Cash flow management focuses on tracking incoming and outgoing funds to maintain a positive balance, while envelope zeroing allocates every dollar to specific spending categories to ensure no money is left unassigned. Cash flow offers flexibility by highlighting available funds for saving or unexpected expenses, whereas envelope zeroing promotes disciplined budgeting by preventing overspending and maximizing control over finances. Choosing between cash flow and envelope zeroing depends on whether you prioritize adaptability or strict categorization in your money management approach.

Table of Comparison

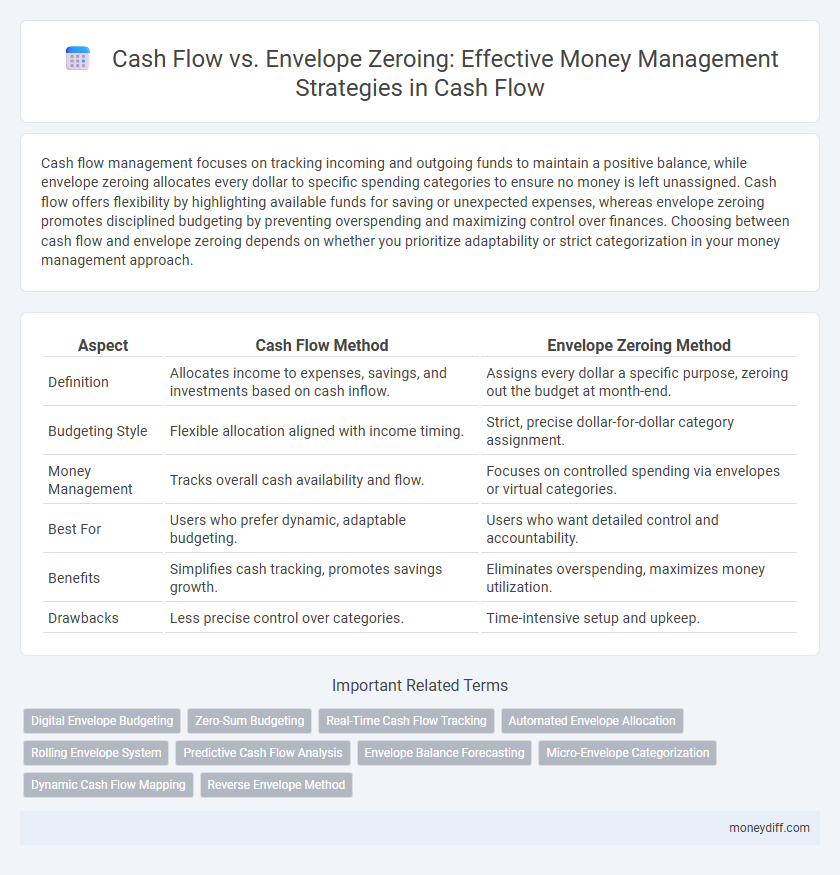

| Aspect | Cash Flow Method | Envelope Zeroing Method |

|---|---|---|

| Definition | Allocates income to expenses, savings, and investments based on cash inflow. | Assigns every dollar a specific purpose, zeroing out the budget at month-end. |

| Budgeting Style | Flexible allocation aligned with income timing. | Strict, precise dollar-for-dollar category assignment. |

| Money Management | Tracks overall cash availability and flow. | Focuses on controlled spending via envelopes or virtual categories. |

| Best For | Users who prefer dynamic, adaptable budgeting. | Users who want detailed control and accountability. |

| Benefits | Simplifies cash tracking, promotes savings growth. | Eliminates overspending, maximizes money utilization. |

| Drawbacks | Less precise control over categories. | Time-intensive setup and upkeep. |

Understanding Cash Flow Management

Cash flow management involves tracking income and expenses to maintain a positive financial balance, ensuring bills are paid and savings goals are met. Envelope zeroing allocates every dollar of income to specific categories, creating a detailed budget that prevents overspending. Understanding cash flow enables better control of finances by highlighting how money moves, while envelope zeroing enforces discipline by pre-assigning funds, both critical for effective money management.

What Is Envelope Zeroing?

Envelope zeroing is a money management technique where every dollar of income is assigned a specific purpose, ensuring that the total amount of money allocated across spending categories equals zero at the end of the budgeting period. This method contrasts with traditional cash flow management by emphasizing intentional allocation to prevent overspending and improve financial discipline. By zeroing out envelopes, individuals gain clear insight into their spending patterns and maintain control over their finances through proactive planning.

Key Differences: Cash Flow vs Envelope Zeroing

Cash flow management emphasizes tracking income and expenses to maintain a positive balance and ensure financial stability, while envelope zeroing allocates every dollar to specific expense categories to prevent overspending and promote disciplined budgeting. Cash flow focuses on the timing and amount of money movement, whereas envelope zeroing enforces strict control by assigning all available funds to predefined envelopes before spending. Both methods aim to optimize financial health, but cash flow offers flexibility, and envelope zeroing provides granular control over expenditures.

Advantages of Cash Flow Management

Cash flow management provides real-time visibility into income and expenses, allowing for better financial decision-making and avoidance of overdrafts. It emphasizes flexibility, enabling adjustments to spending based on actual cash availability rather than rigid budget categories. Tracking cash flow promotes proactive savings and debt repayment, leading to improved financial stability and reduced stress.

Benefits of Envelope Zeroing Method

Envelope Zeroing enhances money management by allocating every dollar a specific purpose, preventing overspending and promoting disciplined budgeting. This method improves cash flow control by ensuring all expenses are accounted for, reducing financial stress and increasing savings potential. Users gain clarity on their financial priorities, leading to more effective spending decisions and long-term financial stability.

Challenges and Limitations of Each Approach

Cash flow management faces challenges in accurately tracking irregular income and unexpected expenses, often leading to cash shortages or overspending. Envelope zeroing requires strict discipline to allocate funds precisely, which can be difficult during fluctuating expenses or emergency costs, limiting flexibility. Both methods struggle with adapting to dynamic financial situations, but cash flow emphasizes ongoing adjustments while envelope zeroing depends on pre-planned budgeting constraints.

How to Choose Between Cash Flow and Envelope Zeroing

Choosing between cash flow and envelope zeroing for money management depends on personal financial goals and spending habits. Cash flow focuses on tracking income and expenses to maintain liquidity, ideal for those needing flexibility. Envelope zeroing allocates every dollar to specific categories, promoting disciplined budgeting and control over spending patterns.

Integrating Both Methods for Better Money Management

Integrating cash flow analysis with envelope zeroing enhances money management by providing both a detailed tracking of income and expenses and a disciplined allocation of funds for specific categories. Cash flow monitoring ensures awareness of financial inflows and outflows, while envelope zeroing enforces spending limits by assigning every dollar a purpose within designated envelopes. Combining these methods promotes financial clarity, prevents overspending, and supports budgeting precision for improved financial health.

Common Mistakes to Avoid with Each Strategy

Common mistakes in cash flow management include neglecting to track all income and expenses accurately, leading to budgeting errors and cash shortages. In envelope zeroing, failing to adjust envelope amounts to reflect changing priorities or unexpected expenses often results in overspending or incomplete zeroing. Both methods require consistent monitoring and flexibility to prevent financial mismanagement and ensure effective money control.

Which Method Is Best for Your Financial Goals?

Cash flow budgeting provides a dynamic approach by tracking actual income and expenses, allowing for flexibility and real-time adjustments to meet financial goals. Envelope zeroing allocates every dollar a specific purpose, promoting disciplined spending and reducing the risk of overspending. Choosing the best method depends on whether you prioritize adaptable financial oversight or strict budget control aligned with your personal money management style.

Related Important Terms

Digital Envelope Budgeting

Digital Envelope Budgeting offers precise cash flow control by allocating funds to specific spending categories, preventing overspending and ensuring monthly expenses align with actual income. Unlike traditional envelope zeroing, this method leverages real-time tracking and automation, enhancing financial discipline and enabling dynamic adjustments based on ongoing cash inflows and outflows.

Zero-Sum Budgeting

Zero-sum budgeting allocates every dollar of income to specific expenses or savings, ensuring total cash flow equals zero by the end of the period, which contrasts with the broader cash flow approach that tracks inflows and outflows without necessarily assigning every dollar a purpose. Envelope zeroing, a practical implementation of zero-sum budgeting, involves physically or digitally dividing income into spending categories, enhancing control and discipline in money management by preventing overspending and promoting mindful financial decisions.

Real-Time Cash Flow Tracking

Real-time cash flow tracking offers immediate visibility into income and expenses, enabling more accurate budgeting compared to the envelope zeroing method that allocates fixed spending limits in advance. This dynamic approach enhances financial agility by continuously updating cash positions, preventing overspending, and optimizing money management decisions.

Automated Envelope Allocation

Automated envelope allocation in cash flow management streamlines budgeting by instantly distributing incoming funds into predefined spending categories, enhancing financial discipline and reducing manual errors. This technique contrasts with envelope zeroing, where funds are manually balanced to zero, by providing real-time adjustments that maintain optimal cash flow and prevent overspending.

Rolling Envelope System

The Rolling Envelope System enhances cash flow management by dynamically reallocating funds across spending categories, ensuring zero-based budgeting aligns with actual income and expenses. This method improves financial flexibility and control by continuously updating envelope balances, preventing overspending and promoting efficient cash utilization.

Predictive Cash Flow Analysis

Predictive cash flow analysis leverages historical income and expense data to forecast future cash availability, enabling more strategic financial planning compared to envelope zeroing, which allocates funds to categories without predicting liquidity trends. By anticipating cash shortfalls or surpluses, predictive methods enhance decision-making accuracy and optimize resource allocation in money management.

Envelope Balance Forecasting

Envelope balance forecasting provides precise projections of each spending category's available funds, allowing for more accurate cash flow management compared to traditional zero-based envelope systems. By anticipating future cash needs and residual balances, this approach enhances budgeting accuracy and reduces the risk of overspending within allocated envelopes.

Micro-Envelope Categorization

Micro-envelope categorization enhances cash flow management by segmenting income into highly specific spending categories, ensuring precise allocation and control over funds. This approach contrasts with envelope zeroing, which balances budgets at broader category levels, allowing micro-envelope systems to optimize cash distribution and prevent overspending on minor expenses.

Dynamic Cash Flow Mapping

Dynamic Cash Flow Mapping offers a more flexible and adaptive approach to money management compared to Envelope Zeroing by continuously adjusting cash allocations based on real-time income and expenses, optimizing liquidity and reducing financial stress. This method enhances financial control by providing a clear visualization of cash movements, enabling proactive decision-making and improved budget accuracy.

Reverse Envelope Method

The Reverse Envelope Method prioritizes allocating cash to specific expense categories in advance, ensuring funds are reserved before spending, while traditional cash flow management monitors income and expenses to maintain balance. Unlike Envelope Zeroing, which aims to spend every dollar to zero out envelopes monthly, the Reverse Envelope Method emphasizes proactive savings and controlled spending to prevent overspending and improve financial discipline.

Cash flow vs Envelope zeroing for money management. Infographic

moneydiff.com

moneydiff.com