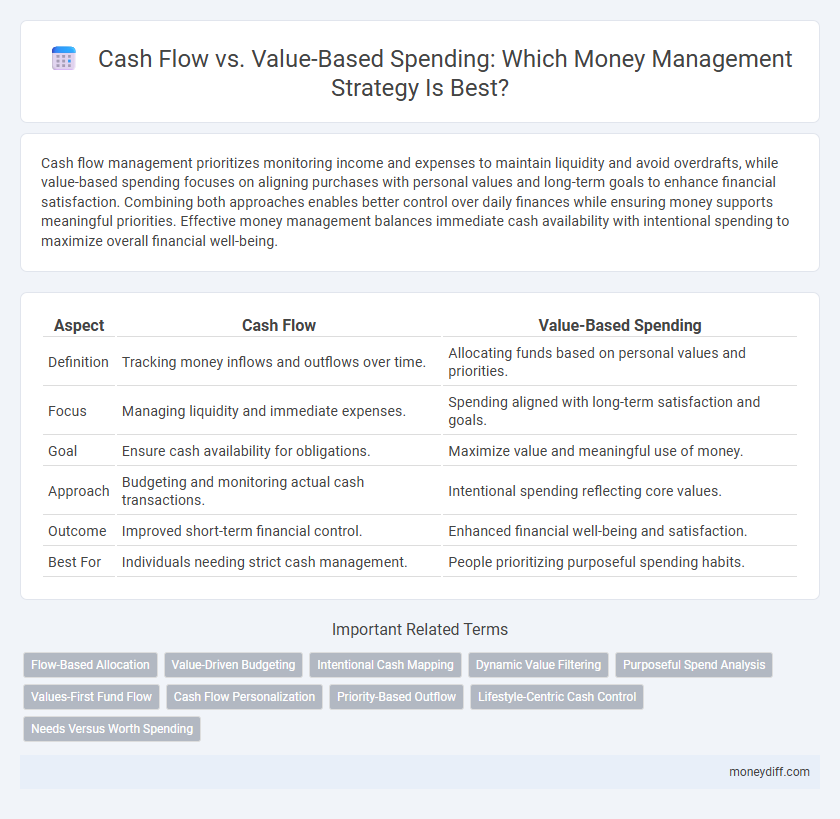

Cash flow management prioritizes monitoring income and expenses to maintain liquidity and avoid overdrafts, while value-based spending focuses on aligning purchases with personal values and long-term goals to enhance financial satisfaction. Combining both approaches enables better control over daily finances while ensuring money supports meaningful priorities. Effective money management balances immediate cash availability with intentional spending to maximize overall financial well-being.

Table of Comparison

| Aspect | Cash Flow | Value-Based Spending |

|---|---|---|

| Definition | Tracking money inflows and outflows over time. | Allocating funds based on personal values and priorities. |

| Focus | Managing liquidity and immediate expenses. | Spending aligned with long-term satisfaction and goals. |

| Goal | Ensure cash availability for obligations. | Maximize value and meaningful use of money. |

| Approach | Budgeting and monitoring actual cash transactions. | Intentional spending reflecting core values. |

| Outcome | Improved short-term financial control. | Enhanced financial well-being and satisfaction. |

| Best For | Individuals needing strict cash management. | People prioritizing purposeful spending habits. |

Understanding Cash Flow in Money Management

Cash flow represents the actual movement of money into and out of a business or personal finances, serving as a critical indicator of liquidity and financial health. Value-based spending prioritizes allocating funds to areas that deliver the highest return or satisfaction, ensuring optimal use of available cash flow. Understanding cash flow allows individuals and organizations to balance inflows and outflows effectively, supporting strategic value-based decisions and sustainable money management.

Defining Value-Based Spending

Value-based spending prioritizes expenditures that align with personal values and long-term goals, ensuring each dollar supports meaningful outcomes. Cash flow management focuses on tracking actual income and expenses to maintain financial stability and liquidity. Combining cash flow analysis with value-based spending strategies enhances money management by promoting intentional choices that balance immediate needs and future aspirations.

Key Differences: Cash Flow vs Value-Based Spending

Cash flow management emphasizes tracking the timing and amount of cash inflows and outflows to maintain liquidity and avoid shortfalls. Value-based spending prioritizes aligning expenditures with personal or organizational values, ensuring money is allocated to areas that maximize satisfaction and long-term benefit. The key difference lies in cash flow focusing on financial timing and balance, while value-based spending centers on purposeful allocation for meaningful impact.

Benefits of Cash Flow Management

Effective cash flow management ensures liquidity by tracking income and expenses, enabling timely payments and avoiding overdrafts. It improves financial stability, allowing businesses and individuals to allocate resources efficiently, thereby reducing unnecessary debt. Prioritizing cash flow supports informed decision-making, enhances budget control, and maximizes available funds for investments or emergencies.

Advantages of Value-Based Spending

Value-based spending enhances financial clarity by aligning expenditures with personal priorities, ensuring money supports what truly matters. This approach promotes intentional cash flow management, reducing impulsive purchases and optimizing budget allocation for long-term goals. By prioritizing value creation, individuals attain improved financial satisfaction and sustained wealth growth over time.

Common Pitfalls in Cash Flow Tracking

Common pitfalls in cash flow tracking include neglecting to categorize expenses accurately and failing to account for irregular or infrequent payments, leading to distorted financial analysis. Overlooking the alignment between cash flow and value-based spending can result in expenditures that do not contribute to long-term financial goals, undermining effective money management. Inconsistent monitoring and lack of real-time updates reduce the reliability of cash flow data, impairing strategic decision-making.

Aligning Spending Habits With Personal Values

Aligning spending habits with personal values enhances cash flow by prioritizing expenses that reflect true financial goals, reducing unnecessary outflows. Value-based spending ensures money management centers on meaningful purchases, improving overall financial well-being and long-term cash reserves. This approach fosters disciplined budgeting, resulting in optimized cash flow and sustained economic security.

Integrating Cash Flow and Value-Based Approaches

Integrating cash flow management with value-based spending enhances financial control by aligning expenditures with personal priorities while ensuring liquidity for essential obligations. This approach optimizes cash flow forecasting to accommodate value-driven purchases, promoting sustainable budgeting and increased financial resilience. By synchronizing income timing with purposeful spending, individuals can maximize both immediate cash availability and long-term financial satisfaction.

Choosing the Right Method for Your Financial Goals

Cash flow management emphasizes tracking income and expenses to maintain liquidity and meet short-term obligations, ensuring immediate financial stability. Value-based spending prioritizes aligning expenditures with personal values and long-term goals, enhancing satisfaction and financial discipline. Selecting the right approach depends on your financial objectives, balancing immediate cash availability with purposeful investment in priorities.

Practical Tips for Balancing Cash Flow and Value-Based Spending

Monitor your cash flow weekly to identify surplus funds that can be redirected toward value-based spending categories aligned with your financial goals. Prioritize essential expenses and allocate discretionary spending to activities or purchases that maximize personal or long-term value. Use budgeting apps or spreadsheets to track actual cash inflows and outflows, ensuring spending decisions remain aligned with both immediate liquidity needs and value optimization.

Related Important Terms

Flow-Based Allocation

Flow-based allocation prioritizes distributing available cash according to real-time inflows and outflows, ensuring liquidity is maintained for operational needs while aligning spending with current revenue streams. This method contrasts with value-based spending by emphasizing cash availability and timing over predetermined budget values, optimizing financial flexibility and reducing the risk of shortfalls.

Value-Driven Budgeting

Value-driven budgeting prioritizes cash flow management by aligning expenditures with long-term financial goals and measurable returns on investment. This approach ensures money is allocated to high-impact areas, optimizing both liquidity and overall financial value rather than merely tracking inflows and outflows.

Intentional Cash Mapping

Intentional Cash Mapping aligns cash flow with value-based spending by categorizing income and expenses to prioritize financial goals and meaningful purchases. This method enhances money management by ensuring every dollar serves a purpose, optimizing both liquidity and long-term value creation.

Dynamic Value Filtering

Dynamic Value Filtering in cash flow management enables real-time prioritization of expenditures based on value contribution, optimizing liquidity and aligning spend with strategic goals. This approach contrasts with traditional value-based spending by continuously adjusting allocations, enhancing financial agility and maximizing return on invested capital.

Purposeful Spend Analysis

Purposeful Spend Analysis in cash flow management emphasizes aligning expenditures with strategic business goals to optimize liquidity and enhance financial health. This approach prioritizes value-based spending by evaluating each outflow's contribution to long-term growth, rather than focusing solely on immediate cash availability.

Values-First Fund Flow

Prioritizing values-first fund flow in cash management aligns spending with core personal or organizational values, ensuring that cash outflows directly support long-term goals and meaningful outcomes. This value-based approach to cash flow emphasizes purposeful allocation over traditional budgeting, enhancing financial discipline and improving overall monetary impact.

Cash Flow Personalization

Cash flow personalization enhances money management by aligning income and expenses with individual financial goals and spending habits, ensuring optimal liquidity and budget control. Unlike value-based spending, which prioritizes the intrinsic worth of purchases, personalized cash flow emphasizes tailored cash inflow and outflow tracking to maintain financial stability and agility.

Priority-Based Outflow

Priority-based outflow in cash flow management ensures funds are allocated first to essential expenses and high-impact investments, optimizing liquidity and financial stability. This approach contrasts with value-based spending by emphasizing cash availability and obligation deadlines over subjective value judgments, improving timely payment and reducing financial stress.

Lifestyle-Centric Cash Control

Lifestyle-centric cash control emphasizes aligning cash flow with value-based spending to optimize financial well-being by prioritizing expenditures that enhance personal lifestyle and long-term satisfaction. This approach ensures that cash inflows are managed to support meaningful experiences and goals rather than impulsive or non-essential purchases, fostering sustainable money management.

Needs Versus Worth Spending

Cash flow management prioritizes meeting essential expenses and maintaining liquidity, ensuring that immediate financial obligations are covered before discretionary spending. Value-based spending emphasizes allocating funds to purchases that genuinely enhance personal worth or long-term satisfaction, balancing needs versus wants to optimize overall financial well-being.

Cash flow vs Value-based spending for money management. Infographic

moneydiff.com

moneydiff.com