Effective money management requires understanding the difference between cash flow and burn rate to maintain financial health. Cash flow measures the actual money moving in and out of a business, indicating liquidity, while burn rate tracks the speed at which a company is spending its cash reserves. Monitoring both metrics ensures sustainable spending and prevents running out of funds prematurely.

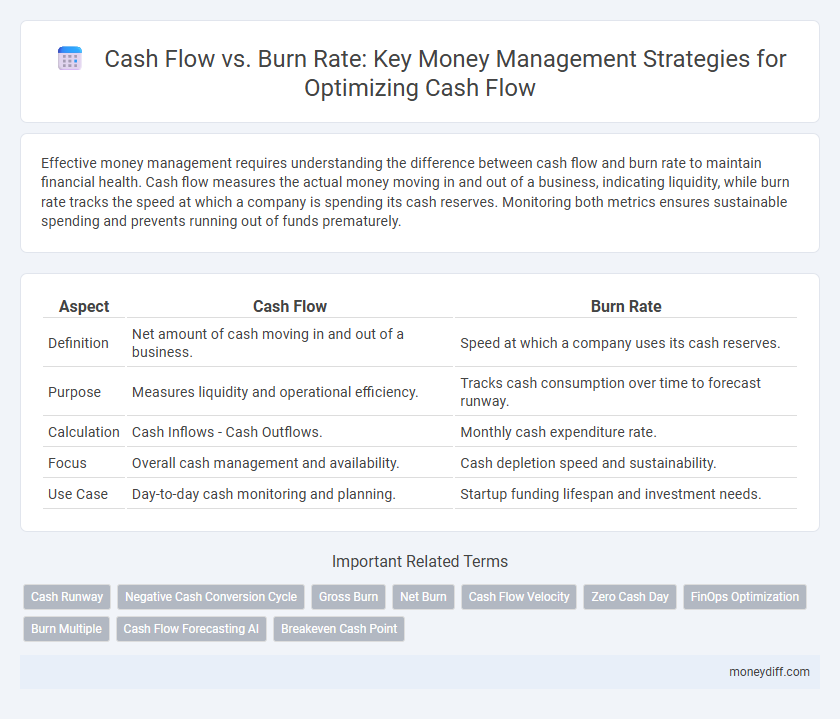

Table of Comparison

| Aspect | Cash Flow | Burn Rate |

|---|---|---|

| Definition | Net amount of cash moving in and out of a business. | Speed at which a company uses its cash reserves. |

| Purpose | Measures liquidity and operational efficiency. | Tracks cash consumption over time to forecast runway. |

| Calculation | Cash Inflows - Cash Outflows. | Monthly cash expenditure rate. |

| Focus | Overall cash management and availability. | Cash depletion speed and sustainability. |

| Use Case | Day-to-day cash monitoring and planning. | Startup funding lifespan and investment needs. |

Understanding Cash Flow and Burn Rate

Cash flow reflects the total amount of money moving in and out of a business, indicating its liquidity and operational health over a specific period. Burn rate measures the speed at which a company spends its available capital, crucial for startups to assess financial runway. Understanding both metrics enables effective money management by balancing income against expenditures to maintain sustainable growth.

Key Differences Between Cash Flow and Burn Rate

Cash flow represents the total amount of money moving in and out of a business over a specific period, reflecting its liquidity and operational efficiency. Burn rate measures the rate at which a company is spending its capital, often focusing on cash outflows in relation to runway duration for startups. The key difference lies in cash flow's broader financial health assessment versus burn rate's emphasis on cash depletion speed for sustainability analysis.

Importance of Tracking Cash Flow in Business

Tracking cash flow provides a clear view of actual inflows and outflows, enabling businesses to maintain liquidity and meet financial obligations. Monitoring cash flow helps identify discrepancies between revenue and expenses, preventing potential cash shortages that can lead to operational disruptions. Accurate cash flow analysis supports informed decision-making for budgeting, investment, and managing the burn rate to sustain long-term business growth.

Why Burn Rate Matters for Startups

Burn rate measures the speed at which a startup spends its available cash, directly impacting the runway before additional funding is needed. Understanding burn rate helps founders manage expenses, plan milestones, and avoid premature cash depletion. Cash flow analysis complements burn rate by tracking actual inflows and outflows, enabling more precise financial control and sustainable growth strategies.

Cash Flow vs Burn Rate: Impact on Financial Planning

Cash flow represents the total inflow and outflow of cash within a business over a specific period, crucial for maintaining operational liquidity. Burn rate measures the rate at which a company spends its capital, especially relevant for startups in the pre-profit phase. Understanding the relationship between cash flow and burn rate is vital for accurate financial planning, ensuring businesses avoid liquidity crises and optimize resource allocation.

Strategies to Improve Positive Cash Flow

Implementing strategies to improve positive cash flow involves closely monitoring cash inflows and outflows to maintain a healthy balance. Reducing unnecessary expenses, optimizing inventory management, and accelerating receivables collection can significantly enhance cash availability. Leveraging financial forecasting tools and negotiating better payment terms with suppliers also contributes to sustaining positive cash flow while managing burn rate effectively.

How to Reduce Your Burn Rate Effectively

Reducing your burn rate effectively requires detailed monitoring of cash flow to identify unnecessary expenses and optimize operational costs, ensuring that outflows consistently stay below inflows. Implementing strict budgeting controls, renegotiating supplier contracts, and automating financial processes can significantly lower the monthly cash burn. Strategic adjustments in spending patterns directly improve cash runway, allowing businesses to sustain operations longer while seeking additional funding or increased revenue streams.

Interpreting Cash Flow Statements for Better Decisions

Analyzing cash flow statements reveals the timing and magnitude of cash inflows and outflows, enabling precise assessment of liquidity beyond the burn rate metric. Distinguishing operational cash flow from financing and investing activities clarifies sustainable cash utilization and potential risks. Integrating burn rate with cash flow insights enhances strategic cash management and forecasting accuracy for business continuity.

The Role of Burn Rate in Startup Sustainability

Burn rate measures the speed at which a startup spends its capital to cover operational expenses, serving as a critical indicator of financial health. Monitoring burn rate alongside cash flow provides insights into how long the company can sustain operations without additional funding. Effective money management requires aligning burn rate with revenue streams to ensure long-term startup sustainability and avoid insolvency.

Balancing Cash Flow and Burn Rate for Long-term Success

Balancing cash flow and burn rate is essential for sustainable money management, ensuring that expenses do not consistently exceed incoming funds. Monitoring cash flow provides real-time insights into liquidity, while controlling the burn rate helps extend the runway for startups and growing businesses. Maintaining this balance supports long-term financial stability and resilience against market fluctuations.

Related Important Terms

Cash Runway

Cash runway measures how long a company can sustain operations before depleting its cash reserves, calculated by dividing available cash by the burn rate. Monitoring cash flow ensures positive liquidity, but understanding cash runway provides critical insight into the timeframe until additional funding or profitability is required for effective money management.

Negative Cash Conversion Cycle

A negative cash conversion cycle (CCC) improves cash flow by allowing a company to receive payments from customers before it needs to pay its suppliers, effectively reducing the burn rate. This strategic timing enhances liquidity management, enabling businesses to sustain operations without depleting cash reserves despite ongoing expenses.

Gross Burn

Gross Burn represents the total monthly operating expenses of a business, providing a clear metric to assess how quickly cash reserves are depleting. Monitoring Gross Burn alongside cash flow ensures effective money management by highlighting the rate at which cash is spent versus incoming revenue.

Net Burn

Net burn quantifies the actual cash outflow after considering revenue, providing a clear measure of how quickly a company is depleting its available capital. Monitoring net burn is essential for effective money management, as it highlights the sustainability of operations and the urgency for additional funding or cost adjustments.

Cash Flow Velocity

Cash flow velocity measures the speed at which cash moves through a business, directly impacting liquidity and operational efficiency compared to burn rate, which tracks the rate of cash expenditure. Optimizing cash flow velocity enhances money management by accelerating receivables and controlling payables, ensuring sufficient funds for sustained growth and reduced reliance on external financing.

Zero Cash Day

Zero Cash Day occurs when daily expenses match daily cash inflow, resulting in no surplus funds available for savings or investment. Monitoring cash flow closely alongside burn rate helps businesses avoid Zero Cash Days by ensuring inflows consistently exceed outflows for sustainable money management.

FinOps Optimization

Effective FinOps optimization requires closely monitoring cash flow to ensure sufficient liquidity while managing burn rate to control the pace of resource consumption in cloud spending. Balancing positive cash flow against burn rate enables organizations to optimize budget allocation, forecast expenses accurately, and sustain long-term financial health in dynamic operational environments.

Burn Multiple

Burn Multiple measures how efficiently a startup converts its cash burn into revenue growth, calculated by dividing net cash burned by net new revenue. A lower Burn Multiple indicates better money management, highlighting sustainable cash flow relative to business expansion.

Cash Flow Forecasting AI

Cash flow forecasting AI leverages machine learning algorithms to predict future cash inflows and outflows more accurately than traditional methods, enabling businesses to monitor cash flow closely against their burn rate. This technology helps optimize money management by providing real-time insights that prevent liquidity crises and improve financial decision-making.

Breakeven Cash Point

The breakeven cash point marks when cash inflows equal outflows, indicating zero net burn rate and sustainable operations. Understanding this point allows businesses to manage liquidity effectively, ensuring they do not deplete cash reserves while scaling.

Cash flow vs Burn rate for money management. Infographic

moneydiff.com

moneydiff.com