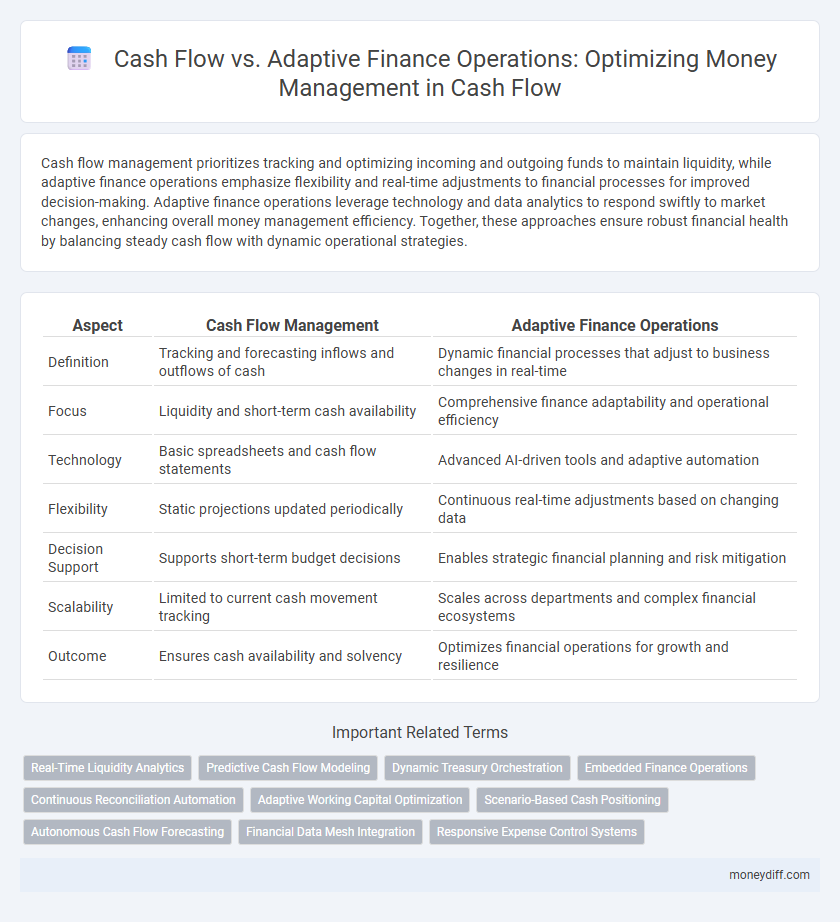

Cash flow management prioritizes tracking and optimizing incoming and outgoing funds to maintain liquidity, while adaptive finance operations emphasize flexibility and real-time adjustments to financial processes for improved decision-making. Adaptive finance operations leverage technology and data analytics to respond swiftly to market changes, enhancing overall money management efficiency. Together, these approaches ensure robust financial health by balancing steady cash flow with dynamic operational strategies.

Table of Comparison

| Aspect | Cash Flow Management | Adaptive Finance Operations |

|---|---|---|

| Definition | Tracking and forecasting inflows and outflows of cash | Dynamic financial processes that adjust to business changes in real-time |

| Focus | Liquidity and short-term cash availability | Comprehensive finance adaptability and operational efficiency |

| Technology | Basic spreadsheets and cash flow statements | Advanced AI-driven tools and adaptive automation |

| Flexibility | Static projections updated periodically | Continuous real-time adjustments based on changing data |

| Decision Support | Supports short-term budget decisions | Enables strategic financial planning and risk mitigation |

| Scalability | Limited to current cash movement tracking | Scales across departments and complex financial ecosystems |

| Outcome | Ensures cash availability and solvency | Optimizes financial operations for growth and resilience |

Understanding Cash Flow: The Foundation of Money Management

Cash flow represents the movement of money in and out of a business, serving as the foundation of effective money management. Adaptive finance operations enhance this by continuously monitoring cash flow trends, enabling real-time adjustments that optimize liquidity and financial stability. Understanding cash flow dynamics is crucial for implementing adaptive strategies that ensure sustained operational efficiency and informed decision-making.

Adaptive Finance Operations: A Modern Approach

Adaptive Finance Operations leverage real-time data integration and automation to optimize cash flow management, enhancing agility and accuracy in financial decision-making. This modern approach replaces traditional cash flow forecasting by continuously adjusting to market changes and internal financial conditions. By implementing adaptive systems, organizations achieve improved liquidity, reduced operational risks, and better alignment between financial strategy and business goals.

Key Differences: Cash Flow vs Adaptive Finance Operations

Cash flow represents the actual inflow and outflow of cash within a business, highlighting liquidity and immediate financial health. Adaptive finance operations utilize real-time data analytics and predictive modeling to dynamically adjust budgets, forecasts, and resource allocation based on changing business conditions. The key difference lies in cash flow's historical, transactional nature versus adaptive finance's forward-looking, strategic approach to money management.

The Role of Technology in Adaptive Finance Operations

Technology plays a pivotal role in adaptive finance operations by enabling real-time cash flow monitoring and predictive analytics, which enhance accuracy in financial forecasting and liquidity management. Advanced automation and AI-driven tools streamline transaction processing and anomaly detection, reducing manual errors and operational costs while optimizing cash reserves. These innovations support dynamic decision-making, allowing finance teams to swiftly adjust strategies in response to market fluctuations and internal financial changes.

Benefits of Robust Cash Flow Management

Robust cash flow management ensures liquidity, enabling timely payments and reducing reliance on external financing, which improves financial stability. It provides accurate forecasts that support adaptive finance operations by allowing dynamic allocation of resources based on real-time data. Enhanced cash flow visibility empowers decision-makers to optimize working capital and seize growth opportunities efficiently.

How Adaptive Finance Operations Enhance Cash Flow

Adaptive finance operations improve cash flow by enabling dynamic forecasting and real-time visibility into financial data, allowing businesses to respond swiftly to market changes and optimize liquidity. Automated workflows reduce processing time and errors, ensuring timely inflows and outflows, which enhances working capital management. Leveraging AI-driven insights, adaptive operations facilitate precise budgeting and scenario planning, increasing cash flow predictability and operational agility.

Challenges in Managing Cash Flow and Adaptive Finance

Challenges in managing cash flow include unpredictable revenue streams, delayed receivables, and fluctuating expenses that disrupt liquidity and operational stability. Adaptive finance operations leverage real-time data analytics and automation to enhance cash forecasting accuracy and optimize working capital management. Implementing adaptive strategies reduces the risk of cash shortfalls and improves financial agility in dynamic business environments.

Integrating Cash Flow with Adaptive Financial Strategies

Integrating cash flow management with adaptive financial strategies enhances real-time visibility into liquidity and operational efficiency, enabling businesses to respond swiftly to market fluctuations. Adaptive finance operations utilize predictive analytics and automated forecasting to optimize cash reserves, minimize risk, and align expenditures with dynamic revenue cycles. This synergy promotes sustainable growth by ensuring financial agility and strategic capital allocation in evolving economic conditions.

Real-World Examples: Successful Money Management Approaches

Effective cash flow management is crucial for business sustainability, as exemplified by companies like Amazon, which leverages adaptive finance operations to optimize liquidity and investment timing. Adaptive finance incorporates real-time data analytics and flexible budgeting, enabling firms such as Unilever to respond dynamically to market fluctuations and improve working capital efficiency. These real-world approaches demonstrate that integrating cash flow analysis with adaptive strategies enhances financial resilience and supports informed decision-making.

Future Trends: Cash Flow and Adaptive Finance Operations

Future trends in cash flow management emphasize the integration of adaptive finance operations powered by AI and real-time data analytics to enhance accuracy and responsiveness. Adaptive finance systems enable dynamic forecasting and automated adjustments, improving liquidity management and reducing cash flow volatility across multiple business scenarios. This convergence optimizes working capital utilization and strengthens financial resilience in rapidly changing market environments.

Related Important Terms

Real-Time Liquidity Analytics

Real-time liquidity analytics enhances cash flow management by providing dynamic insights into available funds, enabling adaptive finance operations to optimize money allocation and reduce liquidity risks. Leveraging advanced data integration and predictive modeling, organizations can track cash inflows and outflows instantly, improving decision-making and ensuring financial agility in volatile markets.

Predictive Cash Flow Modeling

Predictive cash flow modeling enhances adaptive finance operations by leveraging real-time data analytics and machine learning to forecast liquidity needs with high accuracy. This approach enables businesses to optimize cash flow management, reduce financial risks, and improve decision-making agility in dynamic market conditions.

Dynamic Treasury Orchestration

Dynamic Treasury Orchestration enhances cash flow management by integrating real-time data analytics and automated decision-making to optimize liquidity across multiple channels. Adaptive finance operations leverage this orchestration to proactively manage risks, forecast cash positions accurately, and align funding strategies with organizational goals.

Embedded Finance Operations

Embedded Finance Operations integrate cash flow management directly into financial platforms, enabling real-time monitoring and automated adjustments to optimize liquidity and working capital. This approach surpasses traditional cash flow methods by embedding payment processing, forecasting, and reconciliation within operational workflows, enhancing accuracy and efficiency in money management.

Continuous Reconciliation Automation

Continuous Reconciliation Automation enhances cash flow accuracy by systematically matching transactions in real-time, reducing discrepancies and improving liquidity forecasting. Adaptive finance operations leverage this automation to dynamically adjust financial strategies, ensuring optimal money management and minimizing cash shortfalls.

Adaptive Working Capital Optimization

Adaptive Working Capital Optimization leverages real-time cash flow data and predictive analytics to dynamically adjust finance operations, ensuring liquidity aligns with business demands. This approach enhances money management by minimizing cash shortages and optimizing capital allocation compared to traditional static cash flow models.

Scenario-Based Cash Positioning

Scenario-based cash positioning enhances cash flow management by predicting liquidity needs under varying market conditions, enabling adaptive finance operations to allocate resources efficiently. This dynamic approach reduces cash shortfalls and optimizes working capital, ensuring organizations maintain financial agility amidst uncertainty.

Autonomous Cash Flow Forecasting

Autonomous cash flow forecasting leverages advanced AI algorithms and real-time data integration to provide highly accurate predictions, enabling businesses to optimize liquidity management and reduce financial risks compared to traditional adaptive finance operations. This automated approach enhances decision-making agility by continuously adjusting forecasts based on dynamic market conditions and internal cash movements, improving overall money management efficiency.

Financial Data Mesh Integration

Cash flow management benefits significantly from Financial Data Mesh Integration, which enables decentralized data ownership and real-time access across adaptive finance operations, enhancing accuracy and responsiveness in money management. By leveraging a Financial Data Mesh architecture, organizations can seamlessly integrate diverse financial data sources, improving cash flow forecasting and operational agility.

Responsive Expense Control Systems

Responsive Expense Control Systems enhance cash flow management by dynamically adjusting expenditures based on real-time financial data, ensuring optimal liquidity and minimizing unnecessary outflows. These systems outperform traditional adaptive finance operations by providing immediate insights and control mechanisms, directly aligning expenses with fluctuating revenue streams.

Cash flow vs Adaptive finance operations for money management. Infographic

moneydiff.com

moneydiff.com