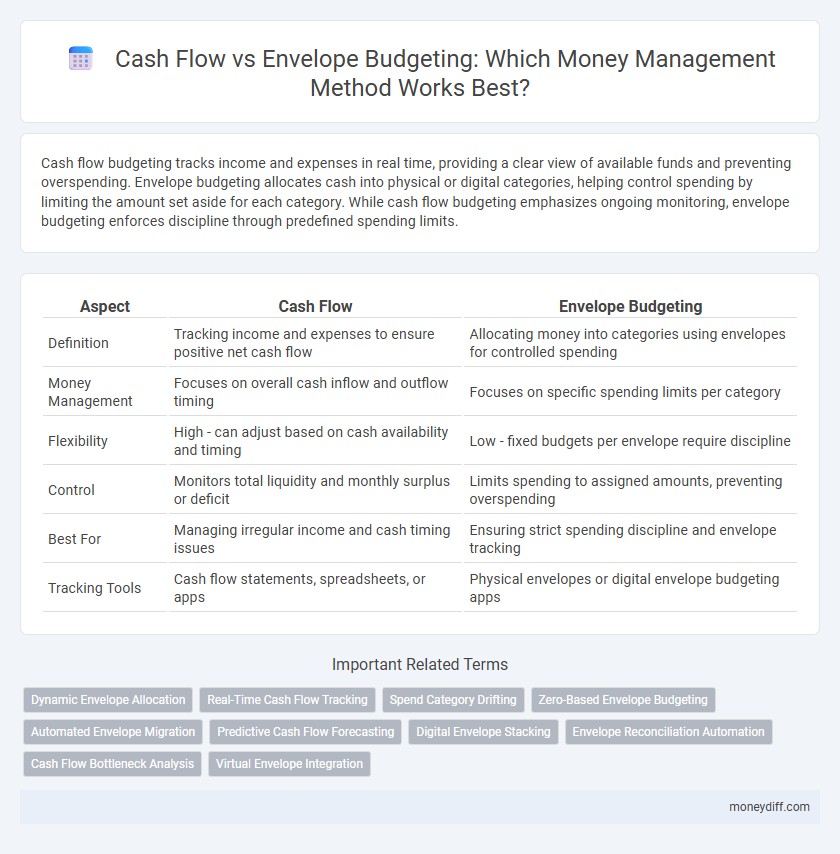

Cash flow budgeting tracks income and expenses in real time, providing a clear view of available funds and preventing overspending. Envelope budgeting allocates cash into physical or digital categories, helping control spending by limiting the amount set aside for each category. While cash flow budgeting emphasizes ongoing monitoring, envelope budgeting enforces discipline through predefined spending limits.

Table of Comparison

| Aspect | Cash Flow | Envelope Budgeting |

|---|---|---|

| Definition | Tracking income and expenses to ensure positive net cash flow | Allocating money into categories using envelopes for controlled spending |

| Money Management | Focuses on overall cash inflow and outflow timing | Focuses on specific spending limits per category |

| Flexibility | High - can adjust based on cash availability and timing | Low - fixed budgets per envelope require discipline |

| Control | Monitors total liquidity and monthly surplus or deficit | Limits spending to assigned amounts, preventing overspending |

| Best For | Managing irregular income and cash timing issues | Ensuring strict spending discipline and envelope tracking |

| Tracking Tools | Cash flow statements, spreadsheets, or apps | Physical envelopes or digital envelope budgeting apps |

Understanding Cash Flow and Envelope Budgeting

Cash flow management involves tracking income and expenses to maintain a positive balance and ensure financial stability. Envelope budgeting allocates specific amounts of cash to labeled categories, helping control spending by limiting funds within each envelope. Understanding both methods enables effective money management by combining detailed cash tracking with disciplined spending limits.

Key Differences Between Cash Flow and Envelope Budgeting

Cash flow budgeting tracks the actual inflow and outflow of money over time to manage liquidity, while envelope budgeting allocates fixed cash amounts to specific spending categories to control expenditures. Cash flow focuses on timing and availability of funds, allowing for flexible adjustments, whereas envelope budgeting emphasizes strict spending limits within predefined categories, often using physical or digital envelopes. The main difference lies in cash flow's dynamic tracking versus envelope budgeting's rigid allocation, both aiming to improve financial discipline but through distinct approaches.

How Cash Flow Management Works

Cash flow management involves tracking income and expenses to ensure there is enough liquidity for daily operations and financial obligations. It prioritizes real-time monitoring of inflows and outflows, enabling dynamic adjustments to spending and saving patterns. Unlike envelope budgeting, which allocates fixed amounts to spending categories, cash flow management adapts to variable income streams and unexpected expenses for more flexible money management.

Step-by-Step Guide to Envelope Budgeting

Envelope budgeting divides your income into specific spending categories by allocating cash into physical or digital envelopes, ensuring precise control over expenses. Start by listing monthly income sources and fixed costs, then determine spending limits for each envelope based on priorities such as groceries, utilities, and entertainment. Regularly monitor and adjust envelopes to maintain balanced cash flow, preventing overspending and promoting disciplined money management.

Pros and Cons of Cash Flow Management

Cash flow management offers real-time tracking of income and expenses, providing greater financial flexibility and the ability to respond quickly to unexpected changes. However, it requires consistent monitoring and can be overwhelming for individuals who prefer rigid budgeting methods like envelope budgeting, which allocates fixed amounts to spending categories. The dynamic nature of cash flow management helps avoid overspending but demands disciplined financial habits and may complicate long-term savings planning.

Advantages and Disadvantages of Envelope Budgeting

Envelope budgeting offers a clear visual method to control spending by allocating specific cash amounts to distinct categories, enhancing discipline and reducing overspending risks. However, it requires strict adherence to physical cash handling, which can be inconvenient in a digital payment world and may limit flexibility in emergencies. Unlike cash flow analysis that tracks money movement comprehensively, envelope budgeting may overlook irregular income or expenses, potentially causing budgeting gaps.

Choosing the Right Method for Your Financial Goals

Choosing between cash flow and envelope budgeting depends on your financial goals and spending habits. Cash flow budgeting tracks income and expenses continuously, ideal for flexible goal setting and managing irregular income, while envelope budgeting allocates fixed amounts to physical or digital envelopes for disciplined spending control. Evaluating your need for flexibility versus strict spending limits helps determine the best method to optimize savings and reduce debt effectively.

Common Mistakes in Cash Flow and Envelope Budgeting

Common mistakes in cash flow management include underestimating irregular expenses and failing to track all sources of income, leading to inaccurate budgeting. In envelope budgeting, errors often arise from allocating insufficient funds to essential categories and neglecting to adjust envelopes for changing financial priorities. Both methods benefit from regular review and adjustment to avoid overspending and ensure financial goals are met.

Integrating Cash Flow and Envelope Budgeting Techniques

Integrating cash flow with envelope budgeting enhances money management by providing real-time tracking and allocation of funds to specific spending categories, ensuring expenses do not exceed actual income. Cash flow analysis identifies inflows and outflows, while envelope budgeting enforces disciplined spending limits, creating a dynamic system that balances financial visibility with practical control. This combined approach reduces overspending and improves savings by aligning cash availability with predefined budget envelopes.

Tools and Apps to Simplify Money Management

Cash flow management tools like QuickBooks and Mint offer real-time tracking of income and expenses, enabling users to optimize budgeting with accurate cash inflow and outflow data. Envelope budgeting apps such as Goodbudget and Mvelopes provide a visual allocation of funds to specific spending categories, helping users enforce spending limits effectively. Integrating cash flow software with envelope budgeting apps enhances financial discipline by combining detailed transaction monitoring with categorized spending controls.

Related Important Terms

Dynamic Envelope Allocation

Dynamic Envelope Allocation enhances traditional cash flow management by allowing real-time adjustments to spending categories based on current inflows and priorities. This method improves financial flexibility and prevents overspending by continuously aligning budget envelopes with actual cash availability.

Real-Time Cash Flow Tracking

Real-time cash flow tracking provides immediate visibility into income and expenses, enabling more accurate and timely financial decisions compared to envelope budgeting, which relies on pre-allocated spending categories and can delay awareness of actual cash availability. The dynamic nature of real-time cash flow analysis supports proactive money management by continuously reflecting up-to-date financial status, enhancing responsiveness to changing economic conditions.

Spend Category Drifting

Cash flow management allows real-time tracking of income and expenses, reducing spend category drifting by maintaining flexibility within budget categories. Envelope budgeting, with its rigid allocation for each spending category, minimizes drift but can limit adaptability, making cash flow a preferable method for dynamic financial planning.

Zero-Based Envelope Budgeting

Zero-Based Envelope Budgeting allocates every dollar of income to specific spending categories, ensuring no funds remain unassigned, which enhances precise cash flow management. This method contrasts with traditional cash flow systems by forcing intentional allocation, reducing overspending and improving financial discipline.

Automated Envelope Migration

Automated envelope migration enhances cash flow management by systematically allocating funds into specific budgeting categories, ensuring precise tracking of expenses and savings goals. This method reduces manual intervention, improves real-time financial visibility, and optimizes the distribution of income to maintain balanced budgets effortlessly.

Predictive Cash Flow Forecasting

Predictive cash flow forecasting enhances money management by providing real-time visibility into future financial positions, allowing for proactive adjustments beyond the static allocations of envelope budgeting. This dynamic approach uses historical data and trend analysis to anticipate cash inflows and outflows, improving liquidity management and reducing the risk of overdrafts compared to traditional envelope systems.

Digital Envelope Stacking

Digital Envelope Stacking enhances traditional envelope budgeting by allowing users to allocate cash flow into multiple virtual envelopes for precise expense tracking and better financial control. This method streamlines money management through real-time adjustments and automated categorization, optimizing cash flow allocation and improving budgeting accuracy.

Envelope Reconciliation Automation

Envelope Reconciliation Automation streamlines cash flow management by accurately tracking and categorizing expenses within predefined budget envelopes, reducing manual errors and saving time. This automation enhances financial discipline compared to traditional Envelope Budgeting by providing real-time updates and seamless integration with bank transactions for precise envelope balances.

Cash Flow Bottleneck Analysis

Cash flow bottleneck analysis identifies critical points where cash inflows and outflows disrupt financial stability, enabling precise adjustments to maintain liquidity. Unlike envelope budgeting, which allocates money into predefined categories, cash flow analysis provides dynamic insights into timing and magnitude of cash movements, improving short-term financial decision-making and preventing cash shortages.

Virtual Envelope Integration

Virtual Envelope Integration enhances cash flow management by digitally allocating funds into specific categories, improving financial organization and real-time tracking. This method offers greater flexibility and automation compared to traditional envelope budgeting, optimizing spending control and savings goals.

Cash flow vs Envelope budgeting for money management. Infographic

moneydiff.com

moneydiff.com