Cash flow budgeting prioritizes tracking actual income and expenses to ensure positive liquidity and prevent overspending, creating a real-time financial picture. Butterfly budgeting divides expenses into fixed, variable, and discretionary categories, promoting balanced allocation and long-term savings goals. Choosing cash flow budgeting allows for more adaptable, day-to-day money management, while butterfly budgeting provides structure for disciplined financial planning.

Table of Comparison

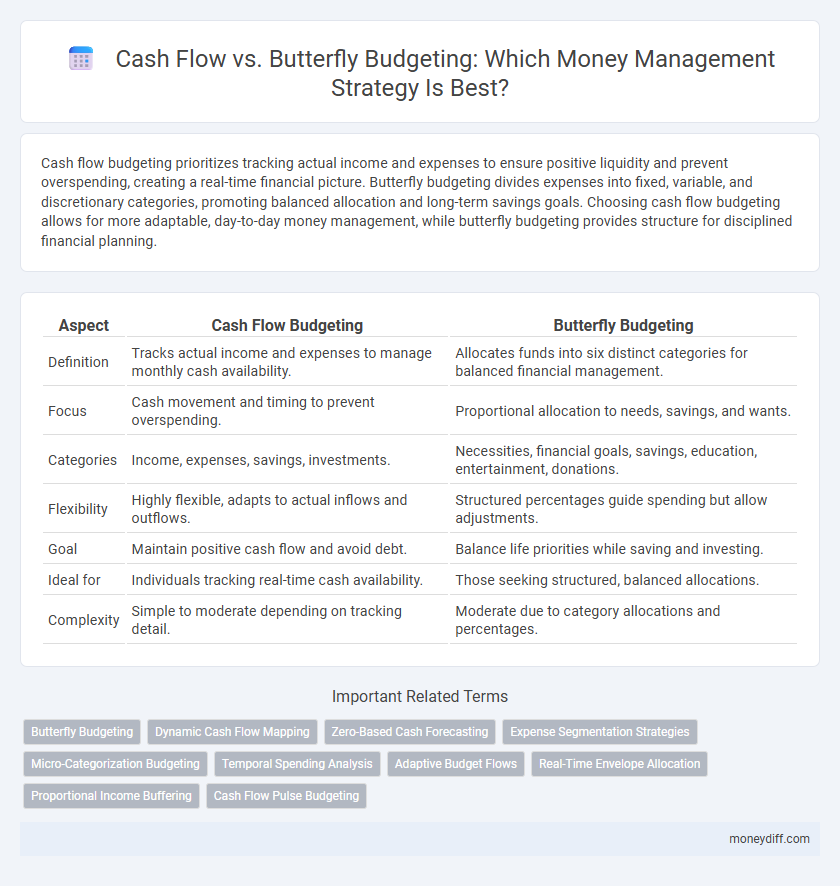

| Aspect | Cash Flow Budgeting | Butterfly Budgeting |

|---|---|---|

| Definition | Tracks actual income and expenses to manage monthly cash availability. | Allocates funds into six distinct categories for balanced financial management. |

| Focus | Cash movement and timing to prevent overspending. | Proportional allocation to needs, savings, and wants. |

| Categories | Income, expenses, savings, investments. | Necessities, financial goals, savings, education, entertainment, donations. |

| Flexibility | Highly flexible, adapts to actual inflows and outflows. | Structured percentages guide spending but allow adjustments. |

| Goal | Maintain positive cash flow and avoid debt. | Balance life priorities while saving and investing. |

| Ideal for | Individuals tracking real-time cash availability. | Those seeking structured, balanced allocations. |

| Complexity | Simple to moderate depending on tracking detail. | Moderate due to category allocations and percentages. |

Understanding Cash Flow in Money Management

Cash flow represents the inflows and outflows of money within a specific period, serving as a critical indicator of financial health and liquidity in money management. Unlike butterfly budgeting, which categorizes expenses into distinct "wings" for balanced allocation, understanding cash flow emphasizes tracking actual income against expenditures to ensure sufficient funds for obligations and savings. Effective cash flow analysis allows individuals and businesses to forecast financial positions, prevent overspending, and optimize resource allocation for sustainable growth.

Introduction to Butterfly Budgeting Method

The Butterfly Budgeting Method divides income into essential expenses, savings, and lifestyle categories, promoting balanced financial management. This approach enhances cash flow control by allocating funds more effectively than traditional methods, avoiding overspending in any single area. By visualizing income distribution, it supports sustainable money habits and improved long-term financial stability.

Key Differences: Cash Flow vs Butterfly Budgeting

Cash flow management tracks actual income and expenses to ensure liquidity and avoid deficits, while butterfly budgeting divides spending into three categories: fixed costs, variable costs, and savings or investments for balanced financial planning. Cash flow offers real-time insights for short-term adjustments, whereas butterfly budgeting emphasizes long-term allocation aligned with financial goals. The key difference lies in cash flow's focus on cash availability versus butterfly budgeting's structured approach to distribute funds systematically.

Benefits and Drawbacks of Cash Flow Techniques

Cash flow techniques provide real-time tracking of income and expenses, allowing precise control over money management and ensuring bills are paid on time, which reduces the risk of overdrafts. However, these methods can become complex and time-consuming without proper tools or discipline, potentially leading to overlooked expenses. Unlike Butterfly budgeting, cash flow focuses more on immediate liquidity rather than fixed allocation, which may limit long-term strategic savings planning.

Pros and Cons of Butterfly Budgeting Strategies

Butterfly budgeting divides income into multiple categories with varying allocation percentages, promoting detailed tracking and ensuring essential expenses and savings receive focused attention. This strategy enhances financial discipline by preventing overspending in one category but can become complex and time-consuming to manage compared to straightforward cash flow methods. While it offers granular control, the rigidity of set percentages may limit flexibility in adapting to unexpected financial changes or irregular income.

Choosing the Right Approach for Your Financial Goals

Cash flow management focuses on tracking income and expenses to maintain liquidity, while Butterfly budgeting allocates funds across multiple categories based on priority and balance. Selecting the right approach depends on whether your financial goals prioritize real-time cash availability or structured allocation for spending and saving. Assess your income variability and spending habits to determine if a dynamic cash flow system or a methodical Butterfly budget better supports your money management objectives.

Managing Irregular Income: Cash Flow vs Butterfly Budgeting

Cash flow management provides real-time tracking of income and expenses, making it ideal for individuals with irregular income by allowing flexible adjustments as cash inflows fluctuate. Butterfly budgeting allocates income into specific categories for needs, savings, and wants, offering a structured but potentially rigid approach that may not adapt well to unpredictable earnings. Effective money management for irregular income prioritizes dynamic cash flow strategies over fixed category allocations to maintain financial stability.

Common Cash Flow Mistakes to Avoid

Common cash flow mistakes to avoid include underestimating expenses, failing to track income accurately, and neglecting to plan for irregular or unexpected costs. Butterfly budgeting can help address these issues by categorizing cash inflows and outflows into distinct "wings," allowing for better visualization and control of financial resources. Regularly reviewing cash flow statements and adjusting budgets based on real data prevents cash shortages and ensures sustainable money management.

Practical Steps to Implement Butterfly Budgeting

To implement Butterfly Budgeting effectively, begin by categorizing your income into essential needs, long-term savings, and discretionary spending, typically allocating around 50%, 30%, and 20% respectively. Track every expense meticulously using budgeting apps like Mint or YNAB to ensure adherence to these allocations and adjust categories monthly based on actual spending patterns. Establish automated transfers for savings and bills to maintain financial discipline, enhancing both cash flow visibility and control over discretionary expenditures.

Which Method Fits Your Lifestyle? A Comparative Analysis

Cash flow budgeting emphasizes tracking income and expenses in real time to maintain liquidity, ideal for individuals seeking flexible money management tailored to variable earnings. Butterfly budgeting divides income into distinct categories for savings, investments, and spending, offering a structured approach suited for those who prefer disciplined financial planning. Choosing between cash flow and butterfly budgeting depends on your lifestyle needs, financial goals, and preference for either adaptability or systematic allocation.

Related Important Terms

Butterfly Budgeting

Butterfly budgeting allocates income into specific categories for essential expenses, financial goals, and lifestyle choices, optimizing cash flow management by ensuring balanced spending and saving. This method contrasts with basic cash flow tracking by providing a structured framework that promotes disciplined financial planning and long-term wealth building.

Dynamic Cash Flow Mapping

Dynamic Cash Flow Mapping offers a real-time visualization of income and expenses, enabling precise tracking and adjustment compared to the static allocation approach of Butterfly Budgeting. By continuously monitoring cash inflows and outflows, this method enhances financial flexibility and optimizes money management decisions.

Zero-Based Cash Forecasting

Zero-based cash forecasting enhances cash flow management by allocating every dollar of income to specific expenses, ensuring no funds remain unassigned and eliminating waste. Unlike butterfly budgeting, which categorizes expenses into fixed and variable groups, zero-based forecasting provides a more precise, real-time approach to managing cash inflows and outflows for optimal financial control.

Expense Segmentation Strategies

Cash flow management relies on real-time tracking of income and expenses to ensure liquidity, whereas Butterfly budgeting emphasizes dividing money into specific categories like necessities, savings, and discretionary spending to optimize financial control. Expense segmentation strategies in Butterfly budgeting allocate funds into multiple distinct envelopes, promoting disciplined spending and enhanced visibility of financial priorities compared to the more fluid cash flow approach.

Micro-Categorization Budgeting

Micro-categorization budgeting within cash flow management enables precise tracking of income and expenses by breaking down financial activities into granular categories. This approach enhances control over spending patterns compared to Butterfly budgeting, which offers broader category allocations that may overlook detailed cash flow dynamics.

Temporal Spending Analysis

Cash flow management emphasizes tracking income and expenses over daily, weekly, and monthly cycles to ensure liquidity and avoid overspending. Butterfly budgeting allocates funds into distinct categories with fixed percentages, promoting balanced distribution but may lack real-time temporal spending analysis needed for dynamic cash flow adjustments.

Adaptive Budget Flows

Adaptive Budget Flows leverage real-time cash flow analysis to dynamically allocate funds between essential expenses and discretionary spending, optimizing financial flexibility and reducing the risk of overspending. Unlike rigid Butterfly budgeting, which categorizes income into fixed percentages, Adaptive Budget Flows adjust allocations based on fluctuating cash inflows and outflows to better align with immediate financial priorities.

Real-Time Envelope Allocation

Real-time envelope allocation in cash flow management enables precise tracking and immediate adjustments to spending, unlike butterfly budgeting which relies on predefined periodic categories that may not reflect current financial status. By dynamically allocating funds as income arrives, real-time envelope allocation enhances liquidity control and prevents overspending through continuous monitoring of available cash reserves.

Proportional Income Buffering

Cash flow management emphasizes tracking actual income and expenses in real-time to maintain liquidity, while Butterfly budgeting allocates proportional income buffering by dividing earnings into specific categories like necessities, savings, and discretionary spending for balanced financial growth. Proportional income buffering in Butterfly budgeting ensures that a fixed percentage of each paycheck is reserved for essential expenses and savings, improving long-term financial stability compared to the reactive adjustments typical in cash flow tracking.

Cash Flow Pulse Budgeting

Cash Flow Pulse Budgeting prioritizes real-time tracking of income and expenses to maintain a consistent cash flow, enabling swift adjustments to spending patterns for improved financial stability. Unlike Butterfly Budgeting, which divides income into fixed percentages for categories, Cash Flow Pulse offers dynamic flexibility, optimizing liquidity and reducing cash shortfalls.

Cash flow vs Butterfly budgeting for money management. Infographic

moneydiff.com

moneydiff.com