Cash flow budgeting prioritizes tracking and managing the inflow and outflow of money to ensure daily expenses are covered while maintaining financial stability. The FIRE (Financial Independence, Retire Early) path budgeting emphasizes aggressive saving and investment strategies to achieve early retirement goals by minimizing discretionary expenses. Balancing cash flow management with FIRE principles helps optimize short-term financial health and long-term wealth accumulation.

Table of Comparison

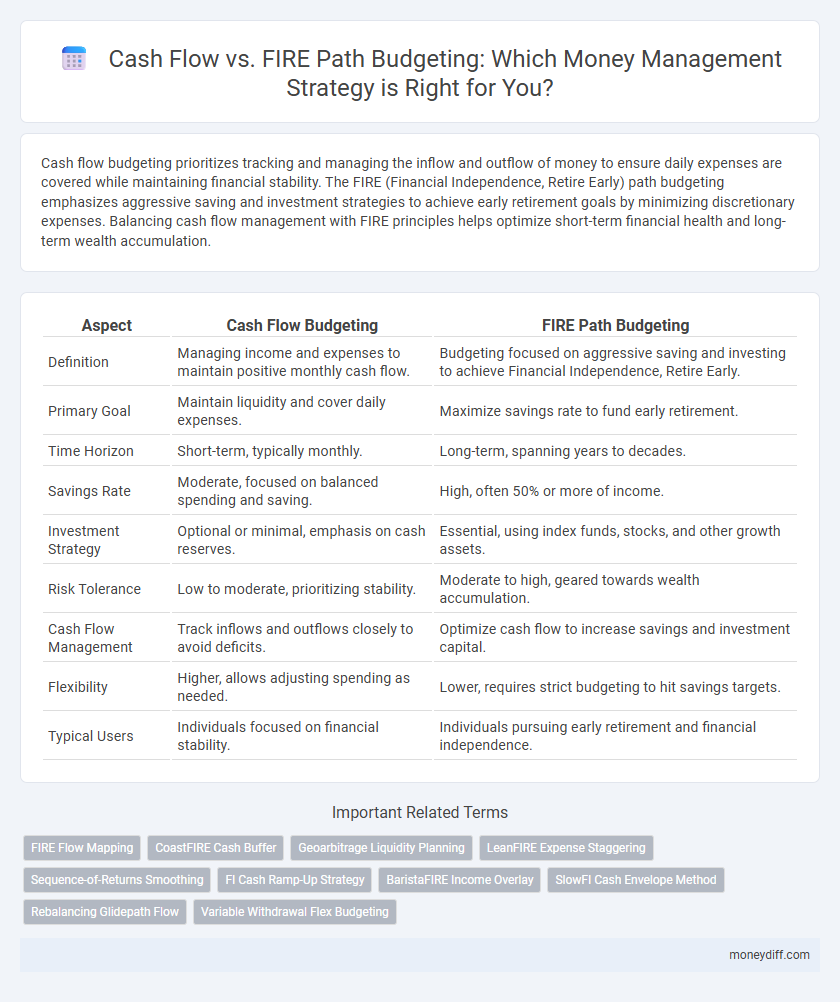

| Aspect | Cash Flow Budgeting | FIRE Path Budgeting |

|---|---|---|

| Definition | Managing income and expenses to maintain positive monthly cash flow. | Budgeting focused on aggressive saving and investing to achieve Financial Independence, Retire Early. |

| Primary Goal | Maintain liquidity and cover daily expenses. | Maximize savings rate to fund early retirement. |

| Time Horizon | Short-term, typically monthly. | Long-term, spanning years to decades. |

| Savings Rate | Moderate, focused on balanced spending and saving. | High, often 50% or more of income. |

| Investment Strategy | Optional or minimal, emphasis on cash reserves. | Essential, using index funds, stocks, and other growth assets. |

| Risk Tolerance | Low to moderate, prioritizing stability. | Moderate to high, geared towards wealth accumulation. |

| Cash Flow Management | Track inflows and outflows closely to avoid deficits. | Optimize cash flow to increase savings and investment capital. |

| Flexibility | Higher, allows adjusting spending as needed. | Lower, requires strict budgeting to hit savings targets. |

| Typical Users | Individuals focused on financial stability. | Individuals pursuing early retirement and financial independence. |

Understanding Cash Flow in Personal Finance

Cash flow in personal finance refers to the total amount of money being transferred into and out of an individual's accounts, crucial for managing day-to-day expenses and long-term goals. Comparing cash flow management with the FIRE (Financial Independence, Retire Early) path budgeting highlights that cash flow focuses on maintaining liquidity and meeting immediate needs, whereas FIRE emphasizes aggressive savings rates and investment growth for early retirement. Mastering cash flow understanding ensures effective budgeting, preventing debt accumulation and supporting sustainable money management strategies aligned with personal financial goals.

The Principles of the FIRE Path Budgeting

The Principles of the FIRE Path Budgeting emphasize strict cash flow management by prioritizing high savings rates and controlled spending to achieve Financial Independence and Retire Early goals. Key strategies include detailed tracking of income and expenses, setting clear savings targets aligned with retirement timelines, and minimizing discretionary spending to maximize capital accumulation. Effective FIRE budgeting transforms cash flow into a disciplined tool for accelerating wealth building and securing long-term financial freedom.

Key Differences: Cash Flow vs. FIRE Budgeting

Cash flow budgeting prioritizes tracking and managing income and expenses on a daily or monthly basis to ensure liquidity and cover immediate financial obligations. FIRE (Financial Independence, Retire Early) budgeting emphasizes aggressive saving, investing, and expense control to rapidly accumulate wealth for early retirement. Key differences include cash flow budgeting's focus on maintaining positive monthly balances versus FIRE budgeting's long-term growth strategy through high savings rates and investment returns.

Income Streams: Stability vs. Aggressive Growth

Income streams in cash flow management prioritize stability through consistent earnings and reliable expenses tracking, ensuring predictable financial sustainability. In contrast, FIRE path budgeting emphasizes aggressive growth by maximizing multiple income streams, including investments and side hustles, to accelerate wealth accumulation and early retirement. Balancing these approaches involves aligning steady cash inflows with high-yield opportunities to optimize overall financial health.

Expense Strategies: Minimalism or Selective Spending

Expense strategies in cash flow management emphasize minimalism by reducing unnecessary costs to maximize available funds, whereas the FIRE path budgeting often prioritizes selective spending to align expenses with financial independence goals. Minimalist approaches focus on essential expenditures to sustain liquidity and avoid debt, while selective spending involves intentional allocation towards investments and retirement savings. Balancing these strategies enhances money management by optimizing cash flow dynamics and accelerating wealth accumulation.

Investing Approaches in Cash Flow and FIRE Models

Cash flow-focused investing emphasizes regular income generation through dividends, interest, and rental yields to sustain expenses and reinvest for growth, contrasting the FIRE (Financial Independence, Retire Early) model's aggressive savings and investment strategy aimed at building substantial asset accumulation quickly. The FIRE path budgeting centers on maximizing savings rate above 50% of income, often by minimizing discretionary spending, to expedite reaching a specific net worth target that supports lean withdrawal rates typically at 3-4% annually. Investors adopting cash flow strategies prioritize stability and liquidity, while FIRE adherents focus on high capital growth and early asset base sufficiency, influencing portfolio allocation choices between income-producing assets and growth-oriented securities.

Risk Management: Safety Nets and Withdrawal Rates

Effective cash flow management enhances financial stability by maintaining safety nets that mitigate unexpected expenses during the FIRE path. Optimizing withdrawal rates ensures sustainable income streams without depleting invested capital prematurely, balancing growth and risk. Prioritizing emergency funds and dynamic budgeting strategies strengthens resilience against market volatility and personal financial shocks.

Tracking Progress: Metrics for Cash Flow and FIRE Success

Tracking progress in cash flow management involves monitoring monthly net income, expenses, and savings rates to ensure positive liquidity and financial stability. For FIRE (Financial Independence, Retire Early) path budgeting, key metrics include the savings rate percentage, investment portfolio growth, and estimated time to reach financial independence based on current cash flow projections. Regularly analyzing these metrics allows for timely adjustments and maintains alignment with long-term financial goals.

Psychological Factors: Comfort, Sacrifice, and Motivation

Cash flow management emphasizes steady income and expenses to maintain financial comfort, reducing stress through predictable budgeting. The FIRE path often requires significant sacrifice and delayed gratification, challenging emotional resilience but boosting motivation with long-term freedom goals. Understanding these psychological factors helps tailor money management approaches that balance immediate comfort and future financial independence.

Choosing the Right Path for Your Money Goals

Cash flow budgeting emphasizes managing income and expenses month-to-month to maintain financial stability and cover immediate needs, while the FIRE (Financial Independence, Retire Early) path budgeting focuses on aggressive saving and investing to achieve early retirement. Selecting the right money management approach depends on individual financial goals, risk tolerance, and timeline, balancing short-term liquidity against long-term wealth accumulation. Effective budgeting aligns cash flow strategies with FIRE objectives by optimizing spending, controlling debt, and maximizing investment growth to ensure both present security and future freedom.

Related Important Terms

FIRE Flow Mapping

FIRE Flow Mapping integrates cash flow analysis with early retirement budgeting strategies, emphasizing disciplined savings rates and optimized expense tracking to accelerate financial independence timelines. This approach aligns income streams with targeted investments and withdrawal plans, ensuring sustainable cash flow management tailored for the FIRE path.

CoastFIRE Cash Buffer

CoastFIRE budgeting emphasizes building a substantial Cash Buffer to cover living expenses without additional work, allowing investments to grow uninterrupted. This Cash Buffer contrasts with traditional Cash Flow budgeting, which relies on continuous income to manage expenses and limits financial flexibility toward early retirement goals.

Geoarbitrage Liquidity Planning

Cash flow management focuses on maintaining a steady inflow and outflow of cash to cover daily expenses, while the FIRE (Financial Independence, Retire Early) path prioritizes aggressive savings and investments for early retirement. Geoarbitrage liquidity planning enhances both strategies by optimizing cash reserves in low-cost-of-living regions, maximizing spending power and ensuring flexible access to funds during financial transitions.

LeanFIRE Expense Staggering

Cash flow management in LeanFIRE expense staggering emphasizes spreading out essential expenditures over time to maintain steady liquidity while minimizing financial stress. This strategic budgeting approach aligns with FIRE goals by ensuring consistent cash availability, reducing reliance on large lump-sum withdrawals, and optimizing the sustainability of retirement funds.

Sequence-of-Returns Smoothing

Sequence-of-Returns Smoothing plays a critical role in cash flow management by reducing the impact of market volatility on withdrawal strategies, especially when pursuing the FIRE (Financial Independence, Retire Early) path. Integrating this technique in budgeting ensures more stable cash flows and preserves capital longevity during retirement phases.

FI Cash Ramp-Up Strategy

The FI Cash Ramp-Up Strategy emphasizes accelerating cash inflows to build a robust financial buffer, contrasting with traditional FIRE path budgeting that prioritizes strict expense control and gradual savings growth. Focusing on optimizing income streams and managing cash flow dynamically enables earlier financial independence by leveraging increased earnings rather than solely reducing expenditures.

BaristaFIRE Income Overlay

BaristaFIRE income overlay integrates part-time or flexible employment earnings with traditional FIRE budgeting to enhance cash flow stability while gradually building retirement assets. This approach prioritizes consistent inflows from barista-style jobs, reducing reliance on aggressive portfolio withdrawals and aligning spending with sustainable income streams.

SlowFI Cash Envelope Method

The SlowFI Cash Envelope Method prioritizes deliberate cash flow management by allocating physical cash into categorized envelopes, ensuring disciplined spending aligned with long-term Financial Independence Retire Early (FIRE) goals. This method contrasts with traditional FIRE path budgeting by emphasizing slow, steady progress through tangible spending limits, reducing reliance on digital transactions and promoting mindful financial habits.

Rebalancing Glidepath Flow

Rebalancing Glidepath Flow in cash flow management adjusts spending and investment allocations over time to maintain a sustainable balance between income and expenses, essential for optimizing both regular cash flow and FIRE (Financial Independence, Retire Early) path budgeting. This strategic approach ensures that as asset values and expenses fluctuate, the glidepath realigns to protect long-term financial goals while accommodating immediate liquidity needs.

Variable Withdrawal Flex Budgeting

Variable Withdrawal Flex Budgeting adapts cash flow management by allowing fluctuating expense limits aligned with actual income, optimizing financial sustainability compared to fixed FIRE path budgeting. This dynamic approach accounts for variable market returns and personal spending, enhancing liquidity control and reducing withdrawal sequence risk.

Cash flow vs FIRE path budgeting for money management. Infographic

moneydiff.com

moneydiff.com