Manual cash flow reconciliation relies heavily on human input, which increases the risk of errors and delays in identifying discrepancies. AI-driven cash flow reconciliation leverages advanced algorithms to automatically detect inconsistencies with higher precision and speed, significantly improving accuracy. This technology reduces manual workload and enhances financial decision-making by providing real-time, reliable cash flow data.

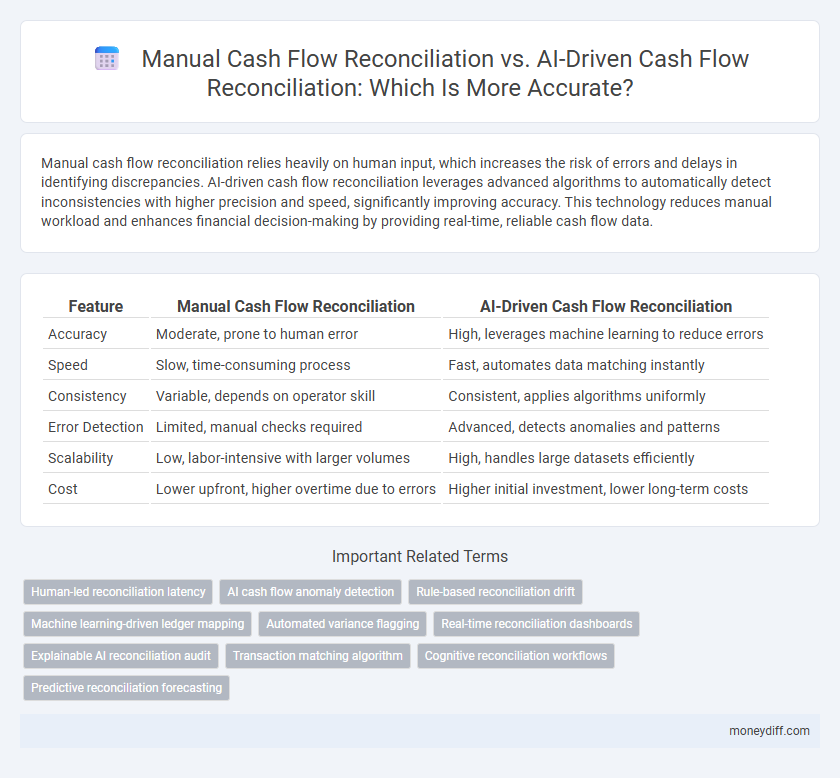

Table of Comparison

| Feature | Manual Cash Flow Reconciliation | AI-Driven Cash Flow Reconciliation |

|---|---|---|

| Accuracy | Moderate, prone to human error | High, leverages machine learning to reduce errors |

| Speed | Slow, time-consuming process | Fast, automates data matching instantly |

| Consistency | Variable, depends on operator skill | Consistent, applies algorithms uniformly |

| Error Detection | Limited, manual checks required | Advanced, detects anomalies and patterns |

| Scalability | Low, labor-intensive with larger volumes | High, handles large datasets efficiently |

| Cost | Lower upfront, higher overtime due to errors | Higher initial investment, lower long-term costs |

Understanding Manual vs AI-Driven Cash Flow Reconciliation

Manual cash flow reconciliation relies on human intervention to match transactions and identify discrepancies, often leading to errors and longer processing times. AI-driven cash flow reconciliation leverages machine learning algorithms to analyze large datasets swiftly, improving accuracy by detecting anomalies and automating routine tasks. Businesses adopting AI technology can significantly reduce reconciliation errors and accelerate cash flow analysis, enhancing financial decision-making.

The Evolution of Cash Flow Reconciliation Methods

Manual cash flow reconciliation relies heavily on human intervention, leading to higher risks of errors, delays, and inconsistencies in financial reporting. AI-driven cash flow reconciliation leverages machine learning algorithms to automate data matching, anomaly detection, and real-time updates, significantly enhancing accuracy and efficiency. This evolution from manual to AI-powered methods transforms cash flow management by reducing reconciliation time and improving financial transparency.

Accuracy in Manual Cash Flow Reconciliation: Challenges and Risks

Manual cash flow reconciliation often suffers from human errors, data entry mistakes, and delayed updates, leading to inaccuracies that can distort financial reporting and decision-making. The lack of automation increases the risk of oversight in complex transactions, making it difficult to identify discrepancies promptly. These challenges undermine the reliability of cash flow data, increasing the potential for costly financial mismanagement and audit failures.

How AI Enhances Cash Flow Reconciliation Accuracy

AI-driven cash flow reconciliation significantly improves accuracy by automating data matching and anomaly detection, reducing human error inherent in manual processes. Machine learning algorithms analyze transaction patterns to identify discrepancies swiftly, ensuring real-time validation of cash inflows and outflows. This enhanced precision facilitates more reliable financial reporting and better cash management decisions.

Speed and Efficiency: Manual Processes vs AI Automation

Manual cash flow reconciliation often involves time-consuming data entry and cross-referencing, leading to higher chances of human errors and delays in identifying discrepancies. AI-driven cash flow reconciliation leverages machine learning algorithms to rapidly process vast datasets with greater precision, drastically reducing the reconciliation cycle time. By automating routine tasks, AI enhances efficiency and accelerates financial closing, ensuring more accurate real-time cash flow insights.

Data Integrity: Human Error vs Machine Learning Precision

Manual cash flow reconciliation is prone to human error, leading to inconsistencies and compromised data integrity in financial records. AI-driven cash flow reconciliation leverages machine learning algorithms to detect anomalies and ensure precise matching of transactions, significantly enhancing accuracy. This technological precision reduces the risk of overlooked discrepancies and improves the reliability of cash flow data for informed decision-making.

Cost Implications of Manual and AI-Driven Reconciliation

Manual cash flow reconciliation demands extensive labor hours, increasing operational costs due to human error and time-consuming processes. AI-driven reconciliation reduces these expenses by automating data matching and anomaly detection, resulting in faster, more accurate cash flow analysis with minimal manual intervention. Companies utilizing AI typically experience lower cost-per-reconciliation cycles and improved financial accuracy, driving significant savings in workforce and error-related losses.

Scalability: Managing Complexity with AI Tools

Manual cash flow reconciliation often struggles to scale effectively, especially when dealing with increasing transaction volumes and complex financial data. AI-driven cash flow reconciliation leverages advanced algorithms and machine learning to process large datasets rapidly and accurately, enabling businesses to manage complexity and scale operations seamlessly. This scalability ensures real-time insights and reduces errors, improving overall financial accuracy and efficiency.

Compliance and Audit Advantages of AI-Driven Reconciliation

AI-driven cash flow reconciliation significantly enhances accuracy by automating the matching of transactions, reducing human errors common in manual processes. This automation ensures strict compliance with regulatory standards through consistent auditing trails and real-time anomaly detection. The resulting transparent and verifiable records simplify audits, minimize risks of non-compliance, and accelerate financial reporting cycles.

Future Trends: The Move Toward Fully Automated Cash Flow Accuracy

Manual cash flow reconciliation often struggles with errors and delays due to human limitations, whereas AI-driven cash flow reconciliation leverages machine learning algorithms to detect discrepancies with higher precision and speed. Future trends indicate a shift toward fully automated cash flow processes, integrating real-time data analytics and predictive modeling to ensure near-perfect accuracy in financial reporting. This evolution enhances decision-making efficiency, reduces operational costs, and strengthens compliance in dynamic business environments.

Related Important Terms

Human-led reconciliation latency

Manual cash flow reconciliation often suffers from significant latency due to human error and time-consuming data processing, leading to delays and inaccuracies. AI-driven cash flow reconciliation enhances accuracy by automating data matching and anomaly detection in real-time, drastically reducing reconciliation time and minimizing human-led errors.

AI cash flow anomaly detection

AI-driven cash flow reconciliation enhances accuracy by leveraging machine learning algorithms to automatically detect anomalies and discrepancies that manual processes often overlook. These AI systems analyze vast transaction data in real-time, reducing human errors and enabling faster identification of irregular cash flow patterns for improved financial control.

Rule-based reconciliation drift

Manual cash flow reconciliation often suffers from rule-based reconciliation drift, leading to increasing errors and inconsistencies over time due to static rules failing to adapt to evolving transaction patterns. AI-driven cash flow reconciliation employs machine learning algorithms that dynamically adjust rules and detect anomalies, resulting in significantly higher accuracy and reduced reconciliation drift.

Machine learning-driven ledger mapping

Manual cash flow reconciliation often leads to human errors and slower processing times due to its reliance on manual ledger mapping, whereas AI-driven cash flow reconciliation leverages machine learning algorithms to automate ledger mapping with higher accuracy and efficiency. Machine learning models continuously improve by analyzing historical transaction patterns, reducing discrepancies and enabling real-time detection of anomalies in cash flow data.

Automated variance flagging

Manual cash flow reconciliation often struggles with accuracy due to human error and time-consuming processes, leading to missed discrepancies. AI-driven cash flow reconciliation improves accuracy by utilizing automated variance flagging, which quickly identifies anomalies and reduces the risk of financial misstatements.

Real-time reconciliation dashboards

Manual cash flow reconciliation relies on periodic data entry prone to human error, limiting accuracy and timeliness, while AI-driven cash flow reconciliation utilizes real-time reconciliation dashboards that continuously analyze transactions to detect discrepancies instantly, enhancing precision and decision-making speed. Real-time dashboards powered by AI enable dynamic updating and predictive insights, significantly reducing reconciliation delays compared to labor-intensive manual processes.

Explainable AI reconciliation audit

Manual cash flow reconciliation often suffers from human errors and time-intensive processes, leading to less accurate financial records. AI-driven cash flow reconciliation with Explainable AI audit capabilities enhances accuracy by automating error detection and providing transparent, interpretable insights into discrepancies, ensuring reliable and auditable cash flow management.

Transaction matching algorithm

Manual cash flow reconciliation relies heavily on human judgment, often leading to errors and inconsistencies in transaction matching accuracy, especially when handling large volumes of data. AI-driven cash flow reconciliation employs advanced transaction matching algorithms that automatically identify discrepancies and patterns, significantly improving precision and reducing reconciliation time.

Cognitive reconciliation workflows

Manual cash flow reconciliation often leads to human errors and delays, whereas AI-driven cash flow reconciliation leverages cognitive workflows to enhance accuracy by automatically identifying discrepancies and patterns in transaction data. Cognitive reconciliation workflows integrate machine learning algorithms and natural language processing to streamline validation processes, reducing reconciliation time and improving financial reporting precision.

Predictive reconciliation forecasting

Manual cash flow reconciliation often suffers from human errors and delays, limiting its effectiveness in identifying discrepancies and forecasting future cash positions accurately. AI-driven cash flow reconciliation leverages predictive algorithms and real-time data analysis to enhance accuracy, enabling proactive financial planning and improved cash flow forecasting.

Manual cash flow reconciliation vs AI-driven cash flow reconciliation for accuracy. Infographic

moneydiff.com

moneydiff.com