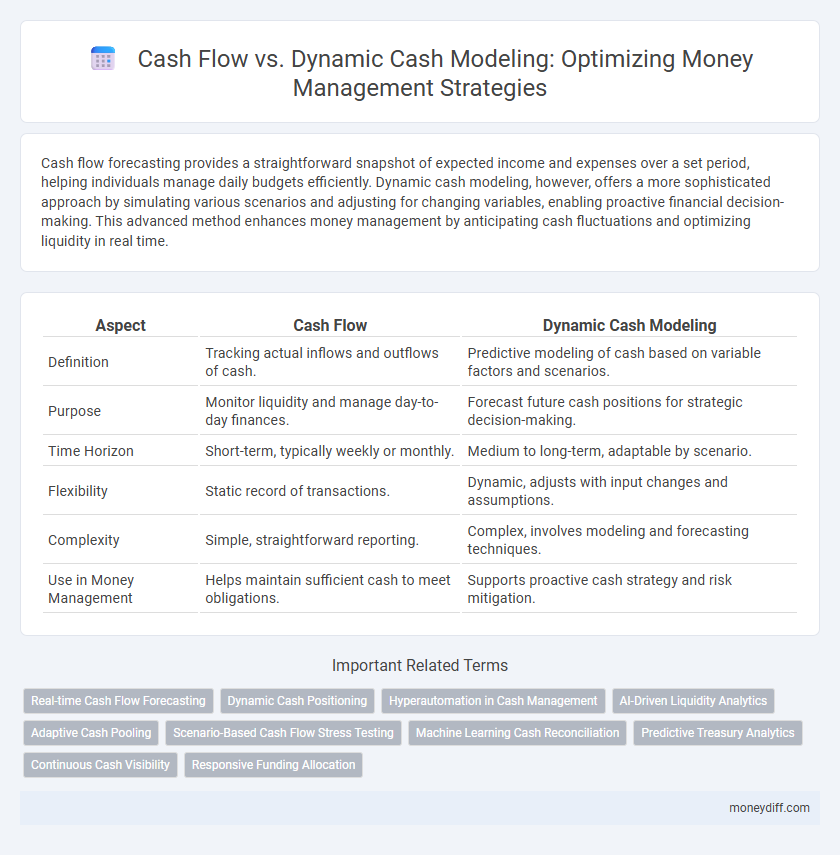

Cash flow forecasting provides a straightforward snapshot of expected income and expenses over a set period, helping individuals manage daily budgets efficiently. Dynamic cash modeling, however, offers a more sophisticated approach by simulating various scenarios and adjusting for changing variables, enabling proactive financial decision-making. This advanced method enhances money management by anticipating cash fluctuations and optimizing liquidity in real time.

Table of Comparison

| Aspect | Cash Flow | Dynamic Cash Modeling |

|---|---|---|

| Definition | Tracking actual inflows and outflows of cash. | Predictive modeling of cash based on variable factors and scenarios. |

| Purpose | Monitor liquidity and manage day-to-day finances. | Forecast future cash positions for strategic decision-making. |

| Time Horizon | Short-term, typically weekly or monthly. | Medium to long-term, adaptable by scenario. |

| Flexibility | Static record of transactions. | Dynamic, adjusts with input changes and assumptions. |

| Complexity | Simple, straightforward reporting. | Complex, involves modeling and forecasting techniques. |

| Use in Money Management | Helps maintain sufficient cash to meet obligations. | Supports proactive cash strategy and risk mitigation. |

Understanding Cash Flow in Money Management

Understanding cash flow is crucial for effective money management, as it tracks the inflow and outflow of funds to maintain liquidity and meet financial obligations. Dynamic cash modeling enhances this process by providing real-time analysis and forecasting, allowing businesses to anticipate cash shortages and optimize working capital. This approach leads to more accurate budgeting, improved decision-making, and better financial stability.

What Is Dynamic Cash Modeling?

Dynamic cash modeling is a sophisticated financial tool that forecasts cash flow by simulating various scenarios based on changing variables like income, expenses, and market conditions. Unlike traditional cash flow analysis that relies on static assumptions, dynamic cash modeling adjusts projections in real time, allowing for more accurate money management and risk assessment. This approach helps businesses and individuals optimize liquidity, plan for contingencies, and make informed financial decisions.

Key Differences: Cash Flow vs Dynamic Cash Modeling

Cash flow analysis provides a static snapshot of expected inflows and outflows over a specific period, offering a straightforward view of liquidity and financial health. Dynamic cash modeling incorporates real-time data and scenario analysis to project cash positions under varying conditions, allowing for adaptive money management strategies. This makes dynamic cash modeling more effective for forecasting uncertainties and optimizing working capital compared to traditional cash flow methods.

Advantages of Traditional Cash Flow Analysis

Traditional cash flow analysis offers clear advantages in money management by providing straightforward tracking of actual cash inflows and outflows, enabling accurate budgeting and expense control. Its simplicity facilitates quick assessments of liquidity and operational efficiency without requiring complex forecasting models. This method supports strong financial discipline through historical data review, helping businesses maintain solvency and plan short-term financial obligations effectively.

Benefits of Dynamic Cash Modeling in Finance

Dynamic cash modeling offers real-time insights into cash flow patterns, enabling more accurate forecasting and proactive financial decision-making. It enhances liquidity management by simulating various scenarios, helping businesses anticipate shortfalls and optimize capital allocation. This approach reduces risks associated with static cash flow projections, improving overall money management efficiency.

Limitations of Static Cash Flow Projections

Static cash flow projections often fail to capture the variability and uncertainties inherent in real-world business operations, leading to inaccurate financial planning. These projections rely on fixed assumptions, which can result in underestimating cash shortages or surpluses when market conditions fluctuate. In contrast, dynamic cash modeling incorporates real-time data and scenario analysis, offering more flexible and responsive money management strategies.

How Dynamic Cash Modeling Enhances Decision-Making

Dynamic cash modeling enhances decision-making by providing real-time visibility into cash inflows and outflows, allowing businesses to anticipate liquidity needs accurately and avoid shortfalls. This approach integrates multiple data sources and scenarios, enabling adaptive forecasting that reflects actual operational changes and market conditions. By contrast, traditional cash flow analysis relies on static historical data, limiting responsiveness and increasing the risk of suboptimal financial decisions.

Real-World Applications: Cash Flow vs Dynamic Models

Cash flow analysis provides a straightforward snapshot of incoming and outgoing cash, essential for short-term liquidity management and budgeting in real-world business operations. Dynamic cash flow modeling incorporates variables like sales projections, payment cycles, and market fluctuations to offer a more flexible, predictive tool for long-term financial planning and risk assessment. Businesses leveraging dynamic models achieve enhanced accuracy in scenario planning, enabling proactive decision-making under varying economic conditions.

Tools and Techniques for Effective Cash Flow Management

Cash flow management utilizes tools like cash flow statements and forecasting software to track inflows and outflows accurately. Dynamic cash modeling incorporates real-time data analytics and scenario planning techniques to adapt projections based on changing business conditions. Combining traditional cash flow analysis with dynamic modeling enhances decision-making and optimizes liquidity management.

Choosing the Right Approach for Your Financial Goals

Cash flow provides a straightforward snapshot of income and expenses, ideal for managing day-to-day liquidity and ensuring bills are paid on time. Dynamic cash modeling offers a more comprehensive, scenario-based analysis that projects future financial positions, helping to anticipate risks and optimize long-term strategic decisions. Selecting the right approach depends on your financial goals: use cash flow for immediate, operational clarity and dynamic cash modeling for proactive, adaptive planning in complex or evolving financial environments.

Related Important Terms

Real-time Cash Flow Forecasting

Real-time cash flow forecasting leverages dynamic cash modeling to provide accurate, up-to-the-minute insights into liquidity, enabling proactive financial decisions and optimized money management. Unlike traditional static cash flow methods, dynamic models integrate continuous data feeds to predict cash position fluctuations, enhancing operational agility and risk mitigation.

Dynamic Cash Positioning

Dynamic cash positioning leverages real-time data analysis and forecasting algorithms to optimize liquidity management, enabling businesses to anticipate cash shortages and surpluses more accurately than traditional cash flow methods. This approach enhances decision-making by adjusting cash allocations dynamically, improving operational efficiency and minimizing reliance on static, historical cash flow projections.

Hyperautomation in Cash Management

Hyperautomation in cash management leverages advanced AI and machine learning to enhance dynamic cash modeling, enabling real-time forecasting and adaptive cash flow strategies. This integration outperforms traditional static cash flow analysis by automating data collection, scenario analysis, and decision-making processes, optimizing liquidity and reducing financial risks.

AI-Driven Liquidity Analytics

AI-driven liquidity analytics enhance cash flow management by providing dynamic cash modeling that predicts real-time financial positions, enabling precise money management decisions. Integrating machine learning algorithms with cash flow data delivers actionable insights into liquidity trends, optimizing working capital and reducing financial risk.

Adaptive Cash Pooling

Adaptive Cash Pooling enhances cash flow management by dynamically reallocating funds across multiple accounts to optimize liquidity and minimize borrowing costs. This approach surpasses traditional static cash flow models by providing real-time visibility and flexibility in cash positioning, ensuring efficient money management tailored to fluctuating financial needs.

Scenario-Based Cash Flow Stress Testing

Scenario-based cash flow stress testing enhances traditional cash flow analysis by simulating various financial conditions to identify vulnerabilities in liquidity management. Dynamic cash modeling integrates real-time data and predictive analytics, enabling more accurate forecasts and proactive cash management decisions under fluctuating business scenarios.

Machine Learning Cash Reconciliation

Machine learning cash reconciliation enhances dynamic cash modeling by automating transaction matching and anomaly detection, enabling more accurate real-time cash flow forecasts. Integrating AI-driven reconciliation reduces manual errors and provides granular insights into cash positions, optimizing liquidity management and financial decision-making.

Predictive Treasury Analytics

Dynamic cash flow modeling leverages predictive treasury analytics to forecast cash positions more accurately by analyzing trends, seasonality, and external variables, enabling proactive liquidity management. This approach surpasses traditional cash flow methods by integrating real-time data and simulations to optimize working capital and mitigate financial risks.

Continuous Cash Visibility

Continuous cash visibility enhances money management by providing real-time insights into cash inflows and outflows, allowing for more accurate forecasting compared to traditional cash flow methods. Dynamic cash modeling integrates variable scenarios and timing fluctuations, enabling proactive adjustments to maintain liquidity and optimize financial stability.

Responsive Funding Allocation

Responsive funding allocation leverages dynamic cash modeling to adjust cash flow projections in real-time, enhancing liquidity management and optimizing capital deployment. Unlike traditional static cash flow analysis, dynamic modeling integrates fluctuating variables, enabling precise allocation decisions aligned with current financial conditions.

Cash flow vs Dynamic cash modeling for money management. Infographic

moneydiff.com

moneydiff.com