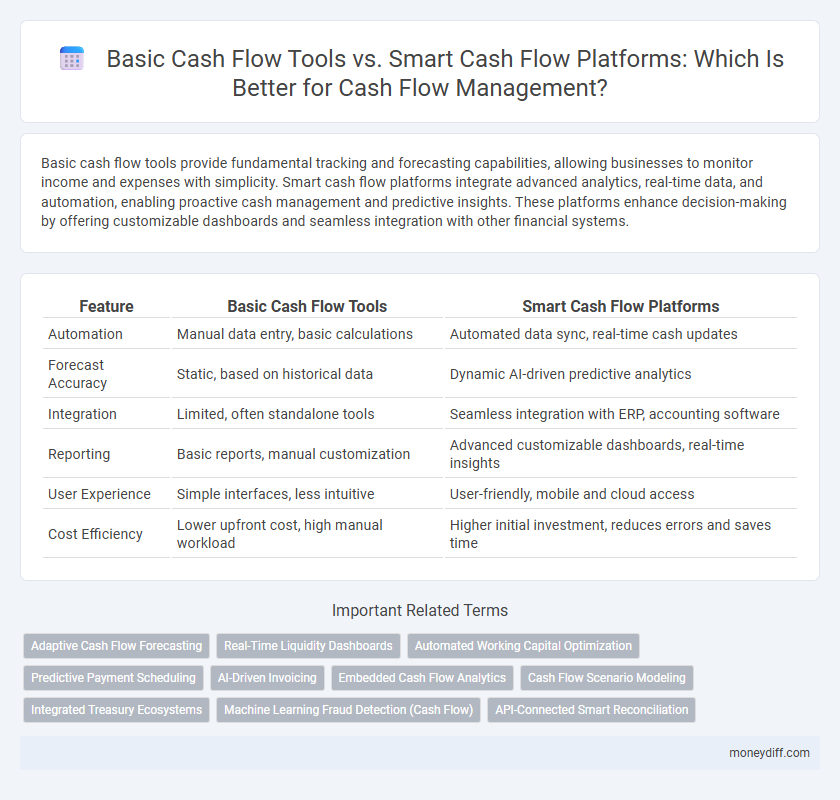

Basic cash flow tools provide fundamental tracking and forecasting capabilities, allowing businesses to monitor income and expenses with simplicity. Smart cash flow platforms integrate advanced analytics, real-time data, and automation, enabling proactive cash management and predictive insights. These platforms enhance decision-making by offering customizable dashboards and seamless integration with other financial systems.

Table of Comparison

| Feature | Basic Cash Flow Tools | Smart Cash Flow Platforms |

|---|---|---|

| Automation | Manual data entry, basic calculations | Automated data sync, real-time cash updates |

| Forecast Accuracy | Static, based on historical data | Dynamic AI-driven predictive analytics |

| Integration | Limited, often standalone tools | Seamless integration with ERP, accounting software |

| Reporting | Basic reports, manual customization | Advanced customizable dashboards, real-time insights |

| User Experience | Simple interfaces, less intuitive | User-friendly, mobile and cloud access |

| Cost Efficiency | Lower upfront cost, high manual workload | Higher initial investment, reduces errors and saves time |

Understanding Cash Flow: Fundamentals for Effective Management

Basic cash flow tools provide essential tracking of inflows and outflows but often lack real-time analytics and predictive capabilities. Smart cash flow platforms integrate AI-driven forecasting, automated data synchronization, and customizable dashboards, enabling proactive financial management. Utilizing advanced platforms enhances decision-making accuracy and helps businesses maintain liquidity by identifying cash flow trends and potential shortfalls early.

Traditional Cash Flow Tools: Key Features and Limitations

Traditional cash flow tools typically include spreadsheets and basic accounting software, offering fundamental features such as manual entry, simple tracking, and static reporting. These tools lack real-time data integration and predictive analytics, limiting proactive cash management and forecasting accuracy. Consequently, businesses face challenges in identifying cash flow trends and responding swiftly to liquidity issues with traditional solutions.

What Are Smart Cash Flow Platforms?

Smart cash flow platforms leverage advanced analytics, real-time data integration, and automation to provide dynamic cash flow forecasting and management. These platforms enable businesses to optimize liquidity by predicting cash shortages, managing receivables and payables efficiently, and offering actionable insights for strategic financial decisions. Unlike basic cash flow tools that rely on manual inputs and historical data, smart platforms enhance accuracy and scalability through AI-driven algorithms and seamless connectivity with financial systems.

Manual vs. Automated Cash Flow Tracking

Manual cash flow tracking relies on basic tools like spreadsheets and ledgers, requiring significant time and prone to human error, which limits real-time visibility and detailed analysis. Smart cash flow platforms automate data collection and analysis through AI and machine learning, providing accurate, up-to-date cash flow forecasts and actionable insights. Automated systems enhance decision-making efficiency and reduce risks by continuously monitoring inflows and outflows with minimal manual intervention.

Data Accuracy: Spreadsheets vs. Intelligent Platforms

Spreadsheets often suffer from manual entry errors and lack real-time updates, compromising data accuracy and timely cash flow insights. Intelligent cash flow platforms leverage automation and AI to minimize human errors, ensuring reliable and dynamic financial data. Enhanced data accuracy in smart platforms supports better decision-making and proactive cash flow management.

Real-Time Insights: Why Smart Platforms Stand Out

Smart cash flow platforms provide real-time insights by continuously analyzing transaction data and forecasting cash positions, enhancing decision-making accuracy. Unlike basic cash flow tools that offer static reports, these intelligent platforms enable proactive management through instant alerts and scenario modeling. This dynamic approach reduces liquidity risks and optimizes capital allocation for businesses.

Integration with Accounting Systems: Old Tools vs. Modern Platforms

Basic cash flow tools offer limited integration with accounting systems, often relying on manual data entry and static reports, which can lead to inaccuracies and time-consuming reconciliations. Modern smart cash flow platforms provide seamless, real-time integration with popular accounting software like QuickBooks, Xero, and NetSuite, automating data synchronization and enhancing accuracy. These platforms enable dynamic cash flow forecasting and provide actionable insights by leveraging AI-driven analytics directly linked to up-to-date financial records.

Customization and Scalability in Cash Flow Solutions

Basic cash flow tools provide limited customization and often support only static financial models, restricting adaptability in dynamic business environments. Smart cash flow platforms leverage advanced algorithms and AI, enabling high scalability and personalized cash flow forecasting tailored to specific organizational needs. These platforms integrate real-time data and customizable dashboards, optimizing cash flow management for businesses of varying sizes and complexities.

Cost-Benefit Analysis: Traditional Tools vs. Smart Platforms

Traditional cash flow tools often involve manual data entry and basic spreadsheets, leading to higher time costs and increased risk of human error. Smart cash flow platforms utilize automation, real-time analytics, and AI-driven forecasting, offering significant cost savings and more accurate financial insights. The cost-benefit analysis clearly favors smart platforms due to improved efficiency, enhanced cash flow prediction, and reduced operational expenses.

Choosing the Right Cash Flow Management Solution for Your Business

Basic cash flow tools offer essential features like simple tracking and manual entry, suitable for small businesses with straightforward financial activities. Smart cash flow platforms integrate advanced analytics, real-time data synchronization, and automated forecasting to provide deeper insights and proactive cash flow management. Selecting the right solution depends on business complexity, growth goals, and the need for scalability and automation in financial operations.

Related Important Terms

Adaptive Cash Flow Forecasting

Basic cash flow tools rely on static data input and manual adjustments, limiting real-time accuracy and adaptability in forecasting. Smart cash flow platforms leverage adaptive cash flow forecasting using AI-driven analytics to dynamically update projections based on changing market conditions and operational variables.

Real-Time Liquidity Dashboards

Real-time liquidity dashboards offered by smart cash flow platforms provide dynamic visibility into cash positions, enabling proactive management and precise forecasting beyond the static snapshots delivered by basic cash flow tools. These advanced platforms integrate multiple data sources and leverage AI analytics to optimize working capital and enhance decision-making agility.

Automated Working Capital Optimization

Basic cash flow tools offer manual tracking and simple forecasting, often lacking integration and real-time data, which limits their ability to optimize working capital efficiently. Smart cash flow platforms utilize automated working capital optimization powered by AI and machine learning, providing real-time analytics, dynamic cash flow forecasting, and proactive management to enhance liquidity and reduce financing costs.

Predictive Payment Scheduling

Basic cash flow tools provide manual tracking and simple forecasting features, but smart cash flow platforms leverage predictive payment scheduling using AI algorithms to optimize payment timings and improve liquidity management. These advanced platforms analyze historical payment patterns and cash inflows, enabling businesses to anticipate cash shortages and automate timely payments for enhanced financial stability.

AI-Driven Invoicing

AI-driven invoicing within smart cash flow platforms automates billing processes, reduces errors, and accelerates payment cycles, significantly enhancing cash flow management efficiency compared to basic cash flow tools. These platforms leverage machine learning algorithms to predict payment delays, optimize invoice scheduling, and provide real-time financial insights, empowering businesses to maintain healthier cash reserves and improve liquidity forecasting.

Embedded Cash Flow Analytics

Basic cash flow tools provide essential tracking and forecasting features but lack advanced data integration and predictive analytics capabilities. Smart cash flow platforms with embedded cash flow analytics enable real-time insights, automated anomaly detection, and scenario modeling to optimize liquidity management and strategic decision-making.

Cash Flow Scenario Modeling

Basic cash flow tools provide static projections based on historical data, limiting the ability to simulate varying financial scenarios or account for market volatility, thereby offering minimal support for proactive decision-making. Smart cash flow platforms utilize advanced cash flow scenario modeling that integrates real-time data, predictive analytics, and customizable assumptions to enable dynamic forecasting, risk assessment, and strategic planning for optimized liquidity management.

Integrated Treasury Ecosystems

Basic cash flow tools often provide limited functionalities such as manual tracking and standalone reporting, whereas smart cash flow platforms leverage integrated treasury ecosystems that unify liquidity management, forecasting, and risk analysis in real time. These advanced platforms enhance decision-making through automation, seamless connectivity with banking networks, and AI-driven insights, maximizing operational efficiency and financial agility.

Machine Learning Fraud Detection (Cash Flow)

Basic cash flow tools rely on manual input and static rules, limiting their ability to detect anomalies and potential fraud in real-time, whereas smart cash flow platforms leverage machine learning algorithms to analyze transaction patterns, identify suspicious activities, and enhance fraud detection accuracy. Machine learning models improve cash flow management by continuously learning from large datasets, reducing false positives, and enabling proactive financial risk mitigation.

API-Connected Smart Reconciliation

API-connected smart reconciliation platforms enhance cash flow management by automating the matching of transactions and reducing manual errors, leading to real-time accuracy and improved liquidity insights. Basic cash flow tools lack this integration, often resulting in delayed updates and inefficient reconciliation processes.

Basic cash flow tools vs Smart cash flow platforms for management. Infographic

moneydiff.com

moneydiff.com