Cash flow management tools prioritize real-time tracking of income and expenses to ensure liquidity, while Wealthfront automation focuses on long-term wealth accumulation through automated investing and portfolio rebalancing. Cash flow apps offer immediate control over budgeting and bill payments, whereas Wealthfront provides tax-loss harvesting and low-cost investment strategies for growth. Choosing between cash flow solutions and Wealthfront depends on whether short-term financial flexibility or long-term wealth building is the primary goal.

Table of Comparison

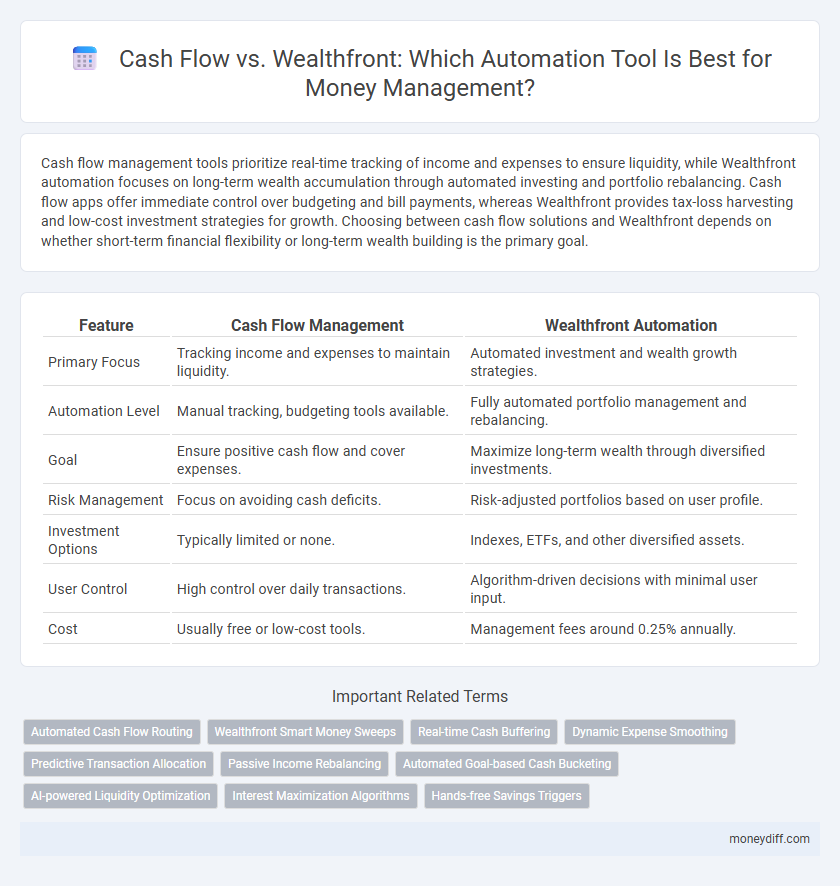

| Feature | Cash Flow Management | Wealthfront Automation |

|---|---|---|

| Primary Focus | Tracking income and expenses to maintain liquidity. | Automated investment and wealth growth strategies. |

| Automation Level | Manual tracking, budgeting tools available. | Fully automated portfolio management and rebalancing. |

| Goal | Ensure positive cash flow and cover expenses. | Maximize long-term wealth through diversified investments. |

| Risk Management | Focus on avoiding cash deficits. | Risk-adjusted portfolios based on user profile. |

| Investment Options | Typically limited or none. | Indexes, ETFs, and other diversified assets. |

| User Control | High control over daily transactions. | Algorithm-driven decisions with minimal user input. |

| Cost | Usually free or low-cost tools. | Management fees around 0.25% annually. |

Introduction to Cash Flow Management

Cash flow management is essential for maintaining financial stability and ensuring sufficient liquidity to cover expenses. Unlike Wealthfront's automation, which focuses on long-term investment strategies and wealth growth using algorithms, cash flow management concentrates on tracking income and expenses in real-time to optimize budget control. Effective cash flow management helps prevent overdrafts, improve savings capacity, and support day-to-day financial decision-making.

Overview of Wealthfront Automation

Wealthfront automation offers seamless integration for cash flow management by automatically allocating funds to high-yield savings, investments, and debt repayment. Its algorithm continuously monitors income and expenses to optimize liquidity while maximizing returns through tax-loss harvesting and diversified portfolio balancing. This automated strategy enhances cash flow efficiency, ensuring users maintain sufficient funds for daily needs while steadily growing wealth.

Key Differences: Cash Flow vs. Wealthfront Automation

Cash flow management focuses on tracking and optimizing the inflow and outflow of funds to ensure sufficient liquidity for daily expenses and short-term goals. Wealthfront automation leverages robo-advisor technology to automate investment portfolios, tax-loss harvesting, and long-term wealth accumulation. The key difference lies in cash flow's emphasis on managing immediate financial health versus Wealthfront's goal of automated, algorithm-driven wealth growth and retirement planning.

Manual Cash Flow Tracking: Pros and Cons

Manual cash flow tracking offers detailed control over personal finances, allowing users to customize categories and monitor every transaction in real-time. However, it requires consistent effort and discipline, which can lead to human error or oversight in complex budgets. Compared to Wealthfront automation, manual tracking lacks algorithm-driven insights and predictive analytics that optimize savings and investment strategies.

Wealthfront’s Automated Money Management Features

Wealthfront's automated money management optimizes cash flow by utilizing sophisticated algorithms for budgeting, investing, and bill payments that ensure timely allocation of funds and minimize overdraft risks. Advanced features such as direct deposit allocation, automated savings transfers, and tax-loss harvesting dynamically adjust to maintain healthy liquidity and maximize portfolio growth. Integration with real-time tracking tools and AI-driven financial advice enhances cash flow forecasting, allowing users to efficiently manage inflows and outflows while growing wealth passively.

Financial Goals: Customization and Flexibility

Cash flow management through Wealthfront automation offers tailored financial goals with customizable parameters that adapt to individual income patterns and spending habits. Its algorithm dynamically adjusts investment allocations and savings targets to optimize liquidity while maximizing portfolio growth. Utilizing Wealthfront enhances control over cash flow by integrating flexibility in goal-setting, ensuring personalized wealth accumulation strategies align with changing financial circumstances.

Real-Time Insights: Manual vs. Automated Systems

Manual cash flow management relies on periodic data entry and delayed financial updates, limiting real-time insights crucial for timely decisions. Wealthfront automation leverages continuous data syncing and advanced algorithms to provide instantaneous cash flow analysis, helping users track spending, investments, and savings in real time. Automated systems minimize human error while enabling dynamic adjustments to budget and investment strategies based on up-to-the-minute financial information.

Security and Privacy in Money Management Tools

Cash flow management platforms prioritize real-time transaction tracking and budgeting, offering granular control but may lack comprehensive encryption standards found in Wealthfront's automation tools. Wealthfront employs robust security protocols, including bank-level encryption and multi-factor authentication, ensuring enhanced privacy and protection of customer data. Both systems emphasize secure data handling, but Wealthfront's automated approach integrates advanced cybersecurity measures tailored for automated investing and financial planning.

Cost Comparison: Traditional Cash Flow vs. Wealthfront

Traditional cash flow management often involves manual tracking, budgeting, and a potential dependence on financial advisors, which can incur fees ranging from 1% to 2% of assets under management. Wealthfront automation provides an efficient alternative with low-cost management fees, typically around 0.25%, leveraging robo-advisors and automated rebalancing to optimize investments and cash flow. This cost efficiency makes Wealthfront an attractive option for users seeking streamlined money management without the higher expenses associated with traditional methods.

Choosing the Right Approach for Your Financial Goals

Evaluating cash flow management versus Wealthfront automation depends on your financial goals and need for control. Cash flow monitoring offers real-time insights and flexibility to adjust spending, while Wealthfront's automation provides algorithm-driven investing and automated portfolio rebalancing to grow wealth passively. Selecting the right approach hinges on whether you prioritize active cash management or hands-free, goal-oriented financial growth.

Related Important Terms

Automated Cash Flow Routing

Automated cash flow routing in Wealthfront optimizes money management by intelligently directing income towards savings, investments, and bills based on personalized financial goals and real-time account balances. This system enhances liquidity management by minimizing idle cash while maximizing investment returns through seamless allocation across Wealthfront's diversified portfolios.

Wealthfront Smart Money Sweeps

Wealthfront Smart Money Sweeps automatically optimize cash flow by transferring excess funds into high-yield accounts, maximizing returns while maintaining liquidity for everyday expenses. This automation enhances cash management efficiency compared to traditional manual cash flow strategies, ensuring seamless investment growth and timely access to funds.

Real-time Cash Buffering

Wealthfront's automation enhances cash flow management by providing real-time cash buffering that ensures immediate liquidity for daily expenses and unexpected costs. This dynamic feature optimizes fund allocation, minimizing overdraft risks while maximizing investment opportunities through seamless, instant adjustments.

Dynamic Expense Smoothing

Dynamic expense smoothing in Cash flow management uses real-time tracking and predictive analytics to balance income and expenditures seamlessly, reducing financial stress and optimizing liquidity. Wealthfront automation, while effective in investment automation and goal-based saving, lacks the granular, adaptive control over daily spending patterns that dynamic expense smoothing provides for proactive cash flow management.

Predictive Transaction Allocation

Cash flow management benefits from Predictive Transaction Allocation by Wealthfront automation, which analyzes income and expenses patterns to forecast future cash inflows and outflows accurately. This technology optimizes liquidity by preemptively categorizing transactions, ensuring efficient allocation for savings, investments, and daily expenses without manual intervention.

Passive Income Rebalancing

Cash flow management through Wealthfront automation optimizes passive income by continuously rebalancing investments to maximize returns while minimizing risk. This approach ensures consistent cash inflow by leveraging automated strategies that adapt to market changes, enhancing overall financial stability.

Automated Goal-based Cash Bucketing

Automated Goal-based Cash Bucketing in Wealthfront optimizes cash flow by categorizing funds into specific savings goals, ensuring efficient allocation and improved liquidity management. This system reduces manual tracking errors and enhances financial discipline compared to traditional cash flow methods.

AI-powered Liquidity Optimization

Wealthfront's AI-powered liquidity optimization enhances cash flow management by automatically allocating funds between spending, saving, and investing, ensuring optimal liquidity while maximizing growth potential. This automation leverages real-time data analysis and predictive algorithms to maintain an ideal balance, reducing the risk of overspending or underutilizing available cash.

Interest Maximization Algorithms

Cash flow strategies integrated with Wealthfront automation leverage advanced Interest Maximization Algorithms to optimize earnings on idle funds by dynamically allocating money between high-yield accounts and investment opportunities. These algorithms analyze real-time market interest rates, ensuring maximum returns while maintaining liquidity for immediate expenses.

Hands-free Savings Triggers

Cash flow automation through Wealthfront utilizes hands-free savings triggers that automatically allocate surplus funds into high-yield accounts, optimizing liquidity without manual intervention. This seamless integration ensures consistent cash flow management by dynamically adjusting savings based on real-time income and expenses, enhancing financial efficiency and growth potential.

Cash flow vs Wealthfront automation for money management. Infographic

moneydiff.com

moneydiff.com