Historical cash flow review provides a detailed analysis of past income and expenses, helping identify spending patterns and areas for improvement. Predictive cash flow modeling uses this data to forecast future financial positions, enabling more accurate budgeting and proactive money management. Combining both approaches ensures a comprehensive understanding of cash flow dynamics for optimized financial decisions.

Table of Comparison

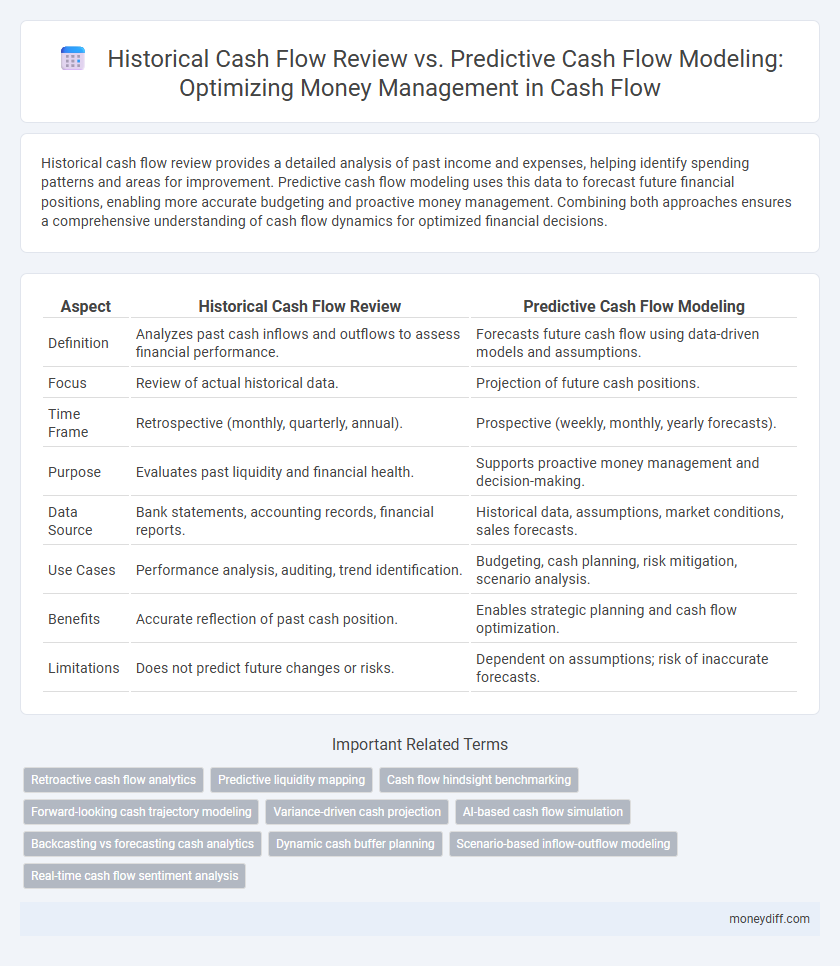

| Aspect | Historical Cash Flow Review | Predictive Cash Flow Modeling |

|---|---|---|

| Definition | Analyzes past cash inflows and outflows to assess financial performance. | Forecasts future cash flow using data-driven models and assumptions. |

| Focus | Review of actual historical data. | Projection of future cash positions. |

| Time Frame | Retrospective (monthly, quarterly, annual). | Prospective (weekly, monthly, yearly forecasts). |

| Purpose | Evaluates past liquidity and financial health. | Supports proactive money management and decision-making. |

| Data Source | Bank statements, accounting records, financial reports. | Historical data, assumptions, market conditions, sales forecasts. |

| Use Cases | Performance analysis, auditing, trend identification. | Budgeting, cash planning, risk mitigation, scenario analysis. |

| Benefits | Accurate reflection of past cash position. | Enables strategic planning and cash flow optimization. |

| Limitations | Does not predict future changes or risks. | Dependent on assumptions; risk of inaccurate forecasts. |

Introduction to Cash Flow Management

Historical cash flow review provides valuable insights by analyzing past inflows and outflows to identify trends and patterns crucial for effective money management. Predictive cash flow modeling leverages statistical techniques and real-time data to forecast future cash positions, enabling proactive financial planning and risk mitigation. Combining these approaches enhances overall cash flow management by balancing retrospective analysis with forward-looking predictions.

Understanding Historical Cash Flow Review

Understanding historical cash flow review involves analyzing past inflows and outflows to identify spending patterns and financial trends. This analysis provides a foundation for accurate budget adjustments and risk assessment by highlighting periods of surplus or deficit. Accurate historical cash flow data supports better forecasting and informed decision-making in money management strategies.

Defining Predictive Cash Flow Modeling

Predictive cash flow modeling uses historical cash flow data combined with statistical algorithms and machine learning techniques to forecast future financial positions accurately. It incorporates variables such as seasonal trends, payment cycles, and market fluctuations to generate dynamic cash flow projections. This proactive approach enables businesses to optimize liquidity management, reduce financial risks, and improve strategic planning over traditional historical cash flow reviews.

Key Differences Between Historical and Predictive Approaches

Historical cash flow review relies on analyzing past financial transactions to assess liquidity trends and identify spending patterns, providing a factual basis for cash management decisions. Predictive cash flow modeling uses algorithms and forecasting techniques to estimate future cash inflows and outflows, enabling proactive planning and risk mitigation. Key differences include the reliance on historical data versus forward-looking projections and the reactive nature of historical analysis compared to the strategic foresight facilitated by predictive models.

Advantages of Historical Cash Flow Analysis

Historical cash flow analysis provides a reliable foundation by utilizing actual past financial data to identify spending patterns, revenue cycles, and liquidity trends that aid in accurate money management. This method reduces forecasting errors and helps businesses understand cash inflows and outflows with greater precision, supporting informed decision-making. Companies leveraging historical cash flow review can more effectively detect anomalies, optimize operational budgets, and improve risk assessment compared to purely predictive models.

Benefits of Predictive Cash Flow Modeling

Predictive cash flow modeling enables businesses to anticipate future cash inflows and outflows with greater accuracy, improving financial planning and decision-making. This proactive approach reduces the risk of liquidity shortfalls and enhances the ability to allocate resources efficiently. Unlike historical cash flow reviews that rely on past data, predictive models incorporate real-time variables and market trends, offering dynamic insights for effective money management.

Limitations of Relying Solely on Historical Data

Relying solely on historical cash flow data for money management often overlooks dynamic market conditions and emerging financial trends, leading to inaccurate forecasts and potential liquidity issues. Historical data may not capture sudden changes in customer behavior, seasonal fluctuations, or unforeseen economic disruptions, limiting its predictive value. Incorporating predictive cash flow modeling enhances financial decision-making by integrating real-time variables and scenario analysis, providing a more robust understanding of future cash positions.

Enhancing Forecast Accuracy with Predictive Tools

Historical cash flow review provides a foundational understanding of past inflows and outflows, enabling identification of spending patterns and seasonal trends that inform money management strategies. Predictive cash flow modeling leverages advanced algorithms and real-time data integration to forecast future cash positions with greater precision, allowing proactive budgeting and risk mitigation. Enhancing forecast accuracy through predictive tools improves liquidity management, reduces unexpected shortfalls, and supports more strategic financial decision-making.

Integrating Historical and Predictive Methods for Optimal Results

Integrating historical cash flow review with predictive cash flow modeling enhances money management by combining actual past financial data with forward-looking projections to improve accuracy and reliability. Historical cash flow analysis identifies trends and seasonal fluctuations, while predictive models use statistical techniques and machine learning to forecast future liquidity needs. This hybrid approach enables businesses to optimize cash reserves, avoid shortfalls, and make informed investment decisions based on comprehensive cash flow insights.

Best Practices for Effective Cash Flow Management

Historical cash flow review offers valuable insights by analyzing past cash inflows and outflows to identify spending patterns and liquidity trends crucial for informed decision-making. Predictive cash flow modeling enhances money management by forecasting future cash positions using statistical techniques and real-time data, enabling proactive adjustments to avoid shortfalls. Combining historical analysis with predictive modeling establishes best practices for effective cash flow management, ensuring accuracy, timely interventions, and optimized financial planning.

Related Important Terms

Retroactive cash flow analytics

Historical cash flow review provides essential retroactive cash flow analytics by analyzing past inflows and outflows to identify trends, seasonal patterns, and anomalies for informed money management. This data-driven approach enhances accuracy in cash forecasting models by grounding predictions in verified historical financial performance.

Predictive liquidity mapping

Predictive liquidity mapping uses historical cash flow data alongside real-time financial inputs to forecast future liquidity positions accurately, enabling proactive money management and risk mitigation. This approach improves decision-making by identifying cash shortages and surpluses before they occur, ensuring optimal allocation of financial resources.

Cash flow hindsight benchmarking

Historical cash flow review provides critical hindsight benchmarking by analyzing past inflows and outflows to identify patterns and discrepancies, enhancing the accuracy of future cash flow predictions. Predictive cash flow modeling leverages this benchmarked data to forecast cash positions, optimize liquidity management, and support strategic financial planning.

Forward-looking cash trajectory modeling

Forward-looking cash trajectory modeling leverages predictive analytics and real-time data to forecast future cash inflows and outflows, enabling proactive money management and liquidity optimization. This approach surpasses historical cash flow reviews by identifying potential financial gaps and opportunities, supporting strategic decision-making and risk mitigation.

Variance-driven cash projection

Variance-driven cash projection leverages discrepancies identified in historical cash flow data to refine predictive cash flow modeling, enhancing money management accuracy. By analyzing past cash inflow and outflow variances, businesses can create dynamic forecasts that adjust to unexpected financial fluctuations, optimizing liquidity planning.

AI-based cash flow simulation

AI-based cash flow simulation leverages machine learning algorithms to analyze historical cash flow data, identifying patterns and anomalies for more accurate future projections. By integrating real-time financial inputs, predictive cash flow modeling enhances money management strategies, enabling proactive decision-making and optimized liquidity planning.

Backcasting vs forecasting cash analytics

Backcasting analyzes historical cash flow data to identify patterns and gaps, enabling accurate reconstruction of past financial performance for improved money management. Forecasting cash flow modeling uses predictive analytics and machine learning to project future cash inflows and outflows, supporting proactive financial planning and risk mitigation.

Dynamic cash buffer planning

Historical cash flow review provides essential insights into past liquidity trends, enabling accurate calibration of dynamic cash buffer planning. Predictive cash flow modeling enhances money management by forecasting future cash inflows and outflows, optimizing buffer levels to maintain financial stability and avoid liquidity shortfalls.

Scenario-based inflow-outflow modeling

Scenario-based inflow-outflow modeling enhances predictive cash flow accuracy by simulating various financial conditions, enabling proactive money management strategies. Historical cash flow review provides essential baseline data but lacks the dynamic insight required for anticipating liquidity challenges in evolving market environments.

Real-time cash flow sentiment analysis

Historical cash flow review provides valuable insights into past financial trends, aiding in identifying recurring patterns and seasonal fluctuations, while predictive cash flow modeling leverages algorithms and real-time cash flow sentiment analysis to forecast future liquidity needs with greater accuracy. Integrating sentiment analysis of transaction data enhances predictive models by capturing instantaneous market reactions and behavioral cues, enabling more dynamic and responsive money management strategies.

Historical cash flow review vs predictive cash flow modeling for money management. Infographic

moneydiff.com

moneydiff.com