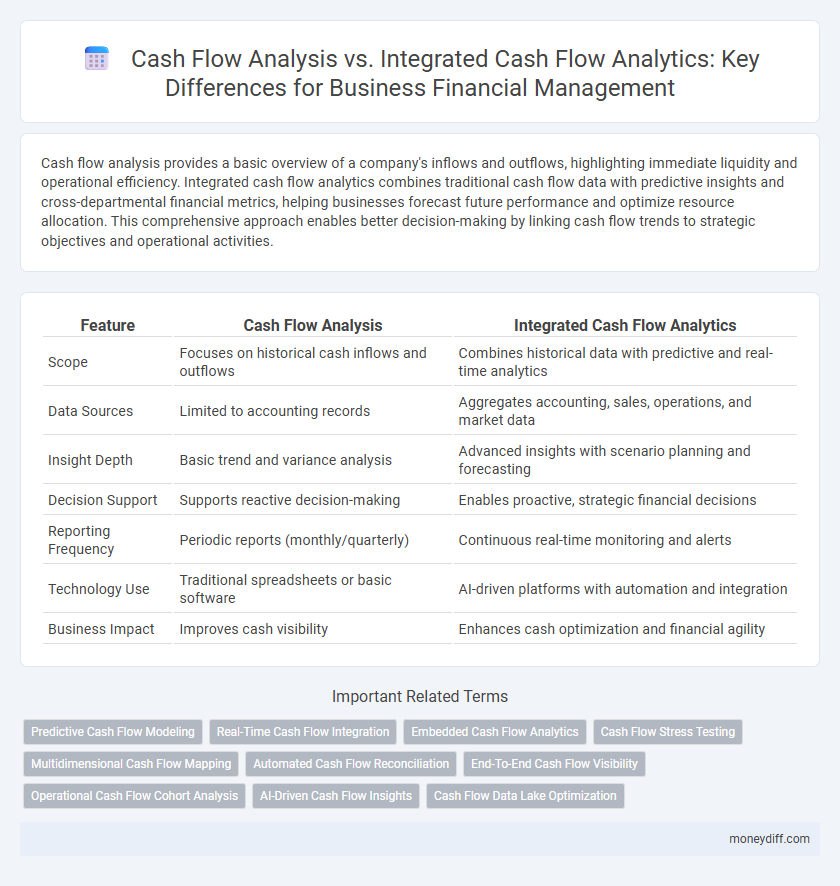

Cash flow analysis provides a basic overview of a company's inflows and outflows, highlighting immediate liquidity and operational efficiency. Integrated cash flow analytics combines traditional cash flow data with predictive insights and cross-departmental financial metrics, helping businesses forecast future performance and optimize resource allocation. This comprehensive approach enables better decision-making by linking cash flow trends to strategic objectives and operational activities.

Table of Comparison

| Feature | Cash Flow Analysis | Integrated Cash Flow Analytics |

|---|---|---|

| Scope | Focuses on historical cash inflows and outflows | Combines historical data with predictive and real-time analytics |

| Data Sources | Limited to accounting records | Aggregates accounting, sales, operations, and market data |

| Insight Depth | Basic trend and variance analysis | Advanced insights with scenario planning and forecasting |

| Decision Support | Supports reactive decision-making | Enables proactive, strategic financial decisions |

| Reporting Frequency | Periodic reports (monthly/quarterly) | Continuous real-time monitoring and alerts |

| Technology Use | Traditional spreadsheets or basic software | AI-driven platforms with automation and integration |

| Business Impact | Improves cash visibility | Enhances cash optimization and financial agility |

Understanding Traditional Cash Flow Analysis

Traditional cash flow analysis focuses on examining historical inflows and outflows to assess a company's liquidity and operational efficiency. It primarily relies on standard financial statements like the cash flow statement to monitor working capital, operating cash flow, and financing activities. This method often lacks real-time insights and predictive capabilities that integrated cash flow analytics provide by combining data from multiple sources for strategic decision-making.

What is Integrated Cash Flow Analytics?

Integrated Cash Flow Analytics combines real-time data from multiple financial sources to provide a comprehensive view of a company's liquidity and cash position. It enables businesses to forecast cash inflows and outflows more accurately by incorporating operational, financial, and market variables into a unified analytical framework. This approach improves decision-making by highlighting potential cash shortages and surpluses, facilitating proactive cash management beyond traditional cash flow analysis.

Key Differences Between Cash Flow Analysis and Integrated Analytics

Cash flow analysis examines historical inflows and outflows to assess liquidity, focusing on short-term cash management and operational efficiency. Integrated cash flow analytics combines cash data with financial forecasting, risk assessment, and cross-departmental insights for strategic decision-making and long-term planning. Key differences include scope--static analysis versus dynamic, predictive modeling--and the use of advanced technology like AI and real-time dashboards in integrated analytics.

Advantages of Integrated Cash Flow Analytics

Integrated Cash Flow Analytics combines data from multiple financial sources to provide a comprehensive view of a company's liquidity and operational efficiency, enabling more accurate forecasting and risk assessment. Unlike traditional cash flow analysis, it leverages real-time data integration, advanced algorithms, and predictive modeling to identify trends and cash flow drivers proactively. This approach enhances decision-making by offering deeper insights into cash inflows and outflows, improving working capital management and strategic planning.

Limitations of Traditional Cash Flow Analysis

Traditional cash flow analysis often suffers from limited insights due to its reliance on historical data and inability to capture real-time financial dynamics. It overlooks interdependencies between operational, investing, and financing activities, leading to fragmented decision-making. In contrast, integrated cash flow analytics provide a holistic view by combining diverse financial data, enabling predictive modeling and strategic cash management.

Impact on Business Decision-Making

Cash flow analysis provides a snapshot of liquidity by examining inflows and outflows over a specific period, enabling businesses to manage short-term financial obligations effectively. Integrated cash flow analytics combines this with broader financial and operational data, offering real-time insights that enhance forecasting accuracy and strategic planning. This comprehensive approach improves business decision-making by identifying cash flow trends, optimizing resource allocation, and mitigating financial risks proactively.

Technology’s Role in Integrated Cash Flow Analytics

Technology enhances integrated cash flow analytics by automating real-time data collection and consolidation from multiple financial sources, enabling accurate forecasting and strategic decision-making. Advanced AI algorithms identify patterns and anomalies in cash movements, improving liquidity management and risk assessment beyond traditional cash flow analysis. Cloud-based platforms facilitate seamless collaboration across departments, ensuring timely insights and more comprehensive financial visibility for businesses.

Data Integration and Real-Time Cash Flow Insights

Cash flow analysis provides historical financial data to assess past liquidity, but integrated cash flow analytics combine multiple data sources for comprehensive, real-time cash flow insights. Data integration from sales, expenses, and forecasting systems enables dynamic monitoring of cash positions, improving decision-making accuracy. Real-time analytics help businesses anticipate cash shortages or surpluses, enhancing financial agility and strategic planning.

Choosing the Right Approach for Your Business

Cash flow analysis provides a snapshot of a business's liquidity by tracking inflows and outflows over a specific period, essential for short-term financial decision-making. Integrated cash flow analytics combines this data with broader financial metrics and forecasting models, offering a comprehensive view that enhances strategic planning and risk management. Selecting the right approach depends on your business size, complexity, and whether you need detailed, real-time insights or a straightforward overview of cash movements.

Future Trends in Cash Flow Management Analytics

Future trends in cash flow management analytics emphasize the integration of AI-driven predictive models and real-time data feeds, enabling businesses to anticipate liquidity needs and optimize working capital with greater precision. Integrated cash flow analytics platforms increasingly incorporate machine learning algorithms that analyze historical and market data to forecast cash inflows and outflows more accurately than traditional cash flow analysis. These advancements facilitate proactive decision-making, reduce financial risks, and enhance overall business agility in dynamic economic environments.

Related Important Terms

Predictive Cash Flow Modeling

Predictive cash flow modeling enhances traditional cash flow analysis by integrating real-time data and advanced analytics to forecast future financial positions with greater accuracy. Integrated cash flow analytics combine historical patterns, market trends, and business-specific variables, enabling proactive decision-making and optimized liquidity management.

Real-Time Cash Flow Integration

Real-time cash flow integration provides businesses with instantaneous visibility into liquidity by connecting multiple financial data streams for seamless updates, unlike traditional cash flow analysis which often relies on periodic data snapshots. This integration enhances decision-making precision by enabling proactive cash management and immediate response to changing financial conditions.

Embedded Cash Flow Analytics

Embedded cash flow analytics integrates real-time data from diverse financial sources, enabling businesses to monitor liquidity and forecast cash positions with greater accuracy compared to traditional cash flow analysis. This approach enhances decision-making by providing dynamic insights into operational cash movements and optimizing working capital management.

Cash Flow Stress Testing

Cash flow analysis provides a snapshot of liquidity by examining inflows and outflows over a specific period, while integrated cash flow analytics combines multiple financial dimensions for a comprehensive view, enhancing predictive accuracy. Cash flow stress testing simulates adverse scenarios to evaluate a business's resilience under financial strain, identifying potential vulnerabilities and informing strategic decision-making.

Multidimensional Cash Flow Mapping

Multidimensional Cash Flow Mapping in integrated cash flow analytics provides a comprehensive view by analyzing cash inflows and outflows across various business dimensions such as departments, projects, and time periods, enhancing strategic decision-making. Traditional cash flow analysis often limits insights to basic inflows and outflows without capturing the complex interdependencies within business units, reducing the accuracy of financial forecasting and resource allocation.

Automated Cash Flow Reconciliation

Automated Cash Flow Reconciliation enhances traditional cash flow analysis by integrating real-time transaction data, reducing manual errors and enabling accurate forecasting for businesses. This integrated cash flow analytics approach streamlines financial reporting and optimizes liquidity management through seamless data synchronization across accounting systems.

End-To-End Cash Flow Visibility

Cash flow analysis provides a snapshot of liquidity by examining inflows and outflows within specific periods, while integrated cash flow analytics offers end-to-end cash flow visibility by aggregating real-time data across departments, forecasting accuracy, and operational impacts. This holistic approach enables businesses to identify cash bottlenecks, optimize working capital, and make informed strategic decisions for sustainable financial health.

Operational Cash Flow Cohort Analysis

Operational Cash Flow Cohort Analysis in integrated cash flow analytics enables businesses to track cash inflows and outflows across specific customer segments over time, revealing patterns in spending and payment behaviors that traditional cash flow analysis might overlook. This advanced approach provides actionable insights for optimizing working capital management and forecasting liquidity needs with greater precision.

AI-Driven Cash Flow Insights

AI-driven cash flow insights leverage integrated cash flow analytics to provide real-time forecasting, anomaly detection, and scenario planning, significantly enhancing the accuracy and depth of cash flow analysis. This advanced approach enables businesses to optimize liquidity management by combining historical data with predictive models, surpassing traditional cash flow analysis tools.

Cash Flow Data Lake Optimization

Cash flow analysis provides a snapshot of liquidity by tracking inflows and outflows, while integrated cash flow analytics leverages consolidated data from multiple sources for deeper financial insights. Optimizing a cash flow data lake enables real-time aggregation and advanced querying, improving accuracy and decision-making speed across the entire business finance ecosystem.

Cash flow analysis vs Integrated cash flow analytics for business. Infographic

moneydiff.com

moneydiff.com