Cash flow prioritizes tracking income and expenses in real time to ensure money is available when needed, promoting flexibility in financial decisions. Antibudgeting rejects rigid spending categories, focusing instead on maximizing cash flow by optimizing spending habits without strict limits. Comparing both, cash flow offers structured awareness while antibudgeting encourages adaptive money management tailored to personal priorities.

Table of Comparison

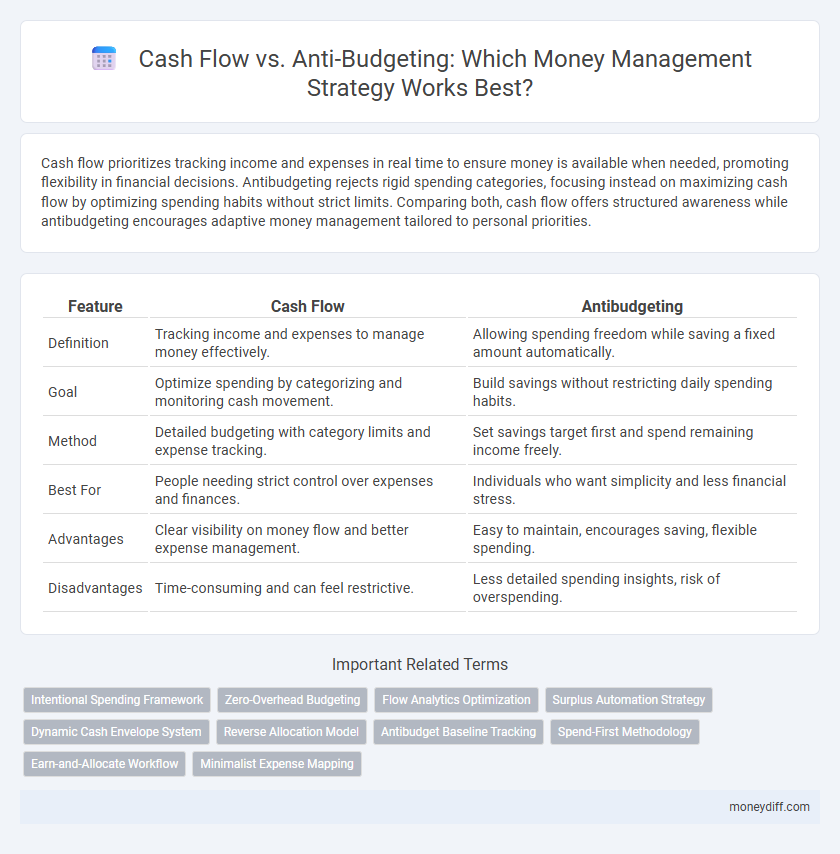

| Feature | Cash Flow | Antibudgeting |

|---|---|---|

| Definition | Tracking income and expenses to manage money effectively. | Allowing spending freedom while saving a fixed amount automatically. |

| Goal | Optimize spending by categorizing and monitoring cash movement. | Build savings without restricting daily spending habits. |

| Method | Detailed budgeting with category limits and expense tracking. | Set savings target first and spend remaining income freely. |

| Best For | People needing strict control over expenses and finances. | Individuals who want simplicity and less financial stress. |

| Advantages | Clear visibility on money flow and better expense management. | Easy to maintain, encourages saving, flexible spending. |

| Disadvantages | Time-consuming and can feel restrictive. | Less detailed spending insights, risk of overspending. |

Understanding Cash Flow in Personal Finance

Understanding cash flow in personal finance involves tracking the movement of money into and out of your accounts to ensure expenses do not exceed income. Cash flow analysis helps identify spending patterns and optimize savings by highlighting periods of surplus or deficit. Unlike antibudgeting, which emphasizes flexible spending without strict limits, cash flow management provides a clear framework for balancing income streams and financial obligations effectively.

What is Antibudgeting?

Antibudgeting is a flexible money management approach that emphasizes tracking cash flow without rigid spending categories, allowing for adaptive spending based on available funds. Unlike traditional budgeting, antibudgeting prioritizes saving first by allocating a fixed percentage of income before covering expenses, promoting financial discipline and reducing overspending. This method simplifies money management by focusing on cash inflows and outflows, making it easier to adjust spending habits while maintaining control over personal finances.

Cash Flow Management: Key Principles

Cash flow management hinges on accurately forecasting income and expenses to ensure liquidity and avoid financial shortfalls. Implementing real-time tracking systems allows businesses to maintain optimal cash balances, facilitating timely payments and strategic investments. Emphasizing cash inflows stabilization and expense control supports sustainable growth and financial resilience.

Antibudgeting: A Flexible Alternative to Traditional Budgets

Antibudgeting offers a flexible alternative to traditional cash flow management by prioritizing spending control without rigid categories or limits. This method focuses on tracking actual income and expenses, allowing adjustments based on real-time financial behavior rather than predefined budgets. By embracing adaptability, antibudgeting helps individuals maintain healthier cash flow by reducing stress and improving financial decision-making.

Comparing Cash Flow Tracking and Antibudgeting Methods

Cash flow tracking provides a detailed record of income and expenses, allowing precise monitoring of financial inflows and outflows to optimize liquidity management. Antibudgeting emphasizes flexibility by focusing on spending according to available cash without rigid categories, reducing the stress of strict budgeting frameworks. Both methods enhance money management, but cash flow tracking offers granular control while antibudgeting promotes adaptability.

Pros and Cons of Cash Flow Management

Cash flow management enables accurate tracking of income and expenses, improving financial stability and decision-making by ensuring funds are available for obligations. However, it requires consistent monitoring and discipline, which can be time-consuming and challenging for individuals with irregular income. Unlike antibudgeting, which emphasizes flexible spending based on available cash, cash flow management provides a structured approach that helps prevent overspending but may limit spontaneity.

Advantages and Drawbacks of Antibudgeting

Antibudgeting offers the advantage of flexible cash flow management by allowing individuals to prioritize spending based on available funds without strict category limits, which can reduce the stress associated with traditional budgeting. However, its drawback lies in the potential lack of structure, leading to inconsistent savings and difficulty tracking financial goals, which may result in overspending. Effective money management with antibudgeting relies heavily on discipline and regular monitoring to avoid cash flow imbalances.

Choosing the Right Approach: Cash Flow vs Antibudgeting

Choosing the right approach between cash flow and antibudgeting depends on personal financial habits and goals; cash flow management prioritizes tracking income and expenses to maintain positive liquidity, while antibudgeting emphasizes spending freely within available funds without rigid limits. Effective cash flow analysis allows for precise forecasting and timely adjustments, enhancing financial control and debt avoidance. In contrast, antibudgeting fosters financial flexibility and reduces stress by eliminating strict category allocations, appealing to those who prefer a more relaxed money management style.

Integrating Cash Flow and Antibudgeting for Financial Success

Integrating cash flow management with antibudgeting techniques enhances financial success by focusing on tracking actual income and expenses rather than rigid budget constraints. This approach improves liquidity control by aligning spending with real-time available funds, reducing the risk of overspending and promoting savings growth. Leveraging cash flow insights alongside flexible antibudgeting methods empowers individuals to make adaptive financial decisions that optimize resource allocation and long-term wealth accumulation.

Tips for Optimizing Money Management with Cash Flow and Antibudgeting

Maximizing money management effectiveness involves leveraging cash flow analysis alongside antibudgeting techniques, which prioritize flexible spending over rigid budgeting constraints. Monitor real-time cash flow to identify income patterns and essential expenses while allocating surplus funds to discretionary categories without strict limits. Automating savings and payments aligned with inflows ensures liquidity, reduces financial stress, and enhances spending adaptability.

Related Important Terms

Intentional Spending Framework

Cash flow management emphasizes tracking actual income and expenses to maintain liquidity, while antibudgeting within the Intentional Spending Framework encourages flexible, purpose-driven allocation of funds based on priorities rather than strict limits. This approach fosters improved financial well-being by aligning spending with intentional goals rather than rigid budget constraints.

Zero-Overhead Budgeting

Zero-overhead budgeting in cash flow management eliminates unnecessary expenses by prioritizing essential costs, unlike antibudgeting which disregards structured expense control. This approach ensures precise allocation of funds, improving liquidity and financial stability by aligning expenditures strictly with available cash inflows.

Flow Analytics Optimization

Cash flow management leverages flow analytics optimization to track and predict income and expenses, ensuring liquidity and financial stability. Antibudgeting, contrasting traditional budgeting, emphasizes flexibility by monitoring net cash flow patterns and adjusting spending dynamically based on real-time financial data.

Surplus Automation Strategy

Surplus automation strategy leverages cash flow analysis to automatically allocate excess funds toward savings, debt repayment, or investments, enhancing financial discipline without the constraints of rigid antibudgeting methods. This approach maximizes surplus utilization by dynamically adjusting allocations based on real-time cash flow variations, ensuring efficient money management and financial growth.

Dynamic Cash Envelope System

The Dynamic Cash Envelope System enhances cash flow management by allocating funds into flexible, goal-driven envelopes that adjust with spending patterns, improving liquidity control compared to static antibudgeting methods. This approach enables real-time tracking of inflows and outflows, optimizing cash flow through adaptive budgeting that prevents overspending while maintaining financial agility.

Reverse Allocation Model

The Reverse Allocation Model in cash flow management prioritizes saving and investment by allocating funds to goals before covering expenses, contrasting traditional antibudgeting which emphasizes spending first and saving what remains. This method enhances financial discipline by ensuring essential commitments are met upfront, improving long-term wealth accumulation and cash flow stability.

Antibudget Baseline Tracking

Antibudget baseline tracking enhances cash flow management by monitoring actual spending against flexible, personalized benchmarks rather than rigid budget categories, enabling adaptive financial control and reducing overspending. This approach prioritizes real-time cash flow analysis to maintain liquidity and financial stability without the constraints of traditional budgeting methods.

Spend-First Methodology

The Spend-First Methodology within cash flow management prioritizes allocating funds to expenses before saving, emphasizing immediate liquidity and flexible budgeting. Unlike antibudgeting, which often ignores detailed tracking, this approach leverages precise cash flow analysis to ensure essential payments are covered while adapting expenditures dynamically.

Earn-and-Allocate Workflow

The Earn-and-Allocate workflow in cash flow management prioritizes systematically directing income toward specific expenses and savings, ensuring each dollar has a designated purpose before spending. This approach contrasts with antibudgeting by emphasizing proactive allocation of funds, which enhances financial discipline and reduces impulsive expenditures.

Minimalist Expense Mapping

Cash flow management emphasizes tracking income and expenses to ensure liquidity, while antibudgeting encourages focusing on key spending categories without rigid limits, promoting financial flexibility. Minimalist expense mapping within antibudgeting reduces tracking complexity by highlighting essential outflows, streamlining money management for improved cash flow control.

Cash flow vs Antibudgeting for money management. Infographic

moneydiff.com

moneydiff.com