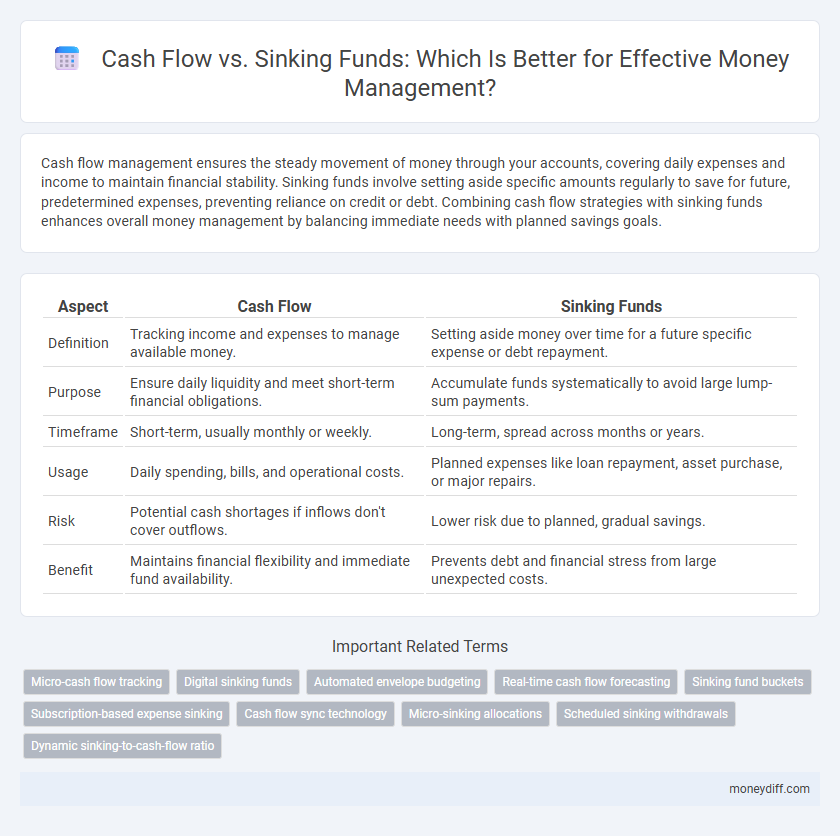

Cash flow management ensures the steady movement of money through your accounts, covering daily expenses and income to maintain financial stability. Sinking funds involve setting aside specific amounts regularly to save for future, predetermined expenses, preventing reliance on credit or debt. Combining cash flow strategies with sinking funds enhances overall money management by balancing immediate needs with planned savings goals.

Table of Comparison

| Aspect | Cash Flow | Sinking Funds |

|---|---|---|

| Definition | Tracking income and expenses to manage available money. | Setting aside money over time for a future specific expense or debt repayment. |

| Purpose | Ensure daily liquidity and meet short-term financial obligations. | Accumulate funds systematically to avoid large lump-sum payments. |

| Timeframe | Short-term, usually monthly or weekly. | Long-term, spread across months or years. |

| Usage | Daily spending, bills, and operational costs. | Planned expenses like loan repayment, asset purchase, or major repairs. |

| Risk | Potential cash shortages if inflows don't cover outflows. | Lower risk due to planned, gradual savings. |

| Benefit | Maintains financial flexibility and immediate fund availability. | Prevents debt and financial stress from large unexpected costs. |

Understanding Cash Flow: The Money Management Essential

Cash flow represents the real-time movement of money in and out of a business or personal account, serving as the foundation for effective money management. Sinking funds are strategic savings set aside for specific future expenses, complementing cash flow by ensuring funds are available without disrupting daily finances. Understanding the dynamic between cash flow and sinking funds enables better financial planning, liquidity maintenance, and long-term stability.

What Are Sinking Funds? Key Concepts Explained

Sinking funds are dedicated savings accounts where money is set aside regularly to cover future expenses or debt repayments, contrasting with cash flow, which manages the timing and amount of cash inflows and outflows. These funds ensure financial stability by providing a disciplined approach to saving for anticipated costs without disrupting daily operations or liquidity. Understanding sinking funds is crucial for effective money management as they reduce the risk of sudden financial shortfalls and help match cash outflows with available resources.

Cash Flow vs Sinking Funds: Core Differences

Cash flow represents the total amount of money moving in and out of a business or personal finances over a specific period, essential for daily operations and liquidity management. Sinking funds refer to reserves set aside systematically for future large expenses or debt repayment, ensuring financial stability without disrupting regular cash flow. The core difference lies in cash flow's continuous liquidity role versus sinking funds' targeted, long-term financial planning purpose.

Benefits of Prioritizing Cash Flow

Prioritizing cash flow ensures liquidity for day-to-day expenses and unexpected costs, maintaining operational stability and financial flexibility. Positive cash flow supports timely debt payments, reducing interest obligations and improving creditworthiness. Effective cash flow management enables reinvestment opportunities and strengthens the business's resilience against market fluctuations.

The Role of Sinking Funds in Financial Planning

Sinking funds play a crucial role in financial planning by gradually setting aside money for future expenses, reducing the reliance on irregular cash flow or high-interest debt. They enhance cash flow management by ensuring funds are available for specific goals like debt repayment, asset replacement, or large purchases. This proactive approach stabilizes finances and supports long-term financial health.

How to Set Up and Track Sinking Funds

Setting up sinking funds begins with identifying specific financial goals and allocating a fixed amount regularly into separate accounts dedicated to each goal, ensuring funds accumulate without impacting daily cash flow. Tracking sinking funds effectively involves using budgeting tools or spreadsheets to monitor contributions, progress, and adjust amounts based on changes in income or expenses. This strategic approach helps maintain liquidity while systematically saving for future large expenses, optimizing overall cash flow management.

Cash Flow Strategies for Everyday Expenses

Effective cash flow strategies for everyday expenses prioritize maintaining a positive cash inflow to cover daily operational costs and avoid liquidity shortages. Regularly monitoring cash inflows and outflows enables timely adjustments, ensuring that essential expenses such as utilities, payroll, and supplies are consistently met. Utilizing forecasting tools to predict cash flow patterns enhances budget accuracy and supports sustained financial stability without compromising sinking fund allocations.

When to Use Sinking Funds Over Cash Flow

Sinking funds are ideal for managing predictable, large expenses over time without disrupting daily cash flow, allowing for strategic allocation toward specific financial goals like debt repayment or asset replacement. Cash flow management prioritizes maintaining liquidity for everyday operational expenses and unforeseen costs, which may be insufficient for long-term financial commitments. Using sinking funds over regular cash flow is advisable when allocating funds systematically reduces financial strain and enhances budgeting accuracy for future obligations.

Combining Cash Flow and Sinking Funds for Balanced Finances

Combining cash flow management with sinking funds enhances financial stability by ensuring regular income covers day-to-day expenses while systematically saving for future liabilities. Cash flow tracking identifies surplus funds that can be allocated to sinking funds, promoting disciplined savings for large expenses without disrupting monthly budgets. This integrated approach reduces financial stress and improves long-term money management efficiency.

Common Mistakes in Managing Cash Flow and Sinking Funds

Common mistakes in managing cash flow and sinking funds include underestimating expenses and failing to align sinking fund goals with cash inflows, leading to liquidity shortages. Inaccurate forecasting and neglecting regular contributions to sinking funds disrupt long-term financial stability and hinder effective money management. Overreliance on cash flow without a disciplined sinking fund strategy increases vulnerability to unexpected expenses and debt accumulation.

Related Important Terms

Micro-cash flow tracking

Micro-cash flow tracking provides real-time insights into daily income and expenses, enabling precise adjustments to maintain sufficient liquidity without over-allocating funds to sinking funds. Effective management involves balancing immediate cash flow needs with periodic savings in sinking funds for anticipated large expenses, optimizing overall financial stability.

Digital sinking funds

Digital sinking funds enhance cash flow management by automating savings for future expenses, reducing the risk of unexpected financial shortfalls. Integrating these funds with real-time cash flow tracking tools optimizes budgeting accuracy and ensures liquidity for planned obligations.

Automated envelope budgeting

Automated envelope budgeting enhances cash flow management by allocating income into digital envelopes for specific expenses, improving spending control and preventing overspending. Unlike sinking funds, which reserve money for future large expenses, automated envelope budgeting dynamically adjusts cash flow in real-time, ensuring efficient daily money management.

Real-time cash flow forecasting

Real-time cash flow forecasting provides dynamic insights for managing liquidity, allowing businesses to anticipate short-term financial needs more accurately than sinking funds, which allocate fixed amounts over time for future obligations. This proactive approach helps optimize working capital by adjusting expenditures and investments immediately based on real-time inflows and outflows, enhancing financial agility.

Sinking fund buckets

Sinking fund buckets enhance cash flow management by allocating specific amounts for future expenses, preventing financial strain from large payments and improving budgeting accuracy. This structured approach ensures that funds are consistently set aside, reducing the risk of cash flow interruptions and promoting long-term financial stability.

Subscription-based expense sinking

Managing subscription-based expenses through sinking funds enhances cash flow stability by allocating specific amounts monthly to cover recurring payments without impacting operational liquidity. This proactive approach ensures consistent budgeting, reduces financial strain during billing cycles, and improves overall money management efficiency.

Cash flow sync technology

Cash flow sync technology enables real-time tracking and forecasting of inflows and outflows, ensuring optimal liquidity management compared to traditional sinking funds that allocate fixed amounts over time. By integrating automated cash flow synchronization, businesses can dynamically adjust financial reserves, minimizing idle funds and enhancing strategic expenditure planning.

Micro-sinking allocations

Micro-sinking allocations optimize cash flow by systematically setting aside small, targeted amounts for specific future expenses, reducing financial strain compared to lump-sum sinking funds. This granular approach enhances liquidity management by aligning funds with precise cash flow cycles, improving budget predictability and minimizing the risk of shortfalls.

Scheduled sinking withdrawals

Scheduled sinking withdrawals ensure disciplined cash flow management by allocating specific funds at predetermined intervals to cover future liabilities or asset replacements, reducing financial strain. This approach contrasts with general cash flow practices by earmarking exact amounts for obligations, enhancing predictability and long-term fiscal stability.

Dynamic sinking-to-cash-flow ratio

The dynamic sinking-to-cash-flow ratio optimizes money management by balancing readily available cash flow with planned sinking fund contributions to meet future liabilities. Monitoring this ratio ensures sufficient liquidity for operational needs while systematically allocating funds for long-term financial goals, enhancing overall fiscal stability.

Cash flow vs Sinking funds for money management. Infographic

moneydiff.com

moneydiff.com