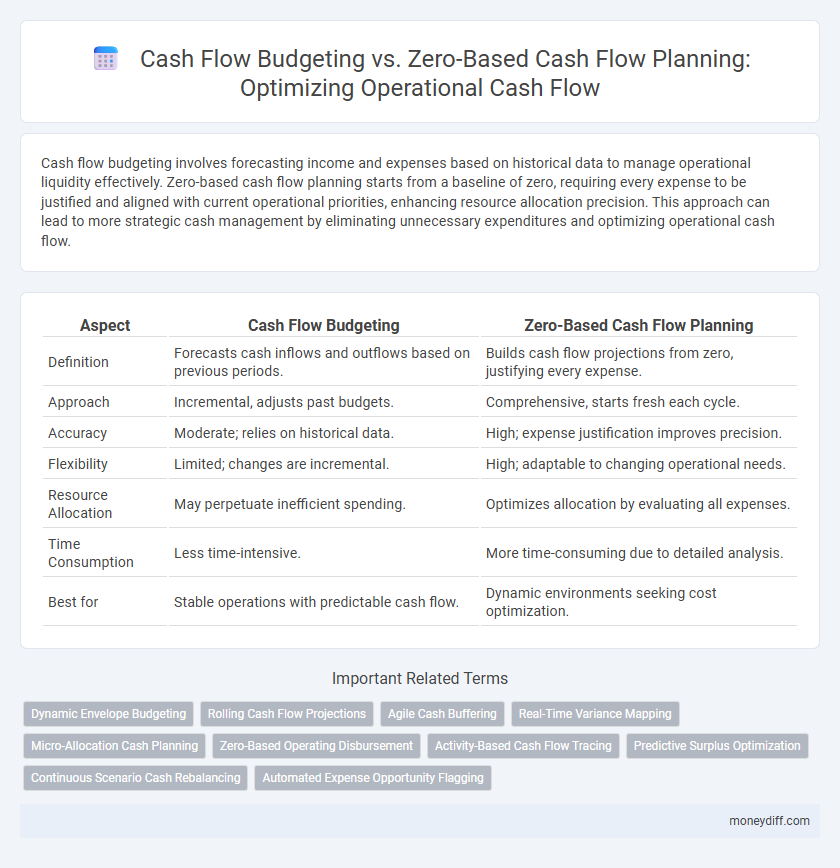

Cash flow budgeting involves forecasting income and expenses based on historical data to manage operational liquidity effectively. Zero-based cash flow planning starts from a baseline of zero, requiring every expense to be justified and aligned with current operational priorities, enhancing resource allocation precision. This approach can lead to more strategic cash management by eliminating unnecessary expenditures and optimizing operational cash flow.

Table of Comparison

| Aspect | Cash Flow Budgeting | Zero-Based Cash Flow Planning |

|---|---|---|

| Definition | Forecasts cash inflows and outflows based on previous periods. | Builds cash flow projections from zero, justifying every expense. |

| Approach | Incremental, adjusts past budgets. | Comprehensive, starts fresh each cycle. |

| Accuracy | Moderate; relies on historical data. | High; expense justification improves precision. |

| Flexibility | Limited; changes are incremental. | High; adaptable to changing operational needs. |

| Resource Allocation | May perpetuate inefficient spending. | Optimizes allocation by evaluating all expenses. |

| Time Consumption | Less time-intensive. | More time-consuming due to detailed analysis. |

| Best for | Stable operations with predictable cash flow. | Dynamic environments seeking cost optimization. |

Understanding Cash Flow Budgeting

Cash flow budgeting involves forecasting cash inflows and outflows based on historical data and expected operational activities, allowing businesses to anticipate liquidity needs and manage working capital efficiently. It emphasizes maintaining a balance between cash receipts and payments to ensure smooth day-to-day operations and avoid funding shortfalls. This method contrasts with zero-based cash flow planning, which requires justifying all expenses from scratch, making cash flow budgeting more practical for ongoing operational management.

What Is Zero-Based Cash Flow Planning?

Zero-based cash flow planning requires building each operational cash flow forecast from scratch, starting at zero and justifying every expense based on actual needs rather than historical data. This approach contrasts with traditional cash flow budgeting, which adjusts previous periods' cash flows to project future figures, potentially perpetuating inefficiencies. By focusing on detailed, need-based cash flow allocation, zero-based planning enhances operational accuracy and resource optimization.

Key Differences Between Cash Flow Budgeting and Zero-Based Planning

Cash flow budgeting estimates future cash inflows and outflows based on historical data and trends to maintain operational liquidity, while zero-based cash flow planning requires justifying every expense from scratch without relying on past budgets. Cash flow budgeting typically follows a fixed framework, making it less flexible, whereas zero-based planning promotes detailed analysis and resource allocation aligned with current operational priorities. Key differences include the reliance on previous period data in cash flow budgeting versus the zero-based approach's focus on validating all cash movements to optimize financial efficiency.

Pros and Cons of Cash Flow Budgeting

Cash flow budgeting offers the advantage of providing a clear, structured financial plan based on historical data, making it easier to predict and manage operational expenses. However, it may lack flexibility and often assumes past cash flow patterns will continue, potentially overlooking changing business conditions or unexpected expenditures. This approach can result in less precise cash flow control compared to zero-based cash flow planning, which requires justifying all expenses from scratch to optimize resource allocation.

Advantages and Disadvantages of Zero-Based Cash Flow Planning

Zero-based cash flow planning offers precise control by requiring all expenses to be justified for each new period, promoting efficient allocation of resources and eliminating unnecessary costs. This method enhances visibility into operational cash needs but demands significant time and effort, making it resource-intensive and complex to maintain consistently. Compared to traditional cash flow budgeting, zero-based planning provides greater adaptability to changing business conditions but may face resistance due to increased workload and requires rigorous data accuracy.

Impact on Operational Efficiency

Cash flow budgeting relies on historical data to allocate resources, often leading to incremental adjustments that may overlook inefficiencies in operational processes. Zero-based cash flow planning starts from a "zero base," requiring every expense to be justified, which enhances operational efficiency by identifying and eliminating non-essential costs. Organizations adopting zero-based planning report improved cash utilization and streamlined operations due to more precise allocation of funds aligned with current operational priorities.

Implementation Steps for Cash Flow Budgeting

Cash flow budgeting implementation begins with projecting all expected cash inflows and outflows over a specific period, ensuring accurate forecasting based on historical data and market trends. Next, allocate funds for operational needs, capital expenditures, and debt repayments while maintaining necessary liquidity levels. Finally, monitor actual cash flows against the budget regularly, adjusting estimates and operational activities to manage variances effectively and ensure financial stability.

How to Apply Zero-Based Cash Flow Planning in Operations

Zero-based cash flow planning in operations requires building every expense and cash outflow from the ground up, starting at zero to justify each cost item based on current needs and operational objectives. This approach involves detailed analysis of all operational processes, prioritizing cash allocations according to strategic goals, and eliminating redundant or non-essential expenses to optimize liquidity. Integrating real-time data and cross-departmental collaboration ensures accurate forecasting, flexible cash management, and improved alignment with financial targets compared to traditional cash flow budgeting methods.

Common Pitfalls to Avoid in Both Approaches

Common pitfalls in cash flow budgeting and zero-based cash flow planning include underestimating variable expenses and failing to account for seasonal fluctuations, which can lead to inaccurate forecasts. Overreliance on historical data without adjusting for current operational changes often results in cash shortfalls. Both approaches require continuous monitoring and adjustment to prevent liquidity issues and ensure operational stability.

Choosing the Right Method for Your Business Operations

Cash flow budgeting relies on historical data to forecast future inflows and outflows, making it suitable for businesses with stable, predictable operations. Zero-based cash flow planning starts from a zero base and requires justifying all expenses, offering greater accuracy and control for dynamic or rapidly changing businesses. Selecting the right method depends on your business's complexity, operational variability, and the need for detailed expense management.

Related Important Terms

Dynamic Envelope Budgeting

Dynamic Envelope Budgeting enhances cash flow management by allocating funds to specific operational categories based on real-time needs, contrasting with traditional cash flow budgeting that relies on static forecasts. This zero-based cash flow planning method eliminates arbitrary spending limits, ensuring every expense is justified and aligned with current operational priorities.

Rolling Cash Flow Projections

Rolling cash flow projections offer dynamic updates to cash flow budgeting by continuously revising forecasts based on actual operational performance and changing market conditions. Zero-based cash flow planning enhances accuracy in rolling projections by requiring justification for each expense from a zero base, ensuring precise allocation of operational funds.

Agile Cash Buffering

Cash flow budgeting allocates funds based on historical data and fixed projections, often limiting flexibility in dynamic operational environments. Zero-based cash flow planning, combined with Agile Cash Buffering, enhances responsiveness by continuously adjusting cash reserves to meet real-time operational demands and mitigate financial risks effectively.

Real-Time Variance Mapping

Cash flow budgeting provides a static financial plan based on historical data, while zero-based cash flow planning requires justifying every expense from scratch, enabling more precise allocation of resources. Real-time variance mapping enhances zero-based planning by instantly highlighting discrepancies between projected and actual cash flows, allowing operations to quickly adjust financial strategies and improve liquidity management.

Micro-Allocation Cash Planning

Cash flow budgeting forecasts inflows and outflows based on historical data and fixed categories, enabling stable micro-allocation of operational expenses with predictable variance control. Zero-based cash flow planning requires building each operational cash requirement from zero, promoting precise micro-allocation by justifying every expense for optimized resource utilization and minimizing unnecessary cash outflows.

Zero-Based Operating Disbursement

Zero-based operating disbursement prioritizes allocating cash flow by justifying every expense from zero, enhancing budget accuracy and operational efficiency. This method contrasts with traditional cash flow budgeting, which relies on historical data and often perpetuates previous expenditures without thorough evaluation.

Activity-Based Cash Flow Tracing

Activity-Based Cash Flow Tracing in Cash Flow Budgeting allocates cash inflows and outflows according to specific operational activities, enabling precise identification of cost drivers and resource use. In contrast, Zero-Based Cash Flow Planning requires each activity's cash requirements to be justified from scratch, fostering rigorous evaluation and optimization of operational cash flow at every planning cycle.

Predictive Surplus Optimization

Cash flow budgeting relies on historical data to project future cash inflows and outflows, often limiting the accuracy of predictive surplus optimization due to fixed assumptions. Zero-based cash flow planning starts from a clean slate, enabling detailed analysis of every expense and revenue stream, which enhances the precision of forecasting and maximizes predictive surplus optimization for operational efficiency.

Continuous Scenario Cash Rebalancing

Cash flow budgeting allocates resources based on historical data and fixed projections, while zero-based cash flow planning requires justifying all expenses from scratch, enabling more precise allocation of funds. Continuous Scenario Cash Rebalancing enhances zero-based planning by dynamically adjusting cash flow forecasts in real-time, optimizing operational liquidity and responsiveness to changing financial conditions.

Automated Expense Opportunity Flagging

Cash flow budgeting relies on historical data to project expenses, often missing real-time opportunities to optimize spending, whereas zero-based cash flow planning rigorously evaluates every expense from scratch, enabling automated expense opportunity flagging to identify unnecessary costs promptly. Implementing automated flagging systems within zero-based planning enhances operational efficiency by reducing wastage and improving cash flow accuracy through continuous expense reevaluation.

Cash flow budgeting vs Zero-based cash flow planning for operations. Infographic

moneydiff.com

moneydiff.com