enhancing supplier relationships. Combining invoicing with dynamic discounting strategies helps optimize money management by balancing payment timing and cost savings in pet care financial operations.

Table of Comparison

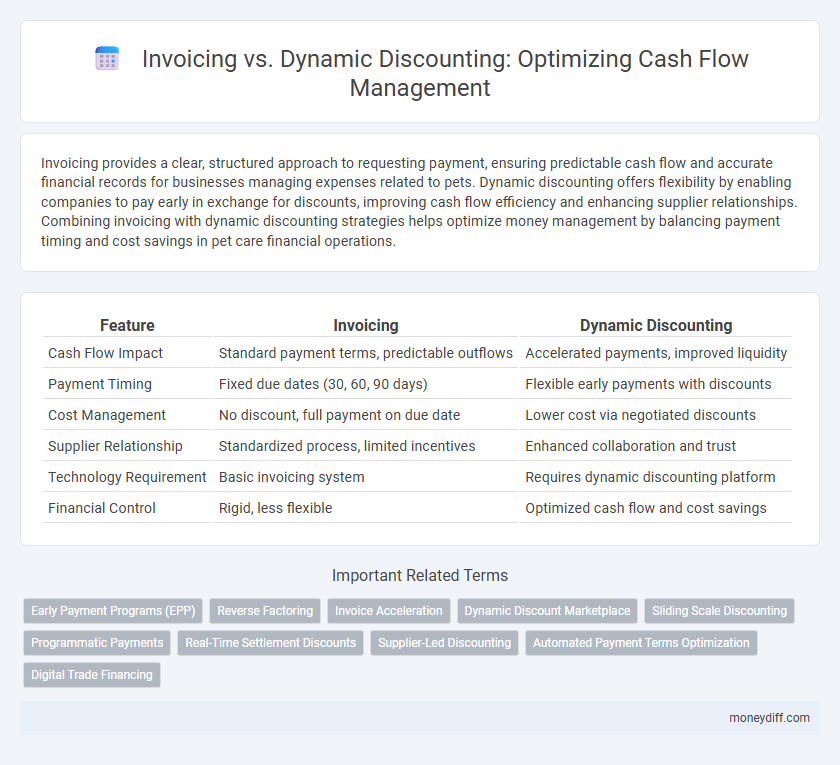

| Feature | Invoicing | Dynamic Discounting |

|---|---|---|

| Cash Flow Impact | Standard payment terms, predictable outflows | Accelerated payments, improved liquidity |

| Payment Timing | Fixed due dates (30, 60, 90 days) | Flexible early payments with discounts |

| Cost Management | No discount, full payment on due date | Lower cost via negotiated discounts |

| Supplier Relationship | Standardized process, limited incentives | Enhanced collaboration and trust |

| Technology Requirement | Basic invoicing system | Requires dynamic discounting platform |

| Financial Control | Rigid, less flexible | Optimized cash flow and cost savings |

Understanding Invoicing in Cash Flow Management

Invoicing plays a critical role in cash flow management by establishing clear payment terms and timelines that help businesses predict and control incoming revenue. Accurate and timely invoicing ensures quicker payment cycles, reducing days sales outstanding (DSO) and improving liquidity. Understanding invoice accuracy, payment deadlines, and follow-up processes can optimize cash flow, making invoicing a fundamental tool for effective money management.

What is Dynamic Discounting?

Dynamic discounting is a cash flow management strategy where buyers offer early payment discounts to suppliers in exchange for accelerated invoice payments, enhancing liquidity for both parties. Unlike traditional invoicing, which involves fixed payment terms, dynamic discounting adjusts discount rates based on the actual payment date, providing flexibility and optimizing working capital. This approach reduces days payable outstanding (DPO) for buyers while improving days sales outstanding (DSO) for suppliers, leading to more efficient money management.

Key Differences Between Invoicing and Dynamic Discounting

Invoicing establishes a fixed payment schedule with predetermined terms, ensuring predictable cash flow but often resulting in delayed payments. Dynamic discounting allows early payment in exchange for a variable discount, enhancing liquidity by accelerating cash inflows and optimizing working capital management. The key difference lies in invoicing's rigid timeline versus dynamic discounting's flexibility to improve cash flow efficiency.

Impact of Invoicing on Cash Flow Cycles

Invoicing directly influences cash flow cycles by determining the timing and predictability of incoming payments, which affects working capital management. Delays in invoicing or extended payment terms can lengthen cash conversion cycles, restricting liquidity and operational flexibility. Efficient invoicing processes accelerate cash inflows, improving cash flow stability and enabling better forecasting for business growth.

How Dynamic Discounting Enhances Liquidity

Dynamic discounting accelerates cash inflows by offering early payment incentives, directly improving a company's liquidity position. Unlike traditional invoicing with fixed payment terms, dynamic discounting allows flexible payment scheduling that aligns with real-time cash availability and supplier needs. This optimized cash flow enhances working capital management and reduces reliance on external financing sources.

Pros and Cons: Invoicing vs Dynamic Discounting

Invoicing provides a clear, structured payment process that supports predictable cash flow management but can lead to delayed payments and increased working capital needs. Dynamic discounting accelerates cash inflows by offering early payment discounts, improving liquidity and reducing days sales outstanding (DSO), yet it may reduce profit margins due to the discounts applied. Balancing invoicing's formal credit terms with dynamic discounting's flexibility optimizes money management by aligning payment timing with cash flow requirements and supplier relationships.

Choosing the Right Strategy for Your Business

Choosing the right strategy for managing cash flow involves evaluating invoicing methods against dynamic discounting opportunities to optimize liquidity and reduce costs. Invoicing provides predictable payment timelines, while dynamic discounting leverages early payment discounts to improve working capital efficiency. Businesses must analyze their cash flow cycles, supplier relationships, and discount terms to determine the most beneficial approach for maintaining financial stability and maximizing savings.

Mitigating Payment Delays with Dynamic Discounting

Dynamic discounting enables businesses to mitigate payment delays by offering early payment incentives that improve cash flow predictability and reduce outstanding receivables. Unlike traditional invoicing, this strategy leverages flexible discount rates tied to payment timing, optimizing working capital management. Companies employing dynamic discounting experience accelerated cash conversion cycles and enhanced supplier relationships through timely settlements.

Technology Solutions for Smarter Invoicing and Discounting

Technology solutions for smarter invoicing and dynamic discounting leverage automation and AI to optimize cash flow management, enabling businesses to accelerate receivables and enhance liquidity. Platforms integrating real-time data analytics provide dynamic discounting options tailored to supplier behavior and payment patterns, increasing working capital efficiency. These innovations reduce manual errors, improve payment predictability, and support strategic decision-making in financial operations.

Best Practices for Integrating Discounting into Invoicing Processes

Integrating dynamic discounting into invoicing processes enhances cash flow management by incentivizing early payments and improving liquidity. Best practices include automating discount calculations within invoicing software, clearly communicating discount terms to suppliers, and aligning discount thresholds with cash flow forecasts. Leveraging real-time data analytics ensures precise discount offers that optimize working capital without compromising supplier relationships.

Related Important Terms

Early Payment Programs (EPP)

Early Payment Programs (EPP) enhance cash flow management by leveraging dynamic discounting, enabling buyers to pay invoices earlier in exchange for discounted rates, which improves supplier liquidity and reduces cost of capital. Unlike traditional invoicing that follows fixed payment terms, EPP's flexible payment schedules optimize working capital efficiency and strengthen supplier relationships.

Reverse Factoring

Reverse factoring enhances cash flow management by enabling suppliers to receive early payments through a third-party financier, improving liquidity without impacting buyer payment terms. Unlike traditional invoicing, this dynamic discounting model leverages financial technology to optimize working capital and reduce days payable outstanding (DPO).

Invoice Acceleration

Invoice acceleration through dynamic discounting improves cash flow by enabling early payment in exchange for a discount, reducing outstanding receivables and enhancing liquidity. This method optimizes working capital management compared to traditional invoicing by shortening the cash conversion cycle and providing suppliers with faster access to funds.

Dynamic Discount Marketplace

Dynamic Discount Marketplaces enable businesses to optimize cash flow by leveraging early payment discounts offered by suppliers, creating a flexible, demand-driven invoicing environment. This approach improves liquidity management and reduces financing costs by transforming payables into a strategic source of working capital.

Sliding Scale Discounting

Sliding scale discounting in dynamic discounting offers companies flexible early payment incentives based on payment timing, enhancing cash flow management compared to traditional fixed-invoice terms. This method optimizes working capital by encouraging faster payments while preserving buyer-supplier relationships through adaptable discount rates aligned with payment speed.

Programmatic Payments

Programmatic payments leverage dynamic discounting to optimize cash flow by automating early payment incentives, reducing days payable outstanding (DPO) and improving supplier relationships. Unlike traditional invoicing, dynamic discounting enables real-time cash management decisions that enhance liquidity and working capital efficiency.

Real-Time Settlement Discounts

Real-time settlement discounts enhance cash flow management by incentivizing early payments through dynamic discounting, reducing days sales outstanding (DSO) and improving liquidity. Unlike traditional invoicing cycles, this approach leverages automated financial technology to instantly adjust discount rates based on payment timing, optimizing working capital efficiency.

Supplier-Led Discounting

Supplier-led discounting optimizes cash flow by enabling suppliers to offer dynamic discounts in exchange for early invoice payments, improving liquidity for buyers without disrupting payment schedules. This model enhances working capital management by aligning payment timing with supplier-driven discount incentives, reducing days payable outstanding (DPO) and fostering stronger supplier relationships.

Automated Payment Terms Optimization

Automated payment terms optimization leverages dynamic discounting to enhance cash flow management by automatically adjusting invoice payment schedules based on real-time liquidity and discount opportunities. This approach improves working capital efficiency by reducing days payable outstanding (DPO) while maximizing early payment discounts and maintaining supplier relationships.

Digital Trade Financing

Invoicing provides a traditional payment schedule that stabilizes cash flow predictability, while dynamic discounting offers flexible early payment options, enhancing liquidity management in Digital Trade Financing. Leveraging dynamic discounting within digital platforms accelerates receivables and reduces financing costs by enabling buyers to capture discounts based on their available cash position.

Invoicing vs dynamic discounting for money management. Infographic

moneydiff.com

moneydiff.com