Cash flow management emphasizes tracking income and expenses to maintain a steady financial balance, while Velocity Banking focuses on leveraging a home equity line of credit (HELOC) to accelerate debt payoff and maximize interest savings. Effective cash flow ensures consistent liquidity for daily expenses, whereas Velocity Banking strategically reduces loan interest by reallocating cash flows to pay down debt faster. Integrating cash flow awareness with Velocity Banking techniques can optimize overall money management and improve long-term financial health.

Table of Comparison

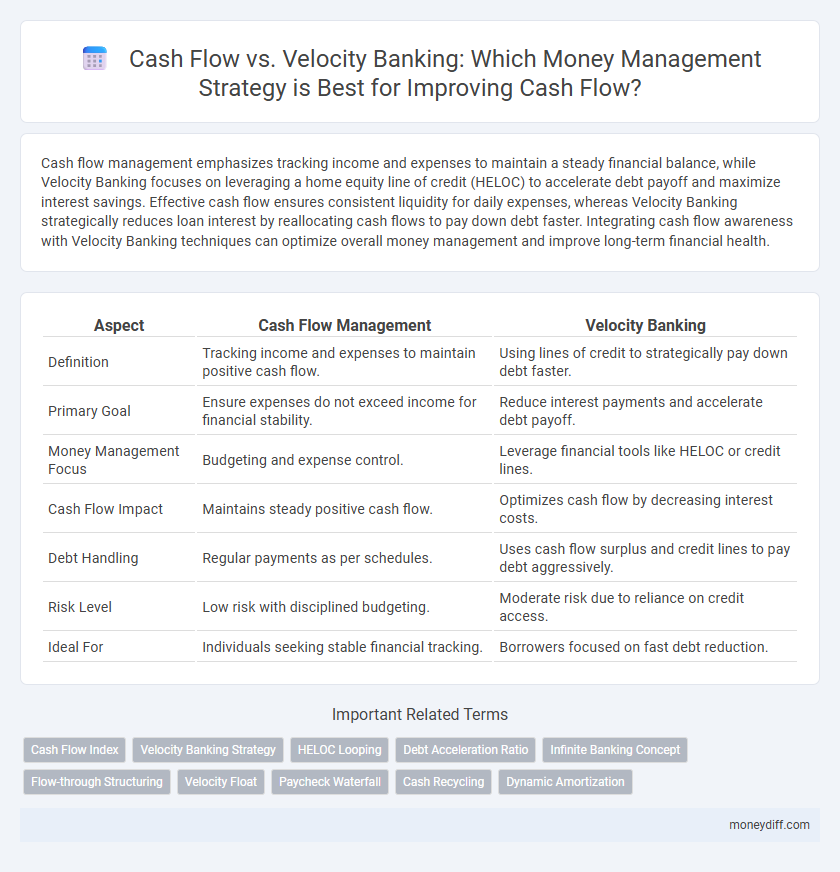

| Aspect | Cash Flow Management | Velocity Banking |

|---|---|---|

| Definition | Tracking income and expenses to maintain positive cash flow. | Using lines of credit to strategically pay down debt faster. |

| Primary Goal | Ensure expenses do not exceed income for financial stability. | Reduce interest payments and accelerate debt payoff. |

| Money Management Focus | Budgeting and expense control. | Leverage financial tools like HELOC or credit lines. |

| Cash Flow Impact | Maintains steady positive cash flow. | Optimizes cash flow by decreasing interest costs. |

| Debt Handling | Regular payments as per schedules. | Uses cash flow surplus and credit lines to pay debt aggressively. |

| Risk Level | Low risk with disciplined budgeting. | Moderate risk due to reliance on credit access. |

| Ideal For | Individuals seeking stable financial tracking. | Borrowers focused on fast debt reduction. |

Understanding Cash Flow in Personal Finance

Cash flow represents the movement of money in and out of personal finances, tracking income versus expenses to maintain financial stability. Velocity banking leverages cash flow by strategically using a line of credit to pay down debt faster and reduce interest payments. Understanding cash flow is essential in velocity banking as it ensures sufficient liquidity to cover obligations while accelerating debt repayment.

What is Velocity Banking?

Velocity banking is a financial strategy that leverages a home equity line of credit (HELOC) or similar revolving credit to accelerate debt repayment and optimize cash flow. By strategically using the HELOC to pay down high-interest debts and funneling income into this account, individuals reduce interest costs and increase the velocity of money movement. This method contrasts with traditional cash flow management by prioritizing rapid debt elimination and maximizing available capital for investment or expenses.

Key Differences: Cash Flow vs Velocity Banking

Cash flow management centers on tracking income and expenses to maintain a positive balance, ensuring financial stability and timely bill payments. Velocity banking leverages strategic use of lines of credit to accelerate debt payoff and maximize interest savings, increasing overall liquidity. Key differences include cash flow's emphasis on budgeting and saving versus velocity banking's focus on debt reduction speed and optimized credit usage.

Advantages of Cash Flow Management

Cash flow management ensures consistent tracking of income and expenses, enabling better financial stability and liquidity. It allows businesses to identify cash shortages early, avoid debt, and optimize working capital. Compared to velocity banking, cash flow management provides clearer visibility into actual financial health, facilitating informed decision-making and risk reduction.

Pros and Cons of Velocity Banking

Velocity Banking leverages a home equity line of credit (HELOC) to accelerate debt repayment and improve cash flow management by reducing interest costs and shortening loan terms. Pros include faster debt elimination and increased financial flexibility, but cons involve risks like fluctuating interest rates on HELOCs and the need for disciplined budgeting to avoid accumulating new debt. Unlike traditional cash flow management, Velocity Banking requires careful monitoring of income and expenses to prevent cash shortages and ensure sustainable financial health.

Building Wealth: Which Method Works Best?

Cash flow management emphasizes consistent tracking of income and expenses to ensure liquidity and financial stability, while velocity banking accelerates debt repayment using strategic credit lines to minimize interest. Building wealth more effectively depends on integrating cash flow discipline with velocity banking tactics, maximizing debt reduction and surplus fund allocation to investments. Individuals leveraging velocity banking to free up cash flow tend to experience faster wealth accumulation compared to traditional cash flow management alone.

Common Mistakes in Cash Flow and Velocity Banking

Common mistakes in cash flow management include underestimating expenses, neglecting irregular payments, and failing to maintain accurate records, which can lead to cash shortages. In velocity banking, errors often arise from miscalculating the optimal use of a home equity line of credit (HELOC), overleveraging debt, and not accounting for interest rate fluctuations. Both methods require disciplined tracking and realistic budgeting to avoid financial pitfalls and maximize money management efficiency.

Impact on Debt Reduction and Financial Freedom

Cash flow management provides a steady overview of income and expenses, enabling disciplined debt repayment that steadily decreases outstanding balances over time. Velocity banking leverages cash flow by strategically using lines of credit to accelerate principal payments, significantly reducing interest costs and shortening debt timelines. Optimizing cash flow alongside velocity banking techniques enhances financial freedom by enabling faster debt elimination and improved capital allocation.

Tools and Techniques for Effective Money Management

Cash flow management relies on tracking income and expenses to maintain positive liquidity, using tools like budgeting software and cash flow statements for accurate forecasting. Velocity banking focuses on leveraging home equity lines of credit (HELOC) and debt acceleration strategies to minimize interest payments and accelerate loan payoff. Combining these techniques with financial dashboards and real-time analytics enhances decision-making and optimizes overall money management efficiency.

Choosing the Right Strategy for Your Financial Goals

Cash flow management ensures consistent tracking of income and expenses to maintain liquidity, while Velocity Banking leverages strategic debt repayment to accelerate wealth building. Analyzing personal financial goals, risk tolerance, and cash availability is crucial in selecting between steady cash flow control or the more aggressive Velocity Banking approach. Prioritizing a strategy aligned with your financial timeline and flexibility enhances money management efficiency and long-term financial health.

Related Important Terms

Cash Flow Index

The Cash Flow Index (CFI) quantifies the efficiency of cash inflows relative to outflows, serving as a critical metric in traditional cash flow analysis. Unlike Velocity Banking, which emphasizes rapid debt repayment through strategic use of revolving credit, the CFI provides a steady measure of liquidity health and financial stability over time.

Velocity Banking Strategy

Velocity Banking strategy accelerates debt repayment and improves cash flow by utilizing a home equity line of credit (HELOC) to offset expenses and reduce interest costs. This method prioritizes leveraging cash flow to minimize loan balances faster compared to traditional cash flow management techniques.

HELOC Looping

Cash flow management emphasizes steady income and expense tracking to ensure liquidity, while Velocity Banking leverages a Home Equity Line of Credit (HELOC) looping strategy to accelerate debt repayment and optimize cash utilization. HELOC looping involves cycling funds between checking and HELOC accounts, reducing interest costs and improving overall financial flexibility compared to traditional cash flow methods.

Debt Acceleration Ratio

Debt Acceleration Ratio in cash flow management measures how quickly surplus cash can reduce outstanding debt compared to traditional velocity banking, which leverages high cash flow velocity to optimize loan repayment schedules. Cash flow methods emphasize steady debt reduction through consistent surplus allocation, whereas velocity banking accelerates debt payoff by strategically cycling cash flow to minimize interest and principal faster.

Infinite Banking Concept

Cash flow management focuses on tracking and optimizing the inflow and outflow of money to maintain liquidity, while Velocity Banking leverages strategic debt and cash flow to accelerate debt repayment and improve financial efficiency. The Infinite Banking Concept integrates cash flow control with using whole life insurance policies as a personal banking system, enabling continuous access to capital for investment and debt management, enhancing financial growth and stability.

Flow-through Structuring

Cash flow management emphasizes consistent inflows and outflows to maintain liquidity, while velocity banking leverages rapid debt repayment through strategic cash flow cycling to maximize interest savings. Flow-through structuring enhances velocity banking by redirecting surplus cash directly toward high-interest liabilities, accelerating debt reduction and improving overall financial efficiency.

Velocity Float

Velocity banking leverages the concept of Velocity Float to optimize cash flow by using a line of credit to manage income and expenses more efficiently, reducing interest costs and accelerating debt repayment. This strategy contrasts traditional cash flow management by focusing on maximizing the time cash remains available within the banking system, enhancing liquidity and financial flexibility.

Paycheck Waterfall

Paycheck Waterfall strategically allocates cash flow by prioritizing essential expenses, debt payments, and savings in a predetermined sequence, enhancing financial discipline and liquidity management. Velocity banking leverages this approach by using a line of credit to accelerate debt payoff, reduce interest costs, and optimize cash flow velocity for faster financial freedom.

Cash Recycling

Cash flow management ensures steady liquidity by tracking income and expenses, while cash recycling in velocity banking optimizes the use of available funds by continuously redirecting repayments to reduce loan principal faster. This strategy improves financial flexibility and accelerates debt elimination, maximizing cash efficiency in personal money management.

Dynamic Amortization

Dynamic amortization in cash flow management allows flexible debt repayment schedules that adjust to income variability, optimizing interest savings and accelerating loan payoff. Velocity banking leverages this by using cash flow surplus to strategically reduce principal balances, enhancing overall financial efficiency and liquidity.

Cash flow vs Velocity banking for money management. Infographic

moneydiff.com

moneydiff.com