Cash flow represents the total amount of money being transferred into and out of a business, providing a snapshot of its liquidity and operational efficiency. Discounted cash flow (DCF) valuation, however, adjusts future cash flows to their present value using a discount rate, reflecting the time value of money and investment risk. Using DCF offers a more accurate measure of an asset's intrinsic value by accounting for the expected profitability and risk over time.

Table of Comparison

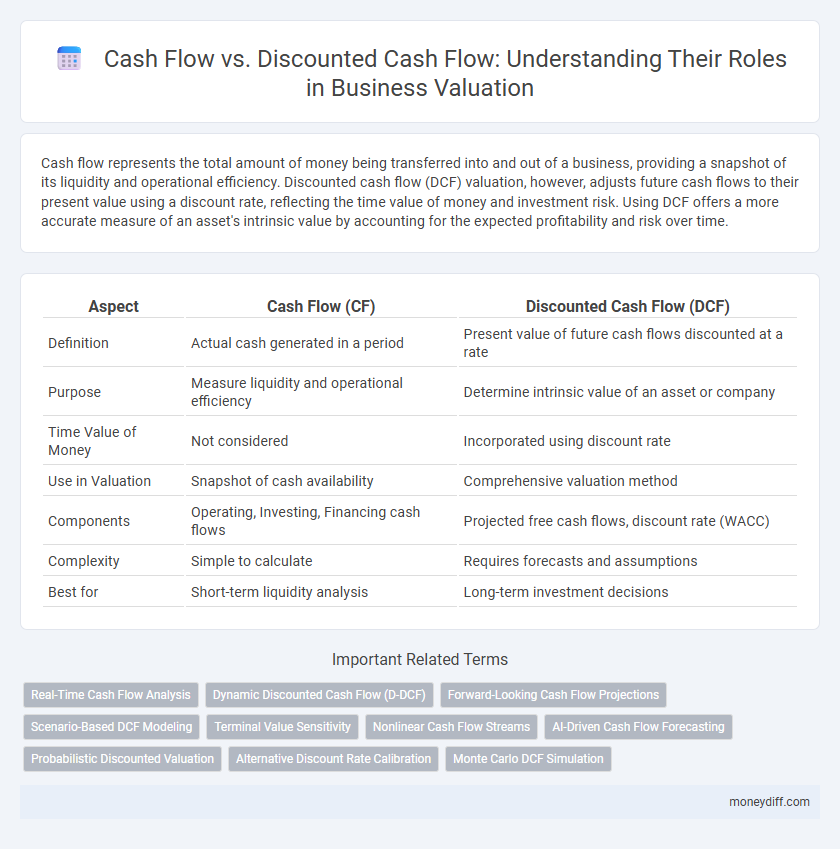

| Aspect | Cash Flow (CF) | Discounted Cash Flow (DCF) |

|---|---|---|

| Definition | Actual cash generated in a period | Present value of future cash flows discounted at a rate |

| Purpose | Measure liquidity and operational efficiency | Determine intrinsic value of an asset or company |

| Time Value of Money | Not considered | Incorporated using discount rate |

| Use in Valuation | Snapshot of cash availability | Comprehensive valuation method |

| Components | Operating, Investing, Financing cash flows | Projected free cash flows, discount rate (WACC) |

| Complexity | Simple to calculate | Requires forecasts and assumptions |

| Best for | Short-term liquidity analysis | Long-term investment decisions |

Understanding Cash Flow: The Basics

Cash flow represents the actual inflow and outflow of money within a business over a specific period, providing a clear snapshot of liquidity and operational efficiency. Discounted cash flow (DCF) valuation refines this concept by adjusting future cash flows to their present value using a discount rate, reflecting the time value of money and investment risk. Understanding cash flow fundamentals is crucial before applying DCF, as it ensures accurate identification of cash inflows and outflows that influence a company's financial health and valuation.

Discounted Cash Flow (DCF): An Overview

Discounted Cash Flow (DCF) valuation calculates the present value of projected future cash flows using a discount rate that reflects the investment's risk and the time value of money. This method incorporates free cash flow forecasts and adjusts for the weighted average cost of capital (WACC) to determine intrinsic value more accurately than simple cash flow analysis. DCF is widely used for investment decisions because it quantifies expected cash inflows and outflows over time, providing a comprehensive financial assessment.

Key Differences Between Cash Flow and Discounted Cash Flow

Cash flow represents the actual inflows and outflows of cash within a business over a specific period, reflecting its liquidity and operational efficiency. Discounted cash flow (DCF) valuation adjusts these cash flows by applying a discount rate to account for the time value of money, providing a present value estimate of future cash earnings. Key differences lie in DCF's incorporation of discounting future cash inflows versus cash flow's raw, nominal figures, making DCF a forward-looking valuation tool while cash flow captures historical or current cash movements.

The Role of Cash Flow in Business Valuation

Cash flow plays a crucial role in business valuation by providing a clear picture of the company's liquidity and operational efficiency. Discounted cash flow (DCF) valuation refines this assessment by projecting future cash inflows and outflows, then discounting them to present value using a discount rate that reflects risk. This method offers a more accurate valuation by incorporating the time value of money and expected growth, making it essential for informed investment decisions.

How Discounted Cash Flow Enhances Valuation Accuracy

Discounted Cash Flow (DCF) enhances valuation accuracy by accounting for the time value of money, discounting future cash flows to their present value using a risk-adjusted discount rate. This method provides a more precise estimate of an asset's intrinsic value compared to simple cash flow analysis, which ignores the timing and risk associated with those cash flows. Incorporating DCF allows investors and analysts to better assess long-term profitability and investment risk, leading to more informed financial decisions.

Pros and Cons: Cash Flow vs Discounted Cash Flow

Cash flow valuation measures a company's liquidity by analyzing actual cash inflows and outflows, offering simplicity and real-time financial health insights but ignoring the time value of money. Discounted cash flow (DCF) valuation incorporates future cash flow projections discounted at a risk-adjusted rate, providing a more accurate estimate of intrinsic value based on present worth but requiring complex assumptions and sensitivity to discount rates. Cash flow analysis excels in short-term financial assessment, while DCF is preferred for long-term investment decisions due to its forward-looking and comprehensive nature.

Practical Applications of Cash Flow in Valuation

Cash flow provides a straightforward measure of the actual liquidity generated by a business, essential for assessing its ability to meet short-term obligations and operational needs. Discounted cash flow (DCF) valuation incorporates the time value of money by projecting future cash flows and discounting them to present value, offering a more comprehensive assessment of long-term investment potential. Practical applications of cash flow in valuation include evaluating company solvency, budgeting, and making informed decisions on mergers and acquisitions by estimating intrinsic value through DCF analysis.

When to Use Discounted Cash Flow for Valuation

Discounted Cash Flow (DCF) valuation is essential when assessing the intrinsic value of an investment by accounting for the time value of money, especially for long-term projects with predictable cash inflows. It provides a more accurate measure than simple cash flow by discounting future cash flows back to their present value using a risk-adjusted discount rate. Investors and analysts use DCF when future cash flows are expected to vary significantly over time or when evaluating businesses with stable, forecastable earnings.

Common Mistakes in Cash Flow and DCF Analysis

Common mistakes in cash flow and discounted cash flow (DCF) analysis include overestimating revenue growth and underestimating capital expenditures, which distort valuation accuracy. Ignoring the proper discount rate or failing to adjust cash flows for inflation leads to misleading present value calculations. Inconsistent treatment of working capital changes and overlooking terminal value assumptions can further compromise the reliability of DCF outcomes.

Best Practices for Cash Flow Valuation Models

Effective cash flow valuation models prioritize accuracy by incorporating discounted cash flow (DCF) methods to reflect the time value of money, ensuring future cash flows are properly adjusted to present value. Best practices include using realistic cash flow projections based on historical data and market conditions, applying appropriate discount rates aligned with the risk profile, and conducting sensitivity analyses to test valuation robustness. Incorporating these elements enhances the reliability of valuation results and supports more informed financial decision-making.

Related Important Terms

Real-Time Cash Flow Analysis

Real-time cash flow analysis provides immediate visibility into a company's liquidity by tracking actual inflows and outflows, enabling more accurate and responsive financial decision-making. Discounted cash flow valuation, in contrast, projects future cash flows and adjusts them for risk and time value, offering a forward-looking estimate of intrinsic value but lacking the immediacy of real-time data.

Dynamic Discounted Cash Flow (D-DCF)

Dynamic Discounted Cash Flow (D-DCF) enhances traditional cash flow valuation by incorporating variable discount rates and adaptive cash flow projections, providing a more nuanced and responsive assessment of a company's intrinsic value. This approach adjusts for market volatility and changing risk profiles, offering superior accuracy compared to static Discounted Cash Flow (DCF) models that apply fixed assumptions.

Forward-Looking Cash Flow Projections

Forward-looking cash flow projections incorporate expected future revenue and expenses, providing a more dynamic and realistic basis for valuation than traditional cash flow analysis, which often relies on historical data. Discounted Cash Flow (DCF) valuation adjusts these projections by applying a discount rate to account for the time value of money and risk, making it a preferred method for estimating intrinsic business value.

Scenario-Based DCF Modeling

Scenario-based discounted cash flow (DCF) modeling enhances valuation accuracy by incorporating multiple future cash flow projections under varying economic and operational conditions, unlike simple cash flow analysis which evaluates only historical or static cash flows. This approach adjusts discount rates and growth assumptions dynamically, enabling investors to better assess risk and potential value fluctuations in complex financial environments.

Terminal Value Sensitivity

Cash flow valuation assesses a company's worth based on projected cash inflows without adjusting for time value, while discounted cash flow (DCF) valuation incorporates the present value by discounting future cash flows, making it highly sensitive to terminal value assumptions. Small changes in terminal growth rate or discount rate within the DCF model significantly impact terminal value estimates, often dominating overall valuation outcomes and highlighting the critical importance of accurate terminal value sensitivity analysis.

Nonlinear Cash Flow Streams

Nonlinear cash flow streams require discounted cash flow (DCF) analysis for accurate valuation because traditional cash flow methods often overlook the time value of money and irregular payment patterns. DCF incorporates varying cash flows over time by discounting them at appropriate rates, capturing the true present value of complex, non-constant cash inflows and outflows.

AI-Driven Cash Flow Forecasting

AI-driven cash flow forecasting leverages machine learning algorithms to enhance the accuracy of traditional cash flow projections by incorporating real-time data and complex financial variables. Discounted cash flow valuation further refines this approach by applying dynamic discount rates to forecasted cash flows, offering a more precise assessment of a company's intrinsic value in fluctuating market conditions.

Probabilistic Discounted Valuation

Probabilistic Discounted Valuation enhances traditional cash flow analysis by integrating uncertainty and risk factors into discounted cash flow models, providing a range of potential outcomes rather than a single deterministic value. This approach uses probability distributions for future cash flows and discount rates, enabling more precise valuation in complex, volatile markets.

Alternative Discount Rate Calibration

Alternative discount rate calibration in cash flow valuation adjusts the discount rate to reflect specific project risks and market conditions, enhancing accuracy beyond standard discounted cash flow (DCF) methods. This approach tailors cash flow discounting by incorporating factors such as opportunity cost, inflation expectations, and sector-specific risk premiums to produce a more precise valuation outcome.

Monte Carlo DCF Simulation

Monte Carlo DCF simulation enhances traditional discounted cash flow valuation by incorporating probabilistic modeling of cash flow uncertainties and discount rates, providing a range of possible valuation outcomes instead of a single estimate. This approach accounts for variability in cash flow projections, market conditions, and discount rate assumptions, improving the robustness and risk assessment of equity valuations in financial decision-making.

Cash flow vs Discounted cash flow for valuation. Infographic

moneydiff.com

moneydiff.com