Cash flow management in transactional businesses directly influences liquidity and operational stability, while embedded finance flow integrates financial services within the business ecosystem to streamline transactions and enhance customer experience. Cash flow ensures immediate availability of funds for daily expenses, whereas embedded finance flow facilitates seamless payments, credit, and insurance services built into the transaction process. Optimizing both flows can drive growth by improving cash availability and reducing friction in financial transactions.

Table of Comparison

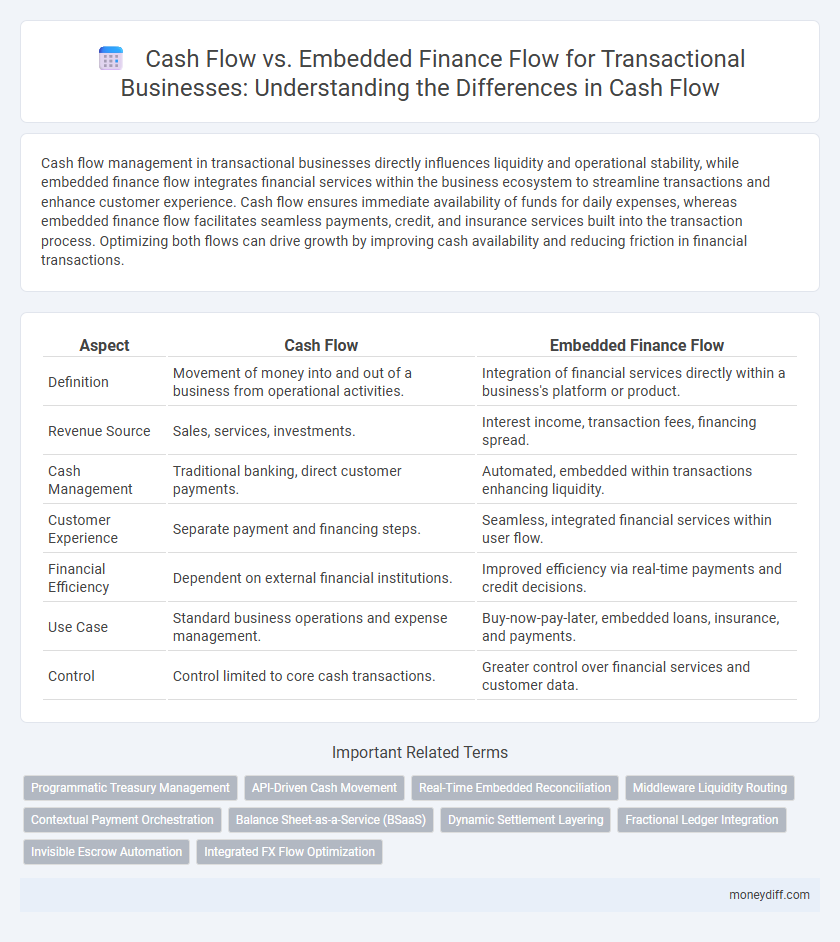

| Aspect | Cash Flow | Embedded Finance Flow |

|---|---|---|

| Definition | Movement of money into and out of a business from operational activities. | Integration of financial services directly within a business's platform or product. |

| Revenue Source | Sales, services, investments. | Interest income, transaction fees, financing spread. |

| Cash Management | Traditional banking, direct customer payments. | Automated, embedded within transactions enhancing liquidity. |

| Customer Experience | Separate payment and financing steps. | Seamless, integrated financial services within user flow. |

| Financial Efficiency | Dependent on external financial institutions. | Improved efficiency via real-time payments and credit decisions. |

| Use Case | Standard business operations and expense management. | Buy-now-pay-later, embedded loans, insurance, and payments. |

| Control | Control limited to core cash transactions. | Greater control over financial services and customer data. |

Understanding Traditional Cash Flow in Transactional Businesses

Traditional cash flow in transactional businesses represents the movement of physical currency and electronic payments through sales, expenses, and operational activities, crucial for maintaining liquidity and ensuring solvency. Unlike embedded finance flows, which integrate financial services directly into non-financial platforms, traditional cash flow relies on discrete transactions and conventional banking channels for settlements and funding. Monitoring cash inflows and outflows helps businesses manage working capital efficiently and forecast financial stability in day-to-day operations.

Defining Embedded Finance Flow and Its Components

Embedded finance flow integrates financial services directly into transactional business platforms, enabling seamless customer payments, lending, insurance, and investment options within the user journey. Key components include API-driven financial product integration, real-time transaction processing, and data analytics for personalized offerings, enhancing cash flow management by streamlining revenue collection and expense disbursement. This model contrasts traditional cash flow by embedding financial functions into the operational framework, driving efficiency and improving capital accessibility.

Key Differences Between Cash Flow and Embedded Finance Flow

Cash flow refers to the movement of actual money in and out of a business, representing liquidity available for operations, investments, and expenses. Embedded finance flow integrates financial services directly within a transactional business platform, enabling seamless payments, lending, or insurance without redirecting customers to third-party providers. Key differences include cash flow's focus on tangible funds management and liquidity, while embedded finance flow emphasizes embedded financial product delivery that enhances customer experience and drives new revenue streams.

Impact on Transaction Speed and Efficiency

Cash flow directly influences transactional business operations by ensuring timely liquidity for seamless payments and revenue cycles, which enhances transaction speed and operational efficiency. Embedded finance flow integrates financial services within non-financial platforms, streamlining payment processes and reducing friction points, leading to faster transaction settlements and optimized workflow efficiency. The synergy between cash flow management and embedded finance solutions significantly accelerates transaction speeds while maximizing overall business efficiency.

Integration with Digital Payment Solutions

Cash flow management in transactional businesses benefits significantly from integrating embedded finance flows with digital payment solutions, streamlining real-time transaction processing and enhancing liquidity visibility. Embedded finance enables seamless payment experiences by embedding financial services directly into the business's platform, reducing friction and accelerating cash inflows. Digital payment integrations, such as APIs for instant settlements and automated reconciliation, optimize operational efficiency and improve working capital management.

Cash Visibility: Traditional Methods vs. Embedded Finance

Traditional cash flow management relies heavily on manual reconciliation and periodic reporting, resulting in delayed cash visibility for transactional businesses. Embedded finance integrates real-time payment processing and automated tracking, enhancing instantaneous cash flow transparency and operational efficiency. This shift enables businesses to make quicker financial decisions and optimize working capital with up-to-date cash position insights.

Cost Implications of Managing Each Flow

Managing cash flow in transactional businesses often incurs higher costs due to traditional banking fees, reconciliation complexities, and delayed settlements. Embedded finance flow reduces these costs by integrating financial services directly within business platforms, streamlining transactions and improving liquidity management. This integration minimizes third-party fees and operational overhead, resulting in enhanced cost efficiency and faster cash conversion cycles.

Data Insights and Reporting Capabilities

Cash flow management in transactional businesses benefits from embedded finance flow through enhanced real-time data insights and comprehensive reporting capabilities that improve financial visibility and operational efficiency. Embedded finance platforms integrate transactional data directly, enabling more accurate cash flow forecasting and granular analysis compared to traditional cash flow tracking methods. Leveraging these advanced reporting tools facilitates faster decision-making and better liquidity management by providing detailed transaction-level data and predictive analytics.

Risk Management in Cash Flow vs. Embedded Finance Flow

Risk management in cash flow centers on liquidity monitoring and forecasting to ensure operational solvency and avoid defaults, with emphasis on managing working capital cycles and credit risk. Embedded finance flow introduces dynamic risk assessment through integrated payment and lending services, leveraging real-time data analytics and AI for fraud detection and adaptive credit limits. Companies adopting embedded finance benefit from enhanced risk mitigation by combining transactional data insights with automated compliance controls.

Choosing the Right Flow for Your Transactional Business

Cash flow management ensures a steady stream of liquidity to cover operational expenses and invest in growth opportunities. Embedded finance flow integrates financial services directly within a transactional business platform, enhancing customer experience through seamless payments and lending options. Choosing between traditional cash flow and embedded finance flow depends on the business model, with embedded finance benefiting companies seeking frictionless transactions and personalized financial products for customers.

Related Important Terms

Programmatic Treasury Management

Programmatic Treasury Management enhances cash flow control by automating embedded finance flows within transactional businesses, enabling real-time liquidity optimization and reduced operational risks. Unlike traditional cash flow models, it integrates payment processing, lending, and reconciliation into a unified platform, driving seamless financial transparency and efficiency.

API-Driven Cash Movement

API-driven cash movement enables seamless integration of cash flow management with embedded finance flows, optimizing transactional business operations by automating payment processing and real-time fund transfers. This approach enhances liquidity visibility, reduces settlement times, and supports scalable financial workflows essential for dynamic cash flow management in digital ecosystems.

Real-Time Embedded Reconciliation

Real-time embedded reconciliation enhances cash flow management by instantaneously matching transactions within embedded finance platforms, reducing delays and errors common in traditional cash flow processes. This seamless integration accelerates liquidity visibility and optimizes working capital for transactional businesses relying on continuous, accurate financial data.

Middleware Liquidity Routing

Middleware liquidity routing optimizes cash flow by seamlessly directing funds through embedded finance platforms, ensuring real-time transactional business settlements and reducing liquidity gaps. Enhanced routing algorithms facilitate efficient cash movement, bridging traditional cash flow management with embedded finance ecosystems to maximize liquidity availability and operational efficiency.

Contextual Payment Orchestration

Cash flow in transactional business relies heavily on optimizing payment streams through Contextual Payment Orchestration, which integrates embedded finance flows to streamline fund movements and reduce friction. Embedded finance flow enhances real-time liquidity management by embedding financial services directly into business platforms, improving cash flow predictability and operational efficiency.

Balance Sheet-as-a-Service (BSaaS)

Cash flow in transactional businesses directly impacts liquidity management, while Embedded Finance flow enhances transactional efficiency through integrated financial services like Balance Sheet-as-a-Service (BSaaS), enabling real-time balance optimization and automated reconciliation within the balance sheet. BSaaS streamlines cash flow visibility and control by embedding financial infrastructure, reducing reliance on traditional banking and improving operational cash conversion cycles.

Dynamic Settlement Layering

Dynamic Settlement Layering enhances cash flow management in transactional businesses by enabling real-time reconciliation and instant settlements, reducing liquidity constraints. Embedded finance flows integrate financial services directly into platforms, optimizing transaction efficiency but rely heavily on dynamic layering to ensure seamless cash movement and minimize settlement delays.

Fractional Ledger Integration

Fractional Ledger Integration enhances cash flow management by combining real-time transactional data with embedded finance flows, enabling precise tracking and allocation of funds across multiple ledger segments. This integration supports seamless reconciliation and optimizes liquidity for transactional businesses by bridging traditional cash flow processes with embedded financial services.

Invisible Escrow Automation

Invisible Escrow Automation enhances cash flow management by seamlessly integrating transaction guarantees within embedded finance flows, reducing settlement delays and increasing liquidity efficiency for businesses. This approach minimizes risk exposure while automating fund release processes, optimizing operational cash flow without interrupting customer experience.

Integrated FX Flow Optimization

Integrated FX flow optimization enhances cash flow management by streamlining currency conversions within embedded finance systems, reducing transaction costs and minimizing currency risk exposure for transactional businesses. This approach enables real-time liquidity allocation and automated FX hedging, driving operational efficiency and improved financial visibility compared to traditional cash flow methods.

Cash flow vs Embedded finance flow for transactional business. Infographic

moneydiff.com

moneydiff.com