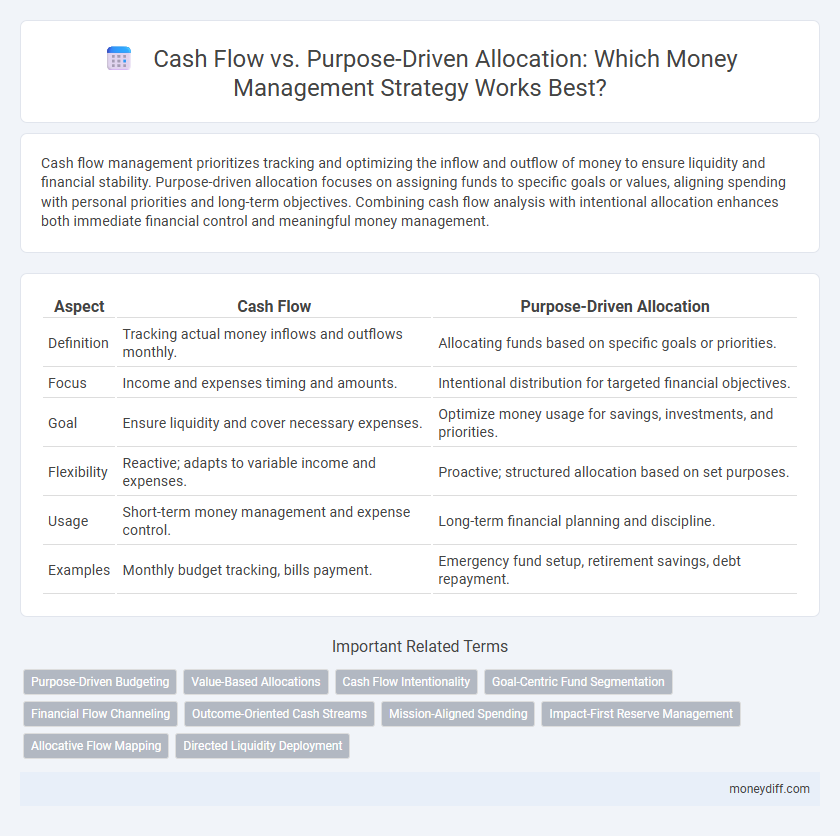

Cash flow management prioritizes tracking and optimizing the inflow and outflow of money to ensure liquidity and financial stability. Purpose-driven allocation focuses on assigning funds to specific goals or values, aligning spending with personal priorities and long-term objectives. Combining cash flow analysis with intentional allocation enhances both immediate financial control and meaningful money management.

Table of Comparison

| Aspect | Cash Flow | Purpose-Driven Allocation |

|---|---|---|

| Definition | Tracking actual money inflows and outflows monthly. | Allocating funds based on specific goals or priorities. |

| Focus | Income and expenses timing and amounts. | Intentional distribution for targeted financial objectives. |

| Goal | Ensure liquidity and cover necessary expenses. | Optimize money usage for savings, investments, and priorities. |

| Flexibility | Reactive; adapts to variable income and expenses. | Proactive; structured allocation based on set purposes. |

| Usage | Short-term money management and expense control. | Long-term financial planning and discipline. |

| Examples | Monthly budget tracking, bills payment. | Emergency fund setup, retirement savings, debt repayment. |

Understanding Cash Flow Management

Effective cash flow management involves tracking incoming and outgoing funds to ensure liquidity and operational stability. Purpose-driven allocation prioritizes directing cash toward specific financial goals, enhancing budget discipline and long-term growth. Balancing cash flow with strategic allocation optimizes resource utilization and supports sustainable financial health.

Defining Purpose-Driven Money Allocation

Purpose-driven money allocation involves directing cash flow towards specific financial goals, ensuring that every dollar spent or saved aligns with long-term objectives. Unlike general cash flow management, which tracks income and expenses broadly, purpose-driven allocation prioritizes intentional distribution of funds to areas such as debt reduction, emergency savings, or investment growth. This approach enhances financial discipline and clarity by linking cash flow directly to meaningful, predefined purposes.

Key Differences: Cash Flow vs Purpose-Driven Allocation

Cash flow management emphasizes tracking inflows and outflows of money to ensure liquidity and operational stability, while purpose-driven allocation focuses on directing funds toward specific financial goals or priorities, such as savings, investments, or debt repayment. Cash flow provides a real-time snapshot of available funds, aiding in short-term decision-making, whereas purpose-driven allocation establishes a strategic framework for long-term financial planning and resource distribution. Understanding the key differences between these approaches helps optimize money management by balancing immediate cash needs with intentional, goal-oriented spending.

Benefits of Cash Flow Tracking

Cash flow tracking provides real-time insight into income and expenses, enabling precise financial planning and improved liquidity management. Monitoring cash flow helps identify spending patterns and potential shortfalls, facilitating proactive adjustments that prevent debt accumulation. This method supports sustainable money management by ensuring funds are available for essential needs before discretionary expenses, enhancing overall financial stability.

Advantages of Purpose-Driven Allocation

Purpose-driven allocation enhances cash flow management by aligning expenditures with specific financial goals, ensuring disciplined spending and preventing unnecessary outflows. This targeted approach increases financial predictability and optimizes resource utilization, supporting long-term wealth building and stability. By prioritizing purpose-driven allocation, individuals and businesses can strategically allocate funds to high-impact areas, reducing waste and improving overall cash flow efficiency.

When to Use Cash Flow Management

Cash flow management is essential when monitoring daily income and expenses to ensure liquidity for operational needs and avoid overdrafts. It is most effective during periods of financial uncertainty or when short-term obligations demand immediate attention. Employ cash flow strategies to optimize working capital and maintain a balanced cash position before implementing purpose-driven allocation for long-term financial goals.

When to Apply Purpose-Driven Allocation

Purpose-driven allocation should be applied when clear financial goals and priorities are established, ensuring that cash flow is directed toward specific objectives such as debt reduction, emergency funds, or investment opportunities. This strategy enhances money management by aligning expenditures with long-term purpose rather than short-term liquidity concerns. Effective cash flow analysis provides the necessary insight to shift from reactive spending to purposeful allocation, optimizing financial stability and growth.

Common Mistakes in Cash Flow and Allocation

Common mistakes in cash flow management include neglecting to forecast expenses accurately and failing to monitor inflows consistently, which leads to unexpected shortfalls. Purpose-driven allocation often suffers from overly rigid budgeting, limiting flexibility needed to address variable cash flow cycles. Ignoring the balance between cash flow timing and allocation priorities frequently causes liquidity issues despite having sufficient overall funds.

Integrating Both Methods for Optimal Money Management

Integrating cash flow management with purpose-driven allocation enhances financial stability by ensuring all income streams are effectively tracked and directed towards specific goals. This combined approach optimizes liquidity while prioritizing expenditures aligned with long-term objectives, improving both operational flexibility and strategic financial planning. Effective integration requires continuous monitoring and adjustment of cash inflows and outflows to maintain balance between immediate needs and future aspirations.

Choosing the Right Approach for Your Financial Goals

Cash flow management prioritizes tracking income and expenses to ensure liquidity and operational stability, while purpose-driven allocation focuses on directing funds toward specific financial goals aligned with personal values or long-term plans. Selecting the right approach depends on whether immediate cash availability or strategic goal fulfillment takes precedence in your financial strategy. Optimizing money management involves balancing cash flow monitoring with targeted allocations to maximize both flexibility and goal achievement.

Related Important Terms

Purpose-Driven Budgeting

Purpose-driven budgeting aligns cash flow management with specific financial goals, ensuring every dollar is allocated toward meaningful priorities rather than just tracking income and expenses. This strategic approach enhances cash flow efficiency by prioritizing spending on essential categories, promoting disciplined financial decision-making and long-term stability.

Value-Based Allocations

Value-based allocations prioritize directing cash flow toward expenditures and investments aligned with personal or organizational core values, enhancing financial decisions with intentional purpose. This approach contrasts with traditional cash flow management by emphasizing meaningful impact over mere liquidity tracking.

Cash Flow Intentionality

Cash flow intentionality emphasizes directing incoming funds toward specific financial goals, ensuring money management aligns with long-term objectives rather than merely tracking income and expenses. Purpose-driven allocation enhances cash flow by prioritizing strategic investments and necessary expenses, fostering sustainable wealth growth and financial stability.

Goal-Centric Fund Segmentation

Goal-centric fund segmentation enhances cash flow management by allocating resources to specific objectives, ensuring financial discipline and targeted spending. This approach contrasts with pure cash flow strategies by prioritizing purposeful distribution over generic liquidity monitoring, optimizing both short-term needs and long-term goals.

Financial Flow Channeling

Cash flow management emphasizes tracking incoming and outgoing funds to maintain liquidity, while purpose-driven allocation directs money towards specific financial goals or priorities. Effective financial flow channeling integrates real-time cash flow analysis with targeted budget allocation to optimize resource utilization and achieve strategic objectives.

Outcome-Oriented Cash Streams

Outcome-oriented cash streams prioritize directing funds toward specific goals, enhancing the efficiency of money management by aligning cash inflows and outflows with targeted financial outcomes. This approach contrasts with traditional cash flow methods by emphasizing purposeful allocation that drives measurable results and supports strategic financial planning.

Mission-Aligned Spending

Mission-aligned spending prioritizes cash flow management by directing funds toward initiatives that reinforce an organization's core values and long-term goals. Effective allocation ensures that cash inflows support strategic projects, optimizing financial sustainability while advancing the mission-driven impact.

Impact-First Reserve Management

Impact-First Reserve Management prioritizes allocating cash flow toward high-impact initiatives before addressing other financial obligations, ensuring that resources drive meaningful outcomes aligned with organizational values. This approach contrasts with traditional methods by emphasizing purpose-driven allocation over simply maintaining liquidity, optimizing cash flow to support mission-critical goals.

Allocative Flow Mapping

Allocative Flow Mapping enhances cash flow analysis by visualizing the distribution of funds according to specific financial purposes, enabling precise tracking and optimization of resource allocation. This method improves financial decision-making by aligning cash inflows and outflows with strategic goals, ensuring efficient money management and maximizing operational effectiveness.

Directed Liquidity Deployment

Directed liquidity deployment prioritizes purposeful allocation of cash flow to optimize financial sustainability and strategic growth. Effective management channels available cash into high-impact areas, enhancing return on investment and ensuring operational efficiency.

Cash flow vs Purpose-driven allocation for money management. Infographic

moneydiff.com

moneydiff.com