Traditional banking relies on standardized services and often involves multiple steps and intermediaries for money management, leading to slower transaction times and limited customization. Embedded finance integrates financial services directly into non-financial platforms, offering seamless, real-time cash flow management tailored to user needs. This approach enhances efficiency, improves user experience, and provides more agile solutions for managing pet-related expenses.

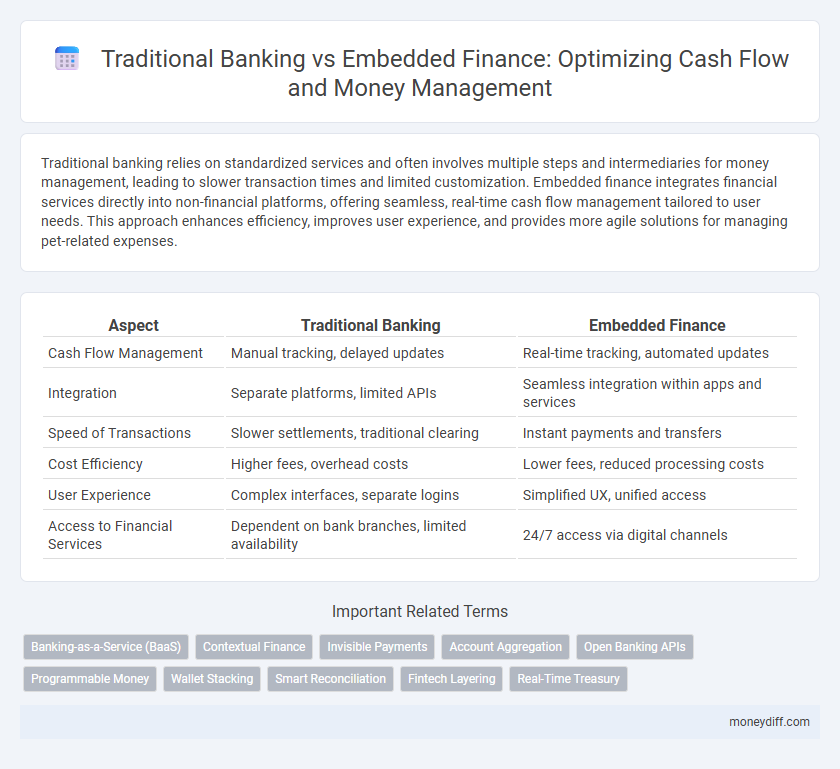

Table of Comparison

| Aspect | Traditional Banking | Embedded Finance |

|---|---|---|

| Cash Flow Management | Manual tracking, delayed updates | Real-time tracking, automated updates |

| Integration | Separate platforms, limited APIs | Seamless integration within apps and services |

| Speed of Transactions | Slower settlements, traditional clearing | Instant payments and transfers |

| Cost Efficiency | Higher fees, overhead costs | Lower fees, reduced processing costs |

| User Experience | Complex interfaces, separate logins | Simplified UX, unified access |

| Access to Financial Services | Dependent on bank branches, limited availability | 24/7 access via digital channels |

Overview of Traditional Banking and Embedded Finance

Traditional banking operates through established financial institutions offering services like savings, loans, and payment processing via physical branches and digital platforms, often with fixed fees and slower transaction times. Embedded finance integrates financial services directly into non-financial apps or platforms, enabling seamless money management, instant payments, and personalized credit options within user experiences. This shift enhances cash flow efficiency by reducing friction and increasing accessibility compared to conventional banking models.

Key Differences in Money Management Approaches

Traditional banking relies on centralized institutions offering standardized money management services such as savings accounts, loans, and payment processing with fixed schedules and fees. Embedded finance integrates financial services directly into non-financial platforms, providing seamless, real-time cash flow management tailored to user behaviors and immediate transactional needs. Key differences include accessibility, customization, and the speed of fund allocation, with embedded finance enabling more agile and data-driven money management solutions.

Accessibility: Bank Branches vs Digital Platforms

Traditional banking relies heavily on physical bank branches, limiting accessibility for customers without convenient locations nearby or restrictive hours. Embedded finance leverages digital platforms, enabling seamless, real-time money management accessible anywhere via smartphones or the internet. This shift increases financial inclusion by providing instantaneous access to services without the need for in-person visits or extensive paperwork.

Speed and Convenience of Cash Flow Management

Traditional banking often involves slower transaction processing times and limited access to real-time cash flow insights, which can hinder efficient money management. Embedded finance integrates financial services directly into business platforms, enabling instant payments and seamless cash flow tracking that enhance operational speed. This integration significantly improves cash flow management by providing users with convenient, on-demand access to funds and financial tools.

Integration with Business Tools and Services

Embedded finance offers seamless integration with business tools and services, enabling real-time cash flow tracking, automated invoicing, and payment processing within a single platform. Traditional banking often requires manual reconciliation and separate applications, leading to fragmented financial management. Embedded solutions streamline workflow by connecting cash flow management directly with accounting, CRM, and ERP systems for enhanced operational efficiency.

Costs and Fees: Comparing Financial Solutions

Traditional banking often involves higher costs and fees, including monthly maintenance charges, transaction fees, and ATM usage costs, which can cumulatively impact cash flow management. Embedded finance platforms typically offer reduced or transparent fee structures by integrating financial services directly into non-financial apps, minimizing intermediary expenses. This cost efficiency enables users to optimize cash flow with lower overhead, making embedded finance a compelling alternative for money management.

Security and Regulatory Considerations

Traditional banking offers robust security frameworks governed by established regulations such as the Dodd-Frank Act and Basel III, ensuring stringent oversight and consumer protection. Embedded finance solutions integrate financial services within non-financial platforms, necessitating compliance with multiple regulatory bodies like the CFPB and GDPR, which can complicate security protocols. Ensuring data encryption, biometric authentication, and real-time fraud detection remains critical in both models to safeguard cash flow integrity and foster consumer trust.

Real-Time Data and Analytics Capabilities

Traditional banking systems often lack real-time cash flow visibility due to batch processing and delayed transaction updates, hindering effective money management. Embedded finance integrates seamlessly with digital platforms, providing businesses with instant access to real-time financial data and advanced analytics for proactive cash flow optimization. Enhanced data granularity and predictive insights enable more accurate forecasting and immediate decision-making, driving improved liquidity management.

User Experience: Customization and Flexibility

Traditional banking offers standardized money management tools with limited customization, often requiring users to navigate multiple platforms for different financial services. Embedded finance integrates financial services directly into non-financial apps, providing seamless, personalized experiences that adapt to individual spending habits and cash flow patterns. This flexibility enhances user control, enabling real-time budgeting, automated savings, and tailored financial insights within familiar environments.

Future Trends in Cash Flow Management Solutions

Embedded finance is reshaping cash flow management by integrating financial services directly into non-banking platforms, enabling real-time payments and automated liquidity optimization. Traditional banking models, reliant on delayed settlement processes and separate financial tools, are increasingly supplemented or bypassed by seamless, API-driven cash flow solutions that enhance operational efficiency. Future trends indicate a rise in AI-powered cash forecasting and personalized financial insights within embedded systems, driving smarter money management and dynamic working capital allocation.

Related Important Terms

Banking-as-a-Service (BaaS)

Traditional banking relies on standalone institutions with slower cash flow cycles, while embedded finance leverages Banking-as-a-Service (BaaS) platforms to integrate seamless, real-time money management within non-bank applications. BaaS accelerates cash flow efficiency by enabling businesses to offer tailored financial services, such as payments, lending, and account management, directly through their digital ecosystems.

Contextual Finance

Traditional banking relies on fixed service models with limited integration capabilities, resulting in slower cash flow management and reduced real-time insights. Embedded finance seamlessly integrates contextual financial services directly into non-financial platforms, optimizing cash flow by enabling instant payments, automated accounting, and tailored credit solutions aligned with users' transactional behaviors.

Invisible Payments

Invisible payments in embedded finance streamline cash flow management by integrating transactions directly into digital platforms, reducing the need for manual intervention and enhancing real-time liquidity tracking. Traditional banking relies on visible, separate payment processes that can slow down cash flow visibility and delay financial decision-making.

Account Aggregation

Account aggregation in embedded finance offers real-time consolidation of multiple financial accounts within a single interface, enhancing cash flow visibility compared to traditional banking's segmented account views. This seamless integration empowers businesses and individuals to optimize money management by providing comprehensive cash flow insights and faster transaction processing.

Open Banking APIs

Traditional banking relies on legacy systems with limited access to real-time cash flow data, whereas embedded finance leverages Open Banking APIs to enable seamless, instant money management and personalized financial services. Open Banking APIs facilitate secure data sharing across platforms, enhancing cash flow monitoring and optimizing liquidity management for businesses and consumers alike.

Programmable Money

Programmable money in embedded finance enables seamless automation of cash flow management through smart contracts and real-time API integration, outperforming traditional banking's delayed transaction processing and rigid structures. This innovation facilitates dynamic allocation, conditional payments, and instant settlement, revolutionizing how businesses control liquidity and optimize financial operations.

Wallet Stacking

Traditional banking often limits cash flow visibility and control through separate accounts, whereas embedded finance enables seamless wallet stacking by integrating multiple financial services within a single platform, optimizing real-time money management. Wallet stacking enhances liquidity management, reduces transaction friction, and improves financial decision-making by consolidating funds from various sources into unified digital wallets.

Smart Reconciliation

Smart reconciliation in embedded finance leverages APIs to automate cash flow matching instantly, reducing manual errors and improving real-time money management compared to traditional banking's slower, batch reconciliation processes. This seamless integration enhances financial accuracy and accelerates liquidity insights, enabling businesses to optimize working capital efficiently.

Fintech Layering

Traditional banking relies on legacy systems with slower transaction processing and limited integration capabilities, often leading to delayed cash flow visibility and constrained money management options. Embedded finance, powered by fintech layering, integrates seamless API-driven financial services directly into non-financial platforms, enhancing real-time cash flow monitoring, automated expense management, and personalized liquidity solutions for businesses.

Real-Time Treasury

Traditional banking processes often involve delayed transaction settlements and limited visibility, hindering effective cash flow and real-time treasury management. Embedded finance integrates seamless, real-time payment and liquidity solutions directly within business platforms, enabling instant cash flow monitoring and optimized treasury operations.

Traditional banking vs embedded finance for money management. Infographic

moneydiff.com

moneydiff.com