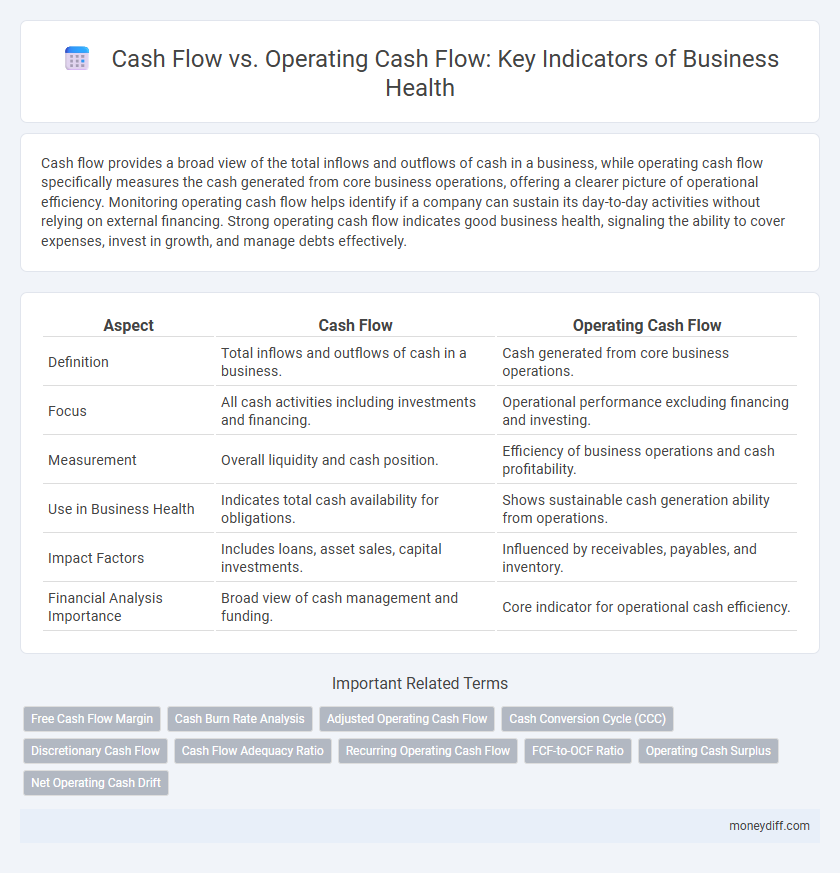

Cash flow provides a broad view of the total inflows and outflows of cash in a business, while operating cash flow specifically measures the cash generated from core business operations, offering a clearer picture of operational efficiency. Monitoring operating cash flow helps identify if a company can sustain its day-to-day activities without relying on external financing. Strong operating cash flow indicates good business health, signaling the ability to cover expenses, invest in growth, and manage debts effectively.

Table of Comparison

| Aspect | Cash Flow | Operating Cash Flow |

|---|---|---|

| Definition | Total inflows and outflows of cash in a business. | Cash generated from core business operations. |

| Focus | All cash activities including investments and financing. | Operational performance excluding financing and investing. |

| Measurement | Overall liquidity and cash position. | Efficiency of business operations and cash profitability. |

| Use in Business Health | Indicates total cash availability for obligations. | Shows sustainable cash generation ability from operations. |

| Impact Factors | Includes loans, asset sales, capital investments. | Influenced by receivables, payables, and inventory. |

| Financial Analysis Importance | Broad view of cash management and funding. | Core indicator for operational cash efficiency. |

Understanding Cash Flow: The Lifeblood of Business

Cash flow represents the total amount of money moving in and out of a business, encompassing operating, investing, and financing activities. Operating cash flow specifically measures cash generated from core business operations, providing a clear indicator of a company's ability to sustain day-to-day activities and generate profit. Analyzing operating cash flow offers deeper insight into business health by highlighting operational efficiency and financial stability, critical for long-term growth and risk management.

What Is Operating Cash Flow? Key Definitions

Operating cash flow (OCF) measures the cash generated from a company's core business operations, excluding financing and investing activities, and reflects its ability to sustain and grow operations. It is calculated by adjusting net income for non-cash items and changes in working capital, providing a clearer picture of liquidity than net income alone. Monitoring operating cash flow helps assess business health by indicating whether the company can cover its short-term obligations and invest in future growth without external financing.

Cash Flow vs Operating Cash Flow: Core Differences

Cash flow represents the total inflow and outflow of cash within a business, encompassing operating, investing, and financing activities. Operating cash flow specifically measures cash generated from core business operations, excluding external factors like investments or financing. Understanding the distinction between overall cash flow and operating cash flow is crucial for assessing a company's liquidity, operational efficiency, and long-term financial health.

Components of Cash Flow in Business Operations

Cash flow encompasses all inflows and outflows of cash within a business, including operating, investing, and financing activities, which together reveal the company's liquidity and financial flexibility. Operating cash flow specifically reflects cash generated from core business operations like revenue collections, payroll, and supplier payments, serving as a critical indicator of operational efficiency and profitability. Analyzing these components separately allows businesses to assess cash generation quality and sustainable financial health, ensuring they meet short-term obligations and support growth.

Why Operating Cash Flow Matters for Financial Health

Operating cash flow reflects the cash generated from a company's core business operations, providing a clear picture of its ability to sustain and grow without relying on external financing. Unlike total cash flow, which includes investing and financing activities, operating cash flow highlights operational efficiency and liquidity, essential for meeting short-term obligations and funding daily activities. Monitoring operating cash flow is crucial for assessing a business's financial health because it indicates true cash-generating capacity and the sustainability of ongoing operations.

Common Misconceptions: Total Cash Flow vs Operating Cash Flow

Total cash flow represents the net change in a company's cash position from all activities, including investing and financing, while operating cash flow specifically measures cash generated by core business operations. Many businesses mistakenly equate strong total cash flow with overall financial health, overlooking that positive operating cash flow is essential for sustaining daily operations and long-term viability. Distinguishing between these cash flow types helps diagnose true business performance and avoid misleading conclusions about liquidity and operational efficiency.

Analyzing Business Performance: Which Metric to Use?

Operating cash flow provides a more precise measure of a company's core business performance by excluding financing and investing activities, unlike total cash flow which includes all cash movements. Analyzing operating cash flow helps identify the sustainability of business operations and the efficiency of cash generation from primary activities. For assessing business health, operating cash flow is a key metric to evaluate profitability and liquidity without distortion from non-operational factors.

Impact of Cash Flow Types on Decision-Making

Cash flow provides a comprehensive overview of all cash movements, while operating cash flow specifically measures cash generated from core business activities, making it a crucial indicator of operational efficiency. Monitoring operating cash flow helps businesses assess sustainable profitability and short-term liquidity, guiding investment and expense decisions. Understanding these cash flow types influences strategic planning, ensuring resources are allocated effectively to maintain financial health and support growth.

Improving Operating Cash Flow: Strategic Approaches

Improving operating cash flow requires strategic management of receivables, payables, and inventory to ensure consistent liquidity for business operations. Implementing efficient billing processes and negotiating favorable payment terms with suppliers directly enhance cash inflows and outflows. Monitoring key performance indicators like days sales outstanding and inventory turnover optimizes working capital, strengthening overall business health.

Monitoring Cash Flow Metrics: Tools and Best Practices

Monitoring cash flow metrics is essential for assessing business health, with tools like cash flow forecasting software and financial dashboards providing real-time insights. Key performance indicators such as operating cash flow ratio and free cash flow ensure accurate evaluation of operational efficiency and liquidity. Implementing best practices like regular tracking, variance analysis, and scenario planning helps businesses maintain stability and make informed financial decisions.

Related Important Terms

Free Cash Flow Margin

Free Cash Flow Margin, calculated by dividing free cash flow by revenue, provides a precise measure of a company's financial health by showing how efficiently operating cash flow covers capital expenditures and generates cash available for growth and debt repayment. While cash flow represents total liquidity, operating cash flow focuses on core business performance, making Free Cash Flow Margin a key indicator to assess sustainability and operational efficiency.

Cash Burn Rate Analysis

Cash flow measures the total inflow and outflow of cash in a business, while operating cash flow specifically tracks cash generated from core business operations, providing a clearer insight into operational efficiency. Analyzing the cash burn rate through operating cash flow helps businesses monitor how quickly they are using available cash, crucial for assessing financial stability and forecasting runway during growth or downturn phases.

Adjusted Operating Cash Flow

Adjusted Operating Cash Flow refines traditional operating cash flow by excluding irregular expenses and one-time gains, providing a clearer picture of a business's sustainable cash-generating ability. This metric is critical for assessing ongoing operational efficiency and long-term financial health, offering investors and management more accurate insights compared to standard cash flow figures.

Cash Conversion Cycle (CCC)

Cash flow provides an overview of all cash inflows and outflows, while operating cash flow specifically measures cash generated from core business operations, crucial for assessing liquidity and operational efficiency. The Cash Conversion Cycle (CCC) directly impacts operating cash flow by indicating the time taken to convert inventory and receivables into cash, thereby influencing business health and financial stability.

Discretionary Cash Flow

Discretionary cash flow represents the cash a business generates after covering operating expenses and necessary capital expenditures, providing insight into financial flexibility beyond operating cash flow alone. Comparing total cash flow to operating cash flow highlights a company's ability to invest in growth opportunities or return value to shareholders without compromising operational stability.

Cash Flow Adequacy Ratio

Cash Flow Adequacy Ratio, calculated by dividing operating cash flow by capital expenditures, measures a business's ability to cover its investments and obligations using internal cash generation, directly reflecting financial health. A higher ratio indicates sufficient operating cash flow to sustain growth and operational needs without external financing, distinguishing overall cash flow from operating cash flow's core role in maintaining liquidity and solvency.

Recurring Operating Cash Flow

Recurring operating cash flow reflects the consistent cash generated from core business operations, providing a reliable indicator of a company's financial health compared to total cash flow, which includes irregular and non-operating sources. Analyzing recurring operating cash flow enables businesses to assess sustainable revenue streams and maintain liquidity for ongoing expenses and growth investments.

FCF-to-OCF Ratio

The Free Cash Flow (FCF)-to-Operating Cash Flow (OCF) ratio is a critical indicator of business health, revealing the proportion of operating cash flow that remains after capital expenditures, which can be used for debt reduction, dividends, or reinvestment. A higher FCF-to-OCF ratio signifies strong financial flexibility, indicating efficient cash management and sustainable growth potential.

Operating Cash Surplus

Operating cash flow reflects the core business's ability to generate cash from its primary activities, serving as a critical indicator of financial health and sustainability. An operating cash surplus demonstrates that a company can cover its operational expenses and invest in growth without relying on external financing, underscoring robust business fundamentals.

Net Operating Cash Drift

Net Operating Cash Drift provides a critical measure of a business's core operational efficiency by isolating cash generated from regular operations, excluding non-operating revenues and expenses that can distort overall cash flow. Analyzing the difference between total Cash Flow and Operating Cash Flow reveals the sustainability of business health, emphasizing the importance of Net Operating Cash Drift in managing liquidity and forecasting financial stability.

Cash flow vs Operating cash flow for business health. Infographic

moneydiff.com

moneydiff.com