Cash flow management ensures businesses maintain sufficient liquidity by tracking incoming and outgoing funds, while automated real-time reconciliation streamlines the process by instantly matching transactions to bank statements. This automation reduces errors, accelerates financial reporting, and provides up-to-date insights for effective money management. Leveraging both cash flow monitoring and automated reconciliation enhances accuracy and supports timely decision-making in financial operations.

Table of Comparison

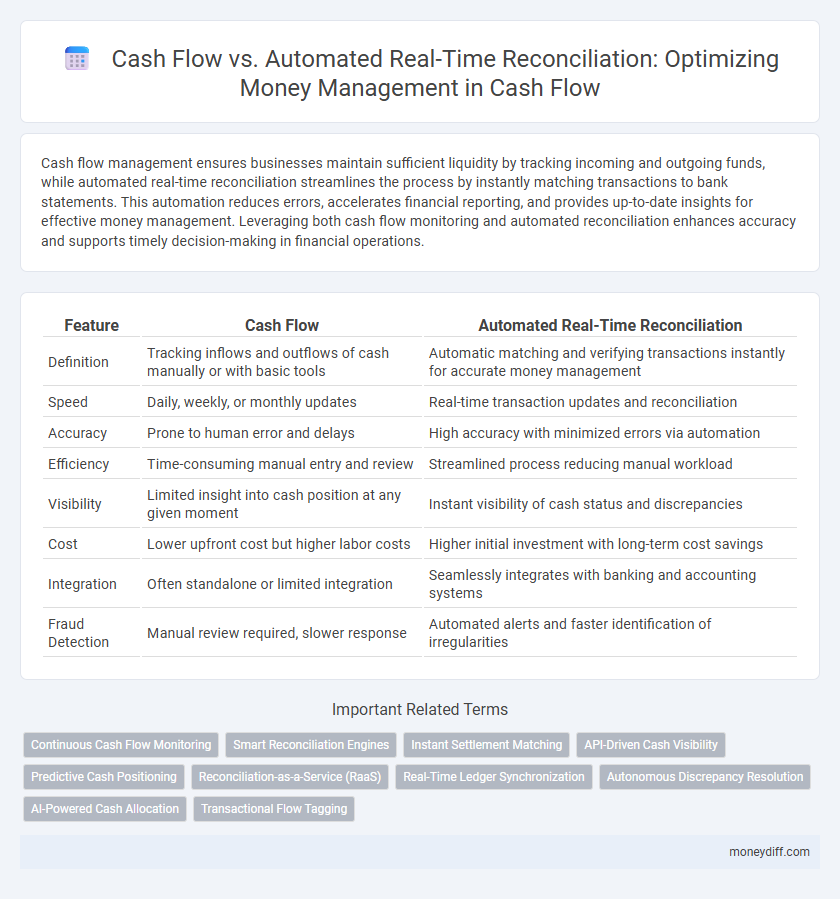

| Feature | Cash Flow | Automated Real-Time Reconciliation |

|---|---|---|

| Definition | Tracking inflows and outflows of cash manually or with basic tools | Automatic matching and verifying transactions instantly for accurate money management |

| Speed | Daily, weekly, or monthly updates | Real-time transaction updates and reconciliation |

| Accuracy | Prone to human error and delays | High accuracy with minimized errors via automation |

| Efficiency | Time-consuming manual entry and review | Streamlined process reducing manual workload |

| Visibility | Limited insight into cash position at any given moment | Instant visibility of cash status and discrepancies |

| Cost | Lower upfront cost but higher labor costs | Higher initial investment with long-term cost savings |

| Integration | Often standalone or limited integration | Seamlessly integrates with banking and accounting systems |

| Fraud Detection | Manual review required, slower response | Automated alerts and faster identification of irregularities |

Understanding Cash Flow in Modern Money Management

Cash flow represents the net amount of cash moving in and out of a business, crucial for maintaining liquidity and meeting operational expenses. Automated real-time reconciliation streamlines money management by instantly matching transactions, reducing errors and providing up-to-date financial insights. Integrating cash flow analysis with automated reconciliation enhances decision-making accuracy and supports proactive financial planning.

The Importance of Automated Real-Time Reconciliation

Automated real-time reconciliation enhances cash flow management by instantly matching transactions, reducing errors and preventing discrepancies that can obscure financial visibility. This technology accelerates the identification of cash inflows and outflows, enabling businesses to maintain accurate, up-to-date financial records. The importance lies in its ability to optimize liquidity management, improve decision-making, and minimize risks associated with delayed transaction reconciliation.

Cash Flow vs. Automated Reconciliation: Key Differences

Cash flow tracks the actual inflow and outflow of cash over time, providing a snapshot of liquidity and operational health, while automated real-time reconciliation continuously matches transactions against records to ensure accuracy and reduce errors. Cash flow management emphasizes forecasting and budgeting for financial planning, whereas automated reconciliation focuses on transaction validation and compliance. Both processes are crucial, but cash flow centers on financial strategy, and automated reconciliation ensures transactional integrity in money management.

Traditional Cash Flow Management Challenges

Traditional cash flow management often struggles with delayed data updates, leading to inaccurate financial forecasting and missed opportunities for optimizing liquidity. Manual processes increase the risk of errors and consume valuable time, reducing the efficiency of money management. Automated real-time reconciliation eliminates these challenges by providing instant visibility into transactions, enhancing accuracy and enabling proactive cash flow decisions.

How Real-Time Reconciliation Enhances Financial Visibility

Real-time reconciliation enhances financial visibility by providing instantaneous updates on cash flow status, enabling businesses to monitor transactions as they occur and reduce discrepancies. Automated systems integrate bank feeds, invoices, and payments seamlessly, offering a comprehensive and accurate financial snapshot. This immediate insight supports better cash flow forecasting, liquidity management, and strategic decision-making for improved money management.

Streamlining Cash Flow with Automation Tools

Automated real-time reconciliation significantly enhances cash flow management by providing instant visibility into transactions, allowing businesses to quickly identify discrepancies and optimize liquidity. This streamlined process reduces manual errors, accelerates cash inflows, and improves forecasting accuracy, ensuring efficient money management. Integration of automation tools enables continuous monitoring of cash movements, facilitating proactive financial decisions and stronger control over working capital.

Accuracy and Efficiency: Manual vs. Automated Processes

Manual cash flow management often results in delayed and error-prone reconciliation, reducing accuracy and efficiency in tracking financial transactions. Automated real-time reconciliation leverages advanced algorithms to instantly verify and match transactions, significantly minimizing discrepancies and improving cash flow visibility. Utilizing automated systems enhances operational efficiency by enabling quicker decision-making and more reliable financial reporting.

Risk Reduction Through Real-Time Reconciliation

Real-time reconciliation significantly reduces cash flow risks by instantly identifying discrepancies between transactions and accounts, preventing fraud and errors. Automated systems enhance money management accuracy by continuously monitoring cash movements, ensuring timely detection of anomalies. This proactive approach minimizes financial losses and strengthens overall financial control.

Scaling Money Management with Automation

Automated real-time reconciliation enhances cash flow management by providing instantaneous transaction matching, reducing errors and delays in financial reporting. This scalability allows businesses to efficiently handle increased transaction volumes without compromising accuracy or speed, facilitating more informed decision-making. Streamlining money management with automation boosts liquidity visibility and operational efficiency, essential for growth in dynamic markets.

Choosing the Right Solution for Cash Flow Optimization

Cash flow optimization hinges on selecting a solution that balances accuracy and timeliness, where automated real-time reconciliation provides precise tracking of transactions and instant error detection, reducing manual effort. This technology enables businesses to maintain up-to-date financial records, improving liquidity management and forecasting accuracy. Prioritizing platforms that integrate seamlessly with existing accounting systems ensures streamlined cash flow monitoring and enhanced financial decision-making.

Related Important Terms

Continuous Cash Flow Monitoring

Continuous cash flow monitoring enables businesses to track inflows and outflows in real time, reducing the risk of liquidity shortages and improving financial stability. Automated real-time reconciliation integrates transaction data instantly, ensuring accurate cash flow visibility and enabling proactive money management decisions.

Smart Reconciliation Engines

Smart Reconciliation Engines enhance cash flow management by automating real-time matching of transactions, reducing errors and accelerating financial closing processes. These advanced systems leverage AI algorithms to instantly identify discrepancies, enabling businesses to maintain accurate liquidity forecasts and optimize working capital.

Instant Settlement Matching

Instant settlement matching enhances cash flow management by enabling automated real-time reconciliation, reducing the lag between transaction recording and confirmation. This process improves liquidity visibility, minimizes errors, and accelerates decision-making for optimized money management.

API-Driven Cash Visibility

API-driven cash visibility enhances cash flow management by providing automated, real-time reconciliation that ensures accurate tracking of transactions and balances across multiple accounts. This integration reduces manual errors and improves liquidity forecasting, enabling businesses to optimize working capital and respond swiftly to financial changes.

Predictive Cash Positioning

Predictive cash positioning enhances cash flow management by leveraging automated real-time reconciliation to provide accurate forecasts of available funds, reducing liquidity risks. This integration enables businesses to optimize working capital, anticipate cash shortages, and make informed financial decisions with increased precision.

Reconciliation-as-a-Service (RaaS)

Reconciliation-as-a-Service (RaaS) streamlines cash flow management by automating real-time transaction matching and discrepancy detection, reducing manual errors and accelerating financial closing processes. Integrating RaaS enhances liquidity visibility and decision-making accuracy, enabling businesses to optimize working capital and improve overall money management efficiency.

Real-Time Ledger Synchronization

Real-time ledger synchronization enhances cash flow management by automatically updating transaction records and providing immediate visibility into financial positions. This automation reduces reconciliation errors, accelerates cash forecasting, and improves liquidity control for more efficient money management.

Autonomous Discrepancy Resolution

Autonomous Discrepancy Resolution enhances cash flow accuracy by automatically identifying and correcting inconsistencies in real-time reconciliation processes, reducing manual intervention and accelerating financial close cycles. This automation improves liquidity management by ensuring immediate alignment of transactions and balances across accounting systems.

AI-Powered Cash Allocation

AI-powered cash allocation enhances cash flow management by automatically matching incoming payments to outstanding invoices in real-time, reducing manual errors and accelerating reconciliation processes. This automation improves liquidity visibility and optimizes working capital by ensuring accurate and timely cash allocation across accounts.

Transactional Flow Tagging

Transactional Flow Tagging enhances cash flow accuracy by categorizing each transaction in real-time, enabling precise automated reconciliation for efficient money management. This process reduces manual errors, accelerates financial reporting, and provides instant visibility into liquidity positions.

Cash flow vs Automated real-time reconciliation for money management. Infographic

moneydiff.com

moneydiff.com