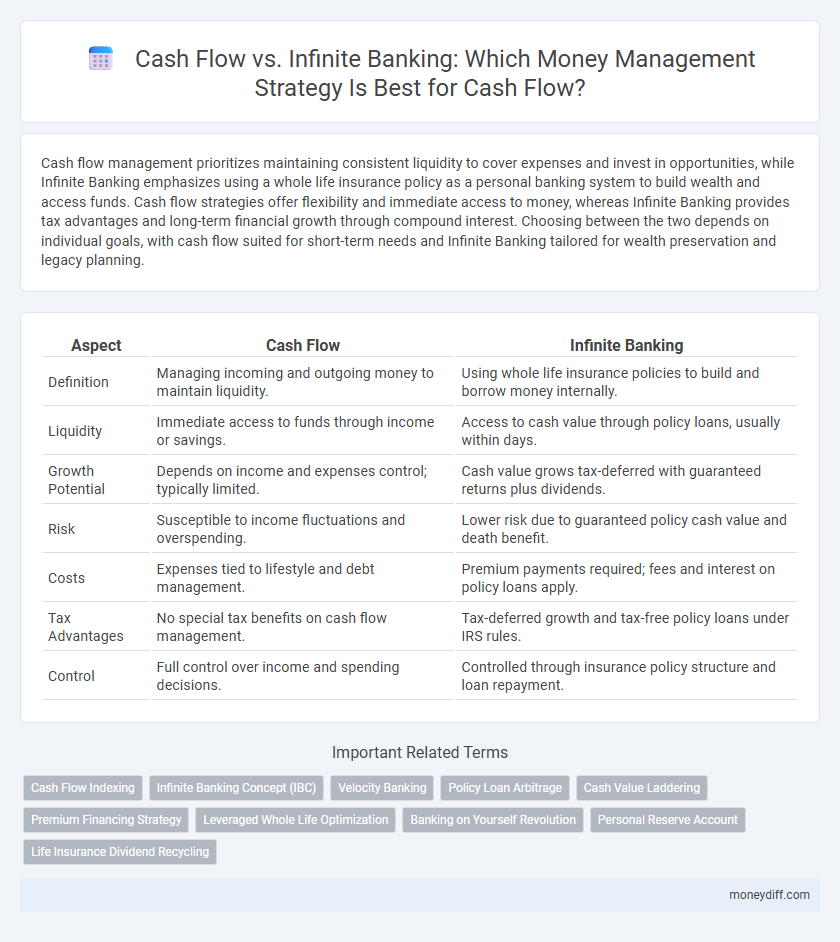

Cash flow management prioritizes maintaining consistent liquidity to cover expenses and invest in opportunities, while Infinite Banking emphasizes using a whole life insurance policy as a personal banking system to build wealth and access funds. Cash flow strategies offer flexibility and immediate access to money, whereas Infinite Banking provides tax advantages and long-term financial growth through compound interest. Choosing between the two depends on individual goals, with cash flow suited for short-term needs and Infinite Banking tailored for wealth preservation and legacy planning.

Table of Comparison

| Aspect | Cash Flow | Infinite Banking |

|---|---|---|

| Definition | Managing incoming and outgoing money to maintain liquidity. | Using whole life insurance policies to build and borrow money internally. |

| Liquidity | Immediate access to funds through income or savings. | Access to cash value through policy loans, usually within days. |

| Growth Potential | Depends on income and expenses control; typically limited. | Cash value grows tax-deferred with guaranteed returns plus dividends. |

| Risk | Susceptible to income fluctuations and overspending. | Lower risk due to guaranteed policy cash value and death benefit. |

| Costs | Expenses tied to lifestyle and debt management. | Premium payments required; fees and interest on policy loans apply. |

| Tax Advantages | No special tax benefits on cash flow management. | Tax-deferred growth and tax-free policy loans under IRS rules. |

| Control | Full control over income and spending decisions. | Controlled through insurance policy structure and loan repayment. |

Understanding Cash Flow in Personal Finance

Cash flow represents the net amount of cash moving in and out of a personal finance system, essential for managing daily expenses and building savings. Positive cash flow ensures that income exceeds expenditures, enabling investment opportunities and financial growth. Understanding cash flow is critical before exploring complex strategies like Infinite Banking, which relies on consistent surplus funds to effectively leverage whole life insurance policies for wealth accumulation.

What Is Infinite Banking?

Infinite Banking is a personal finance strategy that uses whole life insurance policies to create a private banking system, allowing policyholders to borrow against their cash value for investments or expenses. Unlike traditional cash flow management, which relies on income and expenses tracking, Infinite Banking leverages tax-advantaged growth and loan access to build wealth over time. This method provides liquidity, control, and potential interest recapturing advantages not typically found in conventional cash flow systems.

Key Differences: Cash Flow vs Infinite Banking

Cash flow management emphasizes the tracking and optimization of incoming and outgoing funds to maintain liquidity and meet short-term financial obligations. Infinite banking leverages whole life insurance policies to create a personal banking system, allowing policyholders to borrow and repay funds while building cash value and tax advantages. The key difference lies in cash flow's focus on immediate financial movement versus infinite banking's long-term wealth accumulation and control through life insurance.

How Cash Flow Management Impacts Wealth Building

Effective cash flow management ensures consistent liquidity, enabling timely debt payments and strategic investments critical for wealth accumulation. By optimizing income inflows and controlling expenses, individuals can increase savings that fuel compounding growth and financial stability. In contrast to infinite banking, which focuses on leveraging whole life insurance for wealth, cash flow management directly influences the capacity to build and sustain capital over time.

Infinite Banking: Pros and Cons

Infinite banking leverages whole life insurance policies to create a personal banking system, offering tax-advantaged growth and accessible cash value for loans without typical bank restrictions. Pros include predictable growth, tax benefits, and financial control, while cons encompass high initial premiums, slower cash value accumulation in early years, and potentially complex management. Comparing this to cash flow management, infinite banking emphasizes long-term wealth building and liquidity within a controlled financial framework rather than immediate cash availability.

Cash Flow Strategies for Effective Money Management

Cash flow strategies prioritize tracking income and expenses to ensure positive liquidity and prevent financial shortfalls. Effective money management through cash flow involves budgeting, timely bill payments, and maintaining an emergency fund to stabilize finances. Compared to infinite banking, cash flow management emphasizes immediate financial control and flexibility without relying on borrowing against life insurance policies.

Integrating Infinite Banking into Your Cash Flow Plan

Integrating Infinite Banking into your cash flow plan enhances financial control by allowing you to leverage whole life insurance policies as a personal banking system, creating a steady cash flow source. This strategy improves liquidity and provides tax-advantaged growth, enabling more strategic money management compared to traditional cash flow methods. Utilizing Infinite Banking alongside cash flow optimization ensures consistent access to funds while building wealth over time.

Risk Factors: Cash Flow vs Infinite Banking

Cash flow management involves maintaining liquidity to meet short-term obligations, exposing individuals to risks such as unexpected expenses or income fluctuations. Infinite banking, using whole life insurance policies, mitigates liquidity risks by providing consistent cash value growth and loan access, but carries risks related to policy fees, interest on loans, and market performance assumptions. Evaluating risk factors requires comparing cash flow volatility against long-term policy commitments and potential costs of infinite banking strategies.

Comparing Returns: Infinite Banking and Traditional Cash Flow Methods

Infinite banking offers a unique approach to money management by leveraging whole life insurance policies that provide tax-advantaged growth and liquidity, often resulting in steady, predictable returns. Traditional cash flow methods rely on income minus expenses and investment returns, which can be more volatile and subject to market fluctuations. While infinite banking can deliver consistent returns tied to policy dividends, traditional cash flow strategies may offer higher growth potential but with increased risk and less control over cash availability.

Choosing the Right Money Management Approach for You

Cash flow management prioritizes tracking income and expenses to ensure liquidity and meet short-term financial obligations, while infinite banking leverages whole life insurance policies to create a personal banking system for long-term wealth building and tax advantages. Selecting the right approach depends on your financial goals, risk tolerance, and need for immediate cash access versus long-term growth and legacy planning. Evaluating cash flow stability alongside the benefits of infinite banking's compounding interest and loan options helps tailor a strategy aligned with your financial priorities.

Related Important Terms

Cash Flow Indexing

Cash flow indexing measures the timing and certainty of your income streams, providing a dynamic approach to managing liquidity compared to the fixed asset growth model of infinite banking. Emphasizing cash flow indexing enables more precise alignment of expenses with real-time earnings, optimizing financial flexibility and reducing reliance on borrowed capital.

Infinite Banking Concept (IBC)

Infinite Banking Concept (IBC) leverages whole life insurance policies to create a personal banking system, enabling tax-advantaged cash flow management and growth. Unlike traditional cash flow methods reliant on external financing, IBC provides liquidity, control, and compound interest benefits, optimizing money management over time.

Velocity Banking

Velocity Banking leverages cash flow by strategically using a line of credit to pay down debt faster, maximizing debt velocity and minimizing interest costs compared to Infinite Banking, which relies on cash value life insurance policies for money management. Optimizing cash flow through Velocity Banking improves liquidity and accelerates net worth growth by prioritizing debt repayment over accumulating reserved capital.

Policy Loan Arbitrage

Policy loan arbitrage leverages the lower interest rates on infinite banking policy loans compared to higher-interest debts, optimizing cash flow by borrowing against one's life insurance policy to invest or pay off expensive liabilities. This strategy enhances liquidity while maintaining insurance benefits, providing a flexible alternative to traditional cash flow methods focused solely on income and expenses management.

Cash Value Laddering

Cash Value Laddering maximizes cash flow efficiency by strategically timing access to life insurance cash values, enabling more predictable liquidity compared to Infinite Banking's reliance on policy loans. This method enhances money management by creating a structured sequence of cash value utilization, optimizing funds availability without disrupting overall financial growth.

Premium Financing Strategy

Premium financing strategy leverages borrowed capital to pay insurance premiums, enhancing cash flow by freeing up personal funds for investment or expenses. Compared to infinite banking, this method improves liquidity and capital efficiency, supporting optimized money management through strategic debt utilization.

Leveraged Whole Life Optimization

Leveraged Whole Life Optimization integrates cash flow management with Infinite Banking strategies, maximizing liquidity and growth potential through tax-advantaged, permanent life insurance policies while leveraging policy loans to maintain positive cash flow. This approach allows for strategic use of policy dividends and cash values, optimizing both immediate cash availability and long-term wealth accumulation.

Banking on Yourself Revolution

Cash flow management ensures liquidity and operational stability by tracking income and expenses, while the Banking on Yourself Revolution leverages whole life insurance policies to build tax-advantaged cash value for personal financing. Unlike traditional cash flow strategies, Banking on Yourself offers a private, disciplined system for money management that grows wealth independently of market fluctuations.

Personal Reserve Account

A Personal Reserve Account (PRA) enhances cash flow management by providing immediate liquidity and reducing reliance on external credit, unlike Infinite Banking which primarily focuses on building wealth through whole life insurance policies. Utilizing a PRA enables efficient money control and quick access to funds, optimizing day-to-day financial flexibility and emergency readiness.

Life Insurance Dividend Recycling

Life insurance dividend recycling leverages policy dividends to enhance cash flow by reinvesting returns into the policy, creating a self-sustaining financial growth loop. This strategy contrasts with traditional cash flow management by providing tax-advantaged, predictable access to funds while building a legacy asset within the infinite banking framework.

Cash flow vs Infinite banking for money management. Infographic

moneydiff.com

moneydiff.com