Historical reporting provides a detailed account of past cash inflows and outflows, enabling businesses to understand previous financial performance and identify spending patterns. Predictive cash flow analytics uses data modeling and forecasting techniques to anticipate future cash movements, helping organizations make proactive money management decisions and avoid liquidity issues. Combining both approaches enhances financial planning by offering a comprehensive view of cash dynamics and supporting informed strategic choices.

Table of Comparison

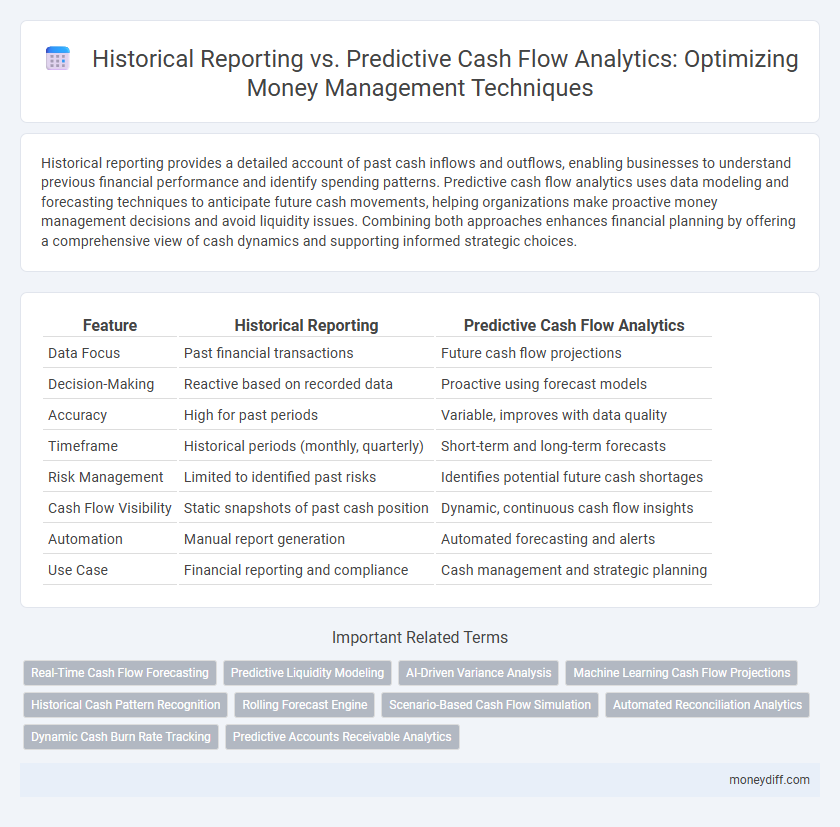

| Feature | Historical Reporting | Predictive Cash Flow Analytics |

|---|---|---|

| Data Focus | Past financial transactions | Future cash flow projections |

| Decision-Making | Reactive based on recorded data | Proactive using forecast models |

| Accuracy | High for past periods | Variable, improves with data quality |

| Timeframe | Historical periods (monthly, quarterly) | Short-term and long-term forecasts |

| Risk Management | Limited to identified past risks | Identifies potential future cash shortages |

| Cash Flow Visibility | Static snapshots of past cash position | Dynamic, continuous cash flow insights |

| Automation | Manual report generation | Automated forecasting and alerts |

| Use Case | Financial reporting and compliance | Cash management and strategic planning |

Understanding Historical Cash Flow Reporting

Historical cash flow reporting provides detailed records of incoming and outgoing cash transactions, enabling businesses to assess past financial performance and identify spending patterns. This data-driven approach highlights trends in revenue collection and expense management, offering a foundation for accurate budgeting and risk assessment. By analyzing historical cash flows, companies gain insights into liquidity cycles, which supports more informed strategic planning and financial stability.

Introduction to Predictive Cash Flow Analytics

Predictive cash flow analytics leverages historical transaction data and advanced machine learning algorithms to forecast future cash inflows and outflows with greater accuracy. This approach enables businesses to anticipate liquidity needs, optimize working capital, and proactively manage financial risks. Integrating real-time data sources enhances the precision of predictions compared to traditional historical reporting methods.

Key Differences Between Historical and Predictive Approaches

Historical cash flow reporting analyzes past financial data to provide a retrospective view of money inflows and outflows, emphasizing accuracy and compliance. Predictive cash flow analytics use algorithms and machine learning to forecast future cash positions, enabling proactive money management and risk mitigation. The key difference lies in historical reporting's reliance on past transactions versus predictive analytics' focus on anticipating future financial trends.

Benefits of Historical Cash Flow Analysis

Historical cash flow analysis provides valuable insights into past financial performance, enabling accurate identification of recurring revenue and expense patterns. This data-driven approach helps businesses optimize budgeting, improve liquidity management, and make informed strategic decisions. Leveraging historical cash flow trends reduces risk by highlighting cash shortage periods and facilitating proactive financial planning.

Advantages of Predictive Cash Flow Analytics

Predictive cash flow analytics leverages real-time data and advanced algorithms to forecast future financial positions with greater accuracy, enabling proactive money management and improved liquidity planning. Unlike historical reporting, which only reflects past transactions, predictive analytics identifies trends and potential cash shortfalls before they occur, reducing financial risks and optimizing working capital. This forward-looking approach enhances decision-making by providing actionable insights for budgeting, investment, and resource allocation.

Limitations of Relying on Historical Data

Historical cash flow reporting offers valuable insights based on past transactions but falls short in anticipating future financial fluctuations and market dynamics. Relying solely on historical data can lead to inaccurate forecasting, as it often overlooks emerging trends, seasonal variations, and unexpected expenses. Predictive cash flow analytics integrates real-time data and advanced algorithms to provide more accurate, forward-looking money management strategies that enhance liquidity planning and risk mitigation.

Predictive Analytics: Forecasting Cash Flow for Better Decisions

Predictive analytics leverages historical cash flow data alongside machine learning algorithms to forecast future cash positions with high accuracy. By analyzing patterns in accounts receivable, payable, and seasonal trends, businesses can anticipate cash shortages or surpluses, optimizing liquidity management. This forward-looking approach enables proactive decision-making, reducing financial risks and improving capital allocation strategies.

Integrating Historical Data with Predictive Analytics

Integrating historical cash flow data with predictive analytics enhances money management by providing a comprehensive view of financial trends and future projections. Historical reporting offers accurate records of past cash inflows and outflows, while predictive analytics uses this data to forecast future liquidity needs and potential risks. Combining these approaches enables businesses to optimize cash reserves, improve budgeting accuracy, and make informed financial decisions.

Impact on Financial Planning and Risk Management

Historical reporting provides a foundation for understanding past cash flow patterns, enabling accurate tracking of income and expenses, which is essential for budgeting and compliance. Predictive cash flow analytics leverage machine learning algorithms and real-time data to forecast future cash positions, enhancing liquidity management and proactive financial decision-making. Integrating predictive insights significantly improves risk mitigation by identifying potential shortfalls and optimizing capital allocation in financial planning.

Choosing the Right Approach for Effective Cash Flow Management

Historical reporting provides a detailed record of past cash inflows and outflows, enabling accurate trend analysis and financial accountability. Predictive cash flow analytics leverages real-time data, machine learning algorithms, and scenario modeling to forecast future liquidity needs and optimize working capital. Selecting the right approach depends on business complexity, data availability, and strategic goals for proactive money management and risk mitigation.

Related Important Terms

Real-Time Cash Flow Forecasting

Real-time cash flow forecasting leverages predictive analytics to provide dynamic insights that surpass historical reporting by anticipating future cash positions based on current and projected financial activities. This approach enhances money management by enabling businesses to optimize liquidity, identify potential shortfalls, and make proactive financial decisions with up-to-date data.

Predictive Liquidity Modeling

Predictive liquidity modeling leverages advanced algorithms and real-time data to forecast cash flow with higher accuracy, enabling proactive money management and optimized liquidity allocation. This approach surpasses historical reporting by identifying future cash flow trends and potential shortages, empowering businesses to make informed financial decisions and mitigate risks effectively.

AI-Driven Variance Analysis

AI-driven variance analysis enhances predictive cash flow analytics by identifying patterns and anomalies beyond historical reporting limitations, enabling more accurate forecasting and proactive money management. Leveraging machine learning algorithms, this technology provides real-time insights into cash flow fluctuations, optimizing liquidity planning and reducing financial risks.

Machine Learning Cash Flow Projections

Machine learning cash flow projections leverage historical reporting data to identify patterns and forecast future inflows and outflows with increased accuracy, enabling proactive money management strategies. These predictive analytics help businesses optimize liquidity by anticipating cash shortages and surpluses before they occur, surpassing traditional retrospective cash flow analyses.

Historical Cash Pattern Recognition

Historical cash flow pattern recognition involves analyzing past inflows and outflows to identify trends and cycles that inform accurate forecasting. This data-driven approach enhances money management by revealing consistent cash behaviors, enabling businesses to optimize liquidity and prepare for future financial needs effectively.

Rolling Forecast Engine

Historical reporting provides a static view of past cash flow patterns, while predictive cash flow analytics, powered by a rolling forecast engine, continuously updates projections based on real-time data and changing business conditions. This dynamic forecasting enables more accurate money management by anticipating future cash positions and optimizing liquidity decisions.

Scenario-Based Cash Flow Simulation

Scenario-based cash flow simulation enables businesses to project future financial positions by modeling diverse economic conditions and operational changes, enhancing predictive accuracy beyond traditional historical reporting. This technique supports dynamic money management decisions by integrating real-time data and variable assumptions, allowing organizations to anticipate liquidity challenges and optimize cash reserves effectively.

Automated Reconciliation Analytics

Automated Reconciliation Analytics enhances predictive cash flow management by leveraging historical reporting data to identify patterns and forecast future cash movements with greater accuracy. This technology reduces manual errors, accelerates reconciliation processes, and provides actionable insights for optimizing liquidity and financial planning.

Dynamic Cash Burn Rate Tracking

Dynamic cash burn rate tracking leverages predictive cash flow analytics to provide real-time insights into spending patterns, enabling proactive money management that surpasses traditional historical reporting. This forward-looking approach helps businesses anticipate future liquidity needs, optimize budgeting, and prevent cash shortages by continuously monitoring cash outflows against projected revenues.

Predictive Accounts Receivable Analytics

Predictive Accounts Receivable Analytics enhances cash flow management by forecasting payment behaviors and identifying potential late payments using historical data trends and machine learning algorithms. This proactive approach allows businesses to optimize liquidity, reduce bad debt risk, and improve financial planning accuracy compared to traditional historical reporting methods.

Historical reporting vs predictive cash flow analytics for money management. Infographic

moneydiff.com

moneydiff.com