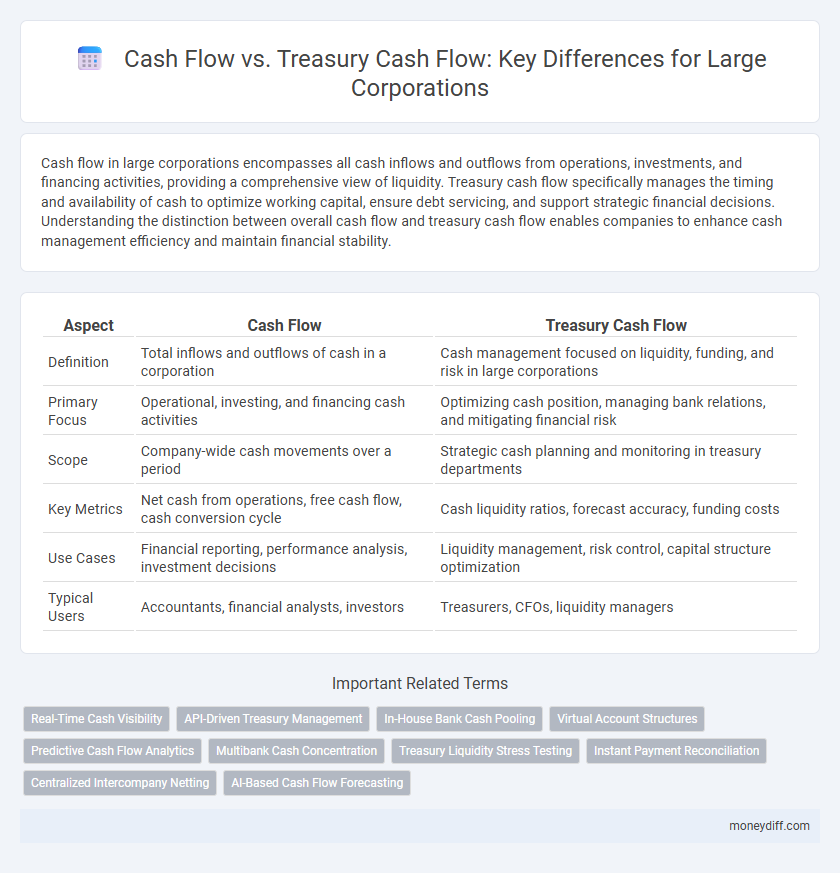

Cash flow in large corporations encompasses all cash inflows and outflows from operations, investments, and financing activities, providing a comprehensive view of liquidity. Treasury cash flow specifically manages the timing and availability of cash to optimize working capital, ensure debt servicing, and support strategic financial decisions. Understanding the distinction between overall cash flow and treasury cash flow enables companies to enhance cash management efficiency and maintain financial stability.

Table of Comparison

| Aspect | Cash Flow | Treasury Cash Flow |

|---|---|---|

| Definition | Total inflows and outflows of cash in a corporation | Cash management focused on liquidity, funding, and risk in large corporations |

| Primary Focus | Operational, investing, and financing cash activities | Optimizing cash position, managing bank relations, and mitigating financial risk |

| Scope | Company-wide cash movements over a period | Strategic cash planning and monitoring in treasury departments |

| Key Metrics | Net cash from operations, free cash flow, cash conversion cycle | Cash liquidity ratios, forecast accuracy, funding costs |

| Use Cases | Financial reporting, performance analysis, investment decisions | Liquidity management, risk control, capital structure optimization |

| Typical Users | Accountants, financial analysts, investors | Treasurers, CFOs, liquidity managers |

Understanding Cash Flow in Large Corporations

Cash flow in large corporations represents the total inflow and outflow of cash generated from operational, investing, and financing activities, reflecting the company's liquidity and financial health. Treasury cash flow specifically manages the timing and allocation of funds to ensure optimal liquidity, risk management, and strategic investment decisions within the corporation. Understanding these distinctions helps large corporations maintain operational stability while optimizing capital structure and financial planning.

Defining Treasury Cash Flow: Scope and Purpose

Treasury cash flow in large corporations centers on managing liquidity, funding, and financial risk, differing from general cash flow by its strategic focus on optimizing capital structure and ensuring operational continuity. It encompasses cash inflows and outflows related to debt issuance, investments, foreign exchange, and hedging activities, designed to maintain solvency and support long-term financial goals. This specialized cash flow management aligns treasury functions with corporate finance objectives to enhance financial stability and value creation.

Key Differences Between Operational and Treasury Cash Flow

Operational cash flow reflects the actual cash generated from a corporation's core business activities, including revenues from sales and day-to-day expenses, which directly impacts liquidity and financial health. Treasury cash flow, managed by the treasury department, encompasses broader cash management functions such as funding, investments, risk management, and cash positioning to optimize corporate liquidity and financial strategy. Large corporations rely on operational cash flow for immediate business needs while treasury cash flow supports strategic decisions, long-term planning, and maintains cash reserves for financial stability.

Strategic Importance of Treasury Cash Flow Management

Treasury cash flow management is crucial for large corporations as it ensures liquidity optimization, risk mitigation, and efficient allocation of capital for strategic investments. Unlike general cash flow, treasury cash flow focuses on forecasting, controlling, and managing cash inflows and outflows to support financial stability and operational continuity. Effective treasury cash flow management enhances decision-making related to debt management, foreign exchange exposure, and working capital optimization, driving sustainable corporate growth.

Impact of Cash Flow vs Treasury Cash Flow on Corporate Liquidity

Cash flow represents the net amount of cash being transferred into and out of a corporation, directly affecting its operational liquidity and ability to meet short-term obligations. Treasury cash flow, managed by the corporate treasury department, provides a strategic overview of cash inflows and outflows, optimizing liquidity through cash forecasting, funding decisions, and risk management. The impact of treasury cash flow on corporate liquidity is critical as it ensures sufficient cash availability, minimizes idle funds, and supports efficient capital allocation across global operations in large corporations.

Tools and Systems for Monitoring Cash Flow Types

Large corporations employ integrated treasury management systems (TMS) and advanced ERP software to monitor both cash flow and treasury cash flow accurately. These tools provide real-time visibility into operational cash inflows and outflows, while also managing liquidity, risk, and investment strategies related to treasury cash flow. Data analytics and AI-powered forecasting enhance decision-making by distinguishing between operational cash flow metrics and treasury-related financial movements.

Role of Treasury in Global Cash Management

Treasury cash flow in large corporations focuses on optimizing liquidity, managing currency risks, and ensuring efficient allocation of funds across global subsidiaries, distinguishing it from general operational cash flow, which tracks day-to-day inflows and outflows. The role of Treasury in global cash management includes centralizing cash positions, forecasting future liquidity needs, and implementing hedging strategies to mitigate foreign exchange exposure. This centralized control enhances corporate financial stability and supports strategic investment and debt management decisions.

Challenges in Reconciling Cash Flow and Treasury Cash Flow

Large corporations face significant challenges in reconciling cash flow and treasury cash flow due to discrepancies in timing, classification, and consolidation processes across multiple subsidiaries and currencies. Treasury cash flow often reflects real-time liquidity management and internal funding movements, while corporate cash flow aggregates operational cash inflows and outflows, creating complexities in alignment. Differences in definitions, reporting standards, and intercompany transactions further complicate accurate reconciliation and financial reporting.

Best Practices for Integrating Cash Flow and Treasury Operations

Integrating cash flow management with treasury operations in large corporations enhances liquidity optimization, risk mitigation, and strategic capital allocation. Implementing real-time cash flow forecasting alongside centralized treasury functions ensures accurate cash visibility and efficient fund deployment across global subsidiaries. Leveraging advanced treasury management systems (TMS) and automated reconciliation processes supports seamless integration, driving improved financial decision-making and corporate profitability.

Future Trends: Digitalization in Cash and Treasury Cash Flow Management

Digitalization in cash and treasury cash flow management is revolutionizing how large corporations forecast, monitor, and optimize liquidity. Advanced technologies like AI-driven analytics and blockchain provide real-time visibility into cash positions, enhancing decision-making accuracy and reducing operational risks. Integration of digital platforms streamlines treasury processes, improving efficiency in managing both cash flow and treasury cash flow across global operations.

Related Important Terms

Real-Time Cash Visibility

Real-time cash visibility in large corporations distinguishes cash flow from treasury cash flow by providing instant insights into liquidity across all accounts and subsidiaries, enabling more accurate forecasting and efficient capital allocation. Treasury cash flow focuses on managing centralized funds and optimizing short-term investments, while operational cash flow reflects day-to-day financial activities critical for maintaining solvency and operational efficiency.

API-Driven Treasury Management

API-driven treasury management enhances cash flow visibility by integrating real-time data across corporate financial systems, enabling precise monitoring of treasury cash flow distinct from operational cash flow. Large corporations leverage these APIs to automate liquidity forecasting, optimize working capital, and ensure compliance with global banking networks, thereby improving decision-making and reducing financial risk.

In-House Bank Cash Pooling

In-house bank cash pooling enhances large corporations' cash flow management by consolidating multiple subsidiaries' liquidity to optimize treasury cash flow, reduce external borrowing costs, and improve internal fund transfers. This centralized approach enables real-time visibility and control over cash resources, maximizing working capital efficiency across the corporate group.

Virtual Account Structures

Virtual Account Structures enhance Treasury cash flow management in large corporations by centralizing liquidity and improving real-time visibility, unlike traditional cash flow processes which often operate on decentralized and fragmented accounts. This approach minimizes intercompany funding costs, accelerates cash reconciliation, and streamlines liquidity optimization across multiple business units and geographies.

Predictive Cash Flow Analytics

Predictive Cash Flow Analytics enhances large corporations' ability to forecast both operational cash flow and treasury cash flow, enabling more accurate liquidity management and strategic financial planning. Advanced modeling techniques integrate real-time data from receivables, payables, and investment activities to anticipate cash inflows and outflows, reducing risk and improving decision-making across departments.

Multibank Cash Concentration

Multibank Cash Concentration enables large corporations to streamline cash flow by consolidating balances from multiple bank accounts into a single treasury account, enhancing liquidity management and optimizing working capital. This approach distinguishes operational cash flow, derived from business activities across various banks, from treasury cash flow focused on strategic cash positioning and investment decisions at the corporate treasury level.

Treasury Liquidity Stress Testing

Treasury cash flow focuses on managing liquidity and funding risks, using Treasury Liquidity Stress Testing to simulate adverse scenarios and ensure sufficient cash reserves for large corporations. Unlike general cash flow analysis, Treasury cash flow integrates real-time data and forecast models to optimize working capital and meet regulatory liquidity requirements.

Instant Payment Reconciliation

Cash flow management in large corporations involves distinguishing between operational cash flow and treasury cash flow, with treasury cash flow focusing on liquidity optimization and risk mitigation through centralized control of funds. Instant payment reconciliation enhances treasury cash flow efficiency by enabling real-time matching of payments and receipts, reducing reconciliation times and improving cash visibility across global accounts.

Centralized Intercompany Netting

Centralized intercompany netting optimizes cash flow management by consolidating intercompany payments, significantly reducing transaction volumes and enhancing Treasury cash flow visibility for large corporations. This process improves liquidity forecasting and working capital efficiency by aligning operational cash flows with strategic Treasury cash flow objectives.

AI-Based Cash Flow Forecasting

AI-based cash flow forecasting enhances the accuracy of both cash flow and treasury cash flow management for large corporations by analyzing vast datasets and predicting liquidity needs with precision. Leveraging machine learning algorithms, these systems optimize working capital allocation and improve cash flow visibility, reducing financial risk and enabling proactive treasury strategies.

Cash flow vs Treasury cash flow for large corporations. Infographic

moneydiff.com

moneydiff.com