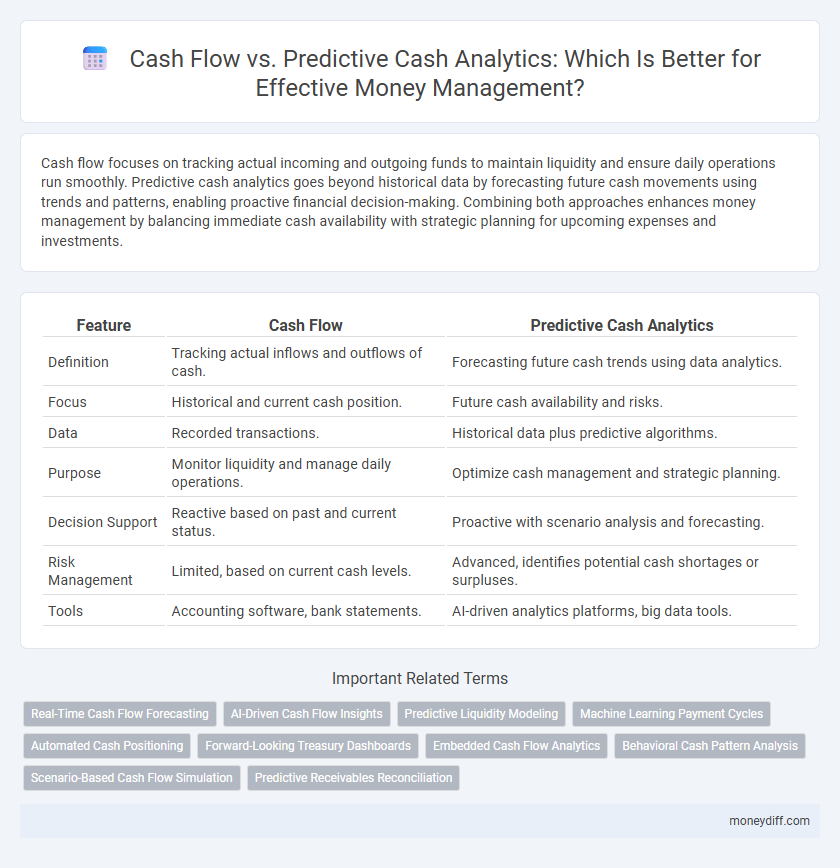

Cash flow focuses on tracking actual incoming and outgoing funds to maintain liquidity and ensure daily operations run smoothly. Predictive cash analytics goes beyond historical data by forecasting future cash movements using trends and patterns, enabling proactive financial decision-making. Combining both approaches enhances money management by balancing immediate cash availability with strategic planning for upcoming expenses and investments.

Table of Comparison

| Feature | Cash Flow | Predictive Cash Analytics |

|---|---|---|

| Definition | Tracking actual inflows and outflows of cash. | Forecasting future cash trends using data analytics. |

| Focus | Historical and current cash position. | Future cash availability and risks. |

| Data | Recorded transactions. | Historical data plus predictive algorithms. |

| Purpose | Monitor liquidity and manage daily operations. | Optimize cash management and strategic planning. |

| Decision Support | Reactive based on past and current status. | Proactive with scenario analysis and forecasting. |

| Risk Management | Limited, based on current cash levels. | Advanced, identifies potential cash shortages or surpluses. |

| Tools | Accounting software, bank statements. | AI-driven analytics platforms, big data tools. |

Understanding Cash Flow in Money Management

Cash flow represents the actual inflow and outflow of money within a business during a specific period, providing a clear snapshot of liquidity and operational health. Predictive cash analytics uses historical data and advanced algorithms to forecast future cash positions, enabling proactive money management and strategic financial planning. Understanding both cash flow and predictive analytics empowers businesses to optimize working capital, minimize cash shortages, and improve overall financial stability.

The Basics of Predictive Cash Analytics

Predictive cash analytics uses historical cash flow data and advanced algorithms to forecast future cash positions, enabling more proactive money management. It provides businesses with real-time insights into expected inflows and outflows, helping to optimize liquidity and reduce the risk of cash shortages. Unlike traditional cash flow analysis, predictive analytics leverages machine learning models to improve accuracy and support strategic financial planning.

Key Differences: Traditional Cash Flow vs. Predictive Analytics

Traditional cash flow focuses on tracking historical inflows and outflows to provide a snapshot of past financial performance, while predictive cash analytics use machine learning algorithms and real-time data to forecast future cash positions and trends. Predictive analytics enable proactive money management by identifying potential cash shortfalls and optimizing liquidity, contrast to traditional methods that react primarily to past transactions. Companies leveraging predictive cash analytics achieve enhanced financial agility and improved decision-making accuracy compared to relying solely on traditional cash flow reports.

Advantages of Cash Flow Monitoring

Cash flow monitoring provides real-time insights into a company's liquidity, enabling timely decision-making to maintain operational stability and avoid insolvency. It offers clear visibility into actual incoming and outgoing cash, facilitating accurate short-term financial planning and immediate response to cash shortages or surpluses. Compared to predictive cash analytics, cash flow monitoring prioritizes concrete data over projections, reducing uncertainty in daily money management.

Benefits of Predictive Cash Analytics for Financial Planning

Predictive cash analytics enhances financial planning by providing accurate forecasts of future cash flows, enabling businesses to anticipate shortfalls and surpluses with greater precision. This data-driven approach supports proactive decision-making, optimizing liquidity management and reducing the risk of unexpected cash constraints. By leveraging historical trends and real-time data, predictive analytics improves budgeting accuracy and strategic allocation of resources.

Real-Time Insights: Cash Flow vs. Predictive Analytics

Real-time cash flow monitoring provides immediate visibility into current financial positions, enabling quick decision-making for daily operations. Predictive cash analytics leverage historical data and machine learning algorithms to forecast future cash movements, improving long-term financial planning and risk mitigation. Combining real-time insights with predictive analytics optimizes money management by balancing current liquidity needs with anticipated cash flows.

Enhancing Accuracy in Money Management

Predictive cash analytics enhances accuracy in money management by using historical data and advanced algorithms to forecast future cash flows more precisely than traditional cash flow statements. This approach allows businesses to anticipate shortfalls and surpluses, enabling proactive decision-making and improved liquidity management. Integrating predictive models reduces uncertainties and optimizes working capital allocation, driving more effective financial planning.

The Role of Technology in Predictive Cash Analytics

Technology plays a pivotal role in predictive cash analytics by leveraging artificial intelligence, machine learning, and big data to forecast cash flow trends with greater accuracy. Advanced software platforms analyze historical financial data and real-time transactions, enabling businesses to anticipate cash shortages or surpluses and make informed monetary decisions. These innovations streamline money management by providing dynamic insights that traditional cash flow reports cannot offer.

Common Challenges in Cash Flow and Predictive Analytics

Common challenges in cash flow management include inaccurate forecasting, delayed data collection, and inability to anticipate unexpected expenses, which hinder effective liquidity control. Predictive cash analytics face obstacles such as algorithmic bias, data integration issues, and the complexity of modeling dynamic market conditions, limiting their reliability for decision-making. Both approaches struggle with real-time data accuracy and require continuous updates to maintain financial foresight.

Choosing the Right Approach for Effective Money Management

Cash flow analysis provides a historical view of actual inflows and outflows, enabling businesses to monitor liquidity and manage day-to-day expenses effectively. Predictive cash analytics uses advanced algorithms and historical data to forecast future cash positions, allowing proactive decision-making and optimized financial planning. Selecting predictive analytics over traditional cash flow review can enhance accuracy in cash management, reducing risks of shortfalls and improving strategic investment timing.

Related Important Terms

Real-Time Cash Flow Forecasting

Real-time cash flow forecasting leverages predictive analytics to provide continuous, up-to-the-minute insights into cash positions, enabling proactive money management and minimizing liquidity risks. Unlike traditional cash flow methods that rely on historical data, predictive cash analytics utilize algorithms and machine learning to anticipate future cash movements with higher accuracy.

AI-Driven Cash Flow Insights

AI-driven cash flow insights leverage predictive cash analytics to forecast future liquidity more accurately than traditional cash flow methods, enabling businesses to optimize working capital and mitigate financial risks. By analyzing historical data and market trends, these advanced models provide actionable intelligence for proactive money management and strategic decision-making.

Predictive Liquidity Modeling

Predictive liquidity modeling enhances money management by forecasting cash flow trends and identifying potential liquidity shortfalls before they occur, enabling proactive financial decisions. Unlike traditional cash flow analysis, which provides historical snapshots, predictive cash analytics leverages real-time data and advanced algorithms to optimize cash reserves and improve working capital efficiency.

Machine Learning Payment Cycles

Machine learning enhances predictive cash analytics by analyzing payment cycle patterns and forecasting cash flow fluctuations with higher accuracy. This enables businesses to optimize liquidity management, reduce forecasting errors, and improve financial decision-making.

Automated Cash Positioning

Automated cash positioning leverages predictive cash analytics to forecast inflows and outflows, optimizing liquidity management and reducing the risk of cash shortfalls compared to traditional cash flow monitoring. This technology enables real-time adjustments to cash reserves, improving financial decision-making and operational efficiency for businesses.

Forward-Looking Treasury Dashboards

Forward-looking treasury dashboards leverage predictive cash analytics to provide real-time insights into future cash flow trends, enabling proactive money management and strategic decision-making. These advanced tools integrate historical data with dynamic forecasting models, optimizing liquidity planning and mitigating financial risks effectively.

Embedded Cash Flow Analytics

Embedded cash flow analytics integrates real-time financial data directly within business applications, enhancing accuracy and enabling proactive money management by forecasting liquidity needs. This approach surpasses traditional cash flow methods by providing predictive insights that optimize working capital and reduce cash shortfalls.

Behavioral Cash Pattern Analysis

Behavioral Cash Pattern Analysis enhances traditional cash flow management by identifying recurring spending behaviors and timing discrepancies, enabling more accurate forecasting and proactive liquidity adjustments. Predictive cash analytics leverage this behavioral insight to optimize money management strategies, reducing the risk of cash shortfalls and improving financial stability.

Scenario-Based Cash Flow Simulation

Scenario-based cash flow simulation enhances predictive cash analytics by modeling various financial outcomes to optimize money management strategies. This approach enables businesses to anticipate cash shortages or surpluses, ensuring better liquidity planning and risk mitigation compared to traditional cash flow analysis.

Predictive Receivables Reconciliation

Predictive Receivables Reconciliation leverages advanced analytics and machine learning to forecast incoming cash flows, enabling businesses to anticipate payment dates and improve liquidity management. This approach enhances traditional cash flow monitoring by providing proactive insights into receivables, reducing days sales outstanding and optimizing working capital.

Cash flow vs Predictive cash analytics for money management. Infographic

moneydiff.com

moneydiff.com