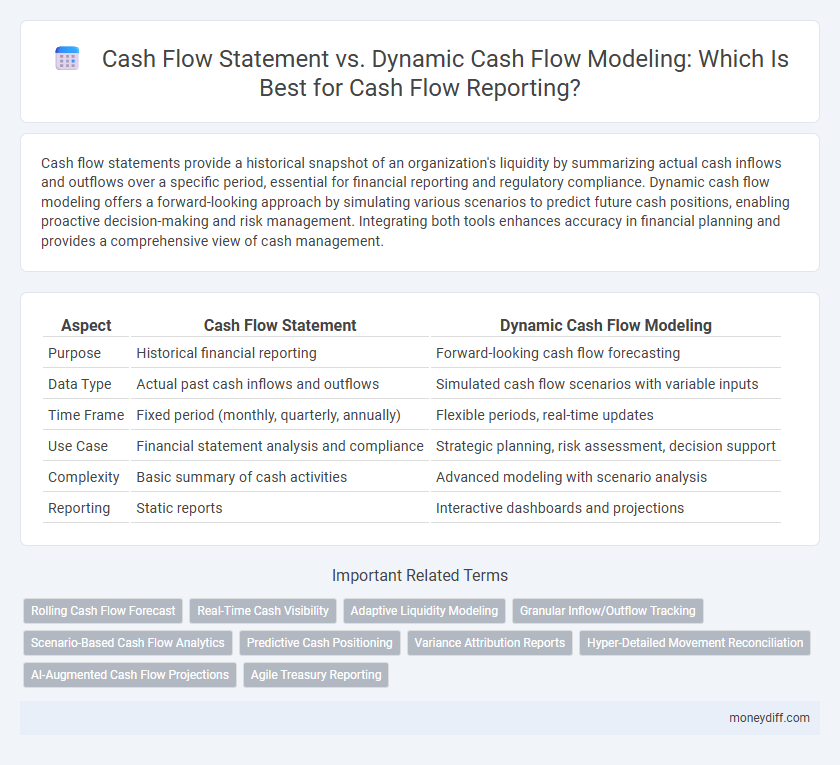

Cash flow statements provide a historical snapshot of an organization's liquidity by summarizing actual cash inflows and outflows over a specific period, essential for financial reporting and regulatory compliance. Dynamic cash flow modeling offers a forward-looking approach by simulating various scenarios to predict future cash positions, enabling proactive decision-making and risk management. Integrating both tools enhances accuracy in financial planning and provides a comprehensive view of cash management.

Table of Comparison

| Aspect | Cash Flow Statement | Dynamic Cash Flow Modeling |

|---|---|---|

| Purpose | Historical financial reporting | Forward-looking cash flow forecasting |

| Data Type | Actual past cash inflows and outflows | Simulated cash flow scenarios with variable inputs |

| Time Frame | Fixed period (monthly, quarterly, annually) | Flexible periods, real-time updates |

| Use Case | Financial statement analysis and compliance | Strategic planning, risk assessment, decision support |

| Complexity | Basic summary of cash activities | Advanced modeling with scenario analysis |

| Reporting | Static reports | Interactive dashboards and projections |

Understanding Cash Flow Statement Fundamentals

The cash flow statement provides a historical summary of cash inflows and outflows over a specific period, highlighting operational, investing, and financing activities. Dynamic cash flow modeling enhances this by projecting future cash positions using real-time data and scenario analysis, enabling proactive financial management. Understanding the fundamentals of cash flow statements is essential for accurate baseline reporting and effective use of dynamic models in forecasting and decision-making.

What Is Dynamic Cash Flow Modeling?

Dynamic cash flow modeling is an advanced financial forecasting technique that uses real-time data and scenario analysis to provide a detailed projection of cash inflows and outflows over time. Unlike the static cash flow statement, which presents historical or periodic cash movements, dynamic models continuously update with changing variables, enabling more accurate liquidity management and strategic decision-making. This approach integrates factors such as market fluctuations, payment delays, and operational changes to optimize cash flow visibility and planning.

Key Differences Between Cash Flow Statement and Dynamic Modeling

The cash flow statement provides a historical summary of cash inflows and outflows over a specific period, offering a snapshot of past liquidity. In contrast, dynamic cash flow modeling uses real-time data and predictive analytics to forecast future cash positions and manage operating cash more proactively. Key differences include static versus forward-looking perspectives, the use of historical data versus scenario analysis, and the level of detail provided for decision-making and strategic planning.

Strengths and Limitations of Traditional Cash Flow Statements

Traditional cash flow statements provide a clear, standardized summary of historical cash inflows and outflows, enabling straightforward financial reporting and regulatory compliance. Their strength lies in simplicity and ease of interpretation, but they are limited by static data that exclude future projections and scenario analysis. This restricts their ability to support dynamic decision-making and proactive cash management in rapidly changing business environments.

Advantages of Dynamic Cash Flow Modeling in Reporting

Dynamic cash flow modeling enhances reporting accuracy by providing real-time data updates and predictive analytics, enabling proactive financial management. It allows organizations to simulate various business scenarios, improving forecasting reliability and strategic decision-making. This approach surpasses traditional cash flow statements by integrating complex variables and trends, delivering a comprehensive view of future cash positions.

Use Cases: Static vs. Dynamic Cash Flow Methods

Cash flow statements provide a historical snapshot of cash inflows and outflows, making them ideal for compliance reporting and fiscal period analysis. Dynamic cash flow modeling enables real-time forecasting and scenario analysis, supporting strategic decision-making and liquidity management. Organizations use static methods for regulatory reporting and dynamic models for adaptive financial planning and risk assessment.

Impact on Decision-Making: Static Versus Dynamic Approaches

The cash flow statement provides a static snapshot of historical cash inflows and outflows, facilitating basic liquidity assessment and compliance reporting. Dynamic cash flow modeling incorporates real-time data and predictive analytics to simulate various scenarios, offering deeper insights for proactive financial planning. This dynamic approach significantly enhances decision-making by enabling timely responses to changing market conditions and business needs.

Data Requirements for Effective Cash Flow Reporting

A cash flow statement requires accurate historical financial data, including operating, investing, and financing activities to reflect past liquidity. Dynamic cash flow modeling demands real-time data inputs such as projected revenues, expenses, and market fluctuations to enable scenario analysis and forecasting. Integrating automated data collection from ERP systems and financial databases enhances precision and responsiveness for both reporting methods.

Choosing the Right Approach for Your Business

Cash flow statements provide a historical overview of cash inflows and outflows, essential for standard financial reporting and compliance. Dynamic cash flow modeling offers real-time forecasting and scenario analysis, enabling businesses to anticipate liquidity needs and make proactive financial decisions. Selecting the right approach depends on your business complexity, with dynamic modeling suited for adaptive planning and traditional statements best for regulatory accuracy.

Future Trends in Cash Flow Reporting and Analysis

Future trends in cash flow reporting emphasize the shift from traditional cash flow statements to dynamic cash flow modeling, which integrates real-time data and predictive analytics for enhanced forecasting accuracy. Dynamic cash flow models enable businesses to simulate various financial scenarios, improving liquidity management and strategic decision-making. This evolution leverages AI and machine learning to provide deeper insights into cash flow patterns, driving more proactive financial planning and risk mitigation.

Related Important Terms

Rolling Cash Flow Forecast

Rolling cash flow forecasts provide a dynamic cash flow modeling approach that continuously updates projections based on real-time data, unlike static cash flow statements which report historical cash flows. This method enhances accuracy in cash flow reporting by enabling proactive financial management and timely adjustments to liquidity planning.

Real-Time Cash Visibility

Cash flow statements provide historical financial data capturing past inflows and outflows, while dynamic cash flow modeling offers real-time cash visibility by forecasting future cash positions using up-to-date transactional data and predictive analytics. This real-time approach enhances decision-making accuracy and liquidity management by continuously integrating current financial activity and scenario analysis.

Adaptive Liquidity Modeling

Adaptive Liquidity Modeling enhances cash flow reporting by integrating real-time data and predictive analytics, offering a dynamic alternative to traditional cash flow statements that rely on static historical data. This approach enables more accurate forecasting and proactive liquidity management, crucial for optimizing working capital and mitigating financial risks.

Granular Inflow/Outflow Tracking

Cash flow statements provide a static summary of inflows and outflows over a specific period, while dynamic cash flow modeling offers granular tracking by continuously updating cash movements in real-time. This granular approach enhances forecasting accuracy and enables more detailed analysis of timing and sources of cash flows for improved financial decision-making.

Scenario-Based Cash Flow Analytics

Scenario-based cash flow analytics leverages dynamic cash flow modeling to project multiple financial outcomes under varying conditions, offering a more granular and forward-looking perspective than traditional cash flow statements. This approach enhances reporting accuracy by integrating real-time data and predictive algorithms, enabling better risk assessment and strategic decision-making.

Predictive Cash Positioning

Cash flow statements provide historical financial snapshots summarizing past inflows and outflows, while dynamic cash flow modeling uses real-time data and predictive analytics to forecast future liquidity trends, enabling proactive cash position management. Predictive cash positioning enhances decision-making by anticipating cash shortages or surpluses, optimizing working capital and ensuring seamless operational continuity.

Variance Attribution Reports

Variance Attribution Reports in cash flow statements provide historical insights by comparing actual cash flows against budgeted figures to identify deviations, aiding in financial reporting accuracy. Dynamic cash flow modeling enhances this by simulating multiple scenarios in real-time, allowing for proactive variance analysis and more precise forecasting adjustments.

Hyper-Detailed Movement Reconciliation

A cash flow statement provides a historical snapshot of cash inflows and outflows, while dynamic cash flow modeling offers predictive insights by simulating future cash movements with hyper-detailed movement reconciliation. This advanced approach enables granular tracking of individual cash transactions, enhancing accuracy in forecasting and financial decision-making.

AI-Augmented Cash Flow Projections

AI-augmented cash flow projections enhance dynamic cash flow modeling by integrating real-time data and predictive analytics, offering more accurate and adaptive forecasting than traditional cash flow statements. This approach enables businesses to anticipate liquidity needs, optimize financial planning, and respond swiftly to market changes with AI-driven insights.

Agile Treasury Reporting

Cash flow statements provide historical snapshots of inflows and outflows for financial reporting, while dynamic cash flow modeling enables real-time scenario analysis and forecasting, crucial for Agile Treasury Reporting. Incorporating dynamic models enhances accuracy in liquidity management and supports rapid decision-making in volatile markets.

Cash flow statement vs Dynamic cash flow modeling for reporting. Infographic

moneydiff.com

moneydiff.com