Cash flow management involves tracking income and expenses manually to maintain financial stability, often leading to time-consuming and error-prone processes. A cash flow automation platform streamlines money management by automatically monitoring transactions, categorizing expenses, and providing real-time insights for better decision-making. This technology enhances accuracy and efficiency, enabling users to optimize their financial health effortlessly.

Table of Comparison

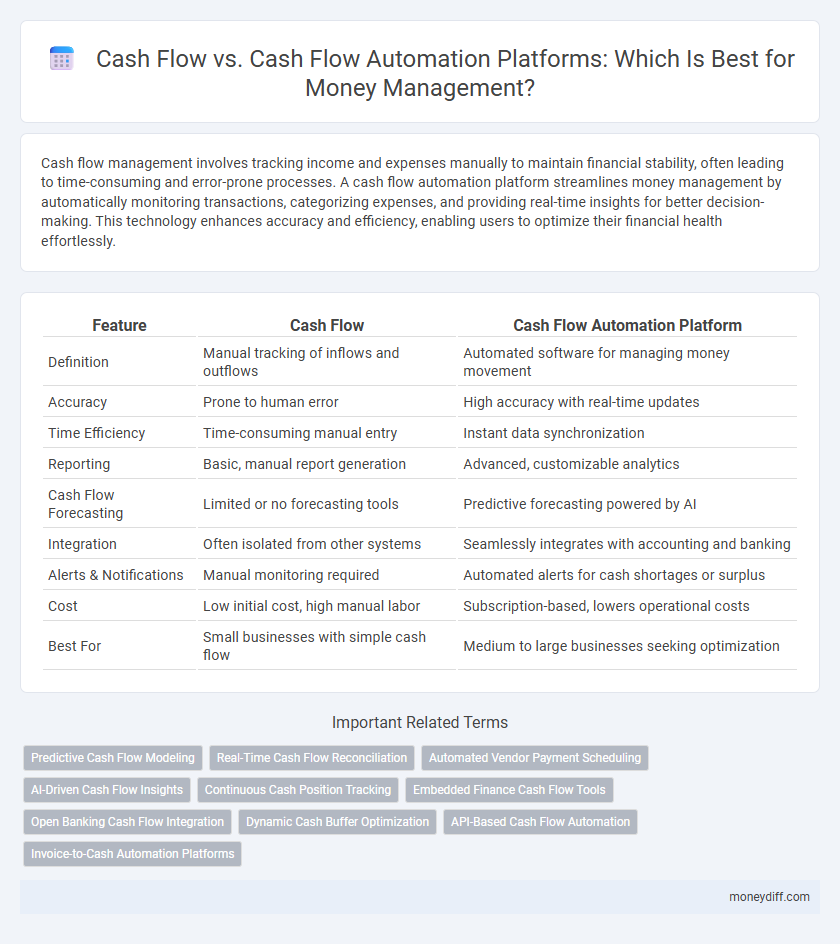

| Feature | Cash Flow | Cash Flow Automation Platform |

|---|---|---|

| Definition | Manual tracking of inflows and outflows | Automated software for managing money movement |

| Accuracy | Prone to human error | High accuracy with real-time updates |

| Time Efficiency | Time-consuming manual entry | Instant data synchronization |

| Reporting | Basic, manual report generation | Advanced, customizable analytics |

| Cash Flow Forecasting | Limited or no forecasting tools | Predictive forecasting powered by AI |

| Integration | Often isolated from other systems | Seamlessly integrates with accounting and banking |

| Alerts & Notifications | Manual monitoring required | Automated alerts for cash shortages or surplus |

| Cost | Low initial cost, high manual labor | Subscription-based, lowers operational costs |

| Best For | Small businesses with simple cash flow | Medium to large businesses seeking optimization |

Understanding Cash Flow in Money Management

Effective money management relies on understanding cash flow, which represents the net amount of cash moving in and out of a business or personal finances over a specific period. Traditional cash flow tracking involves manual monitoring of income and expenses, often leading to errors and delayed insights. Cash flow automation platforms streamline this process by automatically aggregating financial data, providing real-time visibility into liquidity, and enabling proactive decision-making for optimized money management.

Manual Cash Flow Strategies: Pros and Cons

Manual cash flow strategies offer direct control over financial tracking and flexibility in adjusting cash inflows and outflows, benefiting businesses with simple financial operations. However, they are time-consuming, prone to human error, and lack real-time insights, which can lead to inaccurate forecasting and delayed decision-making. In contrast, cash flow automation platforms enhance accuracy, provide instant data analysis, and streamline money management but may require upfront investment and training.

What is a Cash Flow Automation Platform?

A Cash Flow Automation Platform is a software solution designed to streamline and optimize the management of cash inflows and outflows by automating processes such as invoicing, payment collection, and expense tracking. It provides real-time visibility into cash positions, enabling businesses to forecast liquidity needs and reduce manual errors. By integrating with accounting systems and financial institutions, the platform enhances cash flow accuracy and operational efficiency for money management.

Comparing Traditional Cash Flow vs Automated Solutions

Traditional cash flow management relies heavily on manual tracking, which increases the risk of errors and delays in financial reporting. Automated cash flow platforms utilize real-time data integration, predictive analytics, and AI-driven forecasting to enhance accuracy and provide immediate insights into liquidity positions. These automated solutions improve cash flow visibility, optimize working capital, and support proactive money management compared to conventional methods.

Key Features of Cash Flow Automation Platforms

Cash flow automation platforms offer real-time tracking of income and expenses, enhancing visibility and accuracy in money management. Advanced features include automated invoicing, payment reminders, and integration with banking systems to streamline cash inflows and outflows. These tools enable predictive analytics for forecasting and optimize liquidity management, reducing manual errors and improving overall financial efficiency.

Time and Efficiency: Manual vs Automated Cash Flow

Manual cash flow management often involves repetitive data entry and time-consuming reconciliations, leading to inefficiencies and increased risk of human error. Cash flow automation platforms streamline these processes by integrating real-time financial data, enabling faster decision-making and accurate forecasting. Businesses leveraging automated systems typically experience significant time savings and enhanced financial efficiency, driving better money management outcomes.

Impact on Financial Accuracy and Reporting

Manual cash flow management often leads to errors and inconsistencies in financial reporting, affecting the accuracy of forecasts and decision-making. Cash flow automation platforms enhance financial accuracy by integrating real-time data updates and automated reconciliations, significantly reducing human error. These platforms improve reporting efficiency, providing precise, up-to-date financial insights that support strategic money management.

Scalability: Handling Growth with Cash Flow Automation

Cash flow automation platforms enhance scalability by streamlining real-time tracking and forecasting of cash inflows and outflows, enabling businesses to manage increased transaction volumes efficiently. These platforms leverage AI and machine learning algorithms to analyze large datasets, providing actionable insights that support strategic financial decisions during growth phases. Automation reduces manual errors and processing time, ensuring consistent cash flow management as business operations expand.

Security and Risk Management in Automated Cash Flow

Automated cash flow platforms enhance security by integrating real-time fraud detection, encrypted transactions, and multi-factor authentication to protect sensitive financial data. These systems reduce human error and operational risks by automating reconciliation and approval processes, ensuring accurate cash flow forecasting and compliance. Advanced risk management tools in automated platforms also provide continuous monitoring and alerts for anomalous activities, minimizing financial losses and improving overall money management efficiency.

Choosing the Right Cash Flow Solution for Your Needs

Choosing the right cash flow solution depends on your business size, complexity, and management goals, with traditional cash flow methods offering manual tracking and basic forecasting suitable for small operations. Cash flow automation platforms use AI-driven analytics, real-time data integration, and automated invoicing to provide accurate, up-to-date insights ideal for scaling businesses seeking efficiency and error reduction. Evaluating your cash flow volume, frequency of transactions, and need for predictive analytics will help determine if automation enhances your financial visibility and decision-making capabilities.

Related Important Terms

Predictive Cash Flow Modeling

Predictive cash flow modeling enhances financial forecasting by analyzing historical transaction data to anticipate future inflows and outflows with greater accuracy. Cash flow automation platforms streamline this process by integrating real-time data and machine learning algorithms, enabling businesses to proactively manage liquidity and optimize working capital.

Real-Time Cash Flow Reconciliation

Real-time cash flow reconciliation powered by cash flow automation platforms enhances accuracy by instantly matching transactions across accounts, reducing manual errors and enabling proactive money management. This automation streamlines cash flow visibility, supports dynamic forecasting, and optimizes liquidity by providing up-to-date financial data without delays.

Automated Vendor Payment Scheduling

Automated vendor payment scheduling within cash flow automation platforms ensures timely payments by synchronizing due dates and available funds, reducing manual errors and late fees. This automation enhances cash flow management by optimizing liquidity, improving vendor relationships, and providing real-time visibility into outgoing cash commitments.

AI-Driven Cash Flow Insights

AI-driven cash flow automation platforms leverage machine learning algorithms to provide real-time cash flow insights, enabling businesses to predict and manage liquidity with greater accuracy and efficiency. These platforms analyze transactional data to identify patterns, forecast cash inflows and outflows, and recommend optimal financial decisions, significantly enhancing traditional cash flow management.

Continuous Cash Position Tracking

Continuous cash position tracking via a cash flow automation platform provides real-time visibility into liquidity, enabling businesses to manage inflows and outflows with precision. This automation reduces manual errors, accelerates reconciliation processes, and enhances forecasting accuracy compared to traditional cash flow management methods.

Embedded Finance Cash Flow Tools

Cash flow automation platforms integrated with embedded finance cash flow tools optimize real-time liquidity management by streamlining invoicing, payments, and expense tracking. These platforms enhance financial visibility and operational efficiency, reducing manual errors and accelerating cash flow forecasting for businesses.

Open Banking Cash Flow Integration

Open Banking Cash Flow Integration streamlines financial data aggregation by securely connecting multiple bank accounts to a cash flow automation platform, enabling real-time monitoring and accurate forecasting of cash positions. This integration enhances liquidity management, reduces manual reconciliation errors, and accelerates decision-making compared to traditional cash flow methods.

Dynamic Cash Buffer Optimization

Dynamic Cash Buffer Optimization enhances cash flow management by automatically adjusting liquidity reserves based on real-time transaction data and predictive analytics, reducing idle cash without risking liquidity shortages. Cash flow automation platforms streamline this process, integrating live financial inputs and machine learning algorithms to optimize buffer levels, improve working capital efficiency, and support strategic decision-making.

API-Based Cash Flow Automation

API-based cash flow automation platforms streamline money management by integrating real-time financial data, enabling accurate forecasting and optimized liquidity control. These systems reduce manual errors and enhance decision-making efficiency compared to traditional cash flow methods.

Invoice-to-Cash Automation Platforms

Invoice-to-Cash automation platforms streamline cash flow management by accelerating invoice processing, reducing human errors, and improving payment collection efficiency. These platforms enhance liquidity forecasting and optimize working capital by integrating automated billing, payment reminders, and real-time cash flow tracking.

Cash flow vs Cash flow automation platform for money management. Infographic

moneydiff.com

moneydiff.com