Budgeting provides a fixed financial plan outlining expected income and expenses over a set period, helping businesses maintain control over cash outflows. Rolling cash forecasts offer dynamic, real-time updates that adjust to changing financial conditions, enabling more accurate short-term cash flow management. Combining both methods enhances money management by balancing long-term planning with flexible, responsive forecasting.

Table of Comparison

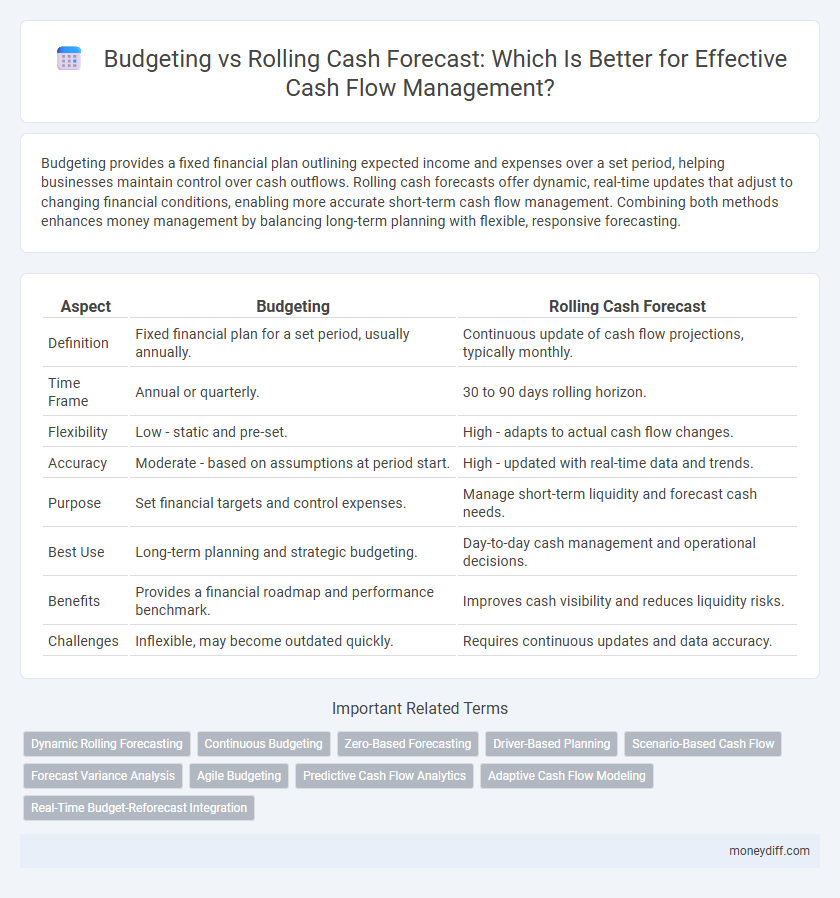

| Aspect | Budgeting | Rolling Cash Forecast |

|---|---|---|

| Definition | Fixed financial plan for a set period, usually annually. | Continuous update of cash flow projections, typically monthly. |

| Time Frame | Annual or quarterly. | 30 to 90 days rolling horizon. |

| Flexibility | Low - static and pre-set. | High - adapts to actual cash flow changes. |

| Accuracy | Moderate - based on assumptions at period start. | High - updated with real-time data and trends. |

| Purpose | Set financial targets and control expenses. | Manage short-term liquidity and forecast cash needs. |

| Best Use | Long-term planning and strategic budgeting. | Day-to-day cash management and operational decisions. |

| Benefits | Provides a financial roadmap and performance benchmark. | Improves cash visibility and reduces liquidity risks. |

| Challenges | Inflexible, may become outdated quickly. | Requires continuous updates and data accuracy. |

Understanding Budgeting in Cash Flow Management

Budgeting in cash flow management establishes a fixed financial plan based on projected income and expenses over a set period, enabling organizations to allocate resources efficiently and monitor financial performance against targets. This approach helps identify potential cash shortages early, supporting informed decision-making to maintain liquidity and operational stability. Unlike rolling cash forecasts, budgeting provides a static framework that anchors financial discipline and strategic planning efforts.

What Is a Rolling Cash Forecast?

A rolling cash forecast is a dynamic financial tool that continuously updates cash flow projections by extending the forecast period as time progresses, typically on a weekly or monthly basis. Unlike traditional budgeting, which sets fixed cash flow targets for a specific period, a rolling cash forecast provides real-time visibility into cash positions, allowing businesses to anticipate short-term liquidity needs and adjust financial strategies promptly. This approach enhances money management by improving accuracy in predicting cash surpluses or shortages, enabling more efficient allocation of resources.

Key Differences Between Budgeting and Rolling Cash Forecast

Budgeting involves creating a fixed financial plan for a specific fiscal period, outlining expected income and expenses to control cash flow and achieve financial goals. Rolling cash forecasts continuously update projections by incorporating real-time data and changing assumptions, allowing for more dynamic money management over a defined horizon. The key differences lie in budgeting's static, periodic nature versus the adaptive, forward-looking approach of rolling cash forecasts, enhancing accuracy and responsiveness in cash flow management.

Pros and Cons of Traditional Budgeting

Traditional budgeting offers a fixed financial plan that provides clear expense limits and goals, facilitating straightforward monitoring and control. However, its rigidity can lead to outdated projections, making it less responsive to real-time cash flow changes and market volatility. This inflexibility often results in missed opportunities or cash shortages compared to the adaptive nature of rolling cash forecasts.

Advantages of Rolling Cash Forecasts for Businesses

Rolling cash forecasts provide businesses with continuous visibility into their cash position, enabling more accurate and timely decision-making compared to static budgets. They adapt dynamically to changes in revenue, expenses, and market conditions, reducing the risk of cash shortfalls and improving liquidity management. This proactive approach enhances financial agility, supports strategic planning, and optimizes working capital utilization for sustained business growth.

Use Cases: When to Use Budgeting vs Rolling Forecast

Budgeting is ideal for setting fixed financial goals and allocating resources for a specific period, typically annually, providing a clear benchmark for performance evaluation. Rolling cash forecasts offer ongoing, dynamic updates that capture real-time changes in cash flow, enabling agile decision-making and short-term liquidity management. Use budgeting for strategic planning and stability, while rolling forecasts excel in managing operational fluctuations and responding to market volatility.

Impact on Business Decision-Making

Budgeting provides a fixed financial plan based on historical data, offering a structured framework for resource allocation but may lack responsiveness to real-time changes. Rolling cash forecasts update continuously with actual cash flow data, enabling more agile decision-making and proactive adjustments to operational strategies. Businesses leveraging rolling forecasts experience enhanced liquidity management and improved capability to navigate market fluctuations effectively.

Tools and Techniques for Effective Cash Flow Planning

Budgeting relies on fixed projections, using historical data to allocate funds, while rolling cash forecasts continuously update estimates based on real-time cash inflows and outflows, enhancing accuracy. Tools such as Excel models, specialized cash flow software like Float and Cashforce, and scenario analysis techniques empower businesses to monitor liquidity and adjust strategies promptly. Effective cash flow planning integrates these techniques, enabling dynamic adjustments and better financial control for optimal money management.

Transitioning from Budgeting to Rolling Forecasts

Transitioning from traditional budgeting to rolling cash forecasts enhances money management by providing continuous visibility into cash positions and liquidity needs. Unlike static budgets fixed for a fiscal period, rolling cash forecasts update regularly, incorporating real-time data and market fluctuations to improve accuracy and responsiveness. This dynamic approach enables businesses to optimize cash flow, reduce risks, and adapt quickly to changing financial conditions.

Best Practices for Integrating Budgeting and Forecasting

Integrate budgeting with rolling cash forecasts by establishing a continuous update cycle that aligns projected cash inflows and outflows with actual financial performance, enhancing accuracy in liquidity management. Utilize scenario analysis within rolling forecasts to adjust budgets dynamically, enabling proactive responses to market volatility and operational changes. Implement robust data consolidation tools to synchronize budget assumptions with real-time cash flow data, ensuring cohesive financial planning and optimized money management.

Related Important Terms

Dynamic Rolling Forecasting

Dynamic rolling cash forecasting provides a more flexible and real-time approach to money management compared to traditional static budgeting, enabling continuous updates based on actual cash flow movements and changing business conditions. This method enhances liquidity planning accuracy by incorporating short-term variations and operational insights, facilitating proactive financial decision-making and improved cash position management.

Continuous Budgeting

Continuous budgeting enhances money management by providing real-time updates to cash flow forecasts, allowing businesses to adapt to financial changes promptly. Unlike static budgets, rolling cash forecasts integrate ongoing data, improving accuracy in predicting liquidity needs and optimizing resource allocation.

Zero-Based Forecasting

Zero-Based Forecasting enhances money management by requiring all expenses to be justified for each new period, offering a more dynamic and precise alternative to traditional budgeting methods. This approach aligns cash flow predictions closely with real-time data, reducing surplus or shortfall risks inherent in static budget models.

Driver-Based Planning

Driver-based planning enhances cash flow management by linking budgeting and rolling cash forecasts to key business metrics such as sales volumes and payment cycles. This approach enables more accurate, dynamic projections that quickly adapt to real-time changes, improving liquidity and operational decision-making.

Scenario-Based Cash Flow

Scenario-based cash flow forecasting integrates dynamic variables to provide a flexible approach in money management, allowing businesses to anticipate and respond to financial uncertainties more effectively than static budgets. By modeling multiple scenarios, companies can optimize liquidity, adjust expenditures proactively, and maintain operational stability amidst fluctuating market conditions.

Forecast Variance Analysis

Budgeting establishes fixed financial targets over a set period, while rolling cash forecasts dynamically update forecasts based on real-time data, enhancing accuracy. Forecast variance analysis compares actual cash flows to these projections, identifying discrepancies and enabling proactive adjustments for optimized money management.

Agile Budgeting

Agile Budgeting enhances money management by allowing continuous adjustments based on real-time cash flow data, unlike traditional static budgets that rely on fixed projections. Rolling cash forecasts provide dynamic insights, enabling organizations to proactively respond to fluctuations and optimize liquidity for operational efficiency.

Predictive Cash Flow Analytics

Budgeting provides a static framework for cash flow management, while rolling cash forecasts leverage predictive cash flow analytics to continuously update projections based on real-time data and trends. Predictive cash flow analytics enhance decision-making accuracy by identifying cash shortfalls and surpluses earlier, enabling proactive adjustments to optimize liquidity and operational efficiency.

Adaptive Cash Flow Modeling

Adaptive cash flow modeling leverages rolling cash forecasts to continuously update projections based on real-time financial data, enhancing accuracy over static budgeting methods that rely on fixed assumptions. This dynamic approach enables proactive money management by reflecting current business conditions and improving liquidity planning.

Real-Time Budget-Reforecast Integration

Real-time budget-reforecast integration enhances cash flow management by continuously aligning budget assumptions with actual financial data, enabling dynamic adjustments and improved accuracy in forecasting. This approach surpasses traditional static budgeting by providing rolling cash forecasts that reflect current market conditions and operational changes, optimizing liquidity planning and decision-making.

Budgeting vs rolling cash forecast for money management. Infographic

moneydiff.com

moneydiff.com