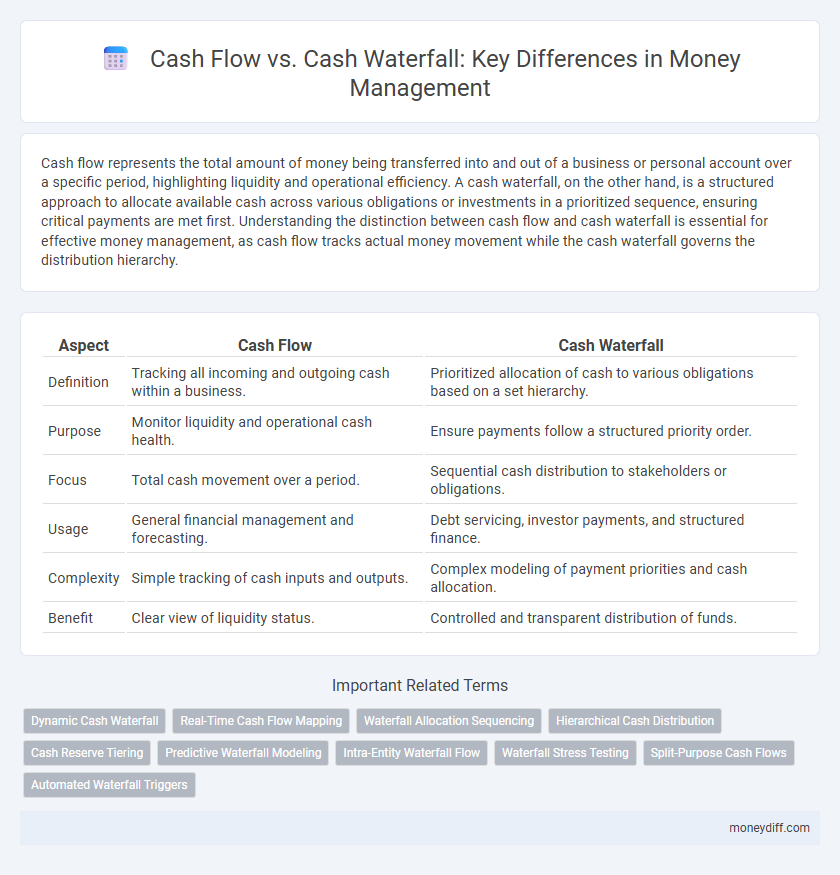

Cash flow represents the total amount of money being transferred into and out of a business or personal account over a specific period, highlighting liquidity and operational efficiency. A cash waterfall, on the other hand, is a structured approach to allocate available cash across various obligations or investments in a prioritized sequence, ensuring critical payments are met first. Understanding the distinction between cash flow and cash waterfall is essential for effective money management, as cash flow tracks actual money movement while the cash waterfall governs the distribution hierarchy.

Table of Comparison

| Aspect | Cash Flow | Cash Waterfall |

|---|---|---|

| Definition | Tracking all incoming and outgoing cash within a business. | Prioritized allocation of cash to various obligations based on a set hierarchy. |

| Purpose | Monitor liquidity and operational cash health. | Ensure payments follow a structured priority order. |

| Focus | Total cash movement over a period. | Sequential cash distribution to stakeholders or obligations. |

| Usage | General financial management and forecasting. | Debt servicing, investor payments, and structured finance. |

| Complexity | Simple tracking of cash inputs and outputs. | Complex modeling of payment priorities and cash allocation. |

| Benefit | Clear view of liquidity status. | Controlled and transparent distribution of funds. |

Understanding Cash Flow in Money Management

Cash flow represents the movement of money into and out of a business, essential for maintaining liquidity and funding daily operations. In contrast, a cash waterfall allocates incoming cash according to a predetermined priority sequence, ensuring obligations such as debt repayments and operational expenses are met systematically. Understanding cash flow provides insight into overall financial health, while the cash waterfall offers a structured approach to managing cash distribution efficiently.

What Is a Cash Waterfall?

A cash waterfall is a financial model that outlines the priority and sequence in which incoming cash flows are distributed among stakeholders or obligations. It is commonly used in complex financing and investment structures to ensure orderly allocation of funds based on predefined rules. Unlike general cash flow management, a cash waterfall provides a structured hierarchy that prioritizes payments such as operating expenses, debt service, and equity returns.

Key Differences Between Cash Flow and Cash Waterfall

Cash flow represents the total amount of money moving in and out of a business, highlighting overall liquidity, while cash waterfall breaks down cash allocations in a structured priority order, ensuring debt repayments, operating expenses, and distributions are handled sequentially. The key difference lies in cash flow's broad overview versus cash waterfall's detailed, prioritized cash distribution framework. Understanding these distinctions enhances effective money management and financial forecasting accuracy.

Advantages of Cash Flow Analysis

Cash flow analysis provides a clear understanding of inflows and outflows over a specific period, enabling more accurate forecasting and liquidity management. It helps identify potential cash deficits early, improving decision-making and ensuring operational stability. Unlike cash waterfall models, cash flow analysis offers granular insights into timing and sources of cash, optimizing working capital and reducing financial risks.

Benefits of Utilizing a Cash Waterfall Structure

A cash waterfall structure enhances money management by prioritizing payments and cash allocations, ensuring critical obligations are met first while optimizing liquidity. This systematic approach increases transparency and control over cash flow, facilitating strategic financial planning and risk mitigation. Businesses benefit from improved capital efficiency and reduced default risk by clearly defining the sequence of cash disbursements.

Common Applications of Cash Flow vs Cash Waterfall

Cash flow management tracks the inflow and outflow of money to ensure liquidity and operational efficiency, commonly applied in budgeting and forecasting. Cash waterfall models allocate cash sequentially to prioritize payments such as debt servicing, investor distributions, and operating expenses, frequently used in project finance and corporate restructuring. Businesses leverage cash flow analysis for day-to-day financial health, while cash waterfall structures optimize capital distribution in complex multi-party agreements.

How to Choose Between Cash Flow and Cash Waterfall

Choosing between cash flow and cash waterfall methods depends on the complexity and transparency required in money management. Cash flow analysis provides a straightforward overview of all cash inflows and outflows, ideal for businesses needing regular liquidity tracking. Cash waterfall models allocate cash sequentially to different stakeholders or financial obligations, offering granular control and prioritization in complex financial structures.

Misconceptions About Cash Flow and Cash Waterfall

Many financial professionals confuse cash flow with the cash waterfall, mistakenly using them interchangeably despite their distinct functions in money management. Cash flow refers to the net amount of cash moving in and out of a business over a period, while the cash waterfall delineates the hierarchical allocation of available capital across various obligations and stakeholders. Understanding these differences is crucial for accurate financial analysis and effective capital distribution planning.

Impact on Financial Decision-Making

Cash flow provides a real-time snapshot of available liquidity, directly influencing short-term financial decisions such as operational expenses and investment timing. In contrast, the cash waterfall prioritizes payments by allocating incoming cash sequentially according to pre-set hierarchies, offering a structured approach that impacts long-term obligations and risk management. Understanding both frameworks enhances precision in forecasting cash availability and optimizing capital deployment strategies.

Best Practices for Effective Cash Allocation

Effective cash allocation requires understanding the distinction between cash flow and cash waterfall methodologies. Cash flow provides a real-time overview of liquidity by tracking inflows and outflows, while a cash waterfall prioritizes payments based on contractual obligations to ensure critical expenses are met first. Best practices include regularly forecasting cash flow to maintain optimal liquidity levels and implementing a cash waterfall structure to systematically manage debt servicing, operational costs, and discretionary spending for balanced financial control.

Related Important Terms

Dynamic Cash Waterfall

Dynamic Cash Waterfall offers a more granular and real-time visualization of cash flow compared to traditional cash flow statements, enabling precise allocation of funds across multiple accounts and obligations. This approach enhances money management by dynamically prioritizing payments, optimizing liquidity, and mitigating the risk of cash shortfalls.

Real-Time Cash Flow Mapping

Real-time cash flow mapping provides instant visibility into cash inflows and outflows, enabling precise tracking and management of liquidity. Cash waterfalls prioritize payment allocation sequences, but real-time cash flow insights allow businesses to dynamically adjust strategies for optimized money management and improved financial decision-making.

Waterfall Allocation Sequencing

Cash flow management ensures liquidity by tracking inflows and outflows, while cash waterfall allocation sequencing organizes payments hierarchically to prioritize debt servicing, operating expenses, and reinvestments. This structured approach enhances financial control by systematically distributing available cash according to predefined rules, optimizing capital deployment and reducing default risk.

Hierarchical Cash Distribution

Hierarchical cash distribution in cash waterfalls allocates available funds sequentially according to priority, ensuring senior obligations are met before subordinate claims, which enhances structured financial management compared to general cash flow monitoring. Cash flow tracks overall liquidity, while cash waterfalls provide a detailed framework for distributing cash based on contractual hierarchies and predefined rules.

Cash Reserve Tiering

Cash flow management focuses on tracking and optimizing the inflow and outflow of cash to ensure liquidity and operational stability, while cash waterfall models prioritize the sequential allocation of cash to different obligations based on predefined tiers. Cash reserve tiering strategically segments cash reserves into multiple levels, providing a structured framework that enhances financial flexibility and risk mitigation by prioritizing essential payments and investment opportunities.

Predictive Waterfall Modeling

Predictive Waterfall Modeling enhances cash flow management by forecasting the sequential allocation of incoming funds based on predefined priorities and obligations, enabling businesses to optimize liquidity and prevent shortfalls. Unlike traditional cash flow analysis, this approach provides a dynamic, scenario-based view of cash distribution, improving financial planning accuracy and operational decision-making.

Intra-Entity Waterfall Flow

Intra-Entity Waterfall Flow optimizes cash flow management by systematically allocating funds within different departments or subsidiaries according to predefined priorities and thresholds. This approach enhances transparency and control over liquidity distribution, contrasting with general cash flow analysis by providing a structured, hierarchical disbursement of cash resources.

Waterfall Stress Testing

Cash waterfall models prioritize the sequential allocation of cash inflows to stakeholders, enabling precise stress testing of liquidity under various scenarios by simulating possible payment shortfalls and prioritizing obligations accordingly. This structured approach offers enhanced visibility into cash flow vulnerabilities compared to traditional cash flow analysis, improving risk management and decision-making accuracy.

Split-Purpose Cash Flows

Split-purpose cash flows enhance money management by categorizing inflows and outflows according to specific objectives, ensuring precise allocation and tracking of funds. Unlike a traditional cash waterfall that prioritizes payments in a hierarchical order, split-purpose cash flows optimize liquidity by simultaneously addressing diverse financial commitments such as operating expenses, debt servicing, and capital investments.

Automated Waterfall Triggers

Automated waterfall triggers streamline cash flow management by systematically allocating funds according to predefined priorities, ensuring timely payments and optimized liquidity. This automation reduces manual errors and enhances real-time cash visibility, improving overall financial control and forecasting accuracy.

Cash flow vs Cash waterfall for money management. Infographic

moneydiff.com

moneydiff.com