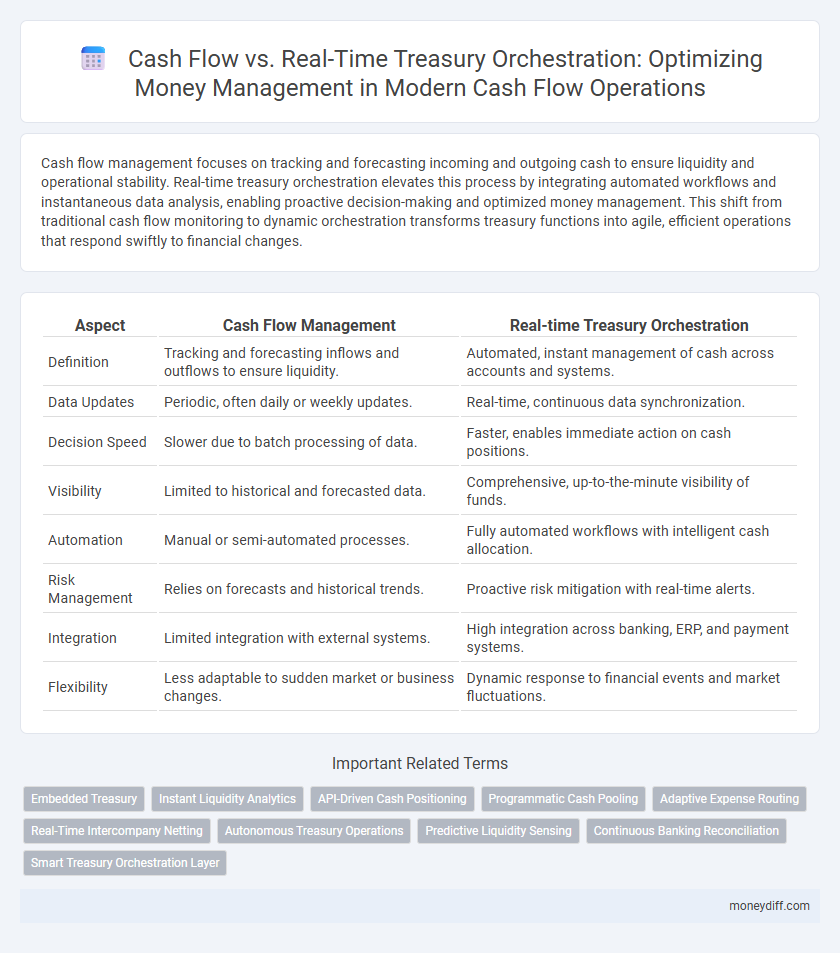

Cash flow management focuses on tracking and forecasting incoming and outgoing cash to ensure liquidity and operational stability. Real-time treasury orchestration elevates this process by integrating automated workflows and instantaneous data analysis, enabling proactive decision-making and optimized money management. This shift from traditional cash flow monitoring to dynamic orchestration transforms treasury functions into agile, efficient operations that respond swiftly to financial changes.

Table of Comparison

| Aspect | Cash Flow Management | Real-time Treasury Orchestration |

|---|---|---|

| Definition | Tracking and forecasting inflows and outflows to ensure liquidity. | Automated, instant management of cash across accounts and systems. |

| Data Updates | Periodic, often daily or weekly updates. | Real-time, continuous data synchronization. |

| Decision Speed | Slower due to batch processing of data. | Faster, enables immediate action on cash positions. |

| Visibility | Limited to historical and forecasted data. | Comprehensive, up-to-the-minute visibility of funds. |

| Automation | Manual or semi-automated processes. | Fully automated workflows with intelligent cash allocation. |

| Risk Management | Relies on forecasts and historical trends. | Proactive risk mitigation with real-time alerts. |

| Integration | Limited integration with external systems. | High integration across banking, ERP, and payment systems. |

| Flexibility | Less adaptable to sudden market or business changes. | Dynamic response to financial events and market fluctuations. |

Understanding Cash Flow in Money Management

Understanding cash flow is essential for effective money management, as it tracks the inflow and outflow of funds within a business, enabling accurate forecasting and liquidity assessment. Real-time treasury orchestration enhances this process by integrating data across multiple financial systems, providing immediate visibility into cash positions and optimizing fund allocation. This dynamic approach reduces reliance on static cash flow reports, improving decision-making and financial agility.

Introduction to Real-time Treasury Orchestration

Real-time treasury orchestration enables instantaneous visibility and control over cash flow, transforming traditional delayed reporting into proactive money management. By integrating payments, liquidity, and cash forecasting in a unified platform, it streamlines decision-making and enhances financial agility. This approach reduces operational risk and optimizes working capital through synchronized, data-driven processes.

Key Differences Between Cash Flow and Treasury Orchestration

Cash flow focuses on tracking and projecting the inflows and outflows of cash within a business, providing a snapshot of liquidity over a specific period. Real-time treasury orchestration integrates data from multiple sources to automate cash positioning, forecasting, and optimized fund allocation dynamically across accounts and entities. Unlike traditional cash flow management, treasury orchestration enables instant decision-making and enhanced visibility, improving working capital efficiency and risk mitigation.

Benefits of Real-time Treasury Orchestration

Real-time treasury orchestration enhances cash flow management by providing instantaneous visibility and control over liquidity across multiple accounts and currencies. This approach minimizes idle cash, reduces overdraft risks, and optimizes funding by automating cash positioning and forecasting with precision. Integrating real-time data analytics enables dynamic decision-making that improves working capital efficiency and supports strategic financial planning.

Limitations of Traditional Cash Flow Management

Traditional cash flow management often suffers from delayed data updates, leading to inaccurate forecasting and inefficient liquidity allocation. Static reporting and manual reconciliation processes limit real-time visibility, increasing the risk of cash shortfalls or idle funds. These limitations hinder agile decision-making and optimal working capital utilization in dynamic market conditions.

Real-time Data Integration for Treasury Operations

Real-time data integration enhances treasury operations by providing instantaneous visibility into cash positions, enabling more accurate forecasting and agile liquidity management. Unlike traditional cash flow methods that rely on delayed reports, real-time treasury orchestration consolidates data from multiple sources instantly, supporting proactive decision-making. This seamless integration reduces operational risk and optimizes working capital by aligning treasury actions closely with current market conditions.

Impact on Liquidity and Risk Management

Cash flow management primarily tracks historical and projected inflows and outflows to ensure sufficient liquidity, but it often lacks the granularity for instantaneous decision-making. Real-time treasury orchestration integrates dynamic cash positions across accounts and currencies, enhancing liquidity visibility and enabling proactive risk mitigation. This continuous synchronization reduces exposure to liquidity shortfalls and optimizes capital allocation, significantly improving overall financial resilience.

Automation in Real-time Treasury Orchestration

Automation in real-time treasury orchestration enables instant visibility and control over cash flow, significantly enhancing liquidity management and decision-making accuracy. By integrating AI-driven predictive analytics and automated workflows, organizations can optimize payment timing, reduce manual errors, and improve working capital efficiency. This seamless orchestration supports proactive risk management and accelerates cash conversion cycles, outperforming traditional cash flow processes.

Cost Efficiency: Cash Flow vs Real-time Orchestration

Cash flow management provides a snapshot of liquidity by tracking inflows and outflows, but real-time treasury orchestration enhances cost efficiency by automating fund allocation and reducing manual intervention. Real-time orchestration minimizes idle cash, optimizes working capital usage, and lowers transaction costs through immediate visibility and control of treasury operations. This dynamic approach outperforms traditional cash flow methods by enabling precise, timely financial decisions that improve overall cost management in corporate treasury.

Future Trends: Evolution of Treasury Management Solutions

Future trends in treasury management solutions emphasize the shift from traditional cash flow monitoring to real-time treasury orchestration, enabling instant visibility and control over liquidity positions. Advanced technologies such as AI-driven analytics, blockchain, and API integrations facilitate seamless money management by automating payments, forecasting cash needs, and optimizing working capital in real time. These innovations support dynamic decision-making, reduce risks, and enhance financial agility in an increasingly complex global market.

Related Important Terms

Embedded Treasury

Embedded Treasury integrates cash flow data with real-time treasury orchestration, enabling dynamic liquidity management and precise fund allocation across multiple accounts. This unified approach enhances visibility, reduces operational risk, and accelerates decision-making, optimizing overall money management efficiency.

Instant Liquidity Analytics

Cash flow provides a historical overview of income and expenses, essential for tracking financial health, while real-time treasury orchestration leverages Instant Liquidity Analytics to optimize money management by delivering up-to-the-minute visibility into cash positions and liquidity risks. Instant Liquidity Analytics enables dynamic decision-making, ensuring businesses maintain optimal cash levels and respond swiftly to fluctuations in working capital.

API-Driven Cash Positioning

API-driven cash positioning enhances cash flow management by enabling real-time treasury orchestration, allowing businesses to automate liquidity tracking and optimize fund allocation instantly. Integrating APIs provides seamless visibility into cash positions across multiple accounts, facilitating precise forecasting and improved decision-making for robust money management.

Programmatic Cash Pooling

Programmatic Cash Pooling enables dynamic aggregation of funds across multiple accounts, enhancing liquidity visibility and optimizing intercompany cash flow management. Real-time treasury orchestration leverages this by automating cash allocation, reducing idle balances, and improving working capital efficiency through immediate transaction settlement and data synchronization.

Adaptive Expense Routing

Adaptive Expense Routing enhances cash flow management by dynamically directing funds based on real-time treasury orchestration, ensuring optimal liquidity distribution and reducing idle cash. This integration maximizes operational efficiency and improves financial agility by aligning expense payments instantly with available resources and strategic priorities.

Real-Time Intercompany Netting

Real-Time Intercompany Netting enhances cash flow efficiency by instantly offsetting receivables and payables between subsidiaries, reducing reliance on manual reconciliation and minimizing idle cash positions. This real-time treasury orchestration enables seamless money management, optimizing liquidity and improving working capital across the enterprise.

Autonomous Treasury Operations

Autonomous Treasury Operations leverage real-time treasury orchestration to enhance cash flow management by automating liquidity forecasting, payments, and risk mitigation across multiple accounts and currencies. This integration improves accuracy, reduces manual intervention, and enables dynamic decision-making for optimized working capital and strategic investment.

Predictive Liquidity Sensing

Predictive Liquidity Sensing enhances cash flow management by forecasting short-term liquidity needs, enabling proactive fund allocation and reducing reliance on real-time treasury orchestration. This approach improves accuracy in cash positioning and optimizes working capital, supporting strategic money management decisions.

Continuous Banking Reconciliation

Continuous banking reconciliation enhances cash flow visibility by automatically aligning transactions with real-time treasury orchestration, enabling precise money management and reducing reconciliation errors. This seamless integration supports dynamic forecasting and liquidity optimization, ensuring efficient fund allocation across accounts.

Smart Treasury Orchestration Layer

The Smart Treasury Orchestration Layer enhances cash flow management by seamlessly integrating real-time data streams with automated decision-making algorithms, ensuring optimal liquidity distribution and risk mitigation. This advanced framework transcends traditional cash flow models by providing dynamic, predictive insights that align treasury operations with immediate market conditions and organizational financial goals.

Cash flow vs Real-time treasury orchestration for money management. Infographic

moneydiff.com

moneydiff.com