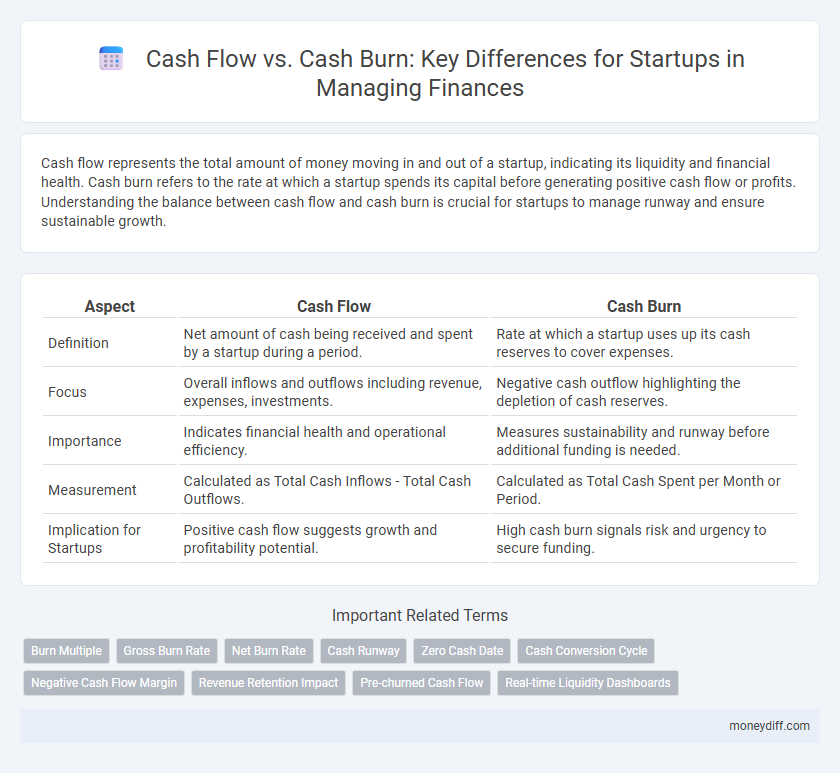

Cash flow represents the total amount of money moving in and out of a startup, indicating its liquidity and financial health. Cash burn refers to the rate at which a startup spends its capital before generating positive cash flow or profits. Understanding the balance between cash flow and cash burn is crucial for startups to manage runway and ensure sustainable growth.

Table of Comparison

| Aspect | Cash Flow | Cash Burn |

|---|---|---|

| Definition | Net amount of cash being received and spent by a startup during a period. | Rate at which a startup uses up its cash reserves to cover expenses. |

| Focus | Overall inflows and outflows including revenue, expenses, investments. | Negative cash outflow highlighting the depletion of cash reserves. |

| Importance | Indicates financial health and operational efficiency. | Measures sustainability and runway before additional funding is needed. |

| Measurement | Calculated as Total Cash Inflows - Total Cash Outflows. | Calculated as Total Cash Spent per Month or Period. |

| Implication for Startups | Positive cash flow suggests growth and profitability potential. | High cash burn signals risk and urgency to secure funding. |

Understanding Cash Flow: The Lifeblood of Startups

Cash flow represents the total amount of money moving in and out of a startup, crucial for maintaining daily operations and funding growth. Cash burn, on the other hand, measures the rate at which a startup spends its capital, indicating how quickly cash reserves are depleted. Understanding the balance between cash flow and cash burn enables startups to optimize capital allocation, avoid insolvency, and extend runway to achieve key milestones.

Defining Cash Burn: A Startup Survival Metric

Cash burn refers to the rate at which a startup spends its available cash to cover operating expenses before generating positive cash flow from revenue. It is a critical survival metric that indicates how long a startup can sustain its operations without additional funding. Monitoring cash burn enables founders to manage runway effectively and make strategic decisions to conserve capital and reach profitability.

Key Differences Between Cash Flow and Cash Burn

Cash flow represents the net amount of cash moving into and out of a startup, reflecting operational efficiency and liquidity status, while cash burn measures the rate at which a startup uses its available cash reserves, often indicating runway length. Positive cash flow signifies that a startup is generating more cash than it spends, whereas cash burn highlights how quickly funding is depleted during growth or pre-revenue phases. Understanding these distinctions helps startups manage financial health, forecast funding needs, and strategize for sustainable growth.

Why Cash Flow Matters More Than Profit

Cash flow represents the actual liquidity available to a startup, ensuring it can meet operational expenses and avoid insolvency, while profit is an accounting measure that may not reflect immediate financial health. Startups often prioritize positive cash flow over profit because consistent cash inflows enable them to sustain growth, pay employees, and invest in crucial development activities. Managing cash flow effectively prevents cash burn, which occurs when outflows exceed inflows, leading to potential shutdown despite showing profitable margins on paper.

Calculating Your Startup’s Cash Burn Rate

Calculating your startup's cash burn rate involves tracking the total cash outflows over a specific period, typically monthly, to understand how quickly your business is spending its capital. Monitoring cash burn rate alongside cash flow provides critical insights into the sustainability of operations and funding needs, ensuring you maintain enough runway to reach profitability. Accurate cash flow analysis combined with burn rate calculation helps startups plan budgets, attract investors, and make strategic decisions to extend financial longevity.

Monitoring Cash Flow vs Cash Burn: Best Practices

Monitoring cash flow and cash burn rates is crucial for startup sustainability and growth. Track daily operational cash inflows and outflows alongside monthly cash burn to anticipate funding needs and optimize resource allocation. Implementing real-time financial dashboards and conducting regular burn rate analysis helps founders maintain liquidity and make informed budgeting decisions.

Impacts of High Cash Burn on Startup Longevity

High cash burn significantly shortens startup longevity by rapidly depleting available financial resources, increasing the risk of insolvency before reaching profitability. Maintaining controlled cash flow is essential to extend runway and support sustainable growth through product development and market expansion. Startups that fail to manage cash burn effectively often face funding challenges and operational constraints, hindering long-term viability.

Strategies to Improve Positive Cash Flow

Startups can improve positive cash flow by closely monitoring cash burn rates and implementing cost control measures such as negotiating better supplier terms and reducing non-essential expenses. Optimizing accounts receivable through faster invoicing and incentivizing early payments enhances cash inflows. Maintaining a cash flow forecast helps anticipate shortfalls and enables proactive financing decisions to sustain operational liquidity.

How Investors Assess Cash Burn and Cash Flow

Investors assess cash burn and cash flow by closely analyzing a startup's runway, measuring how quickly cash reserves are depleted relative to revenue generation. They evaluate cash flow statements to determine sustainability, focusing on net cash inflows from operational activities versus total cash outflows. Key metrics like burn rate, gross margin, and operating expenses inform investors' decisions on funding rounds and growth potential.

Cash Flow and Cash Burn: Building a Sustainable Startup

Cash flow measures the actual inflow and outflow of cash in a startup, reflecting its ability to generate liquidity from operations and investments. Cash burn specifically tracks the rate at which a startup spends its available capital to cover expenses before generating positive cash flow. Monitoring cash flow alongside cash burn is critical for startups to ensure sustainability, manage runway effectively, and strategize timely fundraising or revenue growth.

Related Important Terms

Burn Multiple

Burn Multiple measures the efficiency of a startup's cash burn by comparing net cash outflow to revenue growth, offering a clearer picture of how effectively capital is used to generate growth. A low Burn Multiple indicates sustainable cash flow management, whereas a high value signals rapid cash depletion without proportional revenue increase, raising concerns about long-term viability.

Gross Burn Rate

Gross Burn Rate quantifies the total monthly operating expenses of a startup before revenue, serving as a critical indicator of cash outflow velocity. Monitoring Gross Burn Rate enables founders to manage runway effectively and balance cash flow against growth milestones to avoid premature capital depletion.

Net Burn Rate

Net Burn Rate measures the difference between cash inflows and outflows, indicating how quickly a startup depletes its cash reserves. Understanding Net Burn Rate is crucial for startups to manage cash flow effectively, ensuring sufficient runway to reach profitability or secure additional funding.

Cash Runway

Cash runway measures how long a startup can sustain operations with its current cash flow, directly calculated by dividing available cash by monthly cash burn rate. Monitoring cash flow versus cash burn enables founders to optimize spending and extend the cash runway, critical for securing future funding and achieving profitability.

Zero Cash Date

Zero Cash Date marks the critical point when a startup's cash flow turns negative, indicating that cash burn exceeds cash inflow, signaling the imminent depletion of available funds. Accurate tracking of cash flow and burn rates allows startups to project this date, enabling strategic decisions to secure funding or reduce expenses before liquidity runs out.

Cash Conversion Cycle

Startups often struggle to balance cash flow and cash burn, with the Cash Conversion Cycle (CCC) playing a critical role in optimizing liquidity by measuring the time it takes to convert investments in inventory and other resources into cash receipts from sales. Reducing the CCC accelerates cash inflows, minimizes cash burn rates, and enhances the overall financial stability necessary for sustainable growth.

Negative Cash Flow Margin

Negative cash flow margin indicates a startup is spending more cash than it generates from operations, highlighting a critical stage where cash burn exceeds cash inflow. Monitoring this metric helps startups manage liquidity risks and adjust strategies to extend runway or secure additional funding.

Revenue Retention Impact

Cash flow reflects the net amount of cash being transferred into and out of a startup, while cash burn indicates the rate at which the company spends its available capital. High revenue retention positively impacts cash flow by maintaining consistent income streams, thereby reducing the cash burn rate and extending the runway for startup growth.

Pre-churned Cash Flow

Pre-churned cash flow represents the startup's operational cash flow before accounting for cash burn related to customer churn, offering a clearer picture of core business liquidity. Monitoring pre-churned cash flow helps startups differentiate between cash generated from ongoing operations and cash losses due to customer attrition, enabling more accurate financial planning.

Real-time Liquidity Dashboards

Real-time liquidity dashboards provide startups with instant visibility into cash flow and cash burn rates, enabling precise management of operational expenses and runway duration. These dashboards aggregate financial data to highlight inflows and outflows, ensuring startups maintain optimal liquidity and make informed funding decisions.

Cash flow vs Cash burn for startups. Infographic

moneydiff.com

moneydiff.com