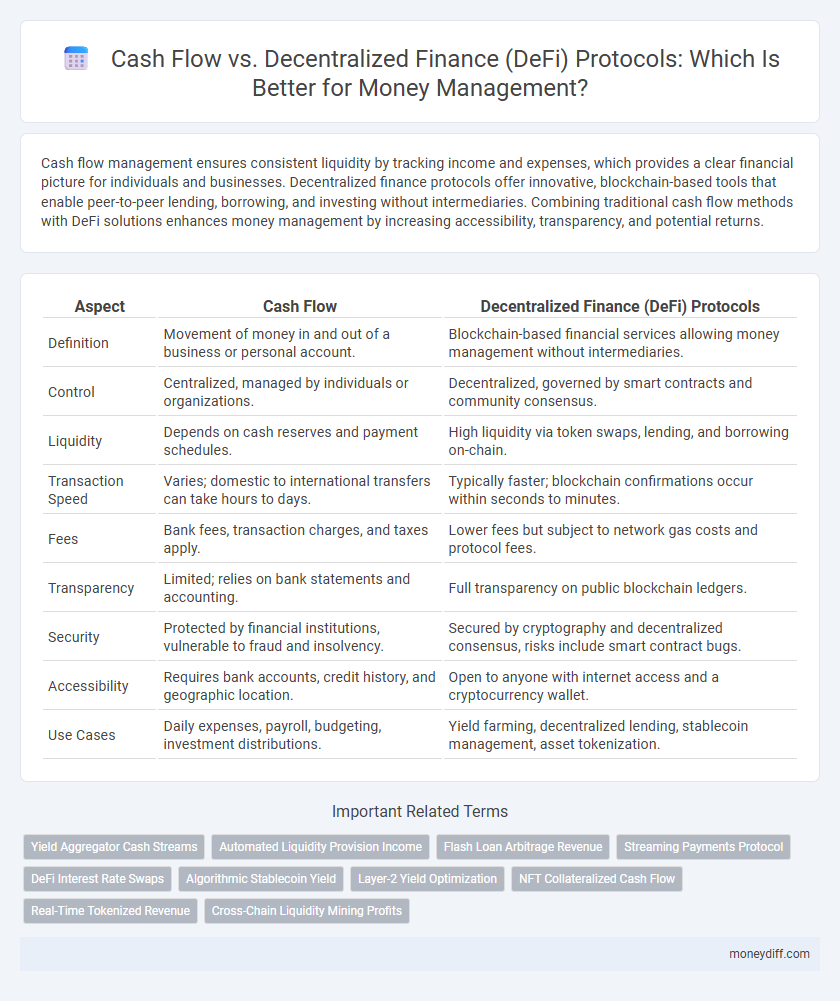

Cash flow management ensures consistent liquidity by tracking income and expenses, which provides a clear financial picture for individuals and businesses. Decentralized finance protocols offer innovative, blockchain-based tools that enable peer-to-peer lending, borrowing, and investing without intermediaries. Combining traditional cash flow methods with DeFi solutions enhances money management by increasing accessibility, transparency, and potential returns.

Table of Comparison

| Aspect | Cash Flow | Decentralized Finance (DeFi) Protocols |

|---|---|---|

| Definition | Movement of money in and out of a business or personal account. | Blockchain-based financial services allowing money management without intermediaries. |

| Control | Centralized, managed by individuals or organizations. | Decentralized, governed by smart contracts and community consensus. |

| Liquidity | Depends on cash reserves and payment schedules. | High liquidity via token swaps, lending, and borrowing on-chain. |

| Transaction Speed | Varies; domestic to international transfers can take hours to days. | Typically faster; blockchain confirmations occur within seconds to minutes. |

| Fees | Bank fees, transaction charges, and taxes apply. | Lower fees but subject to network gas costs and protocol fees. |

| Transparency | Limited; relies on bank statements and accounting. | Full transparency on public blockchain ledgers. |

| Security | Protected by financial institutions, vulnerable to fraud and insolvency. | Secured by cryptography and decentralized consensus, risks include smart contract bugs. |

| Accessibility | Requires bank accounts, credit history, and geographic location. | Open to anyone with internet access and a cryptocurrency wallet. |

| Use Cases | Daily expenses, payroll, budgeting, investment distributions. | Yield farming, decentralized lending, stablecoin management, asset tokenization. |

Understanding Cash Flow in Traditional Money Management

Cash flow in traditional money management refers to the inflow and outflow of cash within a business or personal finance system, essential for maintaining liquidity and meeting financial obligations. It involves monitoring revenues, expenses, and operational costs to ensure positive cash flow and avoid insolvency. In contrast, decentralized finance (DeFi) protocols use blockchain technology to automate money management tasks like lending, borrowing, and yield generation, offering transparency and reduced reliance on intermediaries.

Introduction to Decentralized Finance (DeFi) Protocols

Decentralized Finance (DeFi) protocols revolutionize cash flow management by enabling peer-to-peer financial transactions on blockchain networks without intermediaries. These protocols provide automated liquidity, lending, and yield generation through smart contracts, ensuring transparent and secure cash flow handling. By integrating DeFi solutions, organizations can optimize their cash flow cycles with improved efficiency and lower transaction costs compared to traditional banking systems.

Key Differences: Cash Flow vs DeFi Protocols

Cash flow represents the actual movement of money in and out of a business, reflecting liquidity and operational efficiency, while decentralized finance (DeFi) protocols leverage blockchain technology to enable peer-to-peer financial transactions without intermediaries. Cash flow management focuses on tracking real-time income and expenses to maintain solvency, whereas DeFi protocols emphasize automated, transparent, and permissionless financial services like lending, borrowing, and trading. The key difference lies in cash flow being a traditional measure of financial health, whereas DeFi protocols provide innovative, decentralized tools for money management with enhanced accessibility and reduced reliance on centralized institutions.

Benefits of DeFi for Personal Cash Flow Management

Decentralized finance (DeFi) protocols enhance personal cash flow management by providing seamless access to liquidity through decentralized lending and borrowing platforms, reducing dependency on traditional banks. Real-time tracking and automated smart contracts facilitate efficient cash flow monitoring and timely transactions without intermediaries, improving transparency and control over funds. Lower transaction costs and increased financial inclusion empower individuals to optimize cash flow and maximize returns through decentralized yield farming and staking opportunities.

Risks and Challenges in DeFi Platforms

Cash flow management faces significant risks and challenges within decentralized finance (DeFi) protocols, including smart contract vulnerabilities that can lead to loss of funds and liquidity risks due to volatile token markets. Regulatory uncertainty and lack of institutional oversight increase exposure to fraud and operational risks, complicating cash flow predictability. Users must navigate network congestion and high gas fees, which can disrupt timely transactions and impact effective cash flow planning.

Cash Flow Optimization Strategies Using DeFi

Cash flow optimization strategies using decentralized finance (DeFi) protocols leverage automated liquidity pools, yield farming, and staking to enhance real-time asset utilization and maximize returns. Integrating DeFi platforms enables seamless cash flow management through programmable smart contracts, reducing reliance on traditional intermediaries and lowering transaction costs. Real-time tracking and automated reallocation of funds in DeFi ecosystems improve cash inflows and outflows efficiency, fostering improved liquidity and capital efficiency.

Security and Transparency: Traditional Systems vs DeFi

Traditional cash flow management relies on centralized institutions with established regulatory frameworks, ensuring security through auditing and compliance measures. Decentralized finance (DeFi) protocols offer transparency by leveraging blockchain technology, enabling real-time transaction verification and immutable records. Security in DeFi depends on smart contract robustness and decentralized consensus, reducing single points of failure compared to traditional systems.

Cost Efficiency: Conventional Banking vs DeFi Solutions

Cash flow management in decentralized finance (DeFi) protocols offers significantly lower transaction fees compared to conventional banking, reducing overhead costs for businesses and individuals. DeFi solutions eliminate intermediaries, streamlining payments and enhancing liquidity access with near-instant settlements, which improves overall cost efficiency. Traditional banking systems often impose higher fees and longer processing times, limiting cash flow agility in comparison to the transparent and automated DeFi ecosystem.

DeFi’s Role in Automating Cash Flow Processes

Decentralized finance (DeFi) protocols streamline cash flow management by automating transactions through smart contracts, reducing manual intervention and errors. These protocols enable real-time fund transfers, instant settlements, and enhanced transparency across financial operations. Integrating DeFi solutions improves liquidity management and optimizes operational efficiency in cash flow processes.

Future Trends: Integrating Cash Flow Management with DeFi

Future trends in money management highlight the integration of cash flow management with decentralized finance (DeFi) protocols, enhancing real-time liquidity monitoring and automated transaction processing. Leveraging blockchain technology, this integration facilitates transparent, trustless financial operations, optimizing cash flow predictability and efficiency for businesses and individuals. As DeFi platforms evolve, seamless synchronization with traditional cash flow systems will drive innovation in budgeting, investment strategies, and financial forecasting.

Related Important Terms

Yield Aggregator Cash Streams

Yield aggregator cash streams in decentralized finance protocols optimize cash flow by automatically reallocating assets across multiple liquidity pools and staking opportunities to maximize returns. These protocols enhance traditional cash flow management by providing continuous, algorithm-driven yield generation that outperforms static investment strategies.

Automated Liquidity Provision Income

Automated liquidity provision income in decentralized finance protocols offers continuous cash flow by enabling users to earn fees through supplying assets to liquidity pools, contrasting traditional cash flow systems reliant on fixed schedules and manual management. This decentralized model enhances cash flow efficiency by leveraging smart contracts to automate income generation and optimize asset utilization without intermediaries.

Flash Loan Arbitrage Revenue

Cash flow generated through flash loan arbitrage in decentralized finance (DeFi) protocols offers immediate liquidity without initial capital, enabling rapid profit extraction across multiple platforms. This mechanism leverages smart contracts for seamless, real-time execution of arbitrage opportunities, optimizing revenue streams beyond traditional cash flow management methods.

Streaming Payments Protocol

Streaming Payments Protocol enhances cash flow management by enabling real-time, continuous transfers of funds within decentralized finance protocols, reducing the delays and liquidity constraints typical of traditional cash flow systems. This innovation optimizes financial operations by allowing seamless, automated money flows that improve capital efficiency and responsiveness in DeFi environments.

DeFi Interest Rate Swaps

Cash flow management through DeFi interest rate swaps enables users to hedge against volatile interest rates by locking in fixed payments, ensuring predictable liquidity for operational expenses. These decentralized finance protocols increase cash flow stability by eliminating intermediaries, reducing costs, and providing customizable financial instruments tailored to individual risk profiles.

Algorithmic Stablecoin Yield

Algorithmic stablecoin yield protocols within decentralized finance offer dynamic cash flow management by automatically adjusting supply mechanisms to maintain price stability and optimize earning potential. These systems enable users to generate consistent returns through incentives embedded in smart contracts, contrasting traditional cash flow models that rely on fixed interest or manual adjustments.

Layer-2 Yield Optimization

Layer-2 yield optimization protocols in decentralized finance enhance cash flow management by reducing transaction costs and increasing liquidity efficiency on blockchain networks. These protocols leverage advanced scaling solutions to maximize returns on assets while maintaining secure and transparent financial operations outside traditional banking systems.

NFT Collateralized Cash Flow

NFT collateralized cash flow enables users to unlock liquidity by leveraging non-fungible tokens as collateral within decentralized finance protocols, offering a novel alternative to traditional cash flow methods. This innovation enhances liquidity management by integrating unique digital assets into DeFi ecosystems, optimizing cash flow for holders of NFTs.

Real-Time Tokenized Revenue

Real-time tokenized revenue in decentralized finance protocols enables instantaneous tracking and distribution of cash flow, enhancing transparency and liquidity management compared to traditional delayed cash flow reporting. This innovation optimizes financial operations by automating revenue streams through smart contracts, ensuring timely access to funds and dynamic allocation based on predefined rules.

Cross-Chain Liquidity Mining Profits

Cash flow management benefits from decentralized finance protocols by leveraging cross-chain liquidity mining profits, enabling users to maximize returns across multiple blockchain networks. This approach enhances cash flow stability through diversified yield farming strategies and real-time asset allocation in DeFi ecosystems.

Cash flow vs Decentralized finance protocols for money management. Infographic

moneydiff.com

moneydiff.com