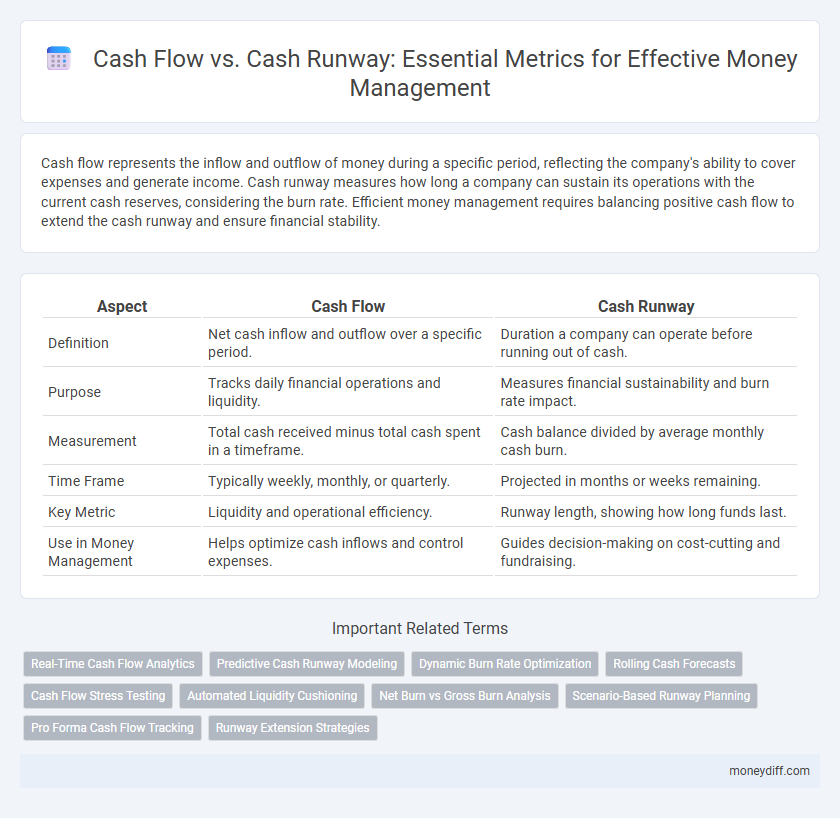

Cash flow represents the inflow and outflow of money during a specific period, reflecting the company's ability to cover expenses and generate income. Cash runway measures how long a company can sustain its operations with the current cash reserves, considering the burn rate. Efficient money management requires balancing positive cash flow to extend the cash runway and ensure financial stability.

Table of Comparison

| Aspect | Cash Flow | Cash Runway |

|---|---|---|

| Definition | Net cash inflow and outflow over a specific period. | Duration a company can operate before running out of cash. |

| Purpose | Tracks daily financial operations and liquidity. | Measures financial sustainability and burn rate impact. |

| Measurement | Total cash received minus total cash spent in a timeframe. | Cash balance divided by average monthly cash burn. |

| Time Frame | Typically weekly, monthly, or quarterly. | Projected in months or weeks remaining. |

| Key Metric | Liquidity and operational efficiency. | Runway length, showing how long funds last. |

| Use in Money Management | Helps optimize cash inflows and control expenses. | Guides decision-making on cost-cutting and fundraising. |

Understanding Cash Flow: The Lifeblood of Your Finances

Cash flow represents the inflow and outflow of money within a business or personal finance, crucial for tracking liquidity and ensuring operational stability. Cash runway calculates how long available cash will sustain expenses without additional income, highlighting financial endurance during lean periods. Understanding cash flow dynamics enables effective money management by identifying spending patterns and optimizing cash runway for long-term viability.

Cash Runway Explained: How Long Will Your Funds Last?

Cash runway measures how long your available funds will sustain operations based on current cash burn rate, providing a crucial timeline for financial planning. Unlike cash flow, which tracks the inflow and outflow of cash over a period, cash runway directly indicates the number of months your business can continue before requiring additional funding. Accurately calculating cash runway helps optimize money management by forecasting fund depletion and informing strategic decisions.

Key Differences Between Cash Flow and Cash Runway

Cash flow represents the inflow and outflow of cash within a business over a specific period, reflecting operational liquidity and the ability to cover short-term expenses. Cash runway indicates the amount of time a company can continue operations using its available cash reserves without generating additional income, often measured in months. Understanding the key difference helps businesses manage immediate financial health through cash flow and plan long-term sustainability via cash runway.

Measuring Cash Flow: Tracking Inflows and Outflows

Measuring cash flow involves accurately tracking all cash inflows, such as sales revenue and financing, alongside outflows like operational expenses and debt repayments to maintain financial stability. Detailed monitoring of these transactions enables businesses to assess liquidity and operational efficiency in real-time. Understanding cash flow dynamics is essential for calculating cash runway, which determines how long available funds can sustain business operations without additional revenue.

Calculating Your Cash Runway: A Step-by-Step Guide

Calculating your cash runway involves dividing your current cash reserves by your average monthly cash burn rate, providing a clear estimate of how many months your business can operate before funds are depleted. Accurately tracking cash flow ensures you have up-to-date data on expenses and revenues, crucial for determining the precise burn rate. This method helps startups and businesses maintain financial health by quantifying the time available to secure additional funding or reduce costs.

The Importance of Positive Cash Flow for Business Survival

Positive cash flow ensures a business can meet its immediate financial obligations, such as payroll and supplier payments, preventing insolvency. Maintaining a healthy cash flow directly impacts the cash runway, which measures how long a company can sustain operations without additional funding. Effective money management prioritizes maximizing positive cash flow to extend the cash runway, enhancing long-term business survival and stability.

Extending Your Cash Runway: Practical Strategies

Extending your cash runway involves reducing operational expenses and accelerating receivables to maintain liquidity over a longer period. Prioritize rigorous cash flow forecasting to identify potential shortfalls early and adjust spending accordingly. Implement strategic cost controls and explore alternative revenue streams to strengthen financial resilience during critical periods.

Cash Flow Forecasting vs. Runway Planning

Cash flow forecasting involves projecting future cash inflows and outflows to ensure sufficient liquidity for operational needs, while runway planning estimates the duration a business can sustain operations with existing cash reserves. Accurate cash flow forecasts enable timely decision-making to optimize spending and investment, whereas runway planning provides a clear timeline for securing additional funding or implementing cost reductions. Combining both approaches enhances financial resilience by aligning daily cash management with long-term sustainability.

Common Pitfalls in Managing Cash Flow and Runway

Common pitfalls in managing cash flow and runway include underestimating fixed and variable expenses, leading to inaccurate forecasting and premature cash depletion. Overreliance on optimistic revenue projections can create a misleading runway duration, increasing the risk of sudden liquidity crises. Failure to regularly update cash flow statements often results in missed warning signs, limiting proactive financial decision-making.

Choosing the Right Metric: When to Focus on Cash Flow or Cash Runway

Cash flow measures the net amount of cash moving in and out of a business over a specific period, providing insights into operational efficiency and short-term liquidity. Cash runway calculates how long the company can continue operating with its current cash reserves, emphasizing sustainability and long-term planning. Choosing the right metric depends on the business stage: startups prioritize cash runway to extend survival, while established firms focus on cash flow to optimize day-to-day money management.

Related Important Terms

Real-Time Cash Flow Analytics

Real-time cash flow analytics provide businesses with immediate insights into their liquidity, enabling precise monitoring of cash inflows and outflows to optimize cash runway. This dynamic approach helps identify spending patterns and forecast available funds, ensuring efficient money management and preventing cash shortages.

Predictive Cash Runway Modeling

Predictive cash runway modeling uses current cash flow data and expense projections to estimate how long a company's available cash will last, enabling more accurate financial planning and risk management. This approach surpasses simple cash flow analysis by forecasting future liquidity needs and identifying potential shortfalls before they occur.

Dynamic Burn Rate Optimization

Cash flow quantifies the real-time inflow and outflow of cash, directly impacting a company's liquidity, while cash runway represents the projected duration that current cash reserves will sustain operations without additional funding. Dynamic Burn Rate Optimization continuously adjusts spending based on evolving cash flow metrics to extend the cash runway, ensuring efficient capital allocation and financial stability.

Rolling Cash Forecasts

Rolling cash forecasts provide dynamic visibility into cash flow patterns by continuously projecting future cash inflows and outflows, enabling precise management of cash runway. This method allows businesses to anticipate liquidity needs, optimize expenditure timing, and extend operational longevity without relying solely on static cash flow statements.

Cash Flow Stress Testing

Cash flow stress testing evaluates a company's ability to maintain positive cash flow under adverse conditions, offering a more dynamic assessment than simply measuring cash runway. By simulating various financial scenarios, businesses identify potential liquidity shortages and refine strategies to ensure sustained operational stability and effective money management.

Automated Liquidity Cushioning

Automated liquidity cushioning optimizes cash flow by dynamically adjusting reserves to extend the cash runway, ensuring sustained operational liquidity without manual intervention. This technology provides real-time cash flow analysis to prevent cash shortages and improve financial resilience during variable income cycles.

Net Burn vs Gross Burn Analysis

Cash flow management requires understanding Net Burn, which measures the actual cash depletion rate after revenue, versus Gross Burn, the total monthly operating expenses before income. Analyzing Net Burn provides clearer insight into cash runway duration, enabling more accurate forecasting of how long funds will last under current financial conditions.

Scenario-Based Runway Planning

Scenario-based runway planning extends cash flow analysis by projecting how long available funds will sustain operations under varying revenue and expense conditions. This method enables businesses to anticipate financial gaps, optimize spending, and make informed decisions to maintain liquidity during fluctuating cash inflows.

Pro Forma Cash Flow Tracking

Pro Forma Cash Flow Tracking projects future cash inflows and outflows, enabling precise monitoring of cash flow versus cash runway to ensure sustainable money management. By forecasting liquidity, businesses can identify potential shortfalls and extend their operational runway through strategic adjustments.

Runway Extension Strategies

Cash runway measures how long a company can sustain operations with existing cash reserves, while cash flow tracks the inflows and outflows of money over time. Extending cash runway involves strategies such as reducing burn rate by cutting discretionary expenses, accelerating receivables, negotiating extended payment terms with suppliers, and securing bridge financing to maintain liquidity.

Cash flow vs Cash runway for money management. Infographic

moneydiff.com

moneydiff.com