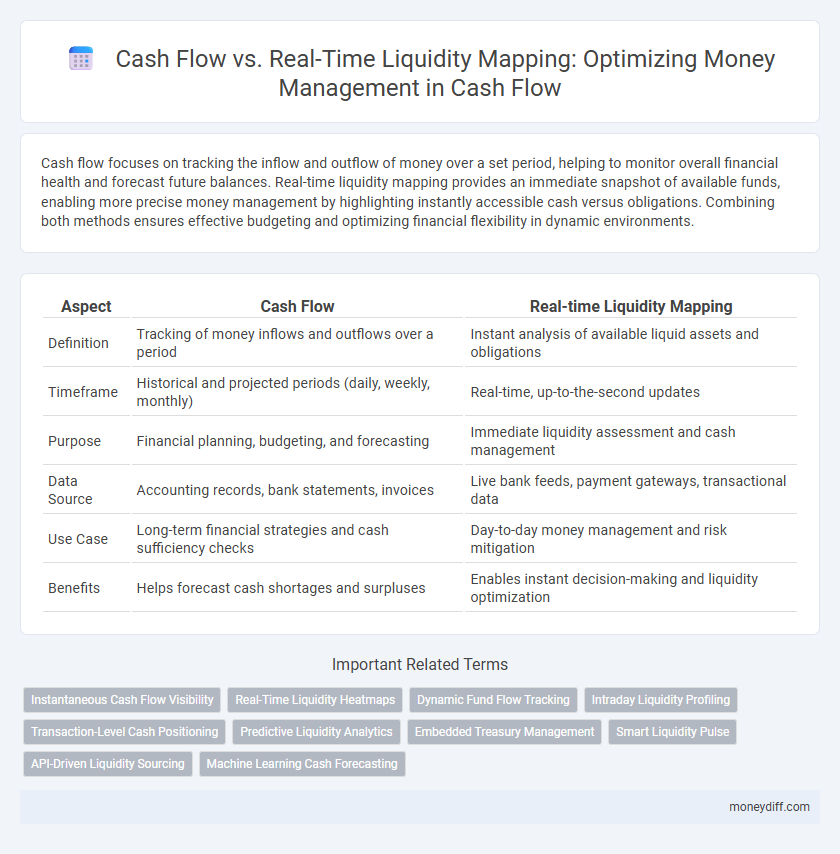

Cash flow focuses on tracking the inflow and outflow of money over a set period, helping to monitor overall financial health and forecast future balances. Real-time liquidity mapping provides an immediate snapshot of available funds, enabling more precise money management by highlighting instantly accessible cash versus obligations. Combining both methods ensures effective budgeting and optimizing financial flexibility in dynamic environments.

Table of Comparison

| Aspect | Cash Flow | Real-time Liquidity Mapping |

|---|---|---|

| Definition | Tracking of money inflows and outflows over a period | Instant analysis of available liquid assets and obligations |

| Timeframe | Historical and projected periods (daily, weekly, monthly) | Real-time, up-to-the-second updates |

| Purpose | Financial planning, budgeting, and forecasting | Immediate liquidity assessment and cash management |

| Data Source | Accounting records, bank statements, invoices | Live bank feeds, payment gateways, transactional data |

| Use Case | Long-term financial strategies and cash sufficiency checks | Day-to-day money management and risk mitigation |

| Benefits | Helps forecast cash shortages and surpluses | Enables instant decision-making and liquidity optimization |

Understanding Cash Flow in Money Management

Cash flow represents the net amount of cash moving in and out of a business or individual's accounts over a specific period, providing crucial insight into financial health and operational efficiency. Real-time liquidity mapping enhances money management by offering instantaneous visibility into available cash resources, enabling more precise tracking of funds relative to immediate obligations. Understanding the distinction between cash flow and real-time liquidity ensures accurate forecasting and effective allocation of capital, optimizing overall financial stability.

Defining Real-Time Liquidity Mapping

Real-time liquidity mapping provides a dynamic overview of available cash and liquid assets, capturing instantaneous financial positions to improve money management. Unlike traditional cash flow analysis, which tracks inflows and outflows over set periods, real-time liquidity mapping monitors liquidity sources continuously, enabling more responsive decision-making. This approach allows businesses to optimize working capital by identifying precise moments of surplus and deficit, enhancing financial agility and risk management.

Key Differences: Cash Flow vs. Real-Time Liquidity Mapping

Cash flow represents the total inflow and outflow of cash over a specific period, providing a historical view of financial health, while real-time liquidity mapping offers an instantaneous snapshot of available liquid assets for immediate use. Cash flow analysis helps forecast future financial positions based on past and projected transactions, whereas real-time liquidity mapping focuses on current asset accessibility to meet urgent obligations. Understanding the distinction between these concepts enables more effective money management decisions, balancing long-term planning with immediate financial responsiveness.

Benefits of Traditional Cash Flow Analysis

Traditional cash flow analysis provides a comprehensive overview of inflows and outflows over a set period, enabling businesses to forecast financial stability and plan budget allocations effectively. It helps identify cash shortages in advance, supporting strategic decisions to secure funding or adjust expenditures. This method offers a structured approach to evaluating past performance and ensuring long-term financial health.

Advantages of Real-Time Liquidity Mapping

Real-time liquidity mapping provides an immediate and precise overview of available funds, enabling businesses to manage cash flow more effectively by anticipating shortfalls and optimizing fund allocation. This approach enhances decision-making by integrating real-time data from multiple accounts and financial instruments, reducing the risk of overdrafts and improving working capital efficiency. It supports dynamic cash management strategies, allowing organizations to react swiftly to market changes and operational needs.

Common Challenges in Managing Cash Flow

Common challenges in managing cash flow include unpredictable income timing, delayed receivables, and fluctuating expenses that disrupt accurate real-time liquidity mapping. Many businesses struggle to align cash inflows and outflows precisely, leading to gaps in funds availability for operational needs. Inefficient cash flow tracking often results in missed opportunities to optimize liquidity and maintain financial stability.

Real-Time Liquidity: Enhancing Financial Visibility

Real-time liquidity provides immediate insight into available cash resources, enabling precise money management that aligns with actual financial positions rather than projected inflows and outflows. Unlike traditional cash flow analysis, which relies on historical and forecasted data, real-time liquidity mapping offers up-to-the-minute visibility into cash availability, reducing the risk of shortfalls. Enhanced financial visibility through real-time liquidity supports proactive decision-making, optimized fund allocation, and improved operational efficiency.

How Technology Transforms Liquidity Management

Technology revolutionizes liquidity management by integrating real-time liquidity mapping with traditional cash flow analysis, enabling businesses to monitor and predict cash positions accurately at any moment. Advanced algorithms and AI-driven platforms process complex transactional data instantly, ensuring optimal allocation of resources and minimizing liquidity risks. Enhanced automation in liquidity management reduces manual errors, accelerates decision-making, and improves overall financial resilience.

Integrating Cash Flow Analysis with Real-Time Mapping

Integrating cash flow analysis with real-time liquidity mapping enhances precision in money management by providing continuous visibility into available funds and anticipated inflows and outflows. This approach enables businesses to forecast liquidity needs accurately while optimizing working capital and avoiding shortfalls. Combining these tools improves decision-making and supports proactive financial strategies aligned with operational demands.

Strategic Recommendations for Optimal Money Management

Strategic recommendations for optimal money management emphasize integrating cash flow analysis with real-time liquidity mapping to enhance financial decision-making and risk mitigation. Implementing dynamic forecasting models that align projected cash inflows and outflows with current liquidity positions enables precise allocation of resources and timely investment opportunities. Leveraging technology-driven liquidity dashboards supports proactive monitoring, ensuring businesses maintain sufficient operational funds while maximizing returns on idle cash.

Related Important Terms

Instantaneous Cash Flow Visibility

Instantaneous cash flow visibility enables precise real-time liquidity mapping, allowing businesses to monitor incoming and outgoing funds continuously for optimized money management. This real-time insight reduces financial risks by providing immediate access to cash positions, ensuring strategic allocation and timely decision-making.

Real-Time Liquidity Heatmaps

Real-Time Liquidity Heatmaps provide dynamic visualizations that map cash flow against available liquidity, enabling precise money management by highlighting liquidity surpluses and shortages as they occur. These heatmaps facilitate swift decision-making by offering granular insights into cash positions, optimizing fund allocation and minimizing liquidity risks.

Dynamic Fund Flow Tracking

Dynamic fund flow tracking enhances cash flow analysis by providing real-time liquidity mapping, allowing precise monitoring of incoming and outgoing transactions. This approach optimizes money management by aligning cash availability with operational needs and financial obligations instantly.

Intraday Liquidity Profiling

Intraday liquidity profiling provides a granular view of cash inflows and outflows throughout the day, enabling precise management of real-time liquidity and reducing the risk of short-term cash shortfalls. Unlike traditional cash flow analysis, this approach aligns liquidity availability with payment deadlines and market operations, optimizing money management and enhancing financial stability.

Transaction-Level Cash Positioning

Transaction-level cash positioning provides granular insight into cash flow by mapping real-time liquidity against projected inflows and outflows, enhancing precise money management. This approach enables businesses to optimize working capital allocation, minimize overdraft risks, and improve financial decision-making through accurate, up-to-the-minute cash availability data.

Predictive Liquidity Analytics

Predictive liquidity analytics leverages historical cash flow data and real-time financial metrics to forecast future liquidity positions, enabling proactive money management and optimized capital allocation. Integrating cash flow projections with real-time liquidity mapping provides businesses with dynamic insights to anticipate funding gaps, enhance working capital efficiency, and mitigate financial risks.

Embedded Treasury Management

Embedded Treasury Management integrates cash flow forecasting with real-time liquidity mapping to optimize money management by providing instant visibility into available funds and future commitments. This approach enhances decision-making efficiency, reduces liquidity risks, and ensures seamless alignment between cash positions and operational needs.

Smart Liquidity Pulse

Smart Liquidity Pulse enhances money management by providing real-time liquidity mapping that complements traditional cash flow analysis, enabling businesses to monitor available funds instantly and optimize spending decisions. This dynamic approach reduces cash shortages and improves financial agility by aligning cash inflows and outflows with real-time liquidity data.

API-Driven Liquidity Sourcing

API-driven liquidity sourcing enhances cash flow management by providing real-time liquidity mapping, enabling businesses to accurately monitor and allocate available funds across multiple accounts and channels. This dynamic approach reduces funding gaps and optimizes working capital by integrating seamless data exchange between financial platforms and treasury systems.

Machine Learning Cash Forecasting

Machine learning cash forecasting enhances cash flow analysis by providing accurate predictions that align with real-time liquidity mapping, enabling precise money management decisions. Integrating these technologies reduces forecasting errors and helps optimize liquidity buffers based on dynamic cash inflows and outflows.

Cash flow vs Real-time liquidity mapping for money management. Infographic

moneydiff.com

moneydiff.com