Cash flow represents the actual movement of money in and out of a business, reflecting real-time financial status and liquidity. Predictive funding flows use historical data and algorithms to forecast future cash movements, enabling proactive money management and better decision-making. Combining both approaches improves accuracy in budgeting and ensures optimal allocation of resources.

Table of Comparison

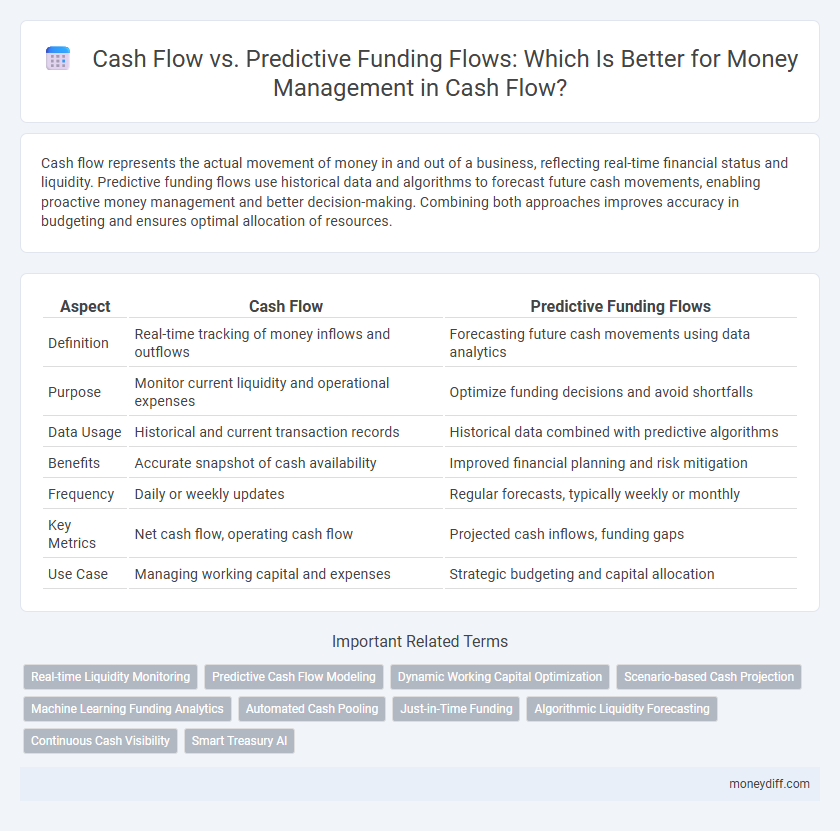

| Aspect | Cash Flow | Predictive Funding Flows |

|---|---|---|

| Definition | Real-time tracking of money inflows and outflows | Forecasting future cash movements using data analytics |

| Purpose | Monitor current liquidity and operational expenses | Optimize funding decisions and avoid shortfalls |

| Data Usage | Historical and current transaction records | Historical data combined with predictive algorithms |

| Benefits | Accurate snapshot of cash availability | Improved financial planning and risk mitigation |

| Frequency | Daily or weekly updates | Regular forecasts, typically weekly or monthly |

| Key Metrics | Net cash flow, operating cash flow | Projected cash inflows, funding gaps |

| Use Case | Managing working capital and expenses | Strategic budgeting and capital allocation |

Understanding Cash Flow in Money Management

Cash flow represents the actual inflow and outflow of cash within a business, reflecting real-time liquidity and operational health. Predictive funding flows use historical data and forecasting models to anticipate future cash movements, enabling proactive financial planning and risk mitigation. Understanding cash flow allows businesses to maintain sufficient liquidity, optimize working capital, and make informed decisions based on current financial status rather than solely relying on projections.

The Basics of Predictive Funding Flows

Predictive funding flows leverage historical financial data and advanced analytics to forecast future cash movements, enhancing money management accuracy beyond traditional cash flow tracking. Unlike basic cash flow statements that only record past and current liquidity, predictive models anticipate timing and amounts of inflows and outflows, enabling proactive funding decisions. This forward-looking approach supports optimized working capital allocation, reduces liquidity risk, and improves financial planning for businesses.

Key Differences: Cash Flow vs Predictive Funding

Cash flow represents the actual inflows and outflows of cash within a business over a specific period, reflecting real-time liquidity and operational efficiency. Predictive funding flows use historical data and forecasting models to estimate future cash positions, enabling proactive financial planning and risk management. The key difference lies in cash flow's retrospective nature versus predictive funding's forward-looking approach to optimize money management decisions.

Advantages of Traditional Cash Flow Analysis

Traditional cash flow analysis provides a clear and historical view of actual cash movements, enabling businesses to accurately track income and expenses over specific periods. This method offers simplicity and reliability, facilitating immediate liquidity assessment and compliance with accounting standards. It helps organizations make informed decisions based on verified financial performance rather than projections, reducing the risk of funding misallocations.

Benefits of Predictive Funding Flows for Financial Planning

Predictive funding flows enhance financial planning by providing accurate forecasts of cash availability, enabling businesses to optimize liquidity and reduce the risk of shortfalls. These flows allow for proactive budgeting, improving decision-making through early identification of potential funding gaps. The integration of predictive analytics supports strategic allocation of resources, ensuring continuous operational efficiency and improved capital management.

Real-Time Financial Decision-Making with Predictive Data

Real-time financial decision-making leverages predictive funding flows by analyzing historical cash flow patterns and forecasting future liquidity needs, enabling proactive money management. Integrating predictive analytics with cash flow data enhances accuracy in anticipating short-term funding gaps and optimizing capital allocation. Companies using predictive funding flows can improve operational efficiency and reduce the risk of cash shortages through timely adjustments.

Risk Management: Cash Flow vs Predictive Models

Cash flow analysis provides real-time insights into liquidity by tracking actual inflows and outflows, enabling immediate response to cash shortages or surpluses. Predictive funding flows use historical data and algorithms to forecast future cash positions, which enhances risk management by anticipating potential funding gaps before they occur. Combining both methods supports more robust risk mitigation strategies by balancing confirmed cash availability with probabilistic future scenarios.

Implementing Predictive Funding in Cash Flow Strategies

Implementing predictive funding in cash flow strategies enhances financial forecasting by leveraging historical data and machine learning algorithms to anticipate future cash inflows and outflows accurately. This proactive approach enables businesses to optimize liquidity management, reduce reliance on short-term borrowing, and improve investment timing. Integrating predictive funding models within ERP systems facilitates real-time cash position visibility and supports dynamic decision-making for efficient money management.

Common Challenges in Forecasting Cash Flow

Forecasting cash flow often struggles with inaccuracies due to unpredictable revenue streams and delayed receivables, complicating liquidity management. Predictive funding flows rely heavily on historical data and algorithmic models, which may not account for sudden market changes or operational disruptions. These challenges hinder precise cash flow projections, affecting strategic decision-making and funding allocation.

Choosing the Right Approach: Cash Flow or Predictive Funding?

Evaluating cash flow versus predictive funding flows hinges on business goals and financial stability; cash flow offers real-time insights into liquidity, while predictive funding leverages data analytics to forecast future financial positions and optimize capital allocation. Companies with volatile revenue streams benefit from the immediate clarity of cash flow statements, whereas organizations aiming for strategic growth rely on predictive funding for proactive money management. Selecting the right approach ensures enhanced cash efficiency, minimizes funding risks, and supports informed decision-making aligned with operational needs.

Related Important Terms

Real-time Liquidity Monitoring

Real-time liquidity monitoring enhances cash flow management by providing immediate visibility into incoming and outgoing funds, enabling accurate predictive funding flow analysis. This approach optimizes working capital allocation and minimizes liquidity risks by forecasting cash availability with precision.

Predictive Cash Flow Modeling

Predictive cash flow modeling leverages historical data and advanced analytics to forecast future cash movements, enabling more accurate money management compared to traditional cash flow methods. This proactive approach optimizes liquidity planning, reduces funding gaps, and supports strategic financial decision-making by anticipating cash surpluses and shortfalls.

Dynamic Working Capital Optimization

Dynamic Working Capital Optimization leverages predictive funding flows to anticipate cash needs, enabling more accurate allocation of resources than traditional cash flow methods. This approach enhances liquidity management by forecasting inflows and outflows, reducing financing costs, and improving overall financial agility.

Scenario-based Cash Projection

Scenario-based cash projection enhances money management by integrating predictive funding flows with real-time cash flow analysis, allowing businesses to forecast financial positions under various conditions. This method improves liquidity planning by identifying potential shortfalls or surpluses ahead of time, enabling proactive adjustments to funding strategies.

Machine Learning Funding Analytics

Machine learning funding analytics enhances cash flow management by accurately predicting future funding requirements through pattern recognition in historical financial data. This predictive insight enables proactive allocation of resources, reducing liquidity risks and optimizing working capital efficiency.

Automated Cash Pooling

Automated Cash Pooling enhances cash flow management by consolidating funds across multiple accounts in real-time, improving liquidity visibility and reducing borrowing costs. This system integrates predictive funding flows to forecast cash needs accurately, enabling proactive allocation and optimized working capital utilization.

Just-in-Time Funding

Just-in-Time Funding optimizes cash flow by aligning incoming capital precisely with expenditure timing, reducing idle cash and enhancing liquidity management. Unlike traditional predictive funding flows, this approach minimizes forecasting errors and increases operational efficiency by releasing funds only when necessary.

Algorithmic Liquidity Forecasting

Algorithmic Liquidity Forecasting enhances cash flow management by providing predictive funding flows that anticipate future liquidity needs, enabling proactive allocation of resources. This approach reduces reliance on historical cash flow data alone, improving accuracy in cash position predictions and optimizing working capital efficiency.

Continuous Cash Visibility

Continuous cash visibility enhances money management by providing real-time insights into cash flow and predictive funding flows, enabling accurate forecasting and optimized liquidity. This approach reduces financial risks and improves strategic decision-making by aligning incoming and outgoing funds with future obligations.

Smart Treasury AI

Smart Treasury AI enhances money management by integrating cash flow analysis with predictive funding flows, enabling real-time forecasting and optimized liquidity allocation. This approach reduces financial risk and maximizes operational efficiency through data-driven decision-making.

Cash flow vs Predictive funding flows for money management. Infographic

moneydiff.com

moneydiff.com