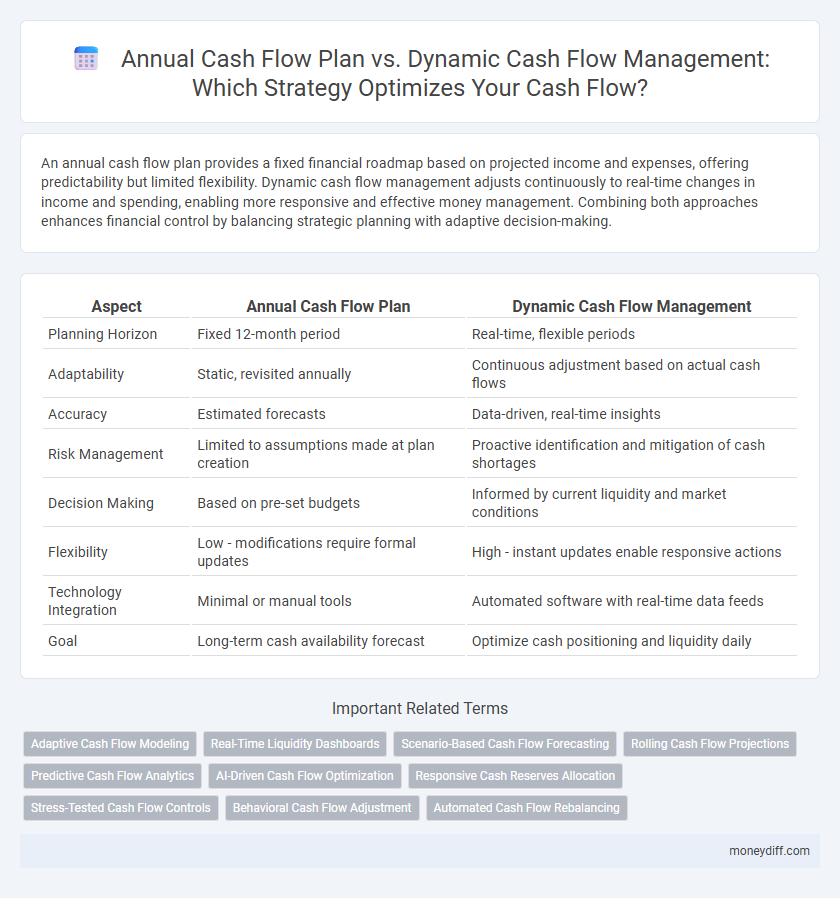

An annual cash flow plan provides a fixed financial roadmap based on projected income and expenses, offering predictability but limited flexibility. Dynamic cash flow management adjusts continuously to real-time changes in income and spending, enabling more responsive and effective money management. Combining both approaches enhances financial control by balancing strategic planning with adaptive decision-making.

Table of Comparison

| Aspect | Annual Cash Flow Plan | Dynamic Cash Flow Management |

|---|---|---|

| Planning Horizon | Fixed 12-month period | Real-time, flexible periods |

| Adaptability | Static, revisited annually | Continuous adjustment based on actual cash flows |

| Accuracy | Estimated forecasts | Data-driven, real-time insights |

| Risk Management | Limited to assumptions made at plan creation | Proactive identification and mitigation of cash shortages |

| Decision Making | Based on pre-set budgets | Informed by current liquidity and market conditions |

| Flexibility | Low - modifications require formal updates | High - instant updates enable responsive actions |

| Technology Integration | Minimal or manual tools | Automated software with real-time data feeds |

| Goal | Long-term cash availability forecast | Optimize cash positioning and liquidity daily |

Understanding Annual Cash Flow Planning

Annual cash flow planning involves creating a fixed projection of expected income and expenses over a year, providing a structured framework for budgeting and resource allocation. This approach allows businesses to anticipate cash shortages and surpluses, enhancing strategic decision-making. Compared to dynamic cash flow management, which adjusts in real-time to changing financial conditions, annual planning emphasizes long-term financial stability and goal setting.

What is Dynamic Cash Flow Management?

Dynamic cash flow management involves continuous monitoring and adjustment of cash inflows and outflows based on real-time financial data, enabling businesses to respond promptly to changing economic conditions. Unlike an annual cash flow plan, which relies on fixed projections and assumptions made at the beginning of the fiscal year, dynamic management leverages technology and analytics to optimize liquidity, reduce risks, and improve operational efficiency. This approach enhances financial agility by adapting cash strategies to actual performance and market fluctuations.

Key Differences Between Annual and Dynamic Approaches

Annual cash flow plans provide a fixed, long-term projection based on historical data and expected income and expenses, offering stability but limited adaptability. Dynamic cash flow management continuously adjusts forecasts and budgets in real-time, responding to market fluctuations and unexpected financial events for more precise money control. Key differences include flexibility, with dynamic methods enabling proactive decision-making, while annual plans prioritize predictability and structure.

Benefits of an Annual Cash Flow Plan

An annual cash flow plan provides a clear financial roadmap, enabling businesses to forecast income and expenses with precision, which supports strategic budgeting and resource allocation. This structured approach enhances financial stability by identifying potential shortfalls early, allowing for proactive adjustments that avoid liquidity crises. Predictability in cash flow strengthens stakeholder confidence and improves long-term financial planning outcomes.

Advantages of Dynamic Cash Flow Management

Dynamic cash flow management offers real-time tracking of inflows and outflows, enabling more accurate forecasting and immediate adjustments to changing financial conditions. This approach reduces the risk of liquidity shortfalls, optimizes working capital, and enhances decision-making by providing up-to-date data compared to static annual cash flow plans. Businesses benefit from improved flexibility and responsiveness, ensuring better alignment with operational needs and financial goals.

Limitations of Annual Cash Flow Planning

Annual cash flow planning often lacks flexibility, making it difficult to respond to unexpected expenses or changes in revenue. This static approach can result in cash shortages or idle funds, reducing overall financial efficiency. Relying solely on annual plans limits real-time decision-making crucial for effective money management.

Challenges with Dynamic Cash Flow Strategies

Dynamic cash flow management faces challenges such as forecasting inaccuracies due to fluctuating revenues and expenses, which complicate real-time decision-making. Integrating continuous data analysis requires advanced technology and skilled personnel, increasing operational costs and complexity. Businesses must also balance liquidity needs with growth investments, making dynamic strategies difficult to sustain without robust financial controls.

Choosing the Right Cash Flow Method for Your Goals

Annual cash flow plans provide a structured, long-term overview for budgeting and forecasting, offering stability in predictable income scenarios. Dynamic cash flow management adapts to real-time financial changes, enhancing flexibility and responsiveness for businesses facing variable cash inflows and outflows. Selecting the right method depends on your financial goals, risk tolerance, and the need for either consistency or agility in managing your money.

Integrating Annual Planning with Dynamic Adjustments

Integrating an annual cash flow plan with dynamic cash flow management enhances financial agility and ensures accurate forecasting. By combining fixed long-term goals with real-time adjustments, businesses can better respond to market fluctuations and unexpected expenses. This hybrid approach optimizes liquidity, reduces risk, and supports sustainable money management strategies.

Practical Tips for Effective Cash Flow Management

An annual cash flow plan provides a long-term financial roadmap, outlining expected income and expenses over the year to ensure budget alignment and prevent shortfalls. Dynamic cash flow management involves continuous monitoring and adjustment based on real-time financial data, allowing for swift responses to unexpected changes in revenue or expenditures. Combining structured annual planning with flexible dynamic management enhances cash flow accuracy, reduces liquidity risks, and supports informed decision-making for optimal money management.

Related Important Terms

Adaptive Cash Flow Modeling

Adaptive cash flow modeling surpasses traditional annual cash flow plans by continuously analyzing real-time financial data to forecast liquidity needs with greater precision. This dynamic cash flow management enables proactive adjustments, optimizing working capital and minimizing risks associated with unforeseen expenses or market fluctuations.

Real-Time Liquidity Dashboards

Annual cash flow plans provide a static overview of projected inflows and outflows, often leading to delayed reactions in liquidity management. Dynamic cash flow management leverages Real-Time Liquidity Dashboards to monitor and adjust cash positions instantly, enhancing accuracy and responsiveness in money management decisions.

Scenario-Based Cash Flow Forecasting

Scenario-based cash flow forecasting enhances dynamic cash flow management by providing real-time adjustments to financial plans based on varying business conditions, unlike traditional annual cash flow plans which offer static and less flexible projections. This approach allows businesses to anticipate liquidity needs more accurately, optimize cash reserves, and respond swiftly to potential cash shortfalls or surpluses.

Rolling Cash Flow Projections

Rolling cash flow projections provide a dynamic cash flow management approach by continuously updating forecasts based on real-time financial data, unlike annual cash flow plans that rely on static, fixed-period budgets. This method enhances liquidity optimization and risk mitigation by allowing businesses to anticipate short-term cash needs and adjust strategies promptly.

Predictive Cash Flow Analytics

Annual cash flow plans provide a static financial roadmap based on historical data, while dynamic cash flow management leverages predictive cash flow analytics to adapt in real-time, optimizing liquidity and forecasting future financial positions. Predictive cash flow analytics use machine learning algorithms to analyze transaction patterns and market trends, enhancing accuracy in cash inflow and outflow projections for proactive money management.

AI-Driven Cash Flow Optimization

Annual cash flow plans provide a fixed framework for forecasting income and expenses over a year, but AI-driven dynamic cash flow management continuously analyzes real-time financial data to optimize liquidity and investment decisions. Leveraging machine learning algorithms, dynamic management enhances accuracy in cash flow predictions, enabling proactive adjustments that maximize operational efficiency and reduce financial risks.

Responsive Cash Reserves Allocation

Annual cash flow plans provide a fixed projection of income and expenses, while dynamic cash flow management adjusts allocations in real-time based on actual financial inflows and outflows. Responsive cash reserves allocation leverages dynamic management to optimize liquidity, ensuring funds are available for unforeseen expenses and investment opportunities without compromising financial stability.

Stress-Tested Cash Flow Controls

Stress-tested cash flow controls integrate dynamic cash flow management techniques that continuously adjust to real-time financial data, outperforming static annual cash flow plans by identifying liquidity risks and cash shortfalls earlier. This proactive approach ensures robust money management, enabling businesses to maintain optimal cash reserves and responsiveness under volatile market conditions.

Behavioral Cash Flow Adjustment

Behavioral Cash Flow Adjustment enhances dynamic cash flow management by continuously aligning spending and saving behaviors with real-time income fluctuations, unlike rigid annual cash flow plans that fail to adapt to unexpected financial changes. This adaptive approach increases the accuracy of cash flow forecasts and improves liquidity management by integrating behavioral patterns into financial decision-making.

Automated Cash Flow Rebalancing

Automated cash flow rebalancing enhances dynamic cash flow management by continuously adjusting allocations based on real-time income and expenses, ensuring optimal liquidity and minimizing idle funds. Unlike static annual cash flow plans, this technology-driven approach improves accuracy, responsiveness, and financial agility for effective money management.

Annual cash flow plan vs dynamic cash flow management for money management. Infographic

moneydiff.com

moneydiff.com