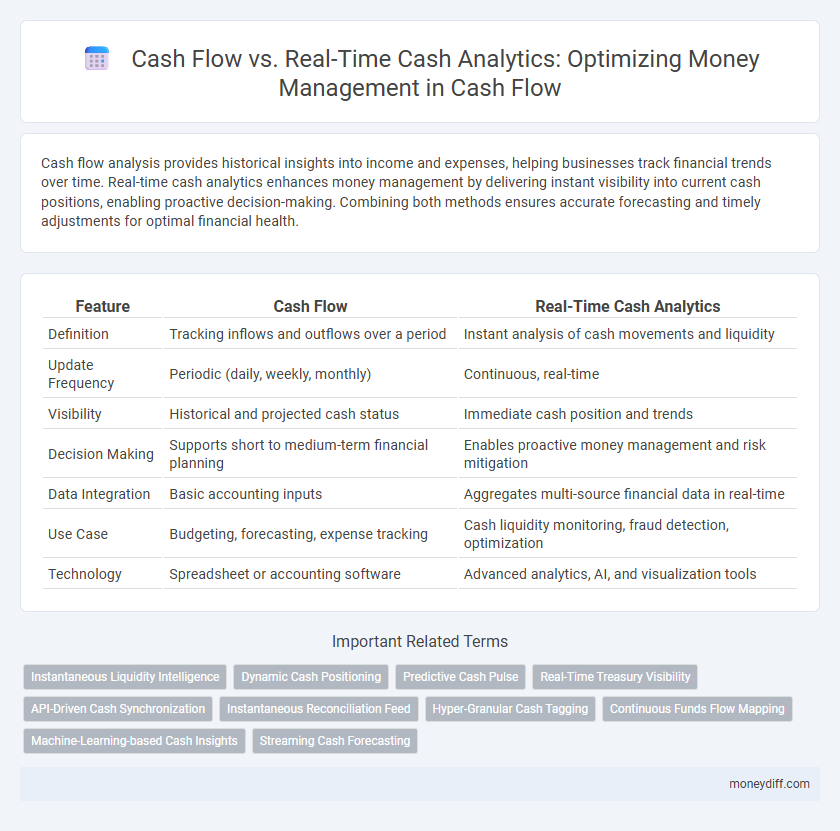

Cash flow analysis provides historical insights into income and expenses, helping businesses track financial trends over time. Real-time cash analytics enhances money management by delivering instant visibility into current cash positions, enabling proactive decision-making. Combining both methods ensures accurate forecasting and timely adjustments for optimal financial health.

Table of Comparison

| Feature | Cash Flow | Real-Time Cash Analytics |

|---|---|---|

| Definition | Tracking inflows and outflows over a period | Instant analysis of cash movements and liquidity |

| Update Frequency | Periodic (daily, weekly, monthly) | Continuous, real-time |

| Visibility | Historical and projected cash status | Immediate cash position and trends |

| Decision Making | Supports short to medium-term financial planning | Enables proactive money management and risk mitigation |

| Data Integration | Basic accounting inputs | Aggregates multi-source financial data in real-time |

| Use Case | Budgeting, forecasting, expense tracking | Cash liquidity monitoring, fraud detection, optimization |

| Technology | Spreadsheet or accounting software | Advanced analytics, AI, and visualization tools |

Understanding Cash Flow: Basics and Importance

Cash flow represents the movement of money into and out of a business, reflecting its liquidity and ability to meet financial obligations. Real-time cash analytics enhances money management by providing immediate insights into cash positions, enabling proactive decision-making and accurate forecasting. Understanding cash flow basics is crucial for maintaining operational stability and optimizing financial performance.

What is Real-Time Cash Analytics?

Real-time cash analytics provides instantaneous insights into cash inflows and outflows, enabling dynamic financial decision-making and accurate forecasting. Unlike traditional cash flow analysis, which relies on periodic data updates, real-time analytics integrates live transactional data for up-to-the-minute visibility. This approach enhances cash management by identifying liquidity trends, optimizing working capital, and mitigating risks associated with cash shortages or surpluses.

Key Differences Between Cash Flow and Real-Time Cash Analytics

Cash flow measures the historical movement of money in and out of a business over a specific period, providing a snapshot of liquidity and financial health. Real-time cash analytics, on the other hand, continuously monitors cash positions using live data streams, enabling immediate insights and proactive money management. Key differences include the timing of data--with cash flow reflecting past performance and real-time analytics offering up-to-the-minute visibility--and the ability of real-time tools to support dynamic decision-making through predictive modeling and scenario analysis.

Benefits of Traditional Cash Flow Management

Traditional cash flow management provides a clear and structured overview of cash inflows and outflows, enabling businesses to plan budgets and forecast financial needs effectively. It relies on historical data, helping to identify spending patterns and optimize resource allocation for long-term stability. This method reduces reliance on real-time technology, offering simplicity and reliability in strategic financial decision-making.

Advantages of Real-Time Cash Analytics in Money Management

Real-time cash analytics provides immediate visibility into a company's cash position, enabling faster and more accurate financial decision-making. This dynamic insight helps identify cash flow trends, optimize liquidity, and detect potential shortfalls before they impact operations. By leveraging real-time data, businesses enhance cash forecasting precision and improve overall money management efficiency.

Limitations of Manual Cash Flow Tracking

Manual cash flow tracking often leads to delayed insights and increased risk of errors, hindering effective money management. In contrast, real-time cash analytics provide continuous data updates and predictive insights, enabling proactive decision-making. Relying solely on manual methods limits visibility into immediate liquidity, which can result in missed opportunities and financial missteps.

How Real-Time Analytics Enhance Cash Forecasting

Real-time cash analytics provide up-to-the-minute data that significantly improve the accuracy of cash forecasting by capturing dynamic inflows and outflows as they occur. This immediate visibility enables businesses to identify potential liquidity shortages or surpluses in advance, allowing for proactive decision-making and optimized working capital management. Enhanced forecasting accuracy reduces risks associated with delayed payments, unexpected expenses, and market volatility, ultimately strengthening overall financial health.

Integrating Real-Time Analytics with Existing Cash Flow Processes

Integrating real-time cash analytics with existing cash flow processes enhances accuracy by providing up-to-the-minute financial data, enabling businesses to make informed money management decisions. Real-time analytics platforms utilize automated data feeds and AI-driven insights to detect cash flow trends and anomalies quickly, improving forecasting and liquidity management. This seamless integration supports proactive financial planning, minimizes cash shortages, and optimizes working capital utilization.

Choosing the Right Cash Management Approach

Choosing the right cash management approach involves understanding the distinct advantages of cash flow analysis and real-time cash analytics. Cash flow analysis provides a historical overview of inflows and outflows, essential for budgeting and forecasting, while real-time cash analytics delivers instant insights into current liquidity status, enabling rapid decision-making. Integrating both methods optimizes money management by enhancing accuracy, responsiveness, and strategic financial planning.

The Future of Money Management: Real-Time Cash Flow Insights

Real-time cash flow insights revolutionize money management by providing instantaneous visibility into cash positions, enabling more accurate forecasting and proactive decision-making. Unlike traditional cash flow analysis that relies on historical data, real-time analytics leverage continuous data streams and AI-driven algorithms to detect trends and anomalies as they happen. This shift empowers businesses to optimize liquidity, reduce financial risks, and seize growth opportunities with unprecedented agility.

Related Important Terms

Instantaneous Liquidity Intelligence

Cash flow tracking provides historical insights into money movement, while real-time cash analytics delivers Instantaneous Liquidity Intelligence, enabling businesses to monitor available funds instantly and make informed money management decisions. This advanced visibility into cash positions optimizes liquidity planning, reduces overdraft risks, and improves strategic financial agility.

Dynamic Cash Positioning

Dynamic Cash Positioning leverages real-time cash analytics to provide an up-to-the-minute view of liquidity, enabling proactive management of funds and improved decision-making. Unlike traditional cash flow methods that rely on historical data, this approach optimizes working capital by continuously adjusting cash allocations based on current and forecasted financial movements.

Predictive Cash Pulse

Predictive Cash Pulse enhances money management by integrating cash flow forecasting with real-time cash analytics, enabling businesses to anticipate liquidity needs and optimize working capital. This solution leverages machine learning algorithms to provide dynamic, data-driven insights, reducing financial risks and improving cash position accuracy.

Real-Time Treasury Visibility

Real-time cash analytics enable treasury teams to achieve instant visibility into cash positions, enhancing decision-making accuracy and liquidity management compared to traditional cash flow methods that rely on delayed data. Leveraging real-time cash insights allows for proactive risk mitigation and optimized capital allocation, driving improved financial agility and operational efficiency.

API-Driven Cash Synchronization

API-driven cash synchronization enables real-time cash analytics by seamlessly integrating transaction data across multiple accounts, providing businesses with accurate and up-to-the-minute cash flow insights. This dynamic approach enhances money management by allowing instant detection of liquidity changes, optimizing financial decision-making and forecasting.

Instantaneous Reconciliation Feed

Instantaneous Reconciliation Feed enhances cash flow management by providing real-time cash analytics, enabling immediate tracking of inflows and outflows with precision. This integration ensures accurate liquidity visibility and faster decision-making, surpassing traditional cash flow methods that rely on delayed or periodic data updates.

Hyper-Granular Cash Tagging

Hyper-granular cash tagging enhances cash flow management by categorizing transactions at an exceptionally detailed level, enabling precise tracking and forecasting of cash movements. Real-time cash analytics harness this detailed tagging to deliver instantaneous insights, improving liquidity decisions and optimizing operational efficiency.

Continuous Funds Flow Mapping

Continuous Funds Flow Mapping enhances cash flow management by providing real-time cash analytics that track the movement of money across accounts and transactions. This approach enables precise forecasting and immediate adjustments, optimizing liquidity and improving decision-making efficiency for better financial control.

Machine-Learning-based Cash Insights

Machine-learning-based cash insights enhance cash flow management by providing real-time analytics that predict cash positions, detect anomalies, and optimize liquidity decisions. Integrating these advanced algorithms enables businesses to move beyond traditional cash flow forecasting, ensuring more accurate, dynamic, and actionable money management strategies.

Streaming Cash Forecasting

Streaming Cash Forecasting leverages real-time cash analytics to provide continuous updates on cash flow positions, enabling more accurate liquidity management and proactive decision-making. Unlike traditional cash flow methods that rely on historical data and periodic reports, streaming forecasts integrate live transactional data to predict cash availability and optimize working capital efficiently.

Cash flow vs Real-time cash analytics for money management. Infographic

moneydiff.com

moneydiff.com