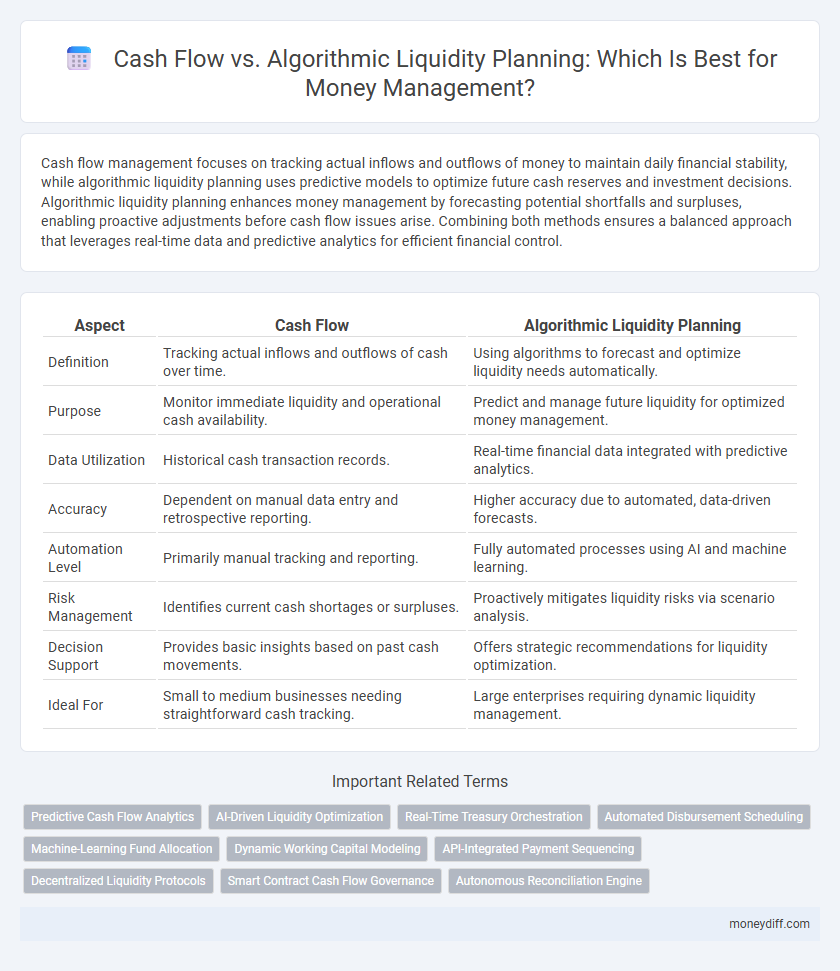

Cash flow management focuses on tracking actual inflows and outflows of money to maintain daily financial stability, while algorithmic liquidity planning uses predictive models to optimize future cash reserves and investment decisions. Algorithmic liquidity planning enhances money management by forecasting potential shortfalls and surpluses, enabling proactive adjustments before cash flow issues arise. Combining both methods ensures a balanced approach that leverages real-time data and predictive analytics for efficient financial control.

Table of Comparison

| Aspect | Cash Flow | Algorithmic Liquidity Planning |

|---|---|---|

| Definition | Tracking actual inflows and outflows of cash over time. | Using algorithms to forecast and optimize liquidity needs automatically. |

| Purpose | Monitor immediate liquidity and operational cash availability. | Predict and manage future liquidity for optimized money management. |

| Data Utilization | Historical cash transaction records. | Real-time financial data integrated with predictive analytics. |

| Accuracy | Dependent on manual data entry and retrospective reporting. | Higher accuracy due to automated, data-driven forecasts. |

| Automation Level | Primarily manual tracking and reporting. | Fully automated processes using AI and machine learning. |

| Risk Management | Identifies current cash shortages or surpluses. | Proactively mitigates liquidity risks via scenario analysis. |

| Decision Support | Provides basic insights based on past cash movements. | Offers strategic recommendations for liquidity optimization. |

| Ideal For | Small to medium businesses needing straightforward cash tracking. | Large enterprises requiring dynamic liquidity management. |

Understanding Cash Flow in Money Management

Cash flow represents the inflows and outflows of cash within a business or personal finances, essential for tracking liquidity and ensuring operational stability. Algorithmic liquidity planning employs data-driven models to predict and optimize cash availability, enhancing precision in managing financial obligations and investments. Understanding cash flow dynamics enables more effective application of algorithmic strategies, improving overall money management efficiency.

The Rise of Algorithmic Liquidity Planning

Algorithmic liquidity planning leverages advanced data analytics and machine learning to optimize cash flow management by predicting inflows and outflows with high precision. Traditional cash flow methods rely on historical data and manual adjustments, often leading to less accurate forecasts and inefficient fund allocation. The rise of algorithmic solutions enables businesses to automate liquidity decisions, minimize cash shortages, and enhance working capital efficiency through real-time financial insights.

Key Differences Between Cash Flow and Algorithmic Planning

Cash flow represents the actual inflows and outflows of cash within a business over a specific period, providing a historical snapshot of liquidity. Algorithmic liquidity planning uses advanced computational models and real-time data to predict and optimize future cash positions, enabling proactive money management. The key difference lies in cash flow's retrospective nature versus algorithmic planning's predictive and prescriptive capabilities for maintaining liquidity.

Efficiency and Accuracy: Manual vs Algorithmic Approaches

Manual cash flow management relies heavily on human judgment, often leading to inefficiencies and potential errors due to overlooked details or miscalculations. Algorithmic liquidity planning leverages advanced algorithms and real-time data analysis to enhance accuracy, predict future cash positions, and optimize fund allocation. This automated approach significantly improves decision-making efficiency and reduces the risk associated with manual forecasting inaccuracies.

Real-Time Data Utilization in Algorithmic Liquidity Planning

Algorithmic liquidity planning leverages real-time data utilization to enhance cash flow management by continuously analyzing transaction patterns, market conditions, and payment cycles. This approach enables dynamic adjustment of liquidity positions, reducing the risk of cash shortages and optimizing fund allocation more effectively than traditional cash flow forecasts. Real-time data integration ensures precise, timely decisions that improve financial agility and operational efficiency.

Risk Management: Traditional Cash Flow vs Algorithms

Traditional cash flow analysis relies on historical data and fixed projections, which can miss sudden market fluctuations and expose businesses to liquidity risks. Algorithmic liquidity planning leverages real-time data and predictive analytics to dynamically adjust cash reserves, minimizing the risk of insolvency. By integrating AI-driven algorithms, companies gain enhanced risk management capabilities, ensuring more accurate forecasting and timely responses to unexpected financial shocks.

Scalability of Algorithmic Liquidity Solutions

Algorithmic liquidity planning offers superior scalability compared to traditional cash flow management by harnessing real-time data and predictive analytics to optimize fund allocation across multiple accounts and investments. This approach enables dynamic adjustment to liquidity needs under varying market conditions, enhancing accuracy and responsiveness far beyond manual cash flow projections. As businesses grow, algorithmic models seamlessly integrate larger datasets, supporting complex financial ecosystems and improving capital efficiency at scale.

Cost Implications: Human Oversight vs Automation

Cash flow management involving human oversight often incurs higher labor costs due to continuous monitoring and manual adjustments, whereas algorithmic liquidity planning reduces operational expenses through automation and real-time data processing. Automated systems minimize errors and optimize cash allocation, lowering the cost associated with missed payments or liquidity shortages. However, initial technology investment and maintenance fees for algorithmic solutions can pose upfront financial considerations compared to traditional manual cash flow processes.

Case Studies: Success Stories and Challenges

Case studies reveal cash flow management's effectiveness in tracking real-time liquidity, enabling businesses to meet immediate obligations and reduce overdraft risks. Algorithmic liquidity planning leverages AI to forecast cash needs more accurately, optimizing fund allocation and enhancing financial agility in volatile markets. Challenges include data integration complexities and algorithm transparency, requiring continuous refinement to fully realize automated liquidity planning benefits.

Future Trends in Money Management: The Hybrid Approach

Cash flow analysis remains fundamental for understanding immediate financial health, while algorithmic liquidity planning leverages predictive analytics to optimize fund allocation dynamically. Emerging trends in money management emphasize a hybrid approach that integrates real-time cash flow tracking with AI-driven liquidity forecasts, enhancing decision-making accuracy and responsiveness. This fusion supports more resilient financial planning by balancing short-term cash availability with long-term liquidity optimization.

Related Important Terms

Predictive Cash Flow Analytics

Predictive cash flow analytics leverages algorithmic liquidity planning to forecast future cash positions with high accuracy, enabling proactive financial decision-making and optimized money management. This approach surpasses traditional cash flow methods by using machine learning models to anticipate cash inflows and outflows, reducing liquidity risks and improving operational efficiency.

AI-Driven Liquidity Optimization

AI-driven liquidity optimization leverages advanced algorithms and real-time data analysis to enhance cash flow forecasting and streamline liquidity management, reducing the risks of liquidity shortages or surpluses. Unlike traditional cash flow methods, algorithmic liquidity planning dynamically adjusts funding strategies based on predictive insights, maximizing capital efficiency and improving financial stability.

Real-Time Treasury Orchestration

Real-time treasury orchestration enhances cash flow management by integrating algorithmic liquidity planning, enabling precise forecasting and instant allocation of funds across multiple accounts and currencies. This dynamic approach minimizes idle cash, reduces borrowing costs, and ensures optimal liquidity positioning for strategic financial decisions.

Automated Disbursement Scheduling

Automated disbursement scheduling enhances cash flow management by aligning payment timings with real-time liquidity forecasts, reducing idle cash and minimizing overdraft risks. Integrating algorithmic liquidity planning enables precise allocation of funds, ensuring optimal cash availability without manual intervention.

Machine-Learning Fund Allocation

Machine-learning fund allocation optimizes cash flow by predicting liquidity needs and dynamically adjusting asset distributions to ensure efficient capital deployment. This approach surpasses traditional algorithmic liquidity planning by leveraging predictive analytics to minimize cash shortages and maximize investment returns.

Dynamic Working Capital Modeling

Dynamic Working Capital Modeling integrates real-time cash flow data with algorithmic liquidity planning to optimize money management by accurately forecasting liquidity needs and minimizing idle capital. This approach leverages predictive analytics to dynamically adjust cash positions, enhancing financial agility and operational efficiency.

API-Integrated Payment Sequencing

API-integrated payment sequencing enhances cash flow management by automating the timing and prioritization of outgoing payments based on real-time liquidity data, reducing overdraft risks and optimizing working capital. This approach surpasses traditional algorithmic liquidity planning by enabling dynamic, data-driven adjustments that improve forecast accuracy and operational efficiency.

Decentralized Liquidity Protocols

Decentralized liquidity protocols enhance cash flow management by enabling real-time algorithmic liquidity planning through automated smart contracts that optimize fund allocation across multiple channels. This approach surpasses traditional cash flow methods by reducing reliance on manual forecasting and improving capital efficiency within decentralized finance ecosystems.

Smart Contract Cash Flow Governance

Smart Contract Cash Flow Governance automates real-time monitoring and allocation of funds, enhancing transparency and efficiency compared to traditional cash flow models. Algorithmic liquidity planning integrates predictive analytics within smart contracts to optimize cash reserves, ensuring seamless money management and reduced liquidity risks.

Autonomous Reconciliation Engine

Autonomous Reconciliation Engine enhances cash flow accuracy by automatically matching transactions and identifying discrepancies, enabling precise real-time liquidity insights. Its algorithmic liquidity planning optimizes fund allocation by forecasting cash positions and balancing inflows with outflows more effectively than manual methods.

Cash flow vs Algorithmic liquidity planning for money management. Infographic

moneydiff.com

moneydiff.com